Loss aversion is a psychological phenomenon that refers to the tendency of people to strongly prefer avoiding losses rather than acquiring equivalent gains. In other words, the pain of losing something is perceived to be greater than the pleasure of gaining something of equal value. This concept plays a critical role in behavioral economics, as it can significantly influence financial decisions and investment strategies. By understanding loss aversion, individuals can make more informed decisions and potentially improve their financial well-being. Loss aversion can be traced back to the basic survival instincts of humans. Our ancestors relied on the ability to minimize losses, such as avoiding dangerous situations or conserving scarce resources, to ensure their survival. This evolutionary adaptation has persisted into modern times and continues to shape our decision-making processes, even in financial matters. The endowment effect is another aspect of loss aversion, which suggests that people tend to ascribe more value to items they possess than those they do not. This effect can lead to irrational decisions, such as overvaluing assets or holding onto investments for longer than is financially prudent. Status quo bias is a cognitive bias that leads people to prefer maintaining the current state of affairs rather than changing it. This can result in resistance to taking action, even when it is in their best financial interest. In the context of loss aversion, individuals may be more inclined to avoid the potential losses associated with change rather than pursue potential gains. The sunk cost fallacy occurs when individuals continue investing time, effort, or money into an endeavor based on the resources they have already invested, rather than evaluating the current and future value of the investment. This bias can exacerbate loss aversion, as individuals may be reluctant to admit a loss and instead continue to invest in a losing proposition. Regret aversion is the desire to avoid feeling regret for making a decision that leads to a negative outcome. This can result in individuals avoiding potentially profitable opportunities due to the fear of experiencing loss, even if the potential gains outweigh the risks. The fear of loss is a powerful emotional driver that can significantly impact financial decision-making. Loss aversion can lead individuals to make conservative choices to avoid potential losses, even at the expense of potential gains. Anxiety and stress can exacerbate loss aversion, as individuals may be more likely to make decisions based on emotion rather than rational thought. High anxiety and stress levels can impair judgment and lead to poor financial choices. The value function is a concept developed by psychologists Daniel Kahneman and Amos Tversky, which illustrates the relationship between the perceived value of gains and losses. According to their prospect theory, the value function is asymmetric, meaning that losses impact individuals' decision-making more than equivalent gains. The loss aversion coefficient is a measure used to quantify an individual's level of loss aversion. It is calculated by comparing the relative weight assigned to losses and gains in decision-making. A higher coefficient indicates a greater degree of loss aversion. Numerous empirical studies have been conducted to investigate the extent and implications of loss aversion in various contexts, such as consumer behavior, investment decisions, and risk-taking. These studies have consistently demonstrated the pervasive nature of loss aversion and its impact on decision-making. Loss aversion can contribute to overspending, as individuals may be more focused on avoiding the immediate pain of losing money rather than considering the long-term benefits of saving. This can lead to impulsive purchases and a reluctance to cut back on expenses, even when it is financially prudent to do so. Loss aversion can also result in inefficient saving strategies. For example, individuals may be more inclined to keep their savings in low-risk, low-return investments, such as savings accounts or conservative bonds, due to the fear of losing their principal. This can limit the potential for wealth accumulation and hinder long-term financial goals. Loss aversion can lead to an overemphasis on short-term gains when managing debt. For instance, individuals may be more inclined to make minimum payments on high-interest debts, avoiding the immediate pain of a larger payment but ultimately paying more in interest over time. On the other hand, some individuals may exhibit debt aversion, avoiding borrowing money even when it could be beneficial for their financial situation. This reluctance to take on debt may stem from the fear of loss associated with repaying the borrowed funds. Loss aversion can lead individuals to over-insure themselves and their assets, purchasing more coverage than is necessary or cost-effective. This behavior is driven by the desire to avoid potential losses, even when the likelihood of such losses is relatively low. Risk aversion, closely related to loss aversion, is the preference for safer options with more predictable outcomes. In the context of insurance and risk management, this can result in individuals selecting insurance policies or risk management strategies that prioritize safety over potential gains, even when the expected value of the riskier option may be more favorable. Loss aversion can significantly impact how individuals approach investment decisions, particularly when evaluating the trade-offs between risk and return. The fear of potential losses can lead to conservative investment choices, such as favoring bonds over stocks or avoiding more volatile investments. Loss aversion can also influence the extent to which individuals diversify their investment portfolios. While diversification can help manage risk, excessive diversification driven by loss aversion can limit potential returns and hinder long-term investment goals. The disposition effect refers to the tendency of investors to sell winning investments too early while holding onto losing investments for too long. This behavior can be attributed to lose aversion, as individuals may be more focused on locking in gains and avoiding the realization of losses, even when it may be more financially advantageous to do otherwise. Herding behavior occurs when individuals follow the investment decisions of others, often driven by the fear of missing out or the desire to conform. This can lead to market bubbles and crashes, as loss aversion may prompt investors to buy or sell based on the actions of others rather than their own independent analysis. Loss aversion can contribute to market anomalies, such as the equity premium puzzle, which refers to the observed difference between the returns on stocks and bonds being larger than can be explained by traditional financial models. Loss aversion may cause investors to demand higher returns for taking on the perceived risks associated with stocks, leading to the observed discrepancy. Market bubbles and crashes can also be exacerbated by loss aversion. As investors become increasingly focused on avoiding losses, they may be more prone to panic selling during market downturns, contributing to sharp asset price declines. Awareness and education are among the most effective ways to overcome loss aversion. By understanding the psychological roots of loss aversion and recognizing its influence on financial decision-making, individuals can take steps to mitigate its impact. Establishing clear financial goals and creating a comprehensive financial plan can help individuals maintain a long-term perspective and avoid making decisions based solely on loss aversion. Individuals can make more rational choices that align with their financial objectives by focusing on the bigger picture. Proper risk assessment and management techniques can also help individuals overcome loss aversion. Individuals can make more informed choices that balance potential gains and losses by understanding and quantifying the risks associated with various financial decisions. Adopting a long-term perspective when making financial decisions can help mitigate the impact of loss aversion. By focusing on the potential gains and losses over an extended period, individuals can avoid becoming overly concerned with short-term fluctuations and make more rational decisions. The significance of loss aversion in financial decision-making cannot be understated, as it can profoundly impact personal finance, investing, and overall financial success. By understanding the psychological underpinnings of loss aversion and taking proactive steps to address its influence, individuals can make more rational financial decisions and improve their long-term financial well-being. Continued research into loss aversion and its implications will further enhance our understanding of this phenomenon and its role in shaping financial behavior.What Is Loss Aversion?

