Investment Model is a strategy or plan that outlines how investors intend to allocate their assets and invest their money. The model depends on the individual's investment goals, risk tolerance, and investment time horizon. Investment Models are essential to investors as they guide them to make sound investment decisions that are in line with their goals. Value investing is an investment strategy that involves picking stocks that are trading below their intrinsic value. This model is based on the premise that the market sometimes undervalues good companies, and as a result, investors can buy them at a discount. Value investors aim to identify these undervalued stocks and hold them for an extended period until the market corrects its price. Growth investing is a strategy that focuses on companies that have the potential to grow significantly in the future. Investors who adopt this model look for companies with high earnings growth rates, high returns on equity, and other metrics that suggest they have strong growth prospects. Growth investors often pay a premium for these stocks since they believe the future growth will be worth the investment. Income investing is an investment strategy that focuses on generating a steady stream of income. Investors who adopt this model invest in stocks or bonds that pay regular dividends or interest payments. These investments are often less volatile and provide a predictable income stream, making them suitable for retirees or investors who are risk-averse. Index investing is an investment strategy that aims to match the performance of a specific index, such as the S&P 500. Instead of picking individual stocks, investors who adopt this model buy a basket of stocks that represent the index. This model is passive and often has lower fees than other models. Momentum investing is a strategy that focuses on buying stocks that have been trending upwards in the market. This model is based on the premise that stocks that have been performing well will continue to perform well in the future. Investors who adopt this model buy stocks that have had strong recent performance and sell stocks that have been underperforming. Socially responsible investing is an investment strategy that focuses on investing in companies that have strong environmental, social, and governance (ESG) practices. Investors who adopt this model invest in companies that are committed to sustainable and ethical practices. The first step in creating an investment model is to assess investment goals. Investors should determine their investment objectives, risk tolerance, and investment time horizon. After assessing investment goals, investors should identify the investment options that are available to them. This includes stocks, bonds, mutual funds, and ETFs. The next step is to determine the asset allocation that is appropriate for the investor's investment objectives, risk tolerance, and investment time horizon. This involves deciding how much of the portfolio should be invested in different asset classes. Once the asset allocation has been determined, investors should create an investment plan that outlines their investment strategy. This includes selecting investments that meet their investment criteria and developing a plan for monitoring and adjusting the portfolio. Investors should regularly monitor their investment portfolio to ensure that it remains in line with their investment objectives and risk tolerance. Rebalancing the portfolio may be necessary if the market fluctuates or if the investor's investment objectives change. Investment objectives are the goals that an investor hopes to achieve through their investments. These objectives vary depending on the individual's financial situation, age, risk tolerance, and investment time horizon. Some common investment objectives include capital preservation, income generation, long-term growth, and tax efficiency. Risk tolerance refers to an investor's ability to handle fluctuations in the market. Investors who have a high-risk tolerance are willing to accept higher levels of risk to achieve higher returns. Conversely, investors who have a low-risk tolerance prefer less volatile investments, such as bonds or cash. Investment time horizon refers to the length of time an investor intends to hold their investments. Investors who have a long-term investment horizon can afford to take more risks and invest in assets with higher volatility. Conversely, investors who have a short-term investment horizon should focus on more stable investments. Asset allocation is the process of dividing an investment portfolio among different asset classes, such as stocks, bonds, and cash. The allocation is based on an individual's investment objectives, risk tolerance, and investment time horizon. Proper asset allocation can help investors achieve their investment goals while minimizing risk. Investment selection criteria refer to the standards that investors use to evaluate potential investments. These criteria vary depending on the investment model, but some common factors include company fundamentals, growth potential, valuation, and industry trends. Diversification is the practice of investing in a variety of assets to reduce risk. Investors who adopt this model spread their investments across different asset classes, sectors, and geographies. Diversification can help investors achieve their investment objectives while minimizing risk. Rebalancing is the process of adjusting the allocation of investments in a portfolio to maintain the desired asset allocation. This practice is essential since market fluctuations can cause the value of different assets to change, resulting in an unbalanced portfolio. An investment model provides investors with a clear strategy for investing their money. This strategy outlines the investor's goals, risk tolerance, and investment time horizon, ensuring that their investments are aligned with their objectives. Investment decisions can be emotional, and investors can be prone to making irrational decisions based on fear or greed. An investment model helps investors make logical and rational investment decisions by providing a framework for decision-making. Disciplined investing is crucial to achieving long-term investment goals. An investment model helps investors stick to their investment strategy by providing a disciplined approach to investing. Investment models are designed to help investors achieve their long-term investment goals. By outlining investment objectives, risk tolerance, and investment time horizon, investors can develop a strategy that is tailored to their specific needs. Investing involves risk, but an investment model can help investors manage that risk by providing a diversified portfolio and a disciplined approach to investing. An investment model is an essential tool for investors seeking to achieve their financial goals. By understanding the different types of investment models available, investors can select a strategy that aligns with their investment objectives, risk tolerance, and investment time horizon. Creating an investment model involves assessing investment goals, identifying investment options, determining asset allocation, and developing an investment plan that outlines investment criteria and monitoring strategies. Key elements of an investment model include investment objectives, risk tolerance, investment time horizon, asset allocation, investment selection criteria, diversification, and rebalancing. By having an investment model, investors can benefit from having a clear investment strategy, minimizing emotions in investment decision-making, facilitating disciplined investing, achieving long-term investment goals, and managing risk. Overall, an investment model is a valuable tool that can help investors make informed decisions and achieve financial success.Definition of Investment Model

