Negative carry refers to a situation where the cost of holding an investment exceeds the income generated from that investment. This is a common occurrence in various financial markets and is usually a result of borrowing costs, storage costs, and other investment-related expenses. If an investor borrows funds to buy a security, and the interest on the loan is greater than the return from the security, then the investor is said to be in a negative carry situation. An investor will face a negative carry situation if the return on investment (ROI) is less than the cost of capital. Understanding negative carry is crucial for both individual and institutional investors. It serves as a reminder that not all investments will generate positive returns, and that borrowing to invest can sometimes lead to losses. Negative carry is frequently associated with borrowing costs. When an investor borrows money to fund an investment, they typically have to pay interest on the borrowed funds. If the investment does not yield a return that is higher than the interest payments, the investor will experience a negative carry. An example of this can be seen in real estate investing, where an investor might borrow money to purchase a rental property. If the rental income from the property does not cover the mortgage payments, the investor will be in a negative carry situation. These are costs directly associated with holding an investment, such as maintenance costs for a property or management fees for a mutual fund. If these costs exceed the return from the investment, the investor will experience a negative carry. For instance, let's consider an investor who owns shares in a mutual fund. The fund charges a 2% management fee annually. If the fund's return for the year is only 1%, the investor will have a negative carry of 1%. This is especially relevant for investments in physical commodities like gold or oil, where there are costs associated with storing and insuring the investment. Take, for example, an investor who buys gold as an investment. The investor may need to pay for secure storage and insurance to protect the investment. If the price of gold does not increase enough to cover these costs, the investor will be in a negative carry situation. Beyond borrowing, investment, and storage costs, there are other expenses that can contribute to negative carry. These can include transaction costs, such as brokerage fees or stamp duties, and indirect costs, such as the opportunity cost of having funds tied up in a non-performing investment. A clear illustration of this can be found in the stock market, where an investor might pay brokerage fees to buy and sell shares. If the shares do not appreciate enough to cover these fees, the investor will experience a negative carry. A typical example occurs when an investor buys a bond at a premium, meaning they pay more than the bond's face value. The bond may have a higher coupon rate than the current market interest rates, making it more expensive to purchase. If the investor has borrowed funds to buy the bond and the interest they earn on the bond is less than the interest paid on the borrowed funds, they will experience negative carry. Furthermore, when interest rates rise, the value of existing bonds with lower coupon rates tends to decrease, as investors seek higher-yielding bonds. In such situations, investors holding bonds with lower coupon rates may face a negative carry, especially if they have borrowed funds to finance their bond investments. Derivatives, such as futures and swaps, can also involve negative carry situations. In a futures contract, for example, an investor agrees to buy or sell an underlying asset at a predetermined price on a future date. If the cost of carrying the futures position, which may include margin requirements and financing costs, exceeds the potential return from the contract, the investor will be in a negative carry situation. Similarly, in a swap agreement, two parties agree to exchange cash flows based on underlying assets or reference rates. If the net cash flow received by one party is less than the cost of holding the swap position, that party will experience a negative carry. In this type of trading, investors borrow funds from their broker to buy securities, using their existing investments as collateral. Margin trading allows investors to amplify their potential returns, but it also comes with increased risk. Negative carry can occur in margin trading when the cost of borrowing funds from the broker, typically in the form of margin interest, exceeds the return generated by the purchased securities. In such cases, the investor will experience a net loss on their investment. An investor who purchases an option, either a call or a put, pays a premium to the option seller for the right to buy or sell the underlying asset at a specified price on or before a certain date. If the investor does not exercise the option, or if the option's intrinsic value does not exceed the premium paid, the investor will face a negative carry. Moreover, if the investor borrows funds to purchase the option and the interest paid on the borrowed funds exceeds the return from the option, the investor will experience a negative carry. Interest rates play a significant role in determining the likelihood of negative carry situations. When interest rates are high, the cost of borrowing increases, making it more likely for investors to face negative carry situations. Conversely, low interest rates can reduce the cost of borrowing, making negative carry situations