Income investing is a strategy where investors seek to generate a steady stream of income from their investments, usually in the form of dividends or interest payments. The goal of income investing is to generate a regular cash flow that can be used to meet living expenses or reinvested to grow wealth over time. Income investing can be a suitable strategy for investors who are looking for a reliable income stream to supplement their other sources of income, such as retirement income. However, investors should carefully consider the risks associated with any investment, including the risk of default, interest rate risk, and market volatility, before investing. Blue-chip stocks are shares in large, well-established companies with a history of stable earnings, financial strength, and dividend payments. These companies are typically leaders in their respective industries and offer lower risk compared to smaller, less-established companies. Dividend aristocrats are companies that have consistently increased their dividend payments for at least 25 consecutive years. This elite group of stocks provides a combination of income and potential capital appreciation. Dividend growth stocks are companies that may not have a long track record of dividend payments but have demonstrated a commitment to increasing dividends over time. These stocks can provide a growing stream of income and potential for capital gains. Government bonds are issued by national governments and are considered relatively low-risk investments. They pay periodic interest, known as coupon payments, to bondholders. Corporate bonds are issued by companies to raise capital. They offer higher yields compared to government bonds, but also come with higher risks, as companies may default on their obligations. Municipal bonds are issued by state and local governments to finance public projects. These bonds typically offer lower yields than corporate bonds but can provide tax advantages, as their interest income is exempt from federal and, in some cases, state and local taxes. REITs are companies that own, manage, and finance income-producing real estate properties. They provide investors with an opportunity to invest in real estate without directly owning or managing properties. REITs pay out at least 90% of their taxable income as dividends to shareholders. MLPs and LPs are publicly traded partnerships that typically invest in energy, infrastructure, and natural resources. They distribute the majority of their income to investors and offer attractive yields, but come with higher risk and unique tax considerations. Preferred stocks are hybrid securities that combine features of stocks and bonds. They pay fixed dividends, which are prioritized over common stock dividends, and offer lower risk compared to common stocks. P2P lending is an alternative investment where investors lend money to borrowers through online platforms. It offers potentially higher returns compared to traditional fixed-income investments but carries higher risks, as borrowers may default on their loans. Annuities are insurance contracts that provide guaranteed income payments to investors, either immediately or at a future date. They offer income stability and can be a part of a retirement income plan but may come with high fees and limited liquidity. CDs are time deposits issued by banks that offer fixed interest rates over a specified term. They are considered low-risk investments but may not provide high returns compared to other income-generating assets. A DRIP allows investors to automatically reinvest their dividends into additional shares of the same stock, compounding their returns over time. Laddering bonds involves investing in a series of bonds with staggered maturity dates. This strategy provides regular cash flow and reduces interest rate risk by allowing investors to reinvest principal as bonds mature at potentially higher interest rates. Passive income investing involves buying and holding income-generating assets for the long term without actively trading or managing the investments. This strategy minimizes transaction costs and taxes, and allows investors to benefit from compounding returns. Active income investing requires investors to actively monitor and manage their income-generating assets, making buy and sell decisions based on market conditions, individual asset performance, and changes in the investor's financial goals. The barbell strategy involves investing in a mix of short-term and long-term bonds, with the goal of balancing risk and return. This strategy can help investors protect their portfolio from interest rate risk while still taking advantage of higher yields offered by longer-term bonds. Investing in income-focused ETFs and mutual funds allows investors to gain exposure to a diversified portfolio of income-generating assets through a single investment. These funds may invest in dividend-paying stocks, bonds, REITs, or other income-producing assets. Dividend yield is the annual dividend payment divided by the stock price. It measures the income generated by a stock relative to its price, helping investors compare the income potential of different stocks. The dividend payout ratio is the proportion of a company's earnings paid out as dividends. A lower payout ratio suggests a company has room to increase its dividend in the future, while a high payout ratio may indicate a higher risk of dividend cuts. The dividend growth rate measures the percentage increase