Dividend growth investing is an investment strategy focused on identifying and investing in companies that consistently increase dividend payments over time. This approach aims to generate passive income, capitalize on the compounding effect of reinvested dividends, and benefit from long-term capital appreciation. The dividend growth investing strategy involves building a portfolio of stocks that exhibit strong and consistent dividend growth, focusing on companies with solid financials and competitive advantages in their industries. Investors following this strategy aim to benefit from income generation and potential capital appreciation over time. Dividend growth plays a crucial role in long-term wealth creation, as reinvested dividends compound over time, leading to exponential growth in an investor's portfolio. Dividend growth investing can also provide a stable income stream, making it an attractive strategy for investors seeking financial independence or retirement income. One key characteristic of dividend growth stocks is a consistent history of dividend payments, indicating the company's commitment to returning value to shareholders. Companies with a long track record of dividend payments are more likely to continue paying and increasing dividends in the future. A strong dividend growth rate is another important characteristic of dividend growth stocks, as it signals the company's ability to increase dividend payments consistently. A high dividend growth rate can lead to faster compounding of reinvested dividends and more significant long-term returns for investors. Dividend growth stocks typically exhibit solid financial fundamentals, including strong revenue and earnings growth, low debt levels, and healthy cash flow generation. These factors contribute to a company's ability to sustain and increase dividend payments over time. Companies with a competitive advantage in their industry is more likely to generate consistent dividend growth, as they can maintain or expand market share, generate higher profit margins, and weather economic downturns more effectively than their competitors. A sustainable payout ratio is crucial for dividend growth stocks. It indicates the company's ability to maintain and increase dividend payments without jeopardizing future growth or financial stability. A lower payout ratio suggests that the company has ample room to grow dividends while still investing in its business. Investors can use screening tools and criteria to identify potential dividend growth stocks by filtering for factors such as dividend yield, dividend growth rate, payout ratio, and financial performance metrics. These tools can help investors create a shortlist of stocks for further analysis and due diligence. To identify dividend growth stocks, investors should analyze a company's financial statements, including the income statement, balance sheet, and cash flow statement. This analysis helps determine a company's financial health, profitability, and ability to sustain and grow dividend payments over time. Assessing dividend sustainability is crucial in identifying dividend growth stocks, as it helps ensure that a company can maintain or increase its dividend payments in the future. Key factors to consider include the payout ratio, cash flow generation, and the company's earnings growth prospects. Understanding industry trends and the competitive landscape can help investors identify dividend growth stocks with strong competitive positions and favorable growth prospects. Companies that capitalize on industry trends and maintain or expand their market share are more likely to consistently grow their dividends. Diversification across sectors is essential when building a dividend growth portfolio, as it helps spread risk and reduce the impact of sector-specific events on portfolio performance. Diversifying across various industries can also increase the potential for identifying strong dividend growth stocks in different market environments. Dividend reinvestment plans (DRIPs) are a popular technique for dividend growth investing, allowing investors to automatically reinvest their dividends back into additional shares of the underlying stock. This can enhance the compounding effect of dividend growth investing and increase long-term returns. Dividend-focused ETFs and mutual funds are investment vehicles that provide investors with exposure to a diversified portfolio of dividend growth stocks. These funds can simplify the investment process and offer a cost-effective way to participate in dividend growth investing. Direct stock purchase plans (DSPPs) offer investors the opportunity to buy shares of dividend-paying companies directly from the company, often with low fees and minimum investment requirements. This can be an attractive option for investors looking to build a dividend growth portfolio without using a traditional brokerage account. Active stock picking involves conducting thorough research and analysis to identify individual dividend