A portfolio manager is responsible for creating a portfolio that aligns with the investor's financial objectives, risk tolerance, and investment time horizon. This involves ongoing monitoring, rebalancing, and adjusting the portfolio as needed to ensure that it remains in line with the investor's goals and market conditions. Portfolio managers are responsible for developing and implementing investment strategies that align with their client's financial goals and risk tolerance. This requires a deep understanding of various investment options, such as stocks, bonds, and alternative investments, as well as the ability to analyze market trends and conditions. Effective asset allocation is crucial to maximizing returns while minimizing risk. Portfolio managers must determine the optimal mix of asset classes to include in their clients' portfolios and ensure proper diversification to mitigate potential losses. Managing risk is a critical aspect of portfolio management. Portfolio managers must identify potential risks associated with investments and develop strategies to mitigate or manage these risks, including hedging and the use of derivatives. Regularly evaluating portfolio performance and comparing it to relevant benchmarks allows portfolio managers to identify areas of strength and weakness, adjust investment strategies, and communicate progress to clients. Portfolio managers work closely with clients to understand their financial objectives, risk tolerance, and investment time horizon. By setting clear goals, they can create customized investment strategies that align with clients' needs and expectations. Once an investment strategy has been developed, portfolio managers are responsible for constructing the actual portfolio, selecting appropriate investments, and periodically rebalancing the portfolio to maintain the desired asset allocation. Portfolio managers must conduct thorough research and analysis of various investment options, including company and industry analysis, macroeconomic trends, and market conditions, to make informed investment decisions. Portfolio managers must adhere to relevant regulations and industry standards, ensuring that their investment strategies are compliant with applicable laws. Additionally, they are responsible for providing regular reports to clients on portfolio performance and any changes in investment strategy. In discretionary portfolio management, clients give portfolio managers full authority to make investment decisions on their behalf. This type of service allows for more efficient decision-making and enables portfolio managers to quickly adapt to changing market conditions. Non-discretionary portfolio management involves the client retaining ultimate control over investment decisions. Portfolio managers provide recommendations and advice, but the client is responsible for approving any changes to the portfolio. In advisory portfolio management, portfolio managers offer advice and guidance on specific investment decisions but do not have the authority to make changes to the client's portfolio. This service is best suited for clients who want to maintain a more hands-on approach to their investments. Portfolio managers must possess strong financial analysis and modeling skills to evaluate investment opportunities and forecast potential returns and risks. Effective communication and relationship-building skills are crucial for portfolio managers, as they must work closely with clients, colleagues, and other stakeholders to deliver optimal results. Portfolio managers must be able to think critically and creatively to solve complex problems, adapt to changing market conditions, and develop innovative investment strategies. A successful portfolio manager must stay current on market trends, economic developments, and regulatory changes to make informed investment decisions and adjust strategies as needed. The rise of technology in the financial services sector has led to the development of innovative tools and platforms for portfolio management. This includes the use of artificial intelligence, machine learning, and big data analytics to improve investment decision-making and risk management processes. There is a growing demand for investment strategies that incorporate environmental, social, and governance (ESG) factors, as investors become increasingly concerned with the long-term sustainability and ethical implications of their investments. Portfolio managers must stay informed about ESG issues and integrate these considerations into their investment strategies. Portfolio managers must keep abreast of global economic trends and regulatory changes that can impact investment opportunities and risks. This includes understanding the implications of geopolitical events, monetary policy decisions, and new regulations that may affect the financial markets. Most portfolio managers hold a bachelor's degree in finance, economics, business, or a related field. Many also pursue advanced degrees, such as a Master of Business Administration (MBA) or a Master of Finance, to enhance their knowledge and skills in the field. Portfolio managers typically begin their careers in entry-level roles within the financial services industry, such as analysts or traders, before progressing to more senior positions. Gaining experience in various aspects of investment management is essential for developing the skills and knowledge needed to succeed as a portfolio manager. Many portfolio managers hold professional certifications, such as the Chartered Financial Analyst (CFA) or the Certified Financial Planner (CFP), to demonstrate their expertise and commitment to ongoing professional development. Additionally, portfolio managers who manage client assets may be required to obtain a securities license, such as the Series 65, to comply with industry regulations. A portfolio manager is responsible for developing and implementing investment strategies that align with clients' financial objectives, risk tolerance, and investment time horizon. Effective asset allocation, risk management, and performance evaluation are crucial competencies that a portfolio manager must possess. The roles and responsibilities of a portfolio manager involve client consultation and goal setting, portfolio construction and rebalancing, research and analysis, and regulatory compliance and reporting. There are three types of portfolio management services, including discretionary, non-discretionary, and advisory portfolio management, and each type caters to different client needs. Essential skills for portfolio managers include financial analysis and modeling, interpersonal and communication skills, critical thinking and problem-solving, and market knowledge and adaptability. With technological innovations, growing demand for ESG investing, and global economic and regulatory developments, portfolio managers must stay informed to make informed investment decisions. What Is A Portfolio Manager?

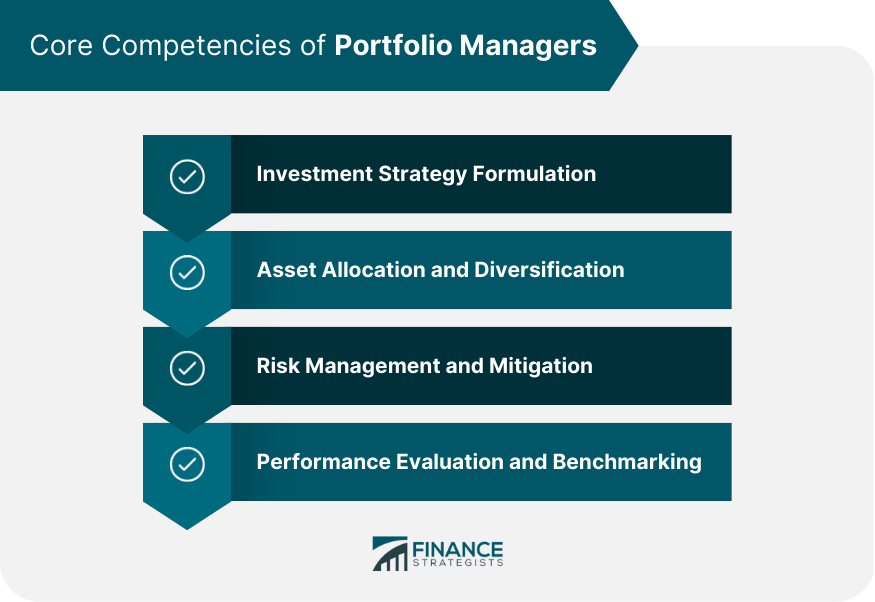

Core Competencies of Portfolio Managers

Investment Strategy Formulation

Asset Allocation and Diversification

Risk Management and Mitigation

Performance Evaluation and Benchmarking

Roles and Responsibilities of Portfolio Managers

Client Consultation and Goal Setting

Portfolio Construction and Rebalancing

Research and Analysis

Regulatory Compliance and Reporting

