What Is Passive Management?

Passive management, also known as passive investing, is a long-term investment strategy that seeks to replicate the performance of a specific financial market index by investing in a diversified portfolio of securities.

This approach differs from active management, where portfolio managers aim to outperform the market by constantly buying and selling securities.

Passive management offers various advantages to investors, including lower fees, tax efficiency, diversification, and consistent returns.

Passive Investment Vehicles

Index Funds

Index funds are mutual funds that aim to replicate the performance of a specific market index. They offer investors a low-cost, diversified investment option with the potential for consistent returns.

Index funds offer several advantages, such as lower fees, broad market exposure, and reduced risk. However, they may need to improve during periods of market inefficiency or when active managers can exploit opportunities.

Exchange-Traded Funds (ETFs)

Exchange-traded funds (ETFs) are investment funds that hold a basket of securities and trade on stock exchanges like individual stocks.

ETFs can track various market indices or sectors, providing investors with a flexible and cost-effective investment option.

ETFs offer many benefits, including low costs, intraday trading, tax efficiency, and access to various asset classes.

However, they may incur trading costs, such as bid-ask spreads and brokerage fees, and may need to track their underlying index perfectly.

Target-Date Funds

Target-date funds, also known as lifecycle funds, are mutual funds designed to simplify long-term investing for retirement.

They automatically adjust their asset allocation as investors approach their target retirement date, shifting from higher-risk assets like stocks to lower-risk assets like bonds.

Target-date funds offer a hands-off investment approach and a diversified portfolio tailored to investors' specific time horizons.

However, they may have higher fees than other passive investment options and may only suit some investors due to their one-size-fits-all approach to risk management.

Robo-Advisors

Robo-advisors are digital platforms that provide automated investment management services using algorithms and pre-determined investment strategies. They offer a low-cost, accessible, and user-friendly option for passive investors.

Robo-advisors offer advantages such as lower fees, automatic rebalancing, tax-loss harvesting, and customizable portfolios.

However, they may need more personalized financial advice and may not be suitable for investors with complex financial situations or unique investment goals.

Passive Investment Strategies

Market Capitalization Weighting

Market capitalization weighting is a passive investment strategy that weights securities in a portfolio based on their market capitalization. Larger companies receive a higher weight, while smaller companies receive a lower weight.

Market capitalization weighting offers a simple, low-cost method for replicating market indices, ensuring broad market exposure and diversification.

However, it may result in over-concentration in certain sectors or large-cap stocks, potentially exposing investors to higher risk.

Equal Weighting

Equal weighting is an alternative passive investment strategy that assigns equal weight to all securities in a portfolio, regardless of their market capitalization.

This approach ensures that smaller companies receive equal representation in the portfolio.

Equal weighting offers increased diversification and reduces concentration risk by avoiding overexposure to large-cap stocks.

However, it may result in higher portfolio turnover and trading costs, as frequent rebalancing is required to maintain equal weights.

Factor-Based Investing

Factor-based investing is a passive investment strategy that targets specific factors, such as value, growth, size, or momentum, to construct a portfolio.

This approach aims to exploit systematic risk factors to generate excess returns over the market.

Factor-based investing can provide diversification benefits and the potential for higher risk-adjusted returns. However, it may underperform during certain market conditions or when specific factors are out of favor.

Sector Investing

Sector investing is a passive investment strategy that focuses on specific sectors or industries within the broader market. Investors can gain exposure to sectors through sector-specific ETFs or mutual funds.

Sector investing allows investors to target specific market areas with strong growth potential or hedge against economic risks.

However, it may result in higher concentration risk and lower diversification compared to broad-market passive strategies.

Role of Passive Management in Asset Allocation

Diversification Benefits

Passive management strategies can enhance portfolio diversification by providing broad market exposure and reducing the risk associated with individual stock or sector fluctuations.

Risk-Adjusted Return Optimization

Passive investments can help optimize risk-adjusted returns by minimizing fees, taxes, and manager risk, leading to more consistent and predictable long-term performance.

Role in Long-Term Investment Portfolios

Passive management strategies can form the foundation of long-term investment portfolios, as they offer a low-cost, diversified approach to capturing market returns over time.

Combining Active and Passive Strategies

Investors can use a combination of active and passive strategies to achieve their investment goals, leveraging the benefits of both approaches to optimize risk-adjusted returns and diversification.