growth stocks that meet an investor's criteria. This approach allows investors to build a customized dividend growth portfolio tailored to their unique investment objectives and risk tolerance. The compounding effect is a significant advantage of dividend growth investing, as reinvested dividends generate additional dividends and capital gains over time. This exponential growth can significantly enhance long-term portfolio performance, especially when dividends are consistently reinvested. Dividend growth stocks tend to exhibit lower price volatility compared to non-dividend-paying stocks, as regular dividend payments provide a cushion against market fluctuations. This reduced volatility can be appealing to risk-averse investors or those seeking more stability in their portfolios. Dividend growth investing provides a reliable income stream, as the strategy focuses on companies with a history of consistent and increasing dividend payments. This income generation can be particularly valuable for investors seeking passive income or retirement. Dividend growth stocks can offer some protection against inflation, as companies that consistently increase their dividend payments often have the pricing power to pass along inflationary costs to consumers. This can help maintain the purchasing power of the dividends received by investors over time. Dividend income is often taxed at a lower rate than ordinary income or short-term capital gains, making dividend growth investing a potentially tax-efficient strategy. This tax advantage can enhance the after-tax returns for investors and contribute to long-term wealth accumulation. One risk in dividend growth investing is the possibility of dividend cuts or suspensions, which can negatively impact an investor's income stream and total returns. To mitigate this risk, investors should focus on companies with strong financials and a history of consistent dividend growth. Overconcentration in high-yield sectors can expose a dividend growth portfolio to sector-specific risks and increase its overall volatility. Investors should maintain a diversified portfolio by investing in companies across various sectors to reduce risk and enhance returns. Market and economic risks can impact dividend growth investing, as they may lead to lower corporate earnings and reduced dividend payouts. Investors should be prepared to adjust their portfolios in response to changing market and economic conditions to protect their investments and maintain their income streams. Valuation risks arise when investors overpay for dividend growth stocks, potentially limiting future returns. Investors should conduct a thorough valuation analysis and seek to invest in reasonably valued companies with strong dividend growth prospects. Regularly rebalancing and maintaining diversification within a dividend growth portfolio is essential for managing risk and optimizing returns. Investors should periodically review their holdings and adjust their allocations to ensure an appropriate balance between different asset classes and sectors. Tax planning and considerations are crucial in dividend growth investing, as taxes can impact an investor's overall returns. Investors should understand the tax implications of their investments and develop strategies to minimize tax liabilities and maximize after-tax returns. Investors should regularly monitor dividend growth trends and company performance to ensure their holdings continue to meet their investment objectives. This may involve tracking dividend increases, evaluating financial performance, and staying informed about industry trends and developments. Adapting to changes in the market and economic environment is crucial for successful dividend growth investing. Investors should be prepared to adjust their portfolios and strategies in response to evolving market conditions and changes in their own financial goals and risk tolerance. Dividend growth investing can play a significant role in long-term wealth creation by generating consistent income and benefiting from the compounding effect of reinvested dividends. This investment strategy can help investors achieve their financial goals while managing risk and adapting to market conditions. In order to maximize long-term returns while managing risk, investors must balance their dividend growth portfolios carefully. This involves selecting a mix of high-quality dividend growth stocks, diversifying across sectors and industries, and maintaining an appropriate asset allocation in line with their investment objectives and risk tolerance. For many investors, seeking professional guidance from financial advisors or wealth management services can be beneficial in building and managing a successful dividend growth portfolio. These professionals can provide expert advice on asset allocation, stock selection, and portfolio management, helping investors navigate the complexities of dividend growth investing and achieve their financial goals.What Is Dividend Growth Investing?

