Optimization in the context of wealth management refers to the process of maximizing investment returns while minimizing risk and cost. This process involves the strategic allocation of assets, careful selection of investments, and ongoing monitoring of portfolio performance. By optimizing their investment strategies, individuals and institutions can work towards achieving their financial goals more effectively. The purpose of optimization in wealth management is to create a portfolio that offers the best possible balance of risk and reward based on an investor's unique objectives, constraints, and preferences. Through optimization, investors can enhance the overall efficiency of their portfolios, ensuring that they are well-positioned to achieve their desired financial outcomes while minimizing unnecessary risk exposure. In order to optimize a portfolio, it is crucial to first understand the investor's goals and objectives. These may include long-term wealth accumulation, capital preservation, income generation, or any combination of these and other objectives. By clearly defining investment goals, it becomes possible to tailor the optimization process to meet the investor's specific needs and preferences. Another critical factor to consider in the optimization process is the investor's risk tolerance. This is a measure of an investor's willingness to accept risk in pursuit of higher returns. Risk tolerance can vary greatly between investors and may change over time due to factors such as age, financial circumstances, or market conditions. Accurately assessing risk tolerance is essential for constructing a portfolio that aligns with the investor's comfort level. The investment time horizon is the expected length of time an investor plans to hold their investments before liquidating them. This factor has significant implications for the optimization process, as portfolios with longer time horizons can typically afford to take on more risk in pursuit of higher returns. Conversely, portfolios with shorter time horizons may require a more conservative approach to preserve capital and mitigate the potential impact of market volatility. Optimization also requires a careful analysis of current and expected market conditions. Factors such as interest rates, economic growth, inflation, and market trends can influence the performance of various asset classes and investment strategies. By considering these factors, investors can make more informed decisions about which assets and strategies are likely to perform well in the current environment and adjust their portfolios accordingly. Taxes play a crucial role in wealth management and must be considered during the optimization process. Different investment vehicles and strategies may have varying tax implications, which can significantly impact overall portfolio performance. Effective optimization should take into account the tax consequences of various investment decisions to minimize the investor's tax burden and maximize after-tax returns. Lastly, optimization must also take into account any regulatory constraints that may apply to the investor or their investment strategies. These may include restrictions on certain types of investments, minimum capital requirements, or disclosure obligations. Ensuring compliance with relevant regulations is essential for protecting the investor's interests and avoiding potential legal and financial consequences. One of the primary benefits of optimization in wealth management is the potential for improved portfolio performance. By carefully selecting investments and allocating assets based on the investor's objectives, risk tolerance, and other factors, it is possible to achieve higher returns with lower levels of risk. This can result in a more efficient portfolio that better aligns with the investor's goals and preferences. Optimization also plays a crucial role in risk mitigation, helping investors to minimize their exposure to various types of risk, such as market, credit, and liquidity risk. By diversifying their portfolios and employing other risk management strategies, investors can reduce the potential impact of adverse market events and ensure that their portfolios remain resilient in the face of uncertainty. Another key benefit of optimization is cost reduction. By identifying and eliminating inefficient investments or strategies, investors can reduce the costs associated with their portfolios, such as management fees, trading costs, and taxes. This can result in increased net returns and a more effective use of the investor's capital. Effective optimization can also lead to more efficient asset allocation, ensuring that the investor's capital is deployed in a way that maximizes potential returns while minimizing risk. This involves evaluating the performance and risk characteristics of various asset classes, as well as their correlations with one another, to create a balanced and diversified portfolio that is well-suited to the investor's needs. Financial markets are inherently uncertain and volatile, making it difficult to predict their future behavior with a high degree of accuracy. This uncertainty can present challenges for the optimization process, as it may be difficult to determine which investments or strategies are likely to perform well in the face of ever-changing market conditions. Optimization often relies on a variety of assumptions and models to estimate the expected performance and risk of different investments and strategies. However, these assumptions and models can be prone to error and may not accurately reflect the true characteristics of the investments or the market environment. This can result in suboptimal portfolio decisions and reduced investment performance. Another potential limitation of optimization is the tendency for investors to over-optimize their portfolios, seeking to maximize returns and minimize risk to an unrealistic extent. This