Dynamic asset allocation is an investment strategy that involves regularly evaluating and adjusting the composition of a portfolio of assets to optimize returns and manage risk based on changing market conditions. This approach contrasts traditional asset allocation strategies, which involve setting a fixed allocation for different asset classes and maintaining that allocation over time. Dynamic asset allocation involves changing the portfolio mix based on movements in market conditions or other relevant factors. For example, if the stock market is experiencing a downturn, an investor using dynamic asset allocation may choose to reduce their allocation to equities and increase their allocation to fixed-income securities, such as bonds. Conversely, if the stock market is performing well, an investor may choose to increase their allocation to equities and reduce their allocation to fixed-income securities. The process of dynamic asset allocation involves evaluating market conditions and other relevant factors on an ongoing basis. It may involve reviewing economic data, analyzing market trends, and monitoring individual securities. Based on this analysis, an investor using dynamic asset allocation will modify their portfolio mix to optimize returns and manage risk. Traditional asset allocation strategies typically involve setting a fixed allocation for different asset classes and maintaining that allocation over time. For example, an investor may choose to allocate 60% of their portfolio to equities and 40% to fixed-income securities. While this approach can help manage risk and provide a stable investment portfolio, it may not be as successful in taking advantage of market opportunities. Dynamic asset allocation, on the other hand, allows investors to adapt to changing market conditions and take advantage of opportunities as they arise. It may involve making short-term adjustments to the portfolio mix based on market conditions, potentially resulting in higher returns over the long term. Another difference between traditional and dynamic asset allocation strategies is the level of risk involved. Traditional asset allocation strategies typically involve a lower level of risk, as the allocation is fixed and the portfolio is not adjusted in response to market conditions. Dynamic asset allocation, on the other hand, may involve a higher level of risk, as the portfolio mix is adjusted in response to changing market conditions. There are several ways to perform dynamic asset allocation, including the following: Rebalancing adjusts the portfolio mix to maintain the desired asset allocation. This strategy ensures the portfolio remains aligned with the investor's risk tolerance, investment goals, and time horizon. For example, say an investor uses a dynamic asset allocation strategy and has set a target allocation of 60% equities and 40% fixed-income securities. Over time, the stock market performs well, and the portfolio's equity allocation increases to 70%. To maintain the desired allocation, the investor must rebalance the portfolio by selling some equities and purchasing fixed-income securities. Doing so would return the portfolio to the target allocation of 60% equities and 40% fixed-income securities. Rebalancing is an important aspect of dynamic asset allocation, as it ensures that the portfolio remains aligned with the investor's goals and risk tolerance. By regularly evaluating and adjusting the portfolio mix, investors can optimize returns and manage risk in a dynamic market. This strategy involves rotating the allocation to different market sectors based on market conditions. This strategy can help investors exploit short-term market trends and diversify their portfolios. For example, suppose an investor uses a dynamic asset allocation strategy and wants to incorporate sector rotation. The investor believes that the technology sector is expected to perform well in the coming months and wants to increase its exposure to this sector. To implement sector rotation, the investor must adjust their portfolio mix to increase the allocation to the technology sector. This could be done by purchasing stocks or exchange-traded funds (ETFs) that track the technology sector. On the other hand, if the investor believes that the healthcare sector is expected to underperform in the coming months, they may want to decrease their exposure to this sector. This could be done by selling stocks or ETFs that track the