in a company's dividend over time. A high dividend growth rate can signal a commitment to returning value to shareholders and the potential for future income growth. EPS is the portion of a company's profit allocated to each outstanding share of common stock. It is an important measure of a company's profitability and can influence dividend payments and stock prices. The P/E ratio is the stock price divided by the earnings per share. It is a valuation metric that helps investors determine if a stock is overvalued or undervalued, which can impact the potential for capital gains and future dividend growth. Credit ratings are assigned by rating agencies to bonds and other debt securities, providing an assessment of the creditworthiness of the issuer. Higher credit ratings indicate lower credit risk, which can affect bond yields and the potential for default. Interest rate risk is the risk that changes in interest rates will negatively impact the value of income-generating assets, especially bonds. As interest rates rise, bond prices typically fall, which can lead to capital losses for bond investors. Inflation risk refers to the possibility that the purchasing power of an investment's income will decline due to rising prices. Fixed-income investments, like bonds and CDs, are particularly vulnerable to inflation risk, as their income payments may not keep up with inflation. Credit risk is the risk that a bond issuer or borrower will default on their debt obligations, leading to losses for investors. Higher-yielding investments, like corporate bonds and P2P loans, often come with higher credit risk. Liquidity risk is the risk that an investor may not be able to quickly buy or sell an investment at a fair price due to a lack of buyers or sellers in the market. Less liquid investments, such as certain bonds or MLPs, can be more difficult to sell, especially during times of market stress. Market risk, also known as systematic risk, is the risk that an investment's value will decrease due to factors affecting the overall market or asset class. Income investors can be exposed to market risk through fluctuations in stock prices, interest rates, and economic conditions. Currency risk is the potential for losses due to fluctuations in exchange rates when investing in foreign income-generating assets. Changes in exchange rates can impact the value of an investment and the income received in the investor's local currency. Dividend income is generally taxed at the investor's ordinary income tax rate, although qualified dividends from U.S. companies may be subject to lower capital gains tax rates. Tax rates on dividends can impact the net return on investment. Interest income from bonds is generally subject to federal income tax and, in some cases, state and local taxes. However, interest from municipal bonds is typically exempt from federal taxes and may be exempt from state and local taxes for residents of the issuing state. Capital gains realized from the sale of income-generating assets, like stocks or bonds, are subject to capital gains tax. Long-term capital gains, on assets held for more than a year, are typically taxed at lower rates than short-term capital gains, which are taxed at ordinary income tax rates. Investing in income-generating assets within tax-advantaged accounts, such as individual retirement accounts (IRAs) or 401(k)s, can help defer or minimize taxes on investment income, allowing for more efficient compounding of returns. Asset allocation is the process of dividing an investment portfolio among different asset classes, such as stocks, bonds, and real estate. Proper asset allocation can help manage risk and optimize returns by taking advantage of the unique characteristics and performance of each asset class. Diversification involves investing in a variety of income-generating assets across different industries, geographies, and asset classes to reduce portfolio risk. A well-diversified portfolio can help protect against market downturns and mitigate the impact of individual asset underperformance. Rebalancing involves periodically adjusting the portfolio's asset allocation to maintain the desired risk-return profile. As asset values change over time, investors may need to buy or sell investments to bring their portfolio back into alignment with their target allocations. Regularly reviewing the performance of income-generating assets and the overall portfolio can help investors identify areas for improvement, adjust their investment strategy, and ensure their financial goals are on track. In conclusion, income investing is a strategy that can provide a reliable source of income for investors seeking regular cash flow and potential capital appreciation. This investment approach includes a range of income-generating assets, such as dividend-paying stocks, bonds, REITs, and P2P lending, each with its unique risks and potential returns. To successfully implement an income investing strategy, investors should carefully consider their financial goals, risk tolerance, and tax implications. Key metrics, such as dividend yield, payout ratio, and credit ratings, can help evaluate income investments, while diversification, asset allocation, and regular portfolio monitoring can help manage risks and optimize returns. With proper planning, research, and execution, income investing can be a powerful tool for achieving long-term financial security and meeting retirement income needs.Definition of Income Investing

