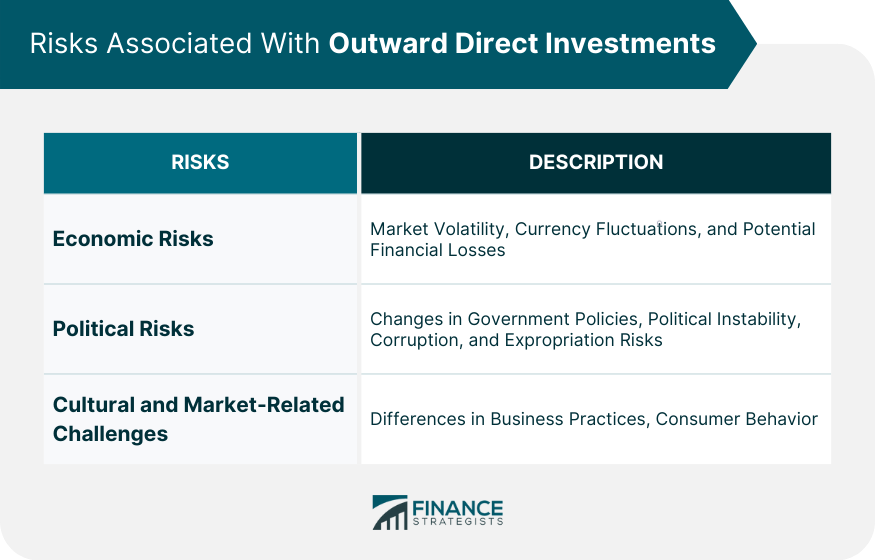

Outward Direct Investment (ODI) refers to the strategic process where a domestic firm expands its operations to a foreign country either via a Greenfield investment, merger and acquisition, or a joint venture. The mechanics involve understanding the foreign market, developing a business strategy, ensuring compliance with international and local laws, and managing cultural differences. ODI comes with several benefits, including access to new markets, diversification of risks, cheaper resources, and socio-political advantages such as enhanced global influence. However, there are risks and challenges, too. These include economic risks like market volatility and currency fluctuations, political risks involving changes in host country policies and instability, and cultural challenges due to differences in business practices and consumer behaviors. Thus, understanding the mechanics, benefits, and challenges of ODI is vital for businesses seeking to invest abroad successfully. ODI plays a crucial role in the global economy. It facilitates international trade, promotes economic integration, and contributes to the economic growth of both the investing and recipient countries. ODI also aids in technology transfer, job creation, and the expansion of international business networks. ODI operates on certain principles and can take various forms. It involves key players including the investing firm, the host country, and sometimes intermediary entities. At its core, ODI involves a firm or individual from one country (the home country) investing in a business or assets in another country (the host country). This investment can take the form of establishing new operations, acquiring an existing business, or forming a strategic alliance with a local firm. ODI can take several forms: Greenfield investments involve setting up new operations in the host country; Mergers and acquisitions (M&A) involve acquiring or merging with an existing foreign firm; Joint ventures and strategic alliances involve partnering with a local firm to leverage its knowledge and resources. Key players in ODI transactions include the investing firm, the host government, and sometimes intermediary entities like investment banks or international organizations. For the investing country, ODI can increase profits through access to new markets, cheaper resources, and labor. It also aids in risk diversification and can boost the home country's GDP. ODI can enhance the investing country's global influence and diplomatic ties. It also fosters cultural exchange and understanding, which can lead to better international relations. Economic risks include market volatility, currency fluctuations, and potential financial losses if the investment fails. The host country's economic stability and development level can also impact the success of the investment. Political risks include changes in government policies, political instability, corruption, and expropriation risks in the host country Cultural and market-related challenges include differences in business practices, consumer behavior, and legal systems. Understanding and adapting to these differences is critical for the success of ODI. Key Performance Indicators (KPIs) are critical for monitoring Outward Direct Investment (ODI). Primarily, Return on Investment (ROI) is a leading KPI, indicating the profitability and efficiency of the investment. It measures the ratio of profit made in a foreign country relative to the amount invested. Another key metric is job creation, which assesses the direct and indirect employment opportunities created as a result of ODI. Additionally, technology transfer signifies the extent to which domestic firms benefit from technological advancements gained through ODI. Market share gained in foreign markets also serves as an important KPI, reflecting the success of market penetration. Lastly, economic growth in the host country is assessed to gauge the positive external impacts of ODI. All these KPIs collectively give a comprehensive picture of the performance and effect of Outward Direct Investments. Outward Direct Investment (ODI) data is instrumental in economic analysis, providing insights into an investing country's economic prowess and its effects on host nations. Key metrics include return on investment (ROI), job creation, and technology transfer. High ROI indicates productive investments, fostering economic growth in both countries. ODI can create jobs in recipient nations, stimulating economic activity and alleviating unemployment. The extent of job creation varies based on the sector of investment and local labor market conditions. In addition, ODI often involves technology transfer, further boosting the host country’s productivity. However, negative impacts can occur if ODI displaces domestic firms or exploits natural resources unsustainably. Therefore, a comprehensive analysis of ODI data is crucial for understanding the true economic implications of these investments. As of the last decade, developed countries like the United States, Japan, and Germany have been leading in terms of ODI. However, emerging economies like China and India have also significantly increased their ODI. Sectors such as technology, manufacturing, and services have been the primary targets of ODI. The regulatory framework governing (ODI) varies by country, reflecting diverse economic policies and objectives. Regulations may include approval processes, reporting requirements, and sector-specific rules. Some countries encourage ODI to access new markets, secure raw materials, or acquire advanced technology. Others may restrict ODI in certain sectors due to national security concerns or to maintain domestic capital. International agreements and treaties also play a crucial role in shaping this framework. Compliance with these regulations is critical for firms to avoid penalties and foster sustainable international growth. International laws and regulations significantly influence Outward Direct Investment. Bilateral Investment Treaties and Free Trade Agreements often establish the legal framework for ODI, ensuring protection and fair treatment of investors. They also regulate dispute resolution and repatriation of profits. World Trade Organization rules impact ODI indirectly through trade liberalization. Moreover, regulations related to environment, labor rights, and anti-corruption, like the Foreign Corrupt Practices Act of the U.S., shape the conduct of foreign investors. Compliance with these international laws is pivotal to avoid legal disputes and ensure successful foreign investments. Bilateral and multilateral investment treaties play a crucial role in promoting and protecting cross-border investments. These treaties, including Bilateral Investment Treaties and Multilateral Investment Treaties establish a stable legal framework that encourages investment by reducing risks associated with foreign ventures. They typically include provisions for fair and equitable treatment, protection from expropriation, dispute resolution mechanisms, and guarantees for the repatriation of investment and returns. By providing these assurances, these treaties foster investor confidence, stimulate economic growth, and facilitate the flow of trade and investment between countries. Local legislation significantly impacts Outward Direct Investment by setting the rules that govern foreign ventures. These regulations may pertain to foreign exchange controls, tax laws, capital repatriation, and sector-specific restrictions. Favorable local laws, such as tax incentives and relaxed exchange controls, can encourage ODI. Conversely, stringent regulations or uncertain legal environments can deter it. Furthermore, the transparency and predictability of the local legal system greatly influence investor confidence. Thus, understanding and complying with local legislation is vital for businesses to manage risks and reap the benefits of their foreign investments. Outward Direct Investment (ODI) is a significant economic activity where businesses from one country invest in companies or assets in another country, assuming considerable control or influence over the foreign entity. ODI provides numerous benefits, including economic advantages for the investing country like increased profits and market access, socio-political gains like enhanced global influence, and plays a vital role in global business expansion. However, ODI also comes with risks and challenges. These include economic risks such as market volatility and currency fluctuations, political risks involving changes in government policies and instability, and cultural and market-related challenges like differences in business practices and consumer behaviors. Thus, understanding ODI's benefits, risks, and challenges is crucial for companies looking to invest abroad and for policymakers aiming to attract foreign investments.Definition of Outward Direct Investments