can result in overly complex and fragile portfolios that are susceptible to underperformance in the face of unexpected market events. It is important for investors to strike a balance between optimization and simplicity to create resilient and adaptable portfolios. Finally, the optimization process depends on the availability and quality of financial data. Inaccurate, incomplete, or outdated data can negatively impact the optimization process and lead to poor investment decisions. Ensuring access to high-quality and up-to-date data is crucial for effective optimization and informed decision-making. Modern Portfolio Theory (MPT) is a foundational concept in optimization, which suggests that investors can achieve optimal portfolio performance by diversifying their investments across various asset classes. MPT emphasizes the importance of considering the correlations between different assets, as well as their individual risk and return characteristics, to create a balanced and efficient portfolio. Mean-variance optimization is a quantitative technique that seeks to maximize portfolio returns while minimizing portfolio risk, as measured by portfolio variance or standard deviation. This approach relies on historical data and statistical analysis to estimate the expected returns, risk, and correlations of different assets, allowing investors to identify the optimal portfolio allocation. The risk-return tradeoff is a fundamental concept in finance that asserts that higher potential returns typically come with higher levels of risk. By understanding and carefully managing this tradeoff, investors can construct portfolios that align with their risk tolerance and investment objectives, ensuring that they are comfortable with the level of risk they are taking on in pursuit of their desired returns. Asset allocation models provide a structured approach to the optimization process, offering guidance on how to allocate investments across various asset classes based on factors such as risk tolerance, investment objectives, and time horizon. These models can help investors create well-diversified portfolios that are tailored to their unique needs and preferences. Diversification is a key strategy for optimization, as it helps to spread risk across a variety of investments and asset classes. By diversifying their portfolios, investors can reduce their exposure to specific market risks and create more resilient portfolios that are better equipped to weather market fluctuations. Robo-advisors are automated investment platforms that leverage algorithms and advanced analytics to optimize portfolios based on the investor's objectives, risk tolerance, and other factors. These platforms can offer cost-effective, personalized investment management services, making the optimization process more accessible to a wider range of investors. Algorithmic trading systems utilize complex algorithms and advanced technologies to execute trades and manage portfolios with a high degree of precision and efficiency. These systems can help investors optimize their portfolios by automating the investment process and minimizing costs associated with trading. Portfolio management software provides investors with a suite of tools and features designed to facilitate the optimization process. These platforms can offer advanced analytics, performance tracking, and other capabilities that can help investors monitor and adjust their portfolios to better align with their goals and preferences. Data analytics and machine learning technologies have the potential to revolutionize the optimization process by enabling more sophisticated analysis and modeling of financial markets. These technologies can help investors uncover hidden patterns and relationships in the data, leading to more informed investment decisions and improved portfolio performance. To maintain an optimal portfolio, it is essential for investors to regularly review their investments and rebalance their portfolios as needed. This process involves adjusting the portfolio's asset allocation to ensure that it remains aligned with the investor's objectives, risk tolerance, and other factors. Stress testing and scenario analysis are important tools for assessing the resilience of a portfolio in the face of various market events and conditions. By simulating different market scenarios, investors can evaluate the potential impact on their portfolios and make adjustments as necessary to minimize risk and maintain optimal performance. In order to effectively optimize their portfolios, investors must stay informed about current and emerging market trends. By closely monitoring market conditions and adjusting their strategies as needed, investors can ensure that their portfolios remain well-positioned to capitalize on new opportunities and navigate potential challenges. Finally, effective optimization often requires close collaboration between financial advisors and their clients. By working together to define investment objectives, assess risk tolerance, and monitor portfolio performance, advisors and clients can create tailored, optimized portfolios that reflect the investor's unique needs and preferences. Optimization is the process of maximizing investment returns while minimizing risk and cost, with the ultimate goal of helping investors achieve their financial objectives. Factors such as investment goals, risk tolerance, time horizon, market conditions, tax considerations, and regulatory constraints must be considered in the optimization process. A variety of methods and strategies, including Modern Portfolio Theory, mean-variance optimization, risk-return tradeoff, asset allocation models, and diversification techniques, can be used to optimize portfolios. Optimization plays a critical role in wealth management by helping investors create efficient, resilient portfolios that align with their goals, risk tolerance, and preferences.What Is Optimization?