less likely. Market volatility can also influence the occurrence of negative carry. In highly volatile markets, the value of investments can fluctuate widely, increasing the chances of negative carry situations arising. Additionally, greater volatility can lead to higher borrowing costs, as lenders may charge higher interest rates to account for the increased risk. Overall market conditions can impact the likelihood of negative carry situations. In a bull market, where asset prices are generally rising, the chances of negative carry decrease. In contrast, during bear markets, where asset prices are falling, the probability of negative carry increases as returns on investments may be lower. Finally, an investor's strategy can greatly influence the occurrence of negative carry. Investors who adopt a more aggressive strategy, with higher levels of borrowing or leveraging, are more likely to encounter negative carry situations. On the other hand, more conservative investors, who rely less on borrowing and focus on lower-cost investments, may be less prone to negative carry situations. Therefore, understanding one's investment strategy and its associated risks is crucial to managing the potential for negative carry. Investors can seek to diversify their investments across various asset classes, industries, and geographic regions, in order to reduce the impact of negative carry situations on the overall portfolio performance. By spreading investments across different areas, investors can limit their exposure to any single investment that may be subject to negative carry. Another strategy for managing negative carry is to optimize the portfolio duration. Duration is a measure of the sensitivity of a bond or bond portfolio to changes in interest rates. By adjusting the portfolio's duration, investors can reduce the impact of interest rate fluctuations on their investments, which can help to minimize the likelihood of negative carry situations. For example, if an investor expects interest rates to rise, they may choose to shorten the duration of their bond portfolio by investing in shorter-term bonds, which are less sensitive to interest rate changes. This can help to mitigate the risk of negative carry arising from rising interest rates. Hedging is another strategy that can be employed to manage negative carry. By using financial instruments such as options, futures, and swaps, investors can protect themselves against potential losses arising from negative carry situations. For instance, an investor who is concerned about the risk of rising interest rates could purchase interest rate swaps or options to hedge against potential losses. However, it is important to note that hedging can come with its own costs, and may not always be the most efficient way to manage negative carry risk. Investors should carefully weigh the potential benefits and costs of hedging before implementing such strategies. Reducing the costs associated with holding an investment can help to minimize the likelihood of negative carry situations. This can be achieved through various means, such as negotiating lower borrowing costs, reducing management fees, or minimizing transaction costs. By lowering the overall cost of investing, investors can increase their chances of generating positive returns and avoiding negative carry situations. As investors borrow funds to finance their investments, they may find themselves facing a growing pile of debt, especially if their investments fail to generate sufficient returns to cover the borrowing costs. In extreme cases, this can lead to financial distress and even bankruptcy. Negative carry can also lead to the erosion of an investor's capital base. As the costs associated with holding an investment exceed the returns, the investor's capital may be gradually depleted, leaving them with less wealth and fewer resources to invest in the future. Liquidity concerns can arise in negative carry situations, as investors may struggle to meet their financial obligations, such as margin calls or loan repayments. In some cases, this may force the investor to sell their investments at an unfavorable time, potentially exacerbating their losses. Finally, negative carry situations can expose investors to increased market risk. As investors borrow funds to finance their investments, they become more sensitive to changes in market conditions, such as interest rate fluctuations or market downturns. This heightened sensitivity can magnify the impact of market risks on the investor's portfolio, potentially leading to greater losses. Negative carry refers to a financial situation where the cost of holding an investment exceeds the income or return generated from it. It occurs when the interest or financing costs associated with an investment outweigh the income or gains generated, resulting in a net loss. Factors that influence negative carry include interest rates, borrowing costs, dividend or coupon rates, and expenses associated with holding the investment. Higher borrowing costs or lower income generated from the investment can contribute to negative carry. To mitigate negative carry, investors can employ several strategies like seeking higher-yielding investments to offset borrowing costs, using leverage judiciously to optimize returns, diversifying the investment portfolio to spread risk, and employing hedging techniques. Careful evaluation of the risk-return characteristics of investments and consideration of the impact of costs and financing are crucial in managing negative carry.What Is Negative Carry?

