An order driven market is a financial market where trades are executed based on the orders placed by buyers and sellers. These orders consist of bids (buy orders) and offers (sell orders), with the prices determined by the interaction of supply and demand. In this market, trades are matched through an electronic order book, which lists all the buy and sell orders in order of price and time priority. The primary purpose of an order driven market is to facilitate the buying and selling of financial instruments by matching the orders placed by market participants. This market structure aims to promote efficient price discovery, trade execution, and market transparency, creating a fair and competitive trading environment for all participants. An order driven market differs from a quote driven market in the way trades are executed. In a quote driven market, also known as a dealer market, trades are executed through market makers or dealers who quote bid and ask prices for financial instruments. In contrast, an order driven market relies on an electronic order book to match buy and sell orders directly between market participants, without the intervention of market makers or dealers. One of the primary functions of an order driven market is to determine the prices of financial instruments through the interaction of supply and demand. As buy and sell orders are submitted by market participants, they are matched in the order book based on price and time priority, resulting in the execution of trades and the establishment of market prices. In an order driven market, trades are executed when buy and sell orders are matched in the order book. This allows for efficient and transparent trade execution, as market participants can observe the available orders in the market and make informed decisions about when and at what price to execute their trades. Order driven markets promote market transparency by making the order book publicly accessible, allowing market participants to view the buy and sell orders, as well as the volume and price of executed trades. This transparency helps to ensure that all market participants have equal access to information, fostering a fair and competitive trading environment. The order driven market plays a crucial role in wealth management by providing a platform for investors to execute their trades and manage their portfolios. The transparency and efficiency of this market structure can inform investment decisions, enabling investors to better understand market dynamics and make more informed choices about when and at what price to trade their financial instruments. The order driven market also has implications for risk management in wealth management, as it allows investors to monitor market activity and gauge the level of liquidity and volatility in the market. By understanding these factors, investors can adjust their trading strategies and manage their exposure to market risk more effectively. In addition to informing investment decisions and risk management, the order driven market can also be utilized in portfolio construction. By analyzing the order book and market activity, wealth managers can identify trends, assess the liquidity of various financial instruments, and make informed decisions about asset allocation and portfolio diversification. One of the main advantages of an order driven market is the efficiency in price discovery, as prices are determined by the interaction of supply and demand. This process ensures that the prices of financial instruments accurately reflect the prevailing market sentiment, allowing for more informed investment decisions. Another advantage of an order driven market is the increased market transparency it provides. The public accessibility of the order book allows market participants to observe the available buy and sell orders, the volume and price of executed trades, and other relevant market information, fostering a fair and competitive trading environment. Order driven markets create an equal opportunity for all market participants by allowing them to directly interact with each other through the order book, without the intervention of market makers or dealers. This ensures that all participants have the same access to market information and trade execution opportunities, promoting fairness and competition in the market. One of the main disadvantages of an order driven market is the possibility of increased price volatility, particularly in illiquid markets. As the order book displays all the available buy and sell orders, large orders can have a significant impact on the market price, causing fluctuations and uncertainty. In an order driven market, liquidity depends on the availability of buy and sell orders in the order book. In some cases, particularly for thinly traded financial instruments, the order book may lack sufficient depth, resulting in illiquidity and potentially limiting the ability of market participants to execute trades at their desired prices. Large orders in an order driven market can have a high price impact, as they may significantly move the market price when executed. This can be particularly problematic for institutional investors, who often need to trade large volumes of financial instruments and may struggle to execute their trades without causing significant market disruptions. An order driven market is a financial market where trades are executed based on the orders placed by buyers and sellers, with prices determined by the interaction of supply and demand. The primary functions of an order driven market include price determination, trade execution, and market transparency. Advantages of order driven markets include efficiency in price discovery, increased market transparency, and equal opportunity for all market participants. Disadvantages include possible price volatility, potential illiquidity, and high price impact of large orders. The order driven market plays a significant role in wealth management by providing a platform for investors to execute trades, manage their portfolios, and make informed investment decisions. This market structure also has implications for risk management and portfolio construction, contributing to more effective wealth management strategies.What Is an Order Driven Market?

Distinction Between Order Driven Markets and Quote Driven Markets

Functions of Order Driven Markets

Price Determination

Trade Execution

Market Transparency

Role of Order Driven Markets in Wealth Management

Impact on Investment Decisions

Implication for Risk Management

Utilization in Portfolio Construction

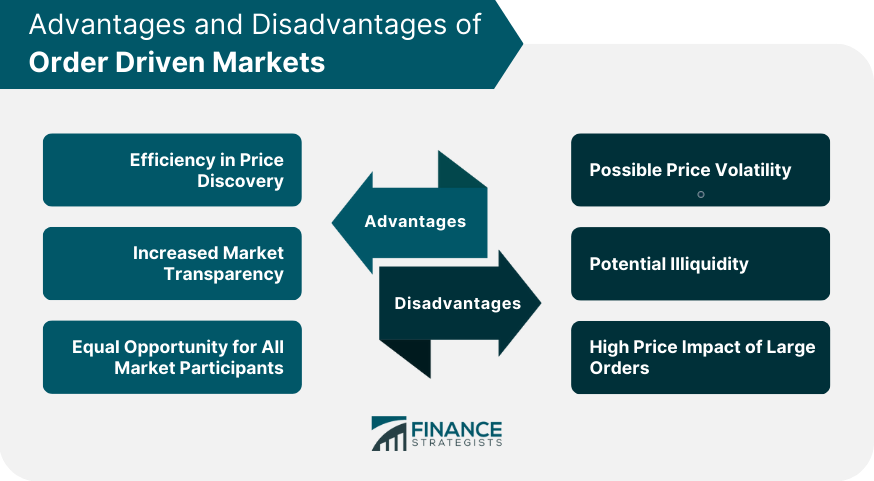

Advantages of Order Driven Markets

Efficiency in Price Discovery

Increased Market Transparency

Equal Opportunity for All Market Participants

Disadvantages of Order Driven Markets

Possible Price Volatility

Potential Illiquidity

High Price Impact of Large Orders

Bottom Line

Order Driven Market FAQs

The main difference between an order driven market and a quote driven market is the way trades are executed. In an order driven market, trades are executed by matching buy and sell orders in the order book, while in a quote driven market, trades are executed through market makers or dealers who quote bid and ask prices.

An order driven market contributes to market transparency by making the order book publicly accessible, allowing market participants to view the buy and sell orders, as well as the volume and price of executed trades.

The order book in an order driven market serves as the central platform for matching buy and sell orders based on price and time priority. It facilitates price determination, trade execution, and market transparency.

Some advantages of an order driven market include efficiency in price discovery, increased market transparency, and equal opportunity for all market participants.

Some disadvantages of an order driven market include possible price volatility, potential illiquidity, and high price impact of large orders.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.