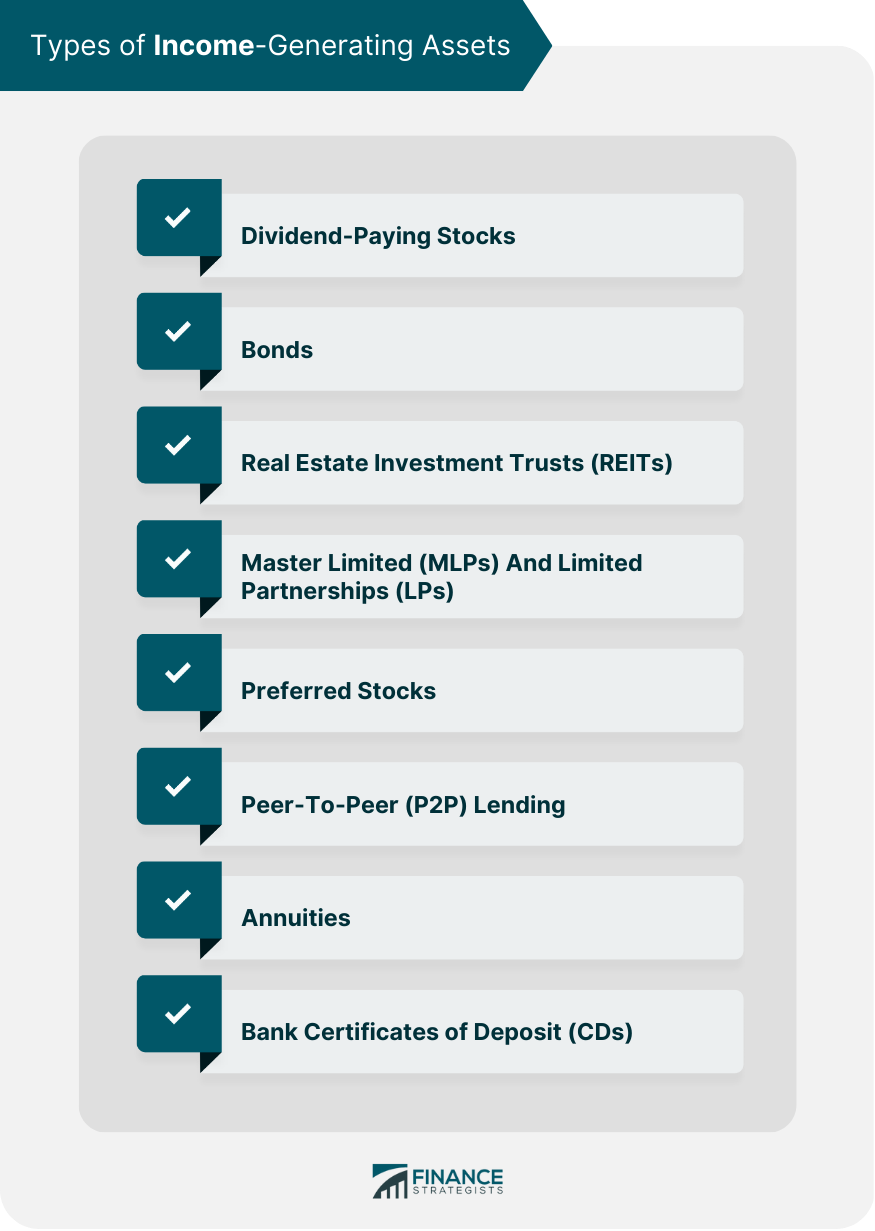

Types of Income-Generating Assets

Dividend-Paying Stocks

Blue-Chip Stocks

Dividend Aristocrats

Dividend Growth Stocks

Bonds

Government Bonds

Corporate Bonds

Municipal Bonds

Real Estate Investment Trusts (REITs)

Master Limited (MLPs) and Limited Partnerships (LPs)

Preferred Stocks

Peer-to-Peer (P2P) Lending

Annuities

Bank Certificates of Deposit (CDs)

