Exchange fees refer to the charges incurred by investors and traders when they buy, sell, or hold financial instruments on a financial exchange, which can include stock exchanges, commodities exchanges, and derivatives exchanges, among others. Each exchange may have its own fee structure and schedule, depending on the specific financial instruments being traded. The fees help cover the operational costs of the exchange, facilitate trade execution, and ensure the overall efficiency of the market. Exchange fees serve multiple purposes, including compensating the exchange for providing trading services, maintaining market infrastructure, and ensuring regulatory compliance. Commissions are fees charged by brokers and exchanges for executing buy and sell orders on behalf of investors. Commissions can be based on a flat fee per trade, a percentage of the trade value, or a combination of both. Spreads refer to the difference between the bid and ask prices of a financial instrument. The spread represents an indirect cost to investors, as they must pay the ask price to buy an asset and accept the bid price when selling. Clearing and settlement fees are charged by clearing houses and exchanges for the processing and settlement of trades. These fees help cover the cost of managing counterparty risk and ensuring that trades are settled accurately and efficiently. Listing fees are charged by exchanges to companies that wish to list their shares or other financial instruments for public trading. These fees can include initial listing fees, annual listing fees, and additional fees for services such as corporate actions or regulatory filings. Exchanges may charge fees for providing market data and information services, such as real-time quotes, historical data, and research reports. These fees can be charged on a subscription basis or on a per-use basis. Some exchanges charge membership and access fees to brokers, market makers, and other participants who wish to access the exchange's trading platform and services. These fees can be based on factors such as trading volume, market activity, or the level of access provided. Exchange fees can vary depending on the type of financial instrument being traded, such as stocks, bonds, commodities, or derivatives. Exchanges may charge higher fees for less liquid assets, as these assets can be more difficult and costly to trade. Competition among exchanges can influence fee structures, as exchanges may lower fees to attract more trading activity and market participants. Regulatory requirements and oversight can impact exchange fees, as exchanges must comply with rules and regulations related to fee transparency, fairness, and competition. Exchanges may offer fee discounts or rebates to high-volume or frequent traders, as these participants contribute to the overall liquidity and efficiency of the market. Exchange fees contribute to the total cost of ownership for investors, as they represent a direct expense related to buying, selling, and holding financial instruments. Exchange fees can impact investment performance, as they reduce the net returns on investment. Investors should consider the effect of exchange fees on their overall investment strategy and performance. Exchange fees can influence trading behavior, as investors may adjust their trading strategies to minimize fees or take advantage of fee discounts and rebates. Exchange fees can affect market efficiency by influencing the cost of trading and the allocation of resources among market participants. Investors can minimize exchange fees by comparing the fee structures of different exchanges and brokers, and selecting the most cost-effective option for their trading needs. Investors can use limit orders to specify a maximum price they are willing to pay when buying or a minimum price they are willing to accept when selling, which can help manage the cost of spreads. Market orders, on the other hand, are executed at the best available price, but may be subject to larger spreads. Investors can consider using trading platforms and brokerage services that offer lower fees or discounts based on trading volume or account size. Investors who adopt passive investment strategies, such as index fund investing, may benefit from lower exchange fees, as these strategies typically involve lower trading activity and costs. Some exchanges and brokers offer fee rebates and discounts to attract and retain customers. Investors can take advantage of these offers to reduce their overall trading costs. Regulatory authorities, such as the Securities and Exchange Commission (SEC) in the United States, oversee the fee practices of exchanges and ensure that fees are transparent, fair, and competitive. Regulatory authorities require exchanges to disclose their fee schedules and ensure that fees are applied fairly and consistently across all market participants. Regulatory authorities continue to monitor exchange fees and their impact on market efficiency, competition, and investor protection. Recent developments in financial markets, such as the growth of electronic trading platforms and the rise of algorithmic trading, have prompted regulators to reevaluate fee structures and practices. Understanding exchange fees is crucial for investors, as these fees can directly impact investment performance and the total cost of ownership. Investors should familiarize themselves with the fee structures of various exchanges and brokers, and consider the impact of these fees on their investment strategies and objectives. Investors must balance the cost of exchange fees with their investment objectives, trading strategies, and risk tolerance. By considering the impact of exchange fees on investment performance, investors can make more informed decisions about their trading activities and overall investment portfolios. Exchange fees can change over time due to market conditions, regulatory developments, or competitive pressures. Investors should regularly monitor and evaluate the fees they are paying and consider making adjustments to their trading strategies or service providers if necessary, to minimize costs and maximize investment returns.What Are Exchange Fees?