Factors Considered in Optimization

Investment Goals and Objectives

Risk Tolerance

Time Horizon

Market Conditions

Tax Considerations

Regulatory Constraints

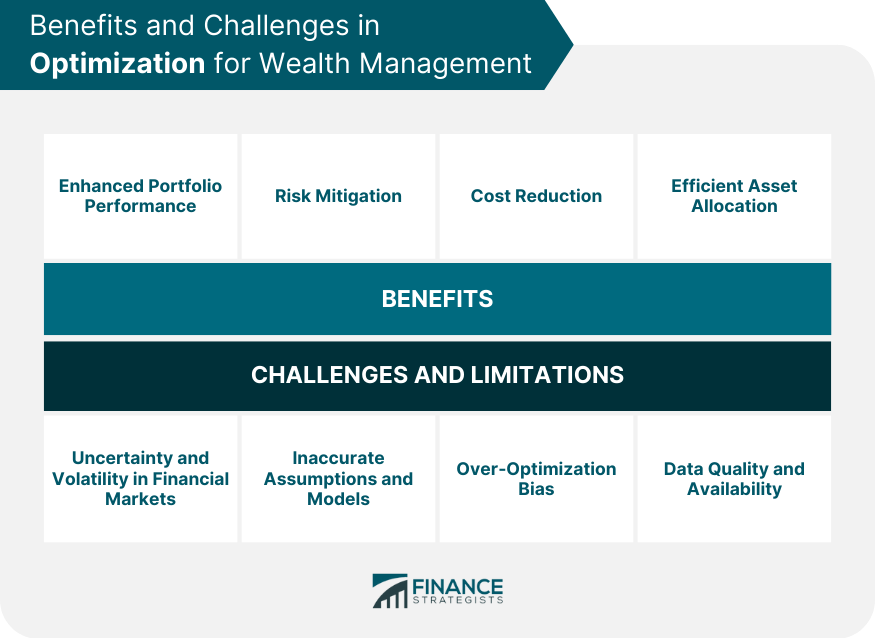

Benefits of Optimization in Wealth Management

Enhanced Portfolio Performance

Risk Mitigation

Cost Reduction

Efficient Asset Allocation

Challenges and Limitations of Optimization

Uncertainty and Volatility in Financial Markets

Inaccurate Assumptions and Models

Over-Optimization Bias

Data Quality and Availability

Methods and Strategies for Optimization

Modern Portfolio Theory

Mean-Variance Optimization

Risk-Return Tradeoff

Asset Allocation Models

Diversification Techniques

Tools and Technologies for Optimization

Robo-Advisors

Algorithmic Trading Systems

Portfolio Management Software

Data Analytics and Machine Learning

Best Practices in Optimization

Regular Portfolio Review and Rebalancing

Stress Testing and Scenario Analysis

Consistent Monitoring of Market Trends

Collaboration Between Advisors and Clients

Bottom Line

Optimization FAQs

Optimization in wealth management refers to the process of maximizing investment returns and minimizing risk by utilizing various strategies, techniques, and tools. It involves balancing the client's financial goals, risk tolerance, and time horizon to create an optimal portfolio that aims to achieve the best possible outcomes.

Several factors play a crucial role in wealth management optimization, including the client's financial goals, risk appetite, time horizon, liquidity needs, tax considerations, and legal constraints. Additionally, factors like market conditions, economic trends, and regulatory changes also need to be considered to make informed investment decisions.

Wealth managers employ various strategies to optimize portfolios. Some common approaches include asset allocation, diversification, risk management techniques (such as hedging or derivatives), tactical asset allocation, and factor-based investing. These strategies aim to balance risk and return, enhance portfolio performance, and align investments with the client's objectives.

To optimize wealth management strategies effectively, it is essential to follow some best practices. These include conducting a thorough analysis of the client's financial situation, setting clear investment objectives, understanding risk tolerance, diversifying investments across different asset classes, regularly monitoring and rebalancing portfolios, staying informed about market trends, and seeking professional advice when needed.

Technology plays a vital role in enhancing wealth management optimization. Advanced portfolio management systems, data analytics tools, and artificial intelligence algorithms enable wealth managers to analyze large volumes of data, identify investment opportunities, perform scenario analysis, and automate routine tasks. Additionally, digital platforms and mobile applications provide clients with real-time access to their portfolios and enable seamless communication with their advisors, improving overall efficiency and convenience in wealth management.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.