Investment performance reporting is a critical aspect of portfolio management, as it provides investors with a clear understanding of their investments' returns, risks, and overall effectiveness. This article delves into the various components of investment performance reporting, performance measurement standards, and best practices to enhance transparency and investor confidence. This section typically contains basic investor information, such as account number, account holder's name, and the reporting period. It serves as a reference point for investors and helps them verify the accuracy of their account details. The performance summary provides an overview of the portfolio's total returns, highlighting changes in the value of investments over the reporting period. It may include cumulative returns, annualized returns, or both to provide a comprehensive picture of the portfolio's performance. This section breaks down the returns by individual investments, asset classes, or sectors. It allows investors to identify the key drivers of portfolio performance and evaluate the effectiveness of their investment strategies. This section provides detailed information on the portfolio's investments, including the security name, ticker symbol, asset class, quantity held, market value, and percentage allocation. The transactions section records all the buying, selling, and other activities within the portfolio during the reporting period. It includes details such as transaction dates, quantities, and prices, allowing investors to track their investment activity and its impact on their portfolio. Benchmarks are essential for assessing the performance of a portfolio relative to a specific market index or industry standard. This section compares the portfolio's returns to one or more relevant benchmarks, helping investors evaluate the effectiveness of their investment strategies. Risk measures quantify the level of risk associated with a portfolio, including metrics such as standard deviation, beta, and Value at Risk (VaR). These measures help investors understand the potential volatility of their investments and make informed decisions about their risk tolerance. This section details the fees and expenses associated with managing the portfolio, including management fees, trading costs, and other miscellaneous expenses. Clear disclosure of fees and expenses is crucial for investors to assess the net performance of their investments. Global Investment Performance Standards (GIPS) is a globally recognized set of standardized guidelines for reporting investment performance. GIPS is based on several key principles, including fair representation and full disclosure, consistency in reporting methodologies, and data accuracy. GIPS compliance offers numerous benefits, such as improved investor trust, easier performance comparisons, and greater transparency. However, GIPS also has some limitations, including the costs associated with compliance and the potential for misinterpretation of performance results. The IPM framework is a set of guidelines developed by the CFA Institute to establish best practices for investment performance measurement and reporting. The Investment Performance Measurement (IPM) framework consists of several components: performance measurement, performance attribution, risk measurement, and composite construction. Implementing the IPM framework involves establishing a performance measurement policy, selecting appropriate benchmarks, and incorporating relevant risk measures. Performance attribution analysis is a technique used to evaluate the sources of a portfolio's returns, attributing them to specific investment decisions, such as asset allocation, security selection, and market timing. The Brinson model is a widely used attribution methodology that decomposes portfolio returns into three components: allocation effect, selection effect, and interaction effect. The Karnosky-Singer model is a multi-currency attribution model that accounts for the effects of currency exposure on international investments. The interaction effect captures the combined impact of asset allocation and security selection on a portfolio's performance. Attribution analysis is used to evaluate the effectiveness of investment strategies, identify areas for improvement, and support better decision-making by portfolio managers. Attribution analysis has its limitations, such as the assumptions made in the models, the difficulty of isolating specific factors, and the potential for misinterpretation of results. Risk-adjusted performance measurement is essential for accurately evaluating the performance of a portfolio by accounting for the level of risk taken to achieve the returns. The Sharpe ratio measures the excess return per unit of risk, as represented by the standard deviation of the portfolio's returns. The Sortino ratio is similar to the Sharpe ratio but focuses on downside risk, making it more suitable for assessing asymmetric return distributions. The Treynor ratio measures the excess return per unit of systematic risk, as represented by the portfolio's beta. Jensen's Alpha measures a portfolio's risk-adjusted performance relative to its expected return based on the Capital Asset Pricing Model (CAPM). The information ratio measures the excess return relative to a benchmark per unit of active risk, as represented by the tracking error. Risk-adjusted performance metrics are widely used in investment management to evaluate the effectiveness of investment strategies and compare the performance of different portfolios. Investment performance can be reported at various frequencies, such as daily, weekly, monthly, quarterly, or annually, depending on the needs of the investor and the nature of the investments. Performance can be presented as cumulative or annualized returns to provide a comprehensive view of the portfolio's performance over different time horizons. Investment performance can be reported based on the calendar year or the fiscal year, depending on the investor's preferences and the portfolio's requirements. Investment performance reporting is subject to various regulations, such as those imposed by the Securities and Exchange Commission (SEC), the Financial Industry Regulatory Authority (FINRA), and the Markets in Financial Instruments Directive II (MiFID II). Compliance with investment performance reporting regulations can be challenging due to the complexity of the rules and the need to adapt to changing regulatory environments. Best practices for regulatory compliance include maintaining accurate and up-to-date records, implementing robust compliance policies and procedures, and providing ongoing training and support for staff. Transparency and full disclosure are crucial for building investor trust and ensuring investors have all the necessary information to make informed investment decisions. Investment performance reports should be delivered in a timely manner and be based on accurate and up-to-date data to facilitate effective decision-making. Consistency in reporting methodologies is essential for enabling accurate comparisons of investment performance across different time periods and investment strategies. Customization and personalization of investment performance reports can help meet individual investors' unique needs and preferences, providing a more tailored and relevant experience. Investment performance reports should be presented in a clear and easily understandable format, with appropriate explanations and context provided to help investors interpret the data and make informed decisions. Investment performance reporting is essential to portfolio management, providing investors with valuable insights into their investments' returns, risks, and overall effectiveness. By adhering to best practices and performance measurement standards, investment professionals can enhance transparency, foster investor confidence, and facilitate better decision-making. As technology continues to advance, the future of investment performance reporting is expected to become even more efficient, accurate, and user-friendly, further benefiting investors and the investment management industry as a whole.Definition of Investment Performance Reporting

