An inflation swap is a financial derivative tool used to transfer inflation risk from one party to another through an exchange of cash flows. In this agreement, one party pays a fixed rate, while the other pays a floating rate linked to an inflation index, such as the Consumer Price Index (CPI). A swap is a derivative contract where two parties exchange financial instruments. These instruments can be almost anything, but most swaps involve cash flows based on a notional principal amount that both parties agree upon. In an inflation swap, the notional amount is not exchanged, but it is used to calculate the final cash flows. Inflation swaps are vital for managing exposure to inflation risk. By hedging against potential changes in the inflation rate, businesses can protect their revenue streams and maintain the real value of their profits. Additionally, these swaps are essential for institutions like pension funds that have long-term, inflation-linked liabilities. The mechanics of an inflation swap involve two parties agreeing to exchange cash flows over a specified period. The party paying the fixed rate makes payments based on a predetermined rate, while the party paying the inflation-linked rate makes payments based on the change in an inflation index. The two main parties in an inflation swap are the payer of the fixed rate, often a corporation or investor seeking to hedge against inflation, and the payer of the inflation rate, typically a financial institution. In a Zero Coupon Inflation Swap, the fixed-rate payer makes a single payment at the end of the swap's term. The inflation payer, on the other hand, makes payments throughout the swap's term. These payments are based on the inflation rate, which is typically measured using a standard index, such as the Consumer Price Index (CPI). The 'Zero Coupon' label comes from the fact that the fixed-rate payer does not make regular payments during the term of the swap. Instead, they make a single payment at the maturity of the contract. The zero coupon inflation swap is the simplest and most common type of inflation swap. Its structure allows for straightforward hedging against future inflation, which makes it popular among corporations and institutional investors. In inflation swap type, both parties make annual payments. The fixed-rate payer's payments remain constant throughout the term of the swap, while the inflation payer's payments change each year. The changes in the inflation payer's payments are based on the inflation rate from one year to the next, hence the term 'Year-on-Year'. This type of swap is often used by investors who wish to speculate on the inflation rate or hedge against inflation risk over a series of specific time periods. The payments' structure, which changes year by year, provides a more granular approach to hedging and speculating, which can be beneficial in certain market conditions. Several factors can influence the pricing of an inflation swap, including the inflation expectations, risk premium, the term of the swap, and the creditworthiness of the counterparties. Valuation of inflation swaps typically involves discounting the future cash flows using a risk-adjusted discount rate. Several models can be used, including the Black-76 model and the Bachelier model, each of which accounts for different market conditions and assumptions. Central banks may use inflation swaps as a tool for implementing monetary policy. By entering into inflation swaps, they can influence market expectations of future inflation, which can help guide inflation towards their target. Central banks' actions can significantly impact the inflation swap markets. Their policy decisions can shift inflation expectations, leading to changes in the pricing and demand for inflation swaps. One of the main risks in an inflation swap is counterparty risk, the risk that one party will default on their obligations. This risk is especially significant in over-the-counter markets where there is no central clearinghouse. Other potential risks include basis risk, the risk that the inflation index may not accurately reflect a party's actual inflation exposure, and liquidity risk, the risk that a party may not be able to enter or exit a swap contract at a reasonable price. Inflation swaps are significant in both bond and derivatives markets. They provide a means for investors to speculate on future inflation and for issuers of inflation-linked bonds to manage their inflation risk. The prices of inflation swaps can also serve as a valuable tool for economic forecasting. Since they reflect market expectations of future inflation, they can provide insights into future economic conditions. Inflation swaps are regulated by financial regulatory bodies, such as the U.S. Commodity Futures Trading Commission (CFTC) and the U.K. Financial Conduct Authority (FCA), which work to ensure transparency and protect against fraudulent activities. Inflation swaps are governed by standard swap agreements, such as the International Swaps and Derivatives Association (ISDA) Master Agreement, which outlines the terms and conditions of the swap, including the obligations of each party and what happens in the event of a default. An inflation swap is a financial derivative that facilitates the exchange of cash flows between two parties, one paying a fixed rate and the other paying a rate that's tied to an inflation index. This mechanism is a powerful tool in the financial landscape, providing a means for parties to manage inflation risk and thereby protect the real value of their future cash flows. The application of inflation swaps extends beyond risk management, influencing monetary policy, and contributing valuable insights into future economic conditions. Despite the advantages they offer, it's important to note that they come with inherent complexities and risks, such as counterparty risk, basis risk, and liquidity risk. Thus, before getting involved in such contracts, it's crucial to seek professional guidance to navigate these intricacies efficiently and ensure the most beneficial outcome for your financial standing.What Is an Inflation Swap?