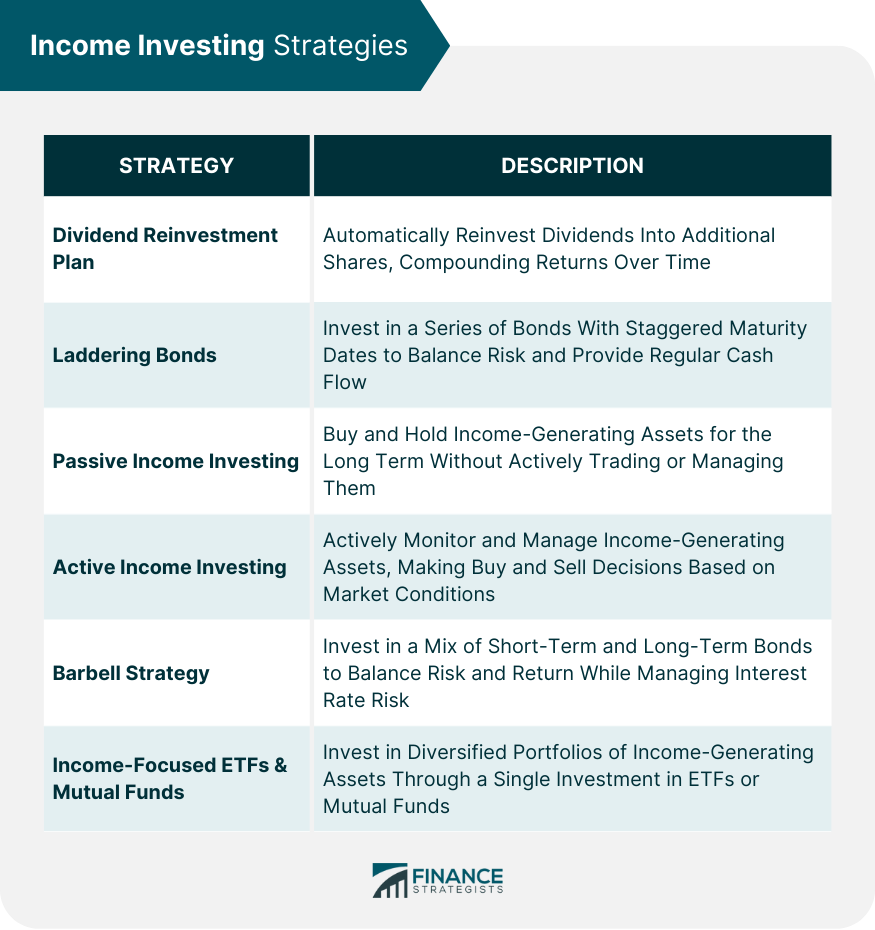

Income Investing Strategies

Dividend Reinvestment Plan (DRIP)