The Psychology of Loss Aversion

Origins and Evolutionary Basis

Survival Instincts

The Endowment Effect

Cognitive Biases

Status Quo Bias

Sunk Cost Fallacy

Regret Aversion

Emotional Aspects

Fear of Loss

The Role of Anxiety and Stress

Measuring Loss Aversion

The Value Function

Loss Aversion Coefficient

Empirical Studies and Findings

Loss Aversion in Personal Finance

Spending and Saving Habits

Overspending

Inefficient Saving Strategies

Debt Management

Overemphasis on Short-term Gains

Debt Aversion

Insurance and Risk Management

Over-Insuring

Risk Aversion

Loss Aversion in Investing

Investment Decisions

Risk and Return Trade-offs

Diversification

Behavioral Biases in Investing

Disposition Effect

Herding Behavior

Market Implications

Market Anomalies

Bubbles and Crashes

Overcoming Loss Aversion

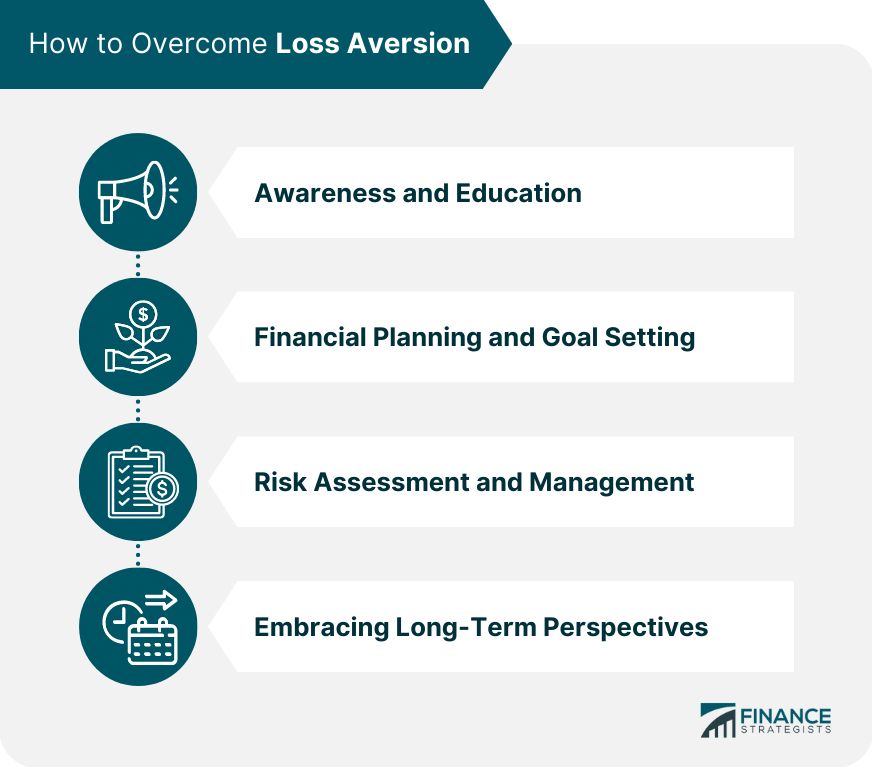

Awareness and Education

Financial Planning and Goal Setting

Risk Assessment and Management

Embracing Long-Term Perspectives

Conclusion

Loss Aversion FAQs

Loss aversion is a psychological phenomenon where people tend to feel the pain of losses more intensely than the pleasure of gains. In other words, the fear of losing something is stronger than the desire to gain something of equal value.

Loss aversion can lead people to make irrational decisions, such as holding onto losing investments for too long or taking on unnecessary risks to avoid potential losses. It can also make people overly cautious and hesitant to take action, even when it may be in their best interest.

While loss aversion is a natural and common human tendency, it is possible to mitigate its effects. One way to do this is by focusing on the potential gains rather than the potential losses. Another approach is recognizing and challenging your biases and emotional responses to losses.

Loss aversion can significantly impact financial behavior, as it can lead people to make poor investment decisions, such as holding onto losing stocks or selling winning stocks too soon. It can also make people overly risk-averse, resulting in missed growth opportunities.

While loss aversion can lead to negative consequences, it can also have some positive effects. For example, it can help people avoid taking unnecessary risks and protect them from potentially harmful situations. Additionally, it can motivate people to work harder to avoid losing what they already have.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.