What Are Independent Custodians?

Independent custodians play a crucial role in safeguarding clients' financial assets.

They act as an impartial third party responsible for holding and administering a client's investments, ensuring safekeeping, and providing a layer of protection against fraud and mismanagement.

The independent custodian's role is vital in the financial industry as they maintain the integrity of the market, promote transparency, and foster investor confidence.

By providing an additional layer of oversight and accountability, independent custodians contribute to the stability and efficiency of the financial ecosystem.

Independent custodians are subject to strict regulatory oversight to protect investors and maintain market integrity.

They must comply with various regulations, such as anti-money laundering (AML) rules, Know Your Customer (KYC) policies, and securities laws, ensuring they operate transparently and compliant.

Types of Independent Custodians

Banks and Trust Companies

Banks and trust companies are common types of independent custodians, providing custody services for a wide range of clients.

They offer secure and efficient asset management as a reliable intermediary between clients and the financial markets.

Broker-Dealers

Broker-dealers can also serve as independent custodians, ensuring the safekeeping of their client's assets.

By providing custody services, broker-dealers offer an additional layer of security and enable clients to access a broad array of investment products.

Investment Management Firms

Some investment management firms act as independent custodians to securely manage their clients' assets.

These firms typically focus on providing comprehensive investment solutions while ensuring clients' assets are safeguarded throughout the investment process.

Specialty Custodians

Specialty custodians cater to specific market segments or unique asset classes, such as digital assets, real estate, or alternative investments.

These custodians possess specialized knowledge and capabilities, allowing them to provide tailored solutions to clients with unique needs.

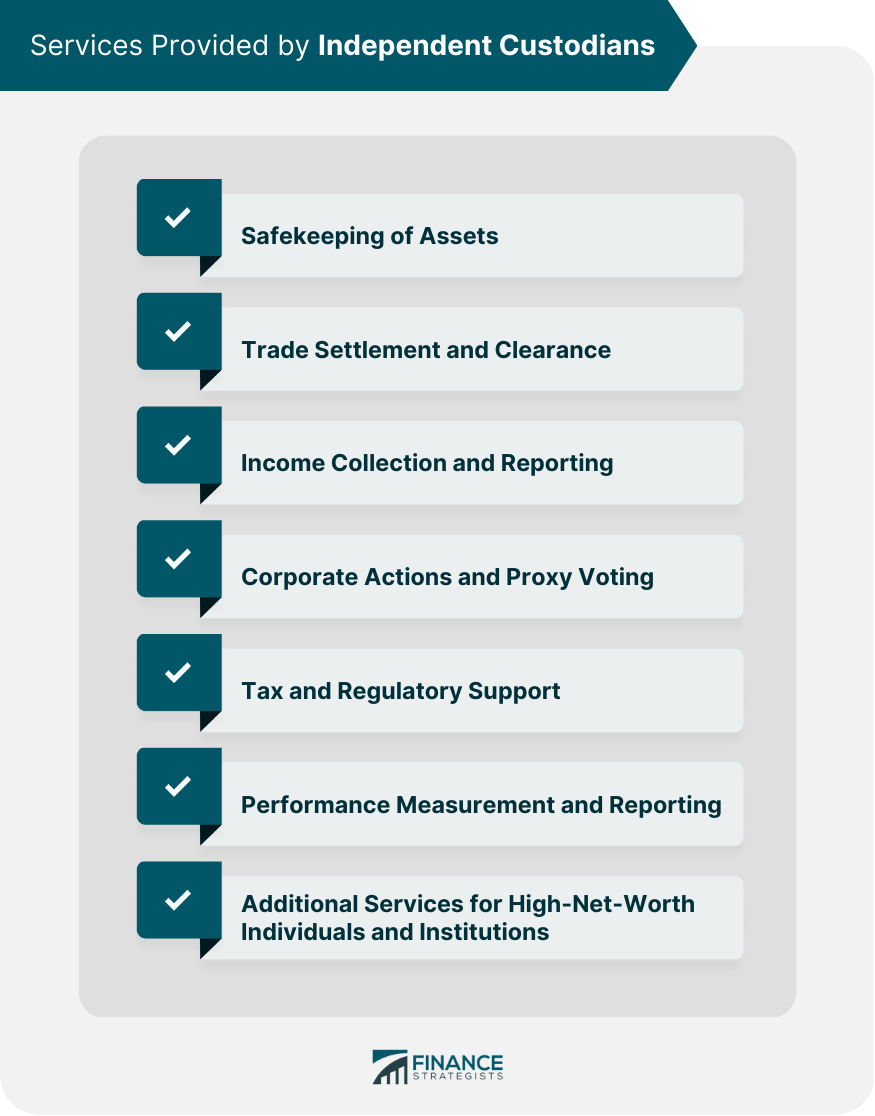

Services Provided by Independent Custodians

Safekeeping of Assets

Independent custodians ensure the safekeeping of clients' assets by holding them in segregated accounts. This separation of assets protects clients from the risk of loss or mismanagement by the custodian or other financial institutions.

