The Notional Principal Amount is a foundational concept in finance, representing a hypothetical value used as the basis for calculating payments in derivatives contracts. Despite its significance in determining cash flows, it is not physically exchanged between parties. In risk management, the notional principal amount is integral as it significantly influences a party's risk exposure. A larger notional amount can equate to greater risk, thus making it a crucial factor in derivative trading risk management. However, it's not without controversy. Critics argue that the notional principal amount may not accurately reflect true risk exposure, especially in complex derivatives, potentially leading to misleading conclusions about a firm's risk profile. Misinterpretation or misuse of this concept can result in excessive risk-taking and significant financial loss, as witnessed in the 2008 financial crisis. The notional principal amount exists to provide a basis for the calculation of payments in derivative transactions. By applying agreed-upon rates to the notional amount, parties can determine the payments they owe one another without needing to exchange the full underlying amount. The notional principal amount is agreed upon by the parties involved at the start of a contract. It is usually set to reflect the scale of exposure the parties wish to undertake. It's crucial to note that the notional amount does not change throughout the life of the contract unless stipulated in the agreement. In most derivatives contracts, the notional principal amount is a hypothetical figure. It is not physically exchanged between parties, but rather serves as a base upon which interest payments are computed. Interest rate swaps are one of the most common applications of the notional principal amount. Here, the two parties agree to exchange interest payments based on the notional amount. One party pays a fixed rate on the notional, while the other pays a floating rate, thus allowing both to hedge their interest rate exposure. Currency swaps involves the exchange of interest and sometimes principal in one currency for the same in another currency. The notional principal amounts in the two currencies are set at the initiation of the contract, based on the prevailing exchange rate. In equity swaps, the notional principal amount is used to calculate the payments exchanged between parties. One party pays returns based on a stock or equity index, while the other pays a fixed or floating interest rate on the notional amount. Credit default swaps (CDS) are financial instruments used for hedging credit risk. The buyer of a CDS makes payments to the seller up to the notional amount in the event of a credit event such as a default. In interest rate swaps, payments are calculated by applying the agreed-upon fixed or floating rate to the notional principal amount. For instance, if the notional amount is $1 million and the fixed rate is 2%, the fixed-rate payer would owe $20,000 annually. In currency swaps, each party's payment obligation is calculated by applying the agreed-upon interest rate to the notional amount in the respective currency. The principal may also be exchanged at the beginning and end of the contract, based on the initial and final exchange rates. For equity swaps, one party's payments are based on the returns of a specified equity index applied to the notional principal amount. The other party's payments are based on a fixed or floating interest rate applied to the notional amount. For example, if the notional amount is $1 million, the equity return is 5%, and the fixed interest rate is 2%, the equity payer would owe $50,000 while the fixed rate payer would owe $20,000. In Credit Default Swaps, the premium payments are usually a percentage of the notional principal amount. If a credit event occurs, the seller of the CDS compensates the buyer, typically covering the difference between the notional principal amount and the recovery amount. The notional principal amount can significantly affect a party's risk exposure. A larger notional amount generally means greater potential payments and thus, greater risk. It is thus a crucial component of risk management in derivatives trading. During the 2008 financial crisis, misunderstanding and misuse of notional principal amounts contributed to excessive risk-taking. Institutions failed to fully comprehend the potential liability they faced, leading to catastrophic losses when market conditions turned adverse. Notional principal amounts are integral to risk modeling and stress testing. These amounts help determine potential losses under various market conditions, enabling institutions to better manage their risk exposure. Under Basel III, the notional principal amount is used in determining an institution's potential future exposure (PFE), a key component of the counterparty credit risk measurement. Financial Accounting Standards Board (FASB) rules require the disclosure of notional principal amounts for derivative instruments. This promotes transparency and enables investors to better understand a company's risk profile. Under regulations like the Dodd-Frank Act in the U.S. and the European Market Infrastructure Regulation (EMIR), the notional principal amount is a key factor in determining which transactions must be centrally cleared, aiming to reduce systemic risk. One limitation of the notional principal amount is that it may not accurately reflect a party's true risk exposure, especially for complex or leveraged derivatives. This can lead to misleading conclusions about a firm's risk profile. Some critics argue that reliance on notional principal amounts can distort risk models. They point out that notional amounts can overstate exposure in some cases and understate it in others, leading to inadequate risk management. Misinterpretation or misuse of notional principal amounts can lead to excessive risk-taking, as witnessed during the 2008 financial crisis. This underscores the need for a deep understanding of this concept and careful risk management. The notional principal amount is a cornerstone of modern financial derivatives, serving as the hypothetical base upon which payment calculations are made. Its role in risk management cannot be overstated, as it directly impacts a party's exposure and potential financial obligation. However, this concept isn't without controversy. Critics point out that the notional principal amount can both understate and overstate risk, leading to potential misunderstandings and misuses, as observed during the 2008 financial crisis. Therefore, the onus is on financial institutions and regulators to ensure that these amounts are used appropriately and transparently and that risk assessments based on these figures are carried out meticulously. As we navigate the complex terrain of modern finance, a comprehensive understanding of the notional principal amount remains critical.Definition of the Notional Principal Amount