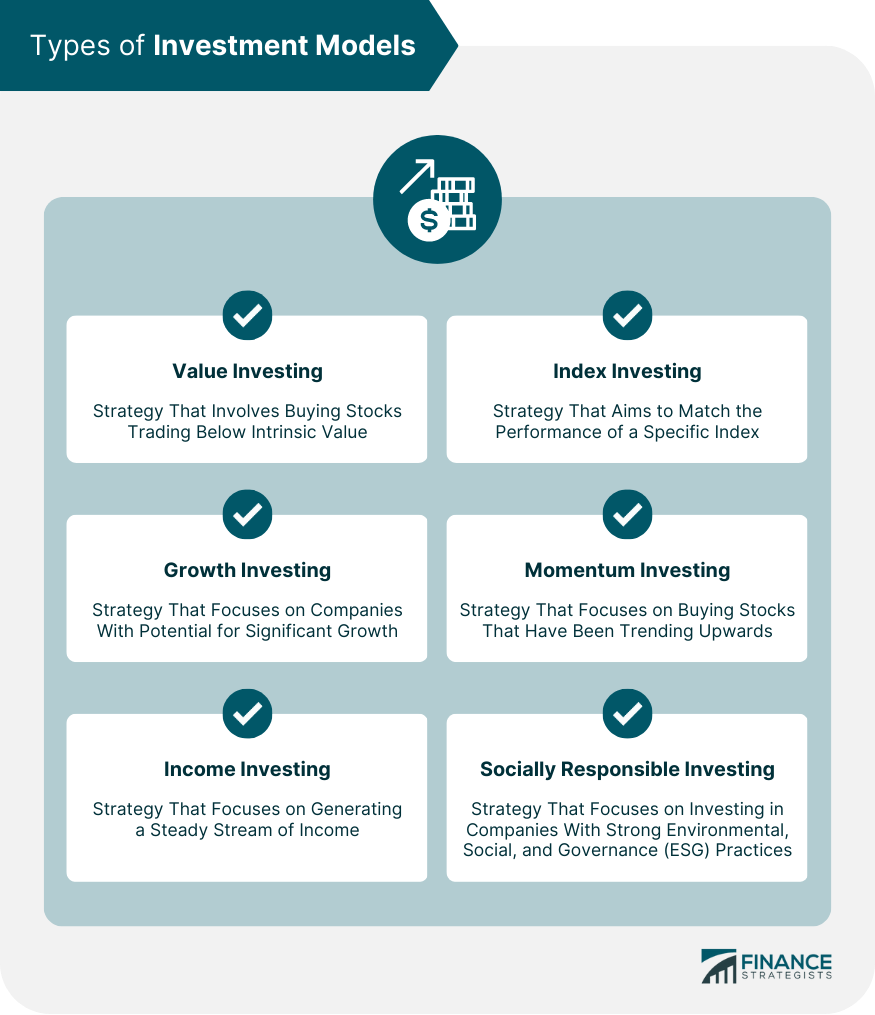

Types of Investment Models

Value Investing Model

Growth Investing Model

Income Investing Model

Index Investing Model

Momentum Investing Model

Socially Responsible Investing Model

Creating an Investment Model

Assessing Investment Goals

Identifying Investment Options

Determining Asset Allocation

Creating an Investment Plan

Monitoring and Adjusting the Investment Model

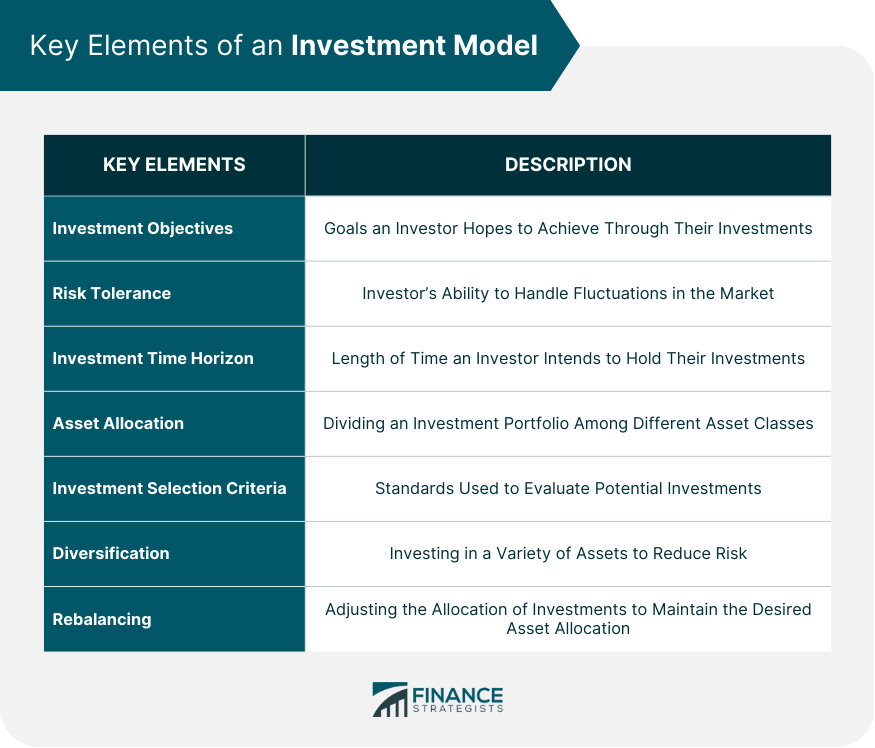

Key Elements of an Investment Model

Investment Objectives

Risk Tolerance

Investment Time Horizon

Asset Allocation

Investment Selection Criteria

Diversification

Rebalancing

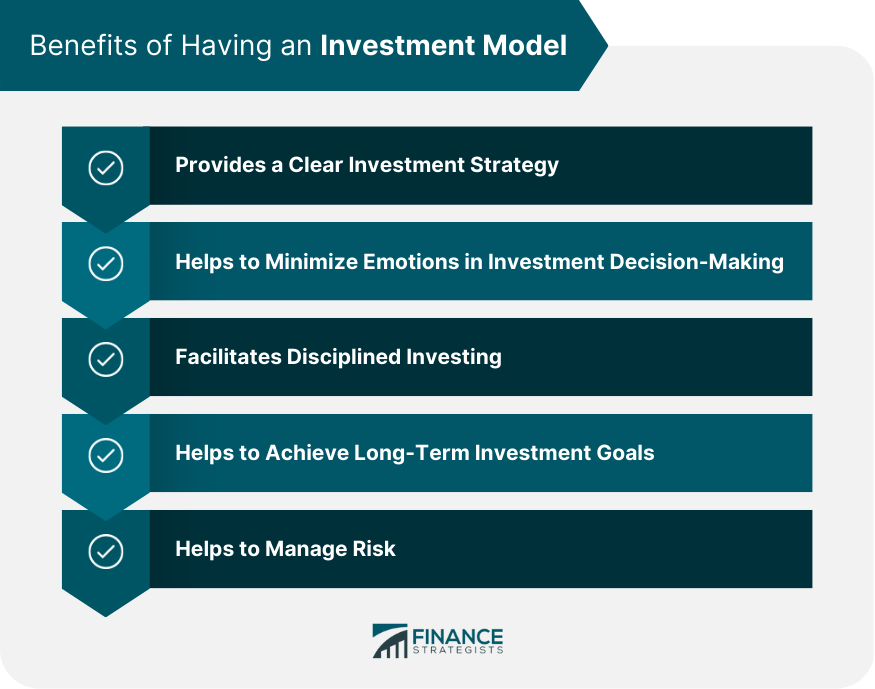

Benefits of Having an Investment Model

Provides a Clear Investment Strategy

Helps to Minimize Emotions in Investment Decision-Making

Facilitates Disciplined Investing

Helps to Achieve Long-Term Investment Goals

Helps to Manage Risk

Conclusion

Investment Model FAQs

Investment models are strategies or plans that outline how investors intend to allocate their assets and invest their money. They are important because they guide investors to make sound investment decisions that are in line with their goals.

The key elements of an investment model include investment objectives, risk tolerance, investment time horizon, asset allocation, investment selection criteria, diversification, and rebalancing.

Investment models help to minimize emotions in investment decision-making by providing a framework for decision-making. They help investors make logical and rational investment decisions based on their investment objectives, risk tolerance, and investment time horizon.

The benefits of having an investment model include providing a clear investment strategy, minimizing emotions in investment decision-making, facilitating disciplined investing, helping to achieve long-term investment goals, and managing risk.

To create an investment model, investors should assess their investment goals, identify investment options, determine asset allocation, create an investment plan, and monitor and adjust the investment model as necessary. It is important to consider investment objectives, risk tolerance, and investment time horizon when creating an investment model.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.