Definition

Understanding the Concept of Swap

Importance of Inflation Swaps

The Mechanics of Inflation Swaps

How an Inflation Swap Works

Parties Involved in the Swap

Types of Inflation Swaps

Zero Coupon Inflation Swap

Year-On-Year Inflation Swap

Pricing and Valuation of Inflation Swaps

Factors Influencing Pricing

Valuation Models and Methods

Use of Inflation Swaps by Central Banks

Monetary Policy and Inflation Swaps

Central Banks' Impact on Inflation Swap Markets

Risks and Limitations of Inflation Swaps

Counterparty Risk

Other Potential Risks

Inflation Swaps in Financial Markets

Importance in Bond and Derivatives Markets

Role in Economic Forecasting

Legal and Regulatory Aspects of Inflation Swaps

Regulatory Bodies Overseeing Swaps

Legal Considerations and Contractual Aspects

Final Thoughts

Inflation Swap FAQs

An inflation swap primarily serves as a hedge against inflation risk. By entering into an inflation swap contract, parties can protect their financial interests from the adverse effects of unexpected inflation.

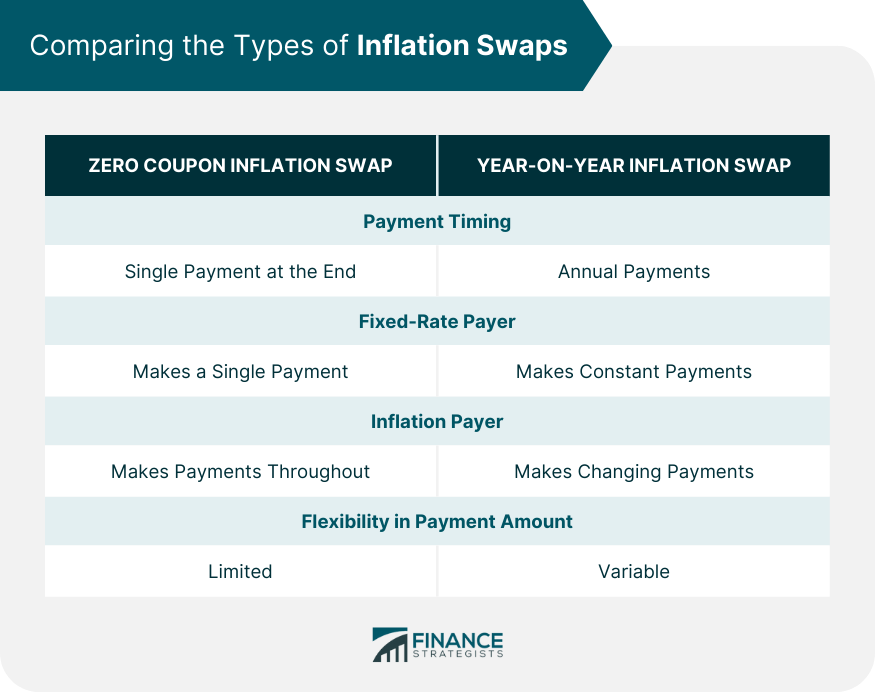

In a zero coupon inflation swap, the fixed-rate payer makes a single payment at the end of the term, while the inflation payer makes payments throughout based on the inflation rate. In a year-on-year inflation swap, both parties make annual payments, with the inflation payer's payments changing based on the yearly inflation rate.

The valuation of inflation swaps typically involves discounting future cash flows using a risk-adjusted discount rate. Several models, such as the Black-76 model and the Bachelier model, can be used for this purpose.

The main risks associated with inflation swaps are counterparty risk (the risk that the other party will default), basis risk (the risk that the inflation index may not accurately reflect a party's actual inflation exposure), and liquidity risk (the risk that a party may not be able to enter or exit a swap contract at a reasonable price).

Inflation swaps are regulated by financial regulatory bodies. In the U.S., the Commodity Futures Trading Commission (CFTC) oversees these swaps, while in the U.K., the Financial Conduct Authority (FCA) has this responsibility. These bodies work to ensure transparency and protect market participants from fraudulent activities.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.