Laddering Bonds

Passive Income Investing

Active Income Investing

Barbell Strategy

Income-Focused Exchange-Traded Funds (ETFs) and Mutual Funds

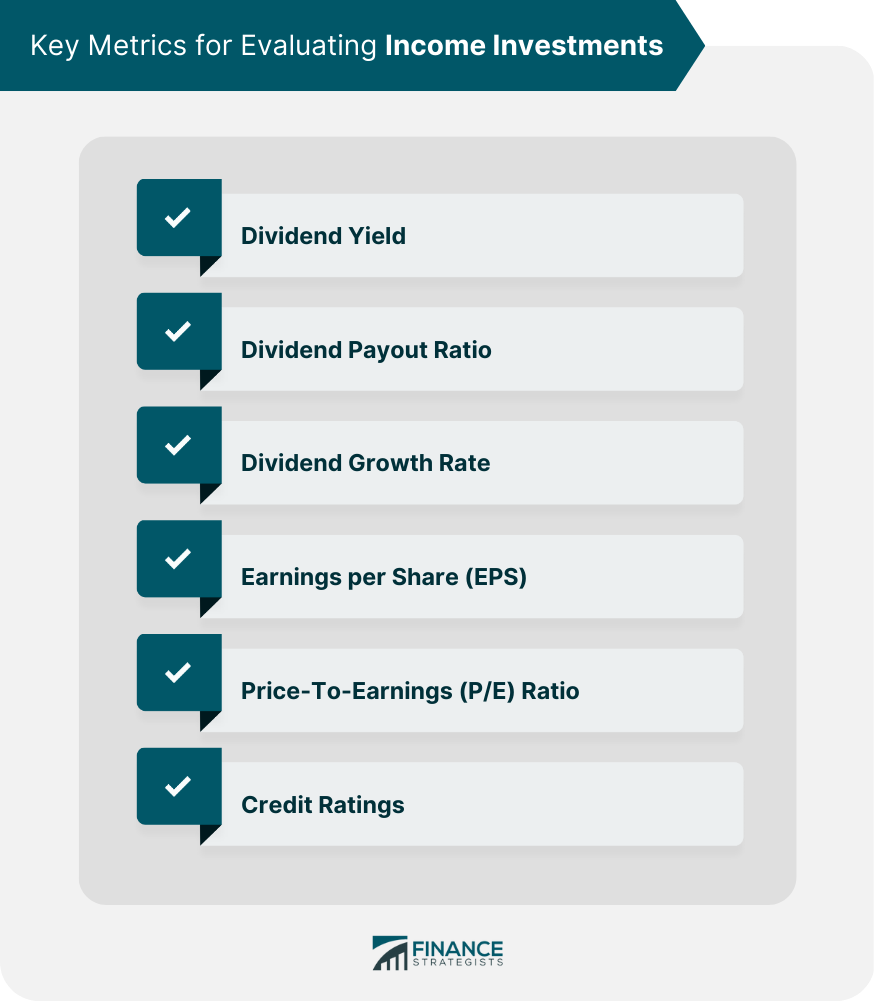

Key Metrics for Evaluating Income Investments

Dividend Yield

Dividend Payout Ratio

Dividend Growth Rate

Earnings per Share (EPS)

Price-to-Earnings (P/E) Ratio

Credit Ratings

Risks in Income Investing

Interest Rate Risk

Inflation Risk

Credit Risk

Liquidity Risk

Market Risk

Currency Risk

Tax Considerations for Income Investors

Dividend Taxation

Bond Interest Taxation

Capital Gains Taxation

Tax-Advantaged Accounts for Income Investing

Building a Balanced Income Investing Portfolio

Asset Allocation

Diversification Across Industries, Geographies, and Asset Classes

Rebalancing the Portfolio

Monitoring Performance and Adjusting Strategy

Conclusion

Income Investing FAQs

Income investing is an investment strategy that focuses on generating regular income from assets such as dividend-paying stocks, bonds, and real estate investment trusts (REITs). It's important because it can provide investors with a steady cash flow to help meet financial goals, supplement retirement income, or create a source of passive income.

The main types of income-generating assets include dividend-paying stocks (e.g., blue-chip stocks, dividend aristocrats, and dividend growth stocks), bonds (e.g., government, corporate, and municipal bonds), real estate investment trusts (REITs), master limited partnerships (MLPs) and limited partnerships (LPs), preferred stocks, peer-to-peer (P2P) lending, annuities, and bank certificates of deposit (CDs).

To build a diversified income investing portfolio, consider allocating your investments across various asset classes, industries, and geographies. This can help manage risk and optimize returns. Additionally, monitor your portfolio's performance regularly, rebalance as needed, and adjust your strategy based on your financial goals and market conditions.

The key risks in income investing include interest rate risk, inflation risk, credit risk, liquidity risk, market risk, and currency risk. It's essential to understand these risks and their potential impact on your income-generating assets, so you can make informed investment decisions and mitigate potential losses.

Yes, income investing involves various tax considerations, including the taxation of dividend income, bond interest income, and capital gains. Understanding the tax implications can help you optimize your net returns. To minimize or defer taxes on your investment income, consider using tax-advantaged accounts, such as individual retirement accounts (IRAs) or 401(k)s, for your income investments.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.