healthcare sector. The key to sector rotation is to have a solid understanding of market trends and to be able to identify sectors that are expected to perform well or underperform. It is a dynamic allocation strategy that involves building the portfolio based on risk rather than asset classes. It balances risk across different asset classes. For example, if stocks are expected to have a higher risk than bonds, the allocation to stocks would be reduced to balance the overall risk of the portfolio. It means that assets with higher risk are budgeted less, while assets with lower risk are allocated more. This approach can potentially provide better risk-adjusted returns by reducing the impact of higher-risk assets on the overall portfolio. The key to risk parity is having a solid understanding of the risk of each asset class and allocating the portfolio in a way that balances that risk. It adjusts the portfolio mix based on changes in market volatility. This strategy can help investors manage risk and reduce the impact of market volatility on the portfolio. This strategy helps investors potentially reduce downside risk and maximize returns. For example, if market volatility is high, an investor using dynamic risk management may choose to increase their allocation to fixed-income securities, such as bonds, which are typically less volatile than equities. Conversely, if market volatility is low, an investor may choose to increase their allocation to equities, which typically offer higher returns than fixed-income securities. Consider the following economic, market, and other factors affecting dynamic asset allocation: It refers to the cyclical nature of economic growth and contraction. Different asset classes tend to perform differently in different stages of the business cycle. For example, equities tend to perform well during the expansion phase, while fixed-income securities tend to perform well during the contraction phase. Dynamic asset allocation may involve adjusting the portfolio mix based on the stage of the business cycle. Interest rates can have a significant impact on the performance of different asset classes. For example, when interest rates rise, bond prices tend to fall. Dynamic asset allocation may involve adjusting the portfolio mix based on changes in interest rates. Inflation refers to the rate at which the general level of prices for goods and services increases over time. It can erode the value of fixed-income securities and cash. Dynamic asset allocation may involve adjusting the portfolio mix to include assets that can potentially protect against inflation, such as real estate or commodities. It is the degree of fluctuation in the price of a particular security or the overall market over a specified period. It is a statistical measure of the dispersion of returns for a given security or market index. Market volatility reflects the magnitude of changes in asset prices. Volatility can be caused by various factors, such as economics, geopolitical events, changes in interest rates, changes in market sentiment, and many others. Market volatility is a crucial element of allocating assets dynamically. Liquidity refers to the ease with which an asset can be bought or sold without affecting the price. The level of liquidity in the portfolio can impact the ability of the investor to respond to changes in market conditions or to take advantage of investment opportunities. Investors need to carefully evaluate liquidity and the potential risks and returns of different assets when constructing a dynamic asset allocation strategy. It is a statistical measure that quantifies the relationship between two or more assets in a portfolio. Correlation can range from -1 to +1, with a correlation of -1 indicating a perfect negative correlation and a correlation of +1 indicating a perfect positive correlation. A correlation of 0 indicates no relationship between the returns of the two assets. Assets that are highly correlated tend to move in the same direction, leading to increased volatility and risk in the portfolio. On the other hand, assets that are negatively or uncorrelated can help to reduce overall portfolio risk and volatility. It is an investor's ability and willingness to tolerate risk in their investment portfolio. It measures how much uncertainty or potential loss an investor can handle to pursue their investment goals. For example, a younger investor with a longer time horizon may have a higher risk tolerance in pursuit of greater returns. An older investor approaching retirement may have a lower risk tolerance and prefer to prioritize capital preservation over higher returns. It refers to the specific financial objectives an investor hopes to achieve through their investments. They can include short-term and long-term goals, such as saving for retirement, paying for a child's education, buying a home, or generating income. In dynamic asset allocation, investment goals are an important consideration when constructing a portfolio. The appropriate asset allocation strategy will depend on the investor's specific investment goals and the time horizon for achieving those goals. Below are discussed the potential advantages that investors can enjoy by using this strategy: Dynamic asset allocation allows investors to adjust their portfolio mix in response to changing market conditions or other relevant factors. This flexibility can help investors optimize the risk and return characteristics of their portfolio and potentially achieve their investment goals. Dynamic asset allocation allows investors to diversify their portfolios across different asset classes, which can help to reduce overall portfolio risk and volatility. By adjusting the portfolio mix in response to changing market conditions, investors can potentially take advantage of market opportunities and generate higher returns. Dynamic asset allocation allows investors to manage their risk more effectively by adjusting the portfolio mix in response to changes in their risk tolerance or market conditions. Investors must also consider the following: Investors must make timely and accurate decisions about when to adjust their portfolio mix in response to changes in market conditions. If investors make poor timing decisions, they may miss out on potential market opportunities or incur unnecessary losses. Investors need to regularly monitor their portfolios and make adjustments as needed, which can require a significant amount of time and effort. Dynamic asset allocation involves frequent portfolio adjustments, which can lead to increased transaction costs. These costs can include brokerage fees, bid-ask spreads, and other expenses associated with buying and selling securities. Furthermore, frequent portfolio adjustments can lead to higher taxes, as each transaction can trigger a taxable event. It can increase the investor's tax liability and reduce after-tax returns. Dynamic asset allocation is based on the assumption that investors can accurately predict changes in market conditions and adjust their portfolio mix accordingly. However, if investors make poor predictions or fail to respond to changing market conditions effectively, their portfolios may underperform over the long term. Even the most sophisticated statistical models may not be able to predict unexpected events or market shocks. This difficulty in predicting market conditions can challenge dynamic asset allocation. Markets are influenced by various factors, including macroeconomic trends, geopolitical events, and investor sentiment. These factors can interact with each other in complex and unpredictable ways. Dynamic asset allocation is an investment strategy that involves regularly evaluating and adjusting the composition of a portfolio of assets to optimize returns and manage risk based on changing market conditions. There are several ways to perform dynamic asset allocation, including rebalancing, sector rotation, risk parity, and dynamic risk management. Factors affecting dynamic asset allocation include the business cycle, interest rates, inflation, volatility, liquidity, asset correlation, risk tolerance, and investment goals. The benefits of dynamic asset allocation include flexibility, diversification, potential for higher returns, and risk management. However, drawbacks include active management, higher transaction costs, underperformance, and difficulty predicting market conditions. Note that dynamic asset allocation can be a powerful tool for investors, but it requires careful evaluation and monitoring. Investors should consider their investment goals, risk tolerance, and market conditions when constructing a dynamic asset allocation strategy. Investors should consult a qualified financial advisor or wealth management professional to determine if dynamic asset allocation suits their investment objectives and risk tolerance.What Is Dynamic Asset Allocation?