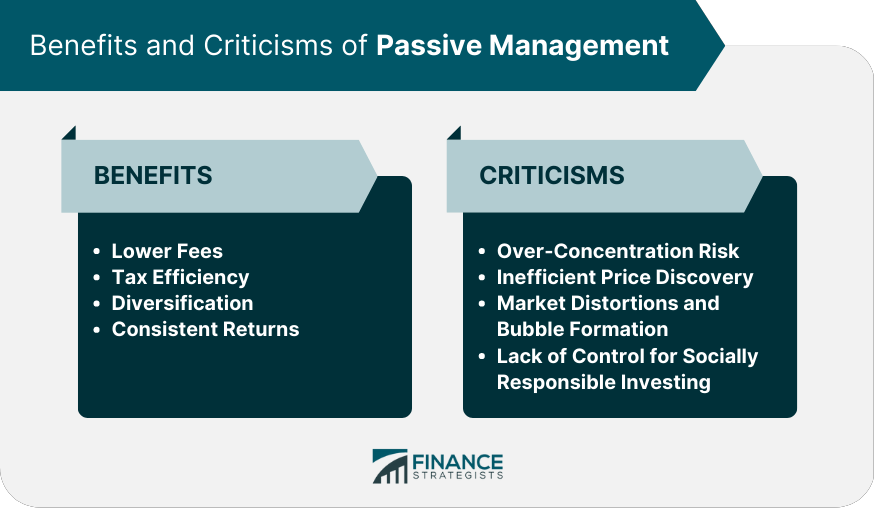

Benefits of Passive Management

Lower Fees

Expense Ratios

Passive management strategies typically have lower expense ratios than actively managed funds. This is because passive funds require fewer resources and personnel to manage, resulting in lower operational costs.

Lower fees can lead to higher net returns for investors over time.

Trading Costs

Passive funds generally have lower trading costs compared to active funds. Since passive funds track a specific index, they trade less frequently, reducing transaction costs and minimizing the impact of market fluctuations.

Tax Efficiency

Lower Turnover

Passive funds typically have lower turnover rates compared to active funds, as they trade less frequently. This results in fewer taxable events, making passive funds more tax-efficient for investors.

Tax-Loss Harvesting

Some passive investment vehicles, such as robo-advisors, offer tax-loss harvesting strategies to enhance tax efficiency further.

This involves selling underperforming investments to realize losses and offset capital gains, potentially reducing investors' overall tax liability.

Diversification

Broad Market Exposure

Passive funds offer investors broad market exposure, as they typically hold a diversified portfolio of securities representing various sectors and industries.

This diversification can help reduce the risk associated with individual stock or sector fluctuations.

Reduced Concentration Risk

By tracking a market index, passive funds avoid the risk of concentrating investments in a single stock or sector. This can help protect investors from the adverse effects of poor stock selection or market timing decisions.

Consistent Returns

Tracking Market Indices

Passive funds aim to replicate the performance of a market index, offering investors consistent returns that closely mirror the overall market's performance.

Elimination of Manager Risk

Passive funds eliminate the risk associated with active portfolio managers' investment decisions. This means that investors can handle underperformance due to poor stock selection or market timing.

Criticisms of Passive Management

Over-Concentration Risk

Passive management strategies, especially market capitalization-weighted approaches, can lead to over-concentration in certain sectors or large-cap stocks, potentially exposing investors to higher risk.

Inefficient Price Discovery

Critics argue that the increasing popularity of passive investing may lead to inefficient price discovery, as passive funds need to evaluate individual securities based on their fundamentals actively.

This could result in mispricings and create opportunities for active managers to exploit market inefficiencies.

Market Distortions and Bubble Formation

The growth of passive investing has raised concerns about potential market distortions and the formation of asset bubbles.

As passive funds automatically allocate capital to securities based on their index weight, they may contribute to the overvaluation of certain stocks or sectors.

Lack of Control for Socially Responsible Investing

Passive investment vehicles may not provide investors with the same level of control over their investments as active management, especially regarding environmental, social, and governance (ESG) factors.

Investors seeking to align their investments with their values may find it challenging to do so with passive strategies.

The Future of Passive Management

Technological Advancements

Technological advancements like artificial intelligence and machine learning may further improve passive investment strategies by optimizing portfolio construction and rebalancing processes, potentially enhancing risk-adjusted returns.

Evolution of Passive Investment Products

The continued growth of passive investing may lead to the development of new passive investment products, such as factor-based ETFs, ESG-focused funds, and innovative index construction methodologies, offering investors even more options for building diversified portfolios.

Potential Regulatory Changes

Regulatory changes may impact the passive management industry as policymakers seek to address concerns related to market distortions, price discovery, and systemic risks associated with passive investing's increasing popularity.

Impact on the Broader Financial Industry

As passive management continues to grow in popularity, it may reshape the broader financial industry, influencing asset management fees, active managers' role, and financial advice's importance in the investment process.

Conclusion

Passive management has emerged as a popular investment strategy, offering investors lower fees, tax efficiency, diversification, and consistent returns.

With various passive investment vehicles and strategies available, investors can tailor their portfolios to suit their unique needs and objectives.

However, it is essential to consider the criticisms and potential future developments in passive investing when making investment decisions.

Ultimately, a well-balanced approach that combines the strengths of both active and passive strategies may be the most effective way to achieve long-term investment goals.

Passive Management FAQs

Passive management is a strategy of investing in a portfolio of securities that tracks a specific market index or benchmark rather than trying to outperform it.

Passive management aims to achieve returns similar to a benchmark, while active management involves selecting individual securities to outperform the benchmark.

Passive management generally has lower fees and transaction costs than active management, and it can provide broad market exposure with minimal effort.

Passive management can result in lower returns than active management during bull markets, and it does not allow for customization or individual security selection.

Index funds and exchange-traded funds (ETFs) are commonly used in passive management strategies, as they track a specific market index or benchmark.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.