Purpose of the Notional Principal Amount

Determining the Notional Principal Amount

The Non-exchange of Notional Principal Amounts in Derivatives Contracts

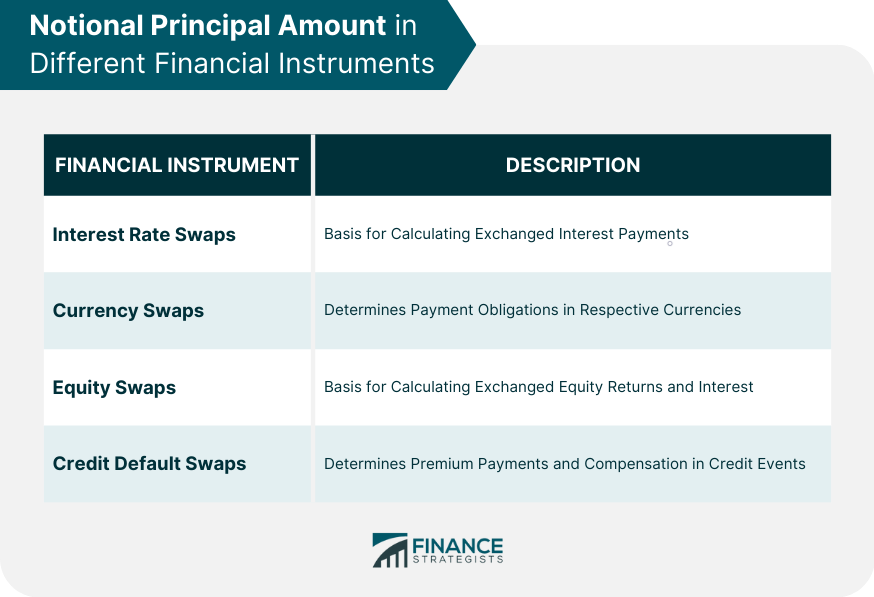

Notional Principal Amount in Different Financial Instruments

Notional Principal Amount in Interest Rate Swaps

Notional Principal Amount in Currency Swaps

Notional Principal Amount in Equity Swaps

Notional Principal Amount in Credit Default Swaps

Calculating Payments Using the Notional Principal Amount

Calculating Payments for Interest Rate Swaps

Calculating Payments for Currency Swaps

Calculating Payments for Equity Swaps

Calculating Payments for Credit Default Swaps

Risk Management and the Notional Principal Amount

The Notional Principal Amount's Impact on Risk

The Role of Notional Principal Amounts in Financial Crises

Notional Principal Amount in Risk Modeling and Stress Testing

Regulatory Considerations and the Notional Principal Amount

Basel III and the Notional Principal Amount

Notional Principal Amount and Financial Accounting Standards

Dodd-Frank, EMIR, and the Notional Principal Amount

Criticisms and Controversies of the Notional Principal Amount

Limitations of the Notional Principal Amount

Criticisms in Financial Modeling

The Impact of Misinterpretation or Misuse

Conclusion

Notional Principal Amount FAQs

The notional principal amount refers to the specified amount of a financial instrument or contract, which serves as a reference point for calculating payments, interest, or other contractual obligations.

The notional principal amount is typically agreed upon by the parties involved in a financial contract or instrument. It represents the hypothetical or face value of the contract and is used as a basis for calculations.

In derivative contracts, the notional principal amount determines the size of the contract and the cash flows involved. It is used to calculate payments, margins, and other obligations between the parties, without the need for an actual exchange of the underlying assets.

In derivative contracts, the notional principal amount determines the size of the contract and the cash flows involved. It is used to calculate payments, margins, and other obligations between the parties, without the need for an actual exchange of the underlying assets.

No, the notional principal amount does not represent the actual value of the contract. It is a nominal or reference amount used for calculating payments and obligations. The actual value of the contract depends on factors such as market conditions, interest rates, and the performance of the underlying assets.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.