Income growth investing is an investment strategy that seeks to invest in companies that have a track record of paying dividends and have the potential to increase their dividend payments over time. This strategy aims to provide investors with a steady stream of income in the form of dividend payments while also allowing for capital appreciation. Investors who practice income growth investing look for companies with a strong financial position, stable earnings growth, and a history of increasing dividend payments over time. By investing in companies with these characteristics, income growth investors hope to benefit from both the income generated by the dividends and the potential for the stock price to increase as the company grows and its earnings increase. One of the key concepts of income growth investing is dividends. Dividends are a portion of a company's earnings that are paid out to shareholders. Companies that pay dividends can provide a consistent stream of income to investors. Dividend growth is another important concept of income growth investing. Companies that consistently increase their dividends over time can provide a growing stream of income for investors. Earnings growth is another important factor to consider when investing in income growth. A company's earnings growth can lead to increases in dividend payments and capital appreciation. Companies that have a history of strong earnings growth are more likely to continue to grow in the future. Capital appreciation is the increase in the value of an investment over time. Companies that have strong earnings growth and a history of increasing dividends are often attractive to income growth investors because they also have the potential for capital appreciation. The payout ratio is the percentage of earnings that a company pays out in dividends. Income growth investors often look for companies with a sustainable payout ratio that allows for continued dividend payments and potential dividend growth. Return on equity is a measure of a company's profitability. Companies with a high return on equity are often more attractive to income growth investors because they have a higher likelihood of continued earnings growth and potential capital appreciation. Dividend investing is a strategy that focuses on investing in companies that pay dividends. The goal of dividend investing is to generate a consistent stream of income through dividend payments. Growth investing is a strategy that focuses on investing in companies with strong earnings growth potential. The goal of growth investing is to generate capital appreciation through an increase in the value of the investment. Dividend growth investing is a strategy that combines the concepts of dividend investing and growth investing. The goal of dividend growth investing is to invest in companies that have a history of increasing dividends and strong earnings growth potential. Total return investing is a strategy that focuses on generating both income and capital appreciation. The goal of total return investing is to invest in companies that have a history of paying dividends and strong earnings growth potential, which can lead to potential capital appreciation. When selecting income growth investments, it is important to consider a company's financials. This includes factors such as revenue growth, earnings growth, and debt levels. A company with strong financials is more likely to continue to pay dividends and have the potential for earnings growth and capital appreciation. Market conditions can have a significant impact on income growth investments. Economic factors such as inflation and interest rates can affect the performance of income growth investments. It is important to consider market conditions when selecting income growth investments. Industry trends can also impact income growth investments. Companies in industries with strong growth potential are more likely to continue to grow and provide potential for earnings growth and capital appreciation. The quality of a company's management team can also impact income growth investments. A strong management team can help guide a company through economic and market challenges and make strategic decisions that can lead to continued growth. Companies with competitive advantages are often more attractive to income growth investors. Competitive advantages can include factors such as proprietary technology, strong brand recognition, and cost advantages. Companies with competitive advantages are more likely to continue to grow and provide potential for earnings growth and capital appreciation. Market risk is a significant risk associated with income growth investing. Economic factors such as inflation, interest rates, and market downturns can impact the performance of income growth investments. It is important to consider market risk when selecting income growth investments and to have a diversified portfolio. Interest rate risk is another significant risk associated with income growth investing. As interest rates rise, the value of income growth investments may decrease. It is important to consider interest rate risk when selecting income growth investments and to have a diversified portfolio. Inflation risk is the risk that the purchasing power of income growth investments will decrease over time due to inflation. It is important to consider inflation risk when selecting income growth investments and to select companies with a history of increasing dividends and potential for capital appreciation. Company-specific risk is the risk that a specific company may underperform or fail. It is important to consider company-specific risk when selecting income growth investments and to have a diversified portfolio. Income growth investing can be an effective strategy for long-term wealth creation. By focusing on companies that pay dividends and have the potential for earnings and capital appreciation growth, investors can generate both income and potential capital appreciation. When selecting income growth investments, it is important to consider factors such as company financials, market conditions, industry trends, management quality, and competitive advantages. It is also important to be aware of the risks associated with income growth investing, such as market risk, interest rate risk, inflation risk, and company-specific risk, and to have a diversified portfolio. By understanding the key concepts, strategies, factors to consider, and risks associated with income growth investing, investors can make informed decisions and achieve their financial goals.What Is Income Growth Investing?