Trade Settlement and Clearance

Custodians play a vital role in facilitating trade settlement and clearance, ensuring that transactions are executed efficiently and accurately. This process involves coordinating the exchange of assets and payments between buyers and sellers.

Income Collection and Reporting

Independent custodians collect and distribute income generated by clients' investments, such as dividends and interest payments. They also provide regular reporting on clients' portfolio performance, enabling clients to make informed investment decisions.

Corporate Actions and Proxy Voting

Custodians manage corporate actions, such as stock splits, mergers and acquisitions, ensuring that clients receive their entitled benefits. They also facilitate proxy voting, allowing clients to exercise their voting rights in company decisions.

Tax and Regulatory Support

Independent custodians assist clients in navigating complex tax and regulatory requirements, helping them remain compliant with relevant laws and regulations. This support may include tax reporting, withholding, and the management of tax-related documentation.

Performance Measurement and Reporting

Custodians provide performance measurement and reporting services to help clients track their investments' performance. These services enable clients to assess the effectiveness of their investment strategies and make necessary adjustments.

Additional Services for High-Net-Worth Individuals and Institutions

Independent custodians may offer specialized services tailored to the needs of high-net-worth individuals and institutions. These services can include customized reporting, access to exclusive investment opportunities, and sophisticated risk management solutions.

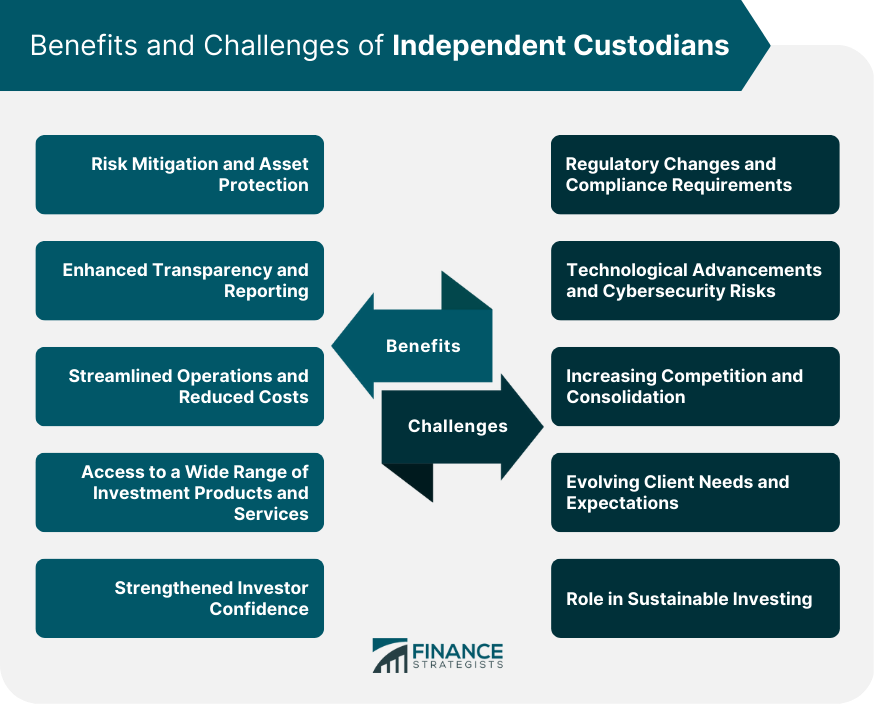

Benefits of Independent Custodians

Risk Mitigation and Asset Protection

Independent custodians provide an added layer of security for clients' assets by segregating them from the custodian's own assets. This separation minimizes the risk of loss due to fraud, insolvency, or mismanagement, ensuring that clients' investments are protected.

Enhanced Transparency and Reporting

Custodians contribute to market transparency by providing clients with accurate and timely reporting on their assets. This information allows clients to monitor their investments, assess performance, and make informed decisions about their portfolios.

Streamlined Operations and Reduced Costs

By centralizing and automating various administrative tasks, independent custodians help clients streamline their operations and reduce costs. This efficiency allows clients to focus on their core investment strategies and goals.