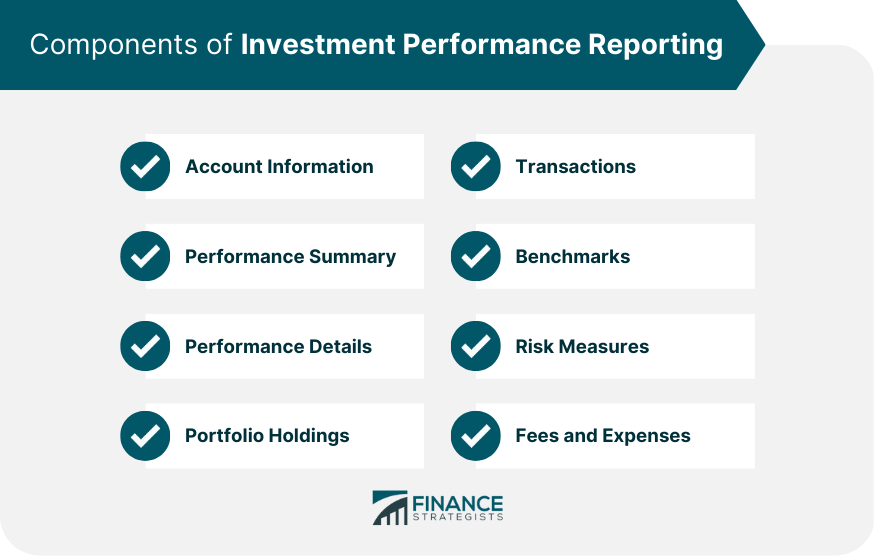

Components of Investment Performance Reporting

Account Information

Performance Summary

Performance Details

Portfolio Holdings

It helps investors assess their portfolio's diversification and make informed decisions about rebalancing or adjusting their holdings.Transactions

Benchmarks

Risk Measures

Fees and Expenses

Performance Measurement Standards

Global Investment Performance Standards (GIPS)

The primary purpose of GIPS is to establish consistent and comparable performance reporting practices, enhancing transparency and fostering investor confidence.CFA Institute Investment Performance Measurement (IPM) Framework

Performance Attribution Analysis

Attribution Methodologies

Brinson Model

Karnosky-Singer Model

Interaction Effect

Applications of Attribution Analysis

Challenges and Limitations

Risk-Adjusted Performance Measurement

Risk-Adjusted Performance Metrics

Sharpe Ratio

Sortino Ratio

Treynor Ratio

Jensen's Alpha

Information Ratio

Applications and Limitations

However, these metrics have limitations, such as their reliance on historical data and their sensitivity to changes in risk factors.Reporting Frequency and Timeframes

Daily, Weekly, Monthly, Quarterly, and Annual Reporting

Cumulative and Annualized Performance

Calendar vs. Fiscal Year Reporting

Regulatory and Compliance Requirements of Investment Performance Reporting

Regulations on Investment Performance Reporting

Compliance Challenges

Best Practices for Regulatory Compliance

Best Practices in Investment Performance Reporting

Transparency and Disclosure

Timeliness and Accuracy

Consistency in Reporting Methodologies

Customization and Personalization

Clear Communication and Education

Conclusion

Investment Performance Reporting FAQs

Investment performance reporting is a process of evaluating and reporting the returns and performance of an investment portfolio over a specific period.

Investment performance reporting benefits investors, financial advisors, and asset managers who need to monitor and evaluate the performance of their investments.

The key components of investment performance reporting include the investment strategy, benchmark, time period, return calculations, and presentation format.

Investment performance reporting should be done at regular intervals, typically quarterly or annually, to provide a consistent and reliable evaluation of investment returns.

Investment performance reporting can help in investment decision-making by providing insights into the performance of individual investments and the overall portfolio. This information can be used to make informed decisions about rebalancing or adjusting investment strategies.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.