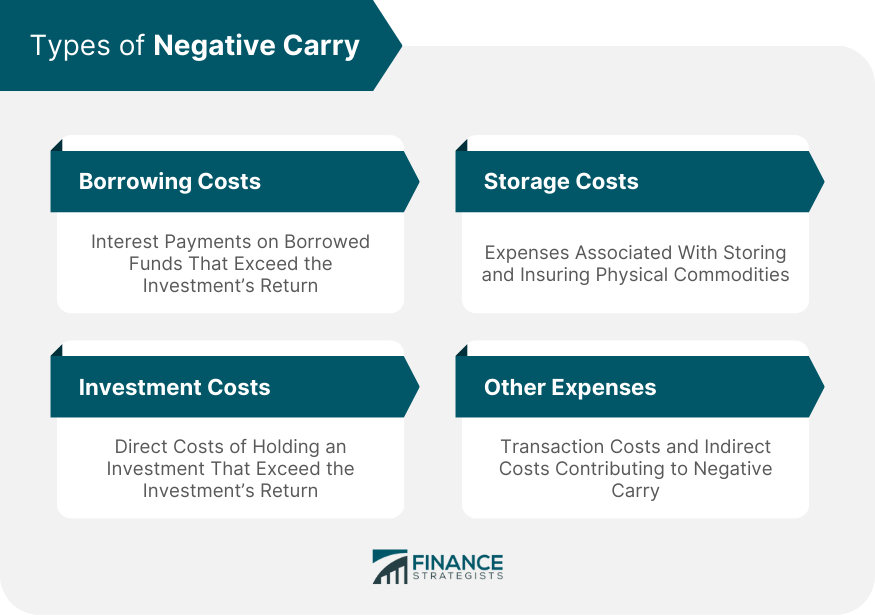

Types of Negative Carry

Borrowing Costs

Investment Costs

Storage Costs

Other Expenses

Negative Carry in Different Financial Instruments

Negative Carry in Bonds

Negative Carry in Derivatives

Negative Carry in Margin Trading

Negative Carry in Options

Factors Influencing Negative Carry

Interest Rates

Volatility

Market Conditions

Investment Strategy

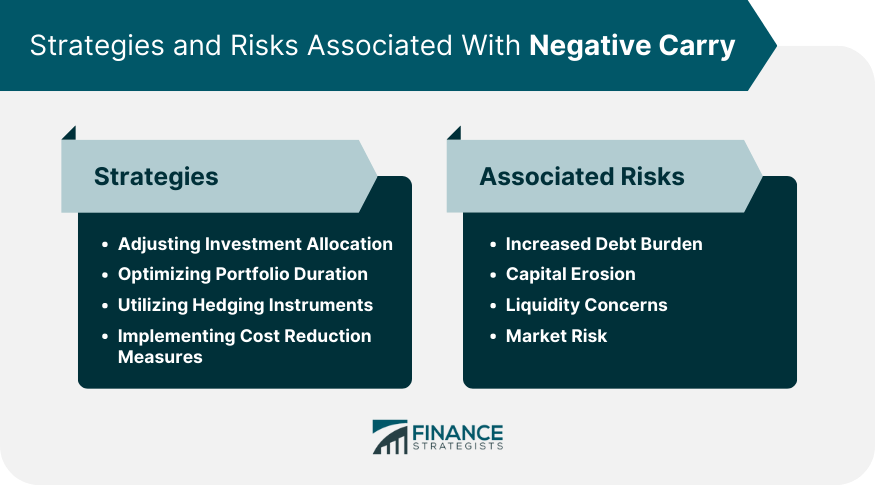

Strategies to Mitigate Negative Carry

Adjusting Investment Allocation

Optimizing Portfolio Duration

Utilizing Hedging Instruments

Implementing Cost Reduction Measures

Risks Associated With Negative Carry

Increased Debt Burden

Capital Erosion

Liquidity Concerns

Market Risk

Conclusion

Negative Carry FAQs

Negative carry refers to a situation where the cost of holding or financing an investment exceeds the return or yield generated from it.

There are various types of negative carry, including borrowing costs, investment costs, storage costs, and other related expenses.

Negative carry can be mitigated through strategies such as adjusting investment allocation, optimizing portfolio duration, utilizing hedging instruments, and implementing cost reduction measures.

Risks associated with negative carry include increased debt burden, capital erosion, liquidity concerns, and market risk.

Yes, negative carry can occur in various financial instruments such as bonds, derivatives, margin trading, and options, depending on the specific circumstances and factors involved.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.