Access to a Wide Range of Investment Products and Services

Independent custodians offer clients access to diverse investment products and services. This access enables clients to build well-diversified portfolios tailored to their specific needs and objectives.

Strengthened Investor Confidence

Independent custodians foster investor confidence by providing a secure and transparent environment for asset management. This confidence, in turn, supports market stability and encourages further investment and growth in the financial industry.

Challenges and Future Trends in the Independent Custodian Industry

Regulatory Changes and Compliance Requirements

Independent custodians must navigate a constantly evolving regulatory landscape, adapting to new rules and compliance requirements to protect clients and maintain market integrity.

Technological Advancements and Cybersecurity Risks

As technology continues to advance, independent custodians must adapt to new systems and processes while managing potential cybersecurity risks. This evolution requires ongoing investment in technology and robust risk management practices.

Increasing Competition and Consolidation

The independent custodian industry faces increasing competition and consolidation, driving firms to differentiate themselves through innovative services and cost-effective solutions.

Evolving Client Needs and Expectations

Client needs and expectations continue to evolve, necessitating that independent custodians remain agile and responsive to shifting market dynamics and client preferences.

Role of Independent Custodians in Sustainable Investing

Independent custodians are increasingly playing a role in sustainable investing, offering services that support clients' environmental, social, and governance (ESG) objectives and promote responsible investment practices.

Choosing an Independent Custodian

Factors to Consider

When selecting an independent custodian, clients should consider several factors, including:

Size and Financial Stability: Clients should evaluate the size and financial stability of the custodian to ensure that they have the resources to manage their clients' assets effectively.

Range of Services and Products: Clients should examine the range of services and products offered by the custodian to ensure that they can meet their specific investment needs.

Fees and Pricing Structure: Clients should assess the fees and pricing structure of the custodian to ensure that they are reasonable and transparent.

Reputation and Industry Experience: Clients should consider the custodian's reputation and industry experience, as this can provide insights into the quality of service provided.

Technological Capabilities and Integration: Clients should evaluate the custodian's technological capabilities and integration, ensuring that they have the tools and resources required to manage investments efficiently and effectively.

Due Diligence Process

Clients should conduct thorough due diligence before selecting an independent custodian, including reviewing the custodian's regulatory history and compliance, evaluating operational and risk management processes

Similarly, it involves examining client service and support, and analyzing performance track records.

Final Thoughts

Independent custodians play a crucial role in the financial ecosystem by safeguarding clients' assets, providing transparency, and fostering investor confidence. Their services contribute to market stability and the efficient functioning of the financial industry.

The independent custodian industry continues to evolve, adapting to regulatory changes, technological advancements, and shifting client needs. This evolution requires firms to remain innovative and responsive to maintain their competitive edge.

Independent custodians offer significant value to investors and financial institutions by providing a secure, transparent environment for asset management.

Their services and expertise help clients navigate the complexities of the financial markets, protect their investments, and achieve their long-term objectives.

In addition to the benefits provided by independent custodians, investors may consider seeking wealth management services to further enhance their financial strategies.

Wealth management professionals can offer personalized advice and comprehensive solutions to help clients achieve their financial goals and optimize their investment portfolios.

Independent Custodians FAQs

Independent custodians are impartial third parties responsible for holding and administering a client's investments, ensuring safekeeping, and providing a layer of protection against fraud and mismanagement. Their role is vital in maintaining the integrity of the market, promoting transparency, and fostering investor confidence.

The types of independent custodians include banks and trust companies, broker-dealers, investment management firms, and specialty custodians. These custodians offer different services and cater to specific market segments or unique asset classes.

Independent custodians provide various services, including safekeeping of assets, trade settlement and clearance, income collection and reporting, corporate actions and proxy voting, tax and regulatory support, performance measurement and reporting, and additional services for high-net-worth individuals and institutions.

The benefits of independent custodians include risk mitigation and asset protection, enhanced transparency and reporting, streamlined operations and reduced costs, access to a wide range of investment products and services, and strengthened investor confidence. The challenges include regulatory changes and compliance requirements, technological advancements and cybersecurity risks, increasing competition and consolidation, evolving client needs and expectations, and their role in sustainable investing.

When selecting an independent custodian, clients should consider factors such as size and financial stability, range of services and products, fees and pricing structure, reputation and industry experience, and technological capabilities and integration. Clients should also conduct thorough due diligence, including reviewing the custodian's regulatory history and compliance, evaluating operational and risk management processes, examining client service and support, and analyzing performance track records.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.