Importance of ODI in Global Economy

Mechanics of Outward Direct Investments

Basic Principles

Different Forms of ODI

Key Players Involved in ODI Transactions

Benefits of Outward Direct Investments

Economic Benefits for the Investing Country

Socio-Political Advantages Linked to ODI

Risks and Challenges Associated With Outward Direct Investment

Economic Risks of ODI

Political Risks in ODI

Cultural and Market-Related Challenges

Measuring and Analyzing Outward Direct Investments

Key Performance Indicators for ODI

Use of ODI Data in Economic Analysis

Leading Countries and Sectors in ODI

Regulatory Framework Governing Outward Direct Investments

International Laws and Regulations Influencing ODI

Role of Bilateral and Multilateral Investment Treaties

Impact of Local Legislation on ODI

Conclusion

Outward Direct Investment (ODI) FAQs

Outward Direct Investment (ODI) is a business activity where companies or individuals from one country invest in businesses, assets, or real estate in another country. This investment usually involves a significant degree of control or influence over the foreign entity.

ODI offers numerous benefits, including economic advantages such as increased profits, access to new markets, cheaper resources, and risk diversification. It also offers socio-political advantages by enhancing the global influence, diplomatic ties, and fostering cultural exchange. Furthermore, ODI plays a critical role in global business expansion.

The risks associated with ODI include economic risks such as market volatility, currency fluctuations, and financial losses. There are also political risks such as changes in government policies, political instability, and corruption in the host country. Cultural and market-related challenges include differences in business practices, consumer behavior, and legal systems.

ODI is governed by various international and domestic laws and regulations. International laws related to trade, investment protection, and dispute resolution often apply, as well as bilateral and multilateral investment treaties. Local legislation in both the home and host countries can also significantly impact ODI.

The future of ODI is likely to be shaped by several emerging trends, including increased investments in digital and green technologies, a rise in South-South investments, and a shift towards more sustainable and inclusive investment practices. Technological advancements, particularly in digital technology, will continue to reshape ODI. Also, geopolitical shifts and the rise of new economic powers could lead to significant changes in the global ODI landscape.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.