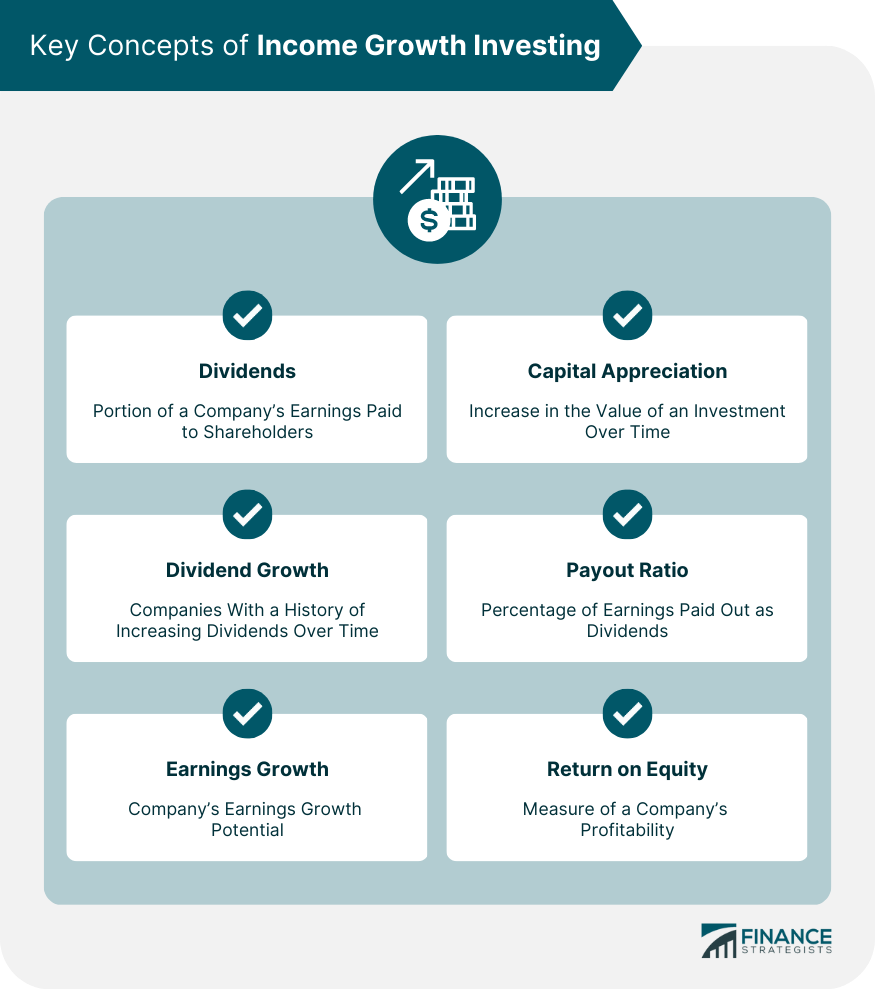

Key Concepts of Income Growth Investing

Dividends and Dividend Growth

Earnings Growth

Capital Appreciation

Payout Ratio

Return on Equity

Income Growth Investing Strategies

Dividend Investing

Growth Investing

Dividend Growth Investing

Total Return Investing

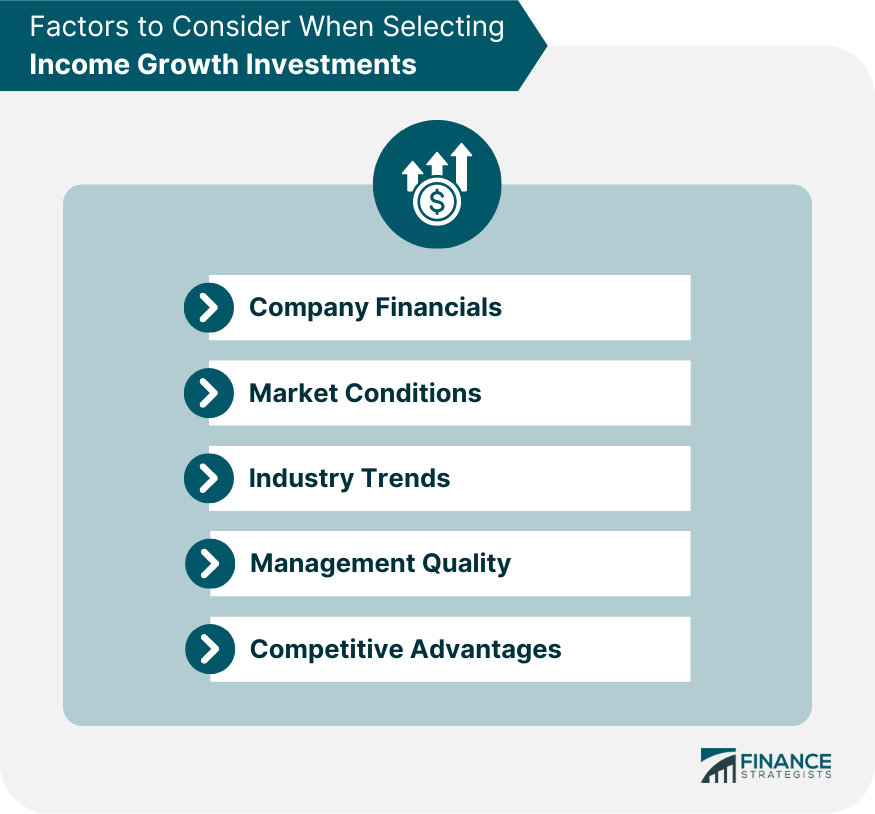

Factors to Consider When Selecting Income Growth Investments

Company Financials

Market Conditions

Industry Trends

Management Quality

Competitive Advantages

Risks and Challenges of Income Growth Investing

Market Risk

Interest Rate Risk

Inflation Risk

Company-Specific Risk

Conclusion

Income Growth Investing FAQs

Income growth investing is a strategy that focuses on investing in companies that pay dividends and have the potential for earnings and capital appreciation growth.

Strategies for income growth investing include dividend investing, growth investing, dividend growth investing, and total return investing.

Factors to consider when selecting income growth investments include company financials, market conditions, industry trends, management quality, and competitive advantages.

Risks associated with income growth investing include market risk, interest rate risk, inflation risk, and company-specific risk.

Diversification is important in income growth investing because it helps to mitigate risks associated with market conditions, interest rates, and company-specific issues, and helps to ensure a well-balanced portfolio.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.