Key Characteristics of Dividend Growth Stocks

Consistent Dividend Payment History

Strong Dividend Growth Rate

Solid Financial Fundamentals

Competitive Advantage in the Industry

Sustainable Payout Ratio

How to Identify Dividend Growth Stocks

Screening Tools and Criteria

Analyzing Financial Statements

Evaluating Dividend Sustainability

Assessing Industry Trends and Competitive Landscape

Diversification Across Sectors

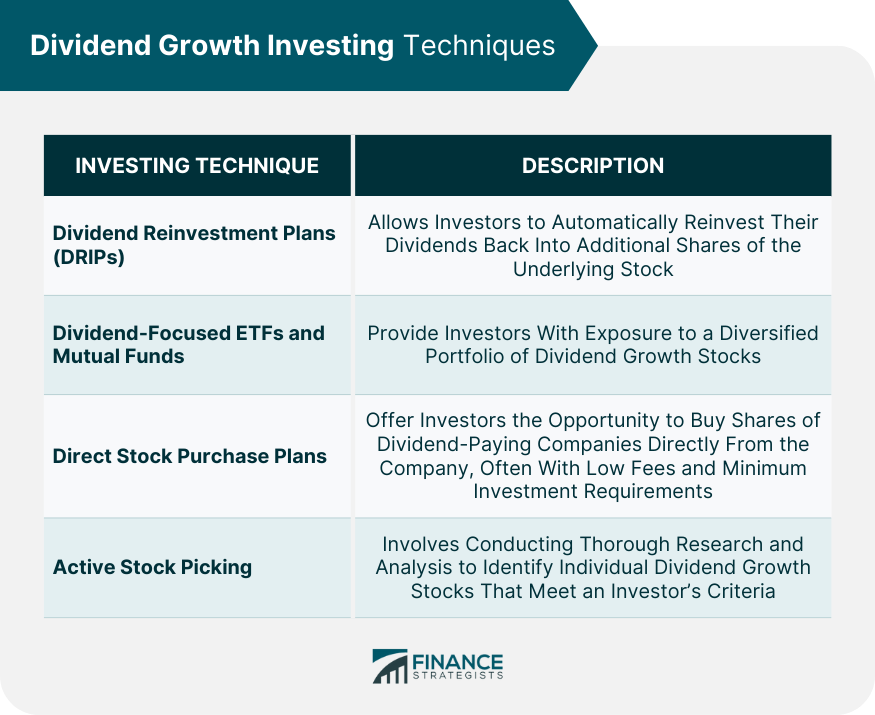

Dividend Growth Investing Techniques

Dividend Reinvestment Plans (DRIPs)

Dividend-Focused Exchange-Traded Funds (ETFs) and Mutual Funds

Direct Stock Purchase Plans (DSPPs)

Active Stock Picking

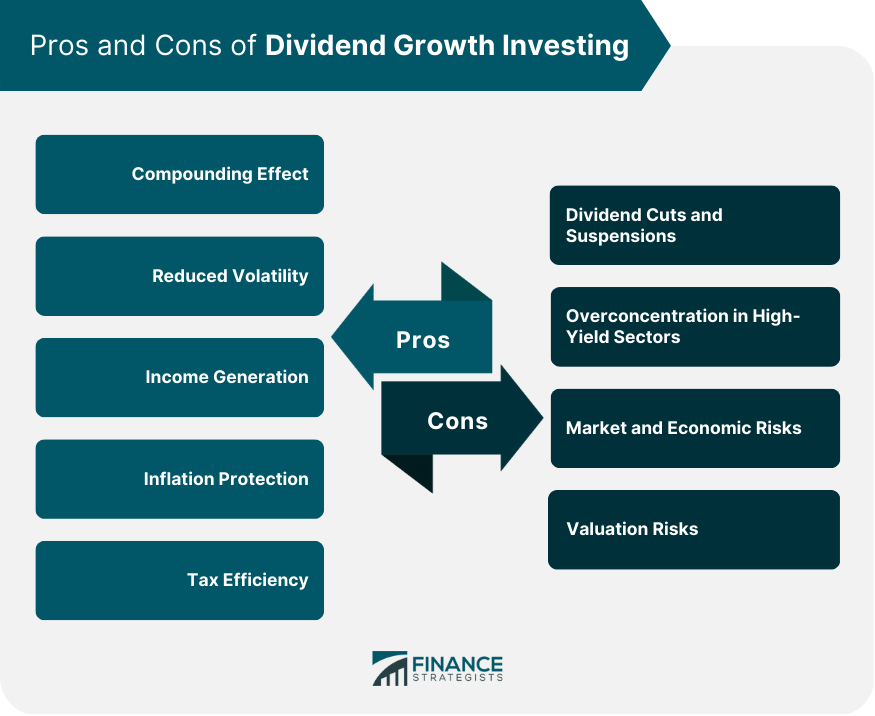

Advantages of Dividend Growth Investing

Compounding Effect

Reduced Volatility

Income Generation

Inflation Protection

Tax Efficiency

Risks and Challenges in Dividend Growth Investing

Dividend Cuts and Suspensions

Overconcentration in High-Yield Sectors

Market and Economic Risks

Valuation Risks

Monitoring and Managing a Dividend Growth Portfolio

Rebalancing and Diversification

Tax Planning and Considerations

Monitoring Dividend Growth Trends and Company Performance

Adapting to Changes in the Market and Economic Environment

Final Thoughts

Dividend Growth Investing FAQs

Dividend growth investing is an investment strategy focused on identifying and investing in companies that consistently increase their dividend payments over time. The key characteristics of dividend growth stocks include a consistent dividend payment history, strong dividend growth rate, solid financial fundamentals, a competitive advantage in the industry, and a sustainable payout ratio.

Investors can identify dividend growth stocks through screening tools and criteria, analyzing financial statements, evaluating dividend sustainability, assessing industry trends and competitive landscapes, and diversifying across sectors.

Dividend growth investing offers advantages such as the compounding effect, reduced volatility, income generation, inflation protection, and tax efficiency.

Risks and challenges in dividend growth investing include the possibility of dividend cuts or suspensions, overconcentration in high-yield sectors, market and economic risks, and valuation risks.

Investors can monitor and manage a dividend growth portfolio through rebalancing and diversification, tax planning and considerations, monitoring dividend growth trends and company performance, and adapting to changes in the market and economic environment. Seeking professional guidance from financial advisors or wealth management services can also be beneficial.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.