How Dynamic Asset Allocation Works

Compared to Traditional Asset Allocation Strategies

Dynamic Asset Allocation Strategies

Rebalancing

Sector Rotation

Risk Parity

Dynamic Risk Management

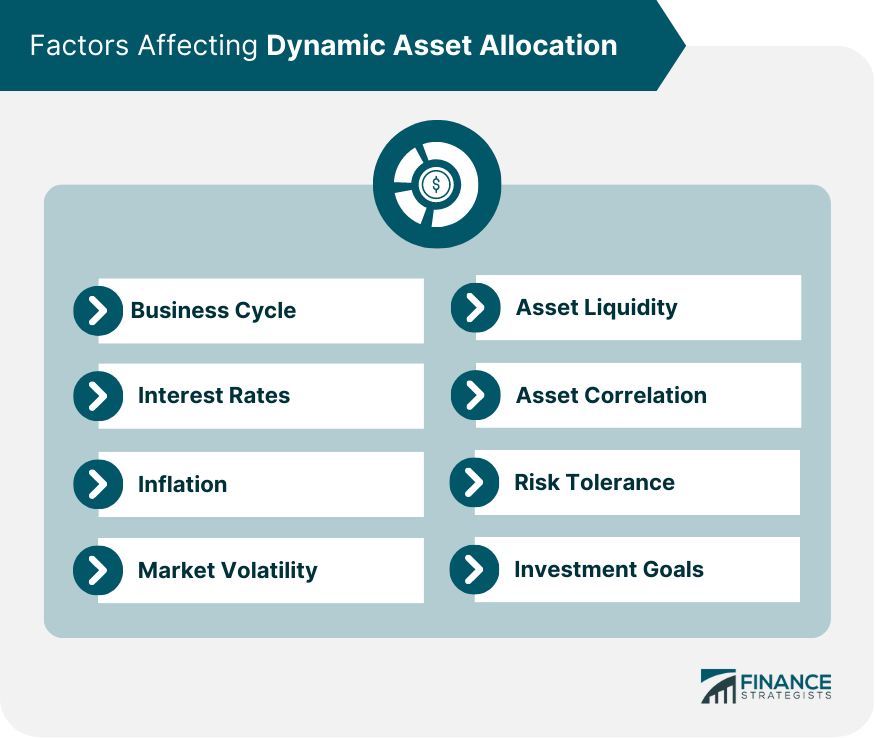

Factors Affecting Dynamic Asset Allocation

Business Cycle

Interest Rates

Inflation

Market Volatility

Asset Liquidity

Asset Correlation

Risk Tolerance

Investment Goals

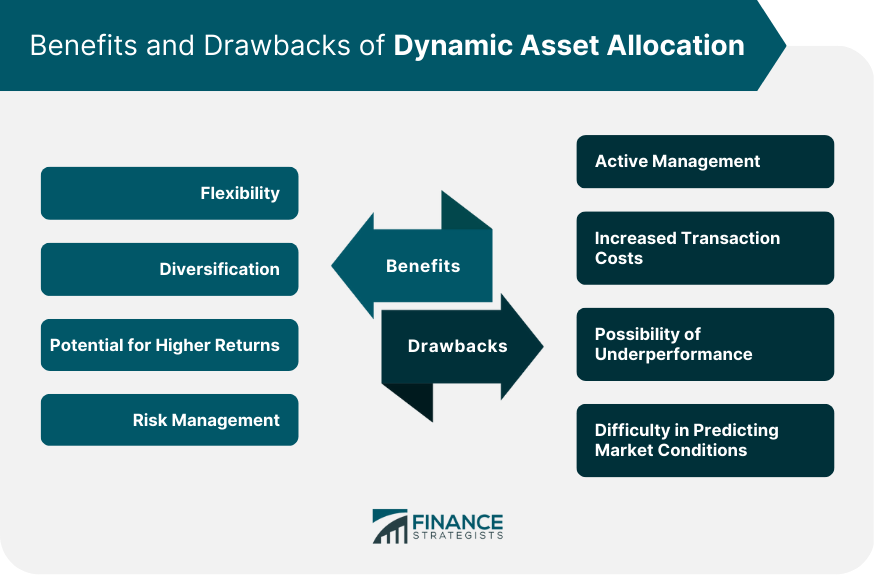

Benefits of Dynamic Asset Allocation

Flexibility

Diversification

Potential for Higher Returns

Risk Management

Drawbacks of Dynamic Asset Allocation

Active Management

Increased Transaction Costs

Possibility of Underperformance

Difficulty in Predicting Market Conditions

Final Thoughts

Dynamic Asset Allocation FAQs

Dynamic asset allocation is an investment strategy that involves regularly evaluating and adjusting the composition of a portfolio of assets to optimize returns and manage risk based on changing market conditions.

Dynamic asset allocation involves changing the portfolio mix based on movements in market conditions or other relevant factors, while traditional asset allocation involves setting a fixed allocation for different asset classes and maintaining that allocation over time.

Some dynamic asset allocation strategies include rebalancing, sector rotation, risk parity, and dynamic risk management. These strategies involve adjusting the portfolio mix based on various factors, such as market conditions and changes in risk tolerance.

Dynamic asset allocation allows for flexibility in adjusting the portfolio mix, diversification across different asset classes, potential for higher returns, and effective risk management.

Drawbacks of dynamic asset allocation include the need for active management, increased transaction costs, potential for underperformance if predictions are poor, and difficulty in predicting market conditions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.