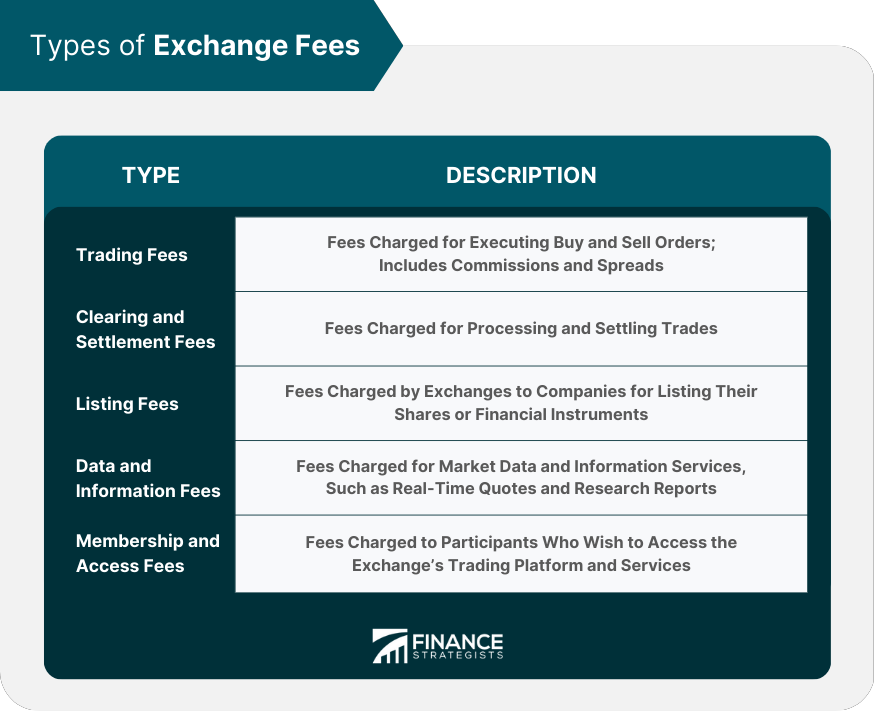

Types of Exchange Fees

Trading Fees

Commissions

Spreads

Clearing and Settlement Fees

Listing Fees

Data and Information Fees

Membership and Access Fees

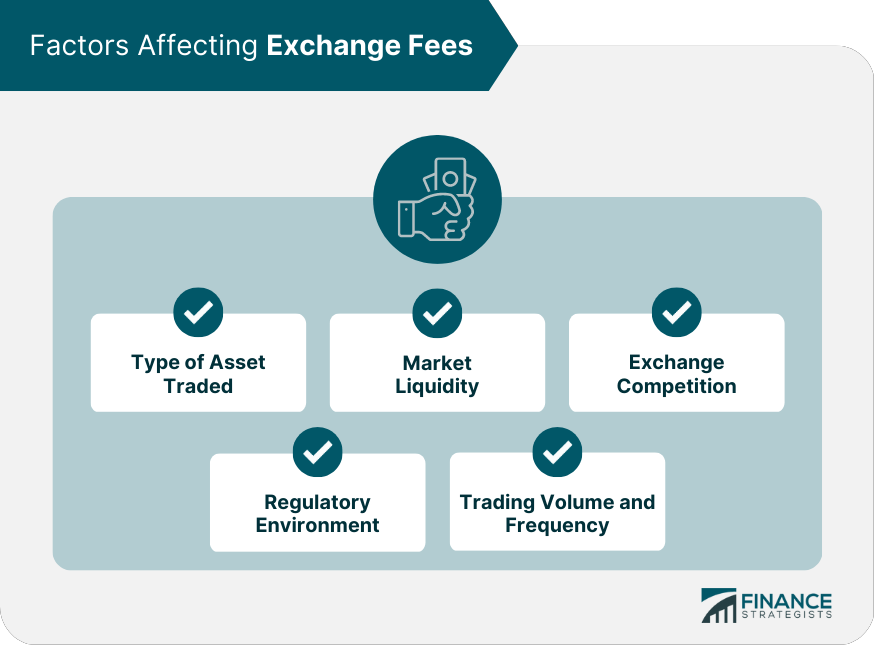

Factors Affecting Exchange Fees

Type of Asset Traded

Market Liquidity

Exchange Competition

Regulatory Environment

Trading Volume and Frequency

Impact of Exchange Fees on Investors

Total Cost of Ownership

Investment Performance

Trading Behavior

Market Efficiency

Strategies for Minimizing Exchange Fees

Comparison Shopping

Limit Orders and Market Orders

Trading Platforms and Brokerage Services

Passive Investment Strategies

Fee Rebates and Discounts

Regulatory Oversight of Exchange Fees

Regulatory Authorities

Fee Transparency and Fairness

Recent Developments and Trends

Conclusion

Exchange Fees FAQs

Exchange fees are charges levied by exchanges for executing trades. They can include fees for executing orders, account maintenance, data feeds, and market access, among others.

Exchange fees are determined by the exchange and can vary depending on the type of order, the trading volume, and other factors. The fees are usually disclosed on the exchange's website and can be found in the exchange's fee schedule.

When evaluating exchange fees, it is important to consider the trading volume, the frequency of trades, and the size of the trades. Additionally, investors should consider the types of securities they are trading, the liquidity of the market, and the fees charged by other exchanges.

Investors can reduce exchange fees by consolidating their trading activity on a single exchange, negotiating with their broker or exchange for reduced fees, using limit orders instead of market orders, and trading during off-peak hours when trading volume is lower.

Exchange fees are generally tax deductible as investment expenses, subject to certain limitations. However, investors should consult with a tax advisor to determine their eligibility for deductions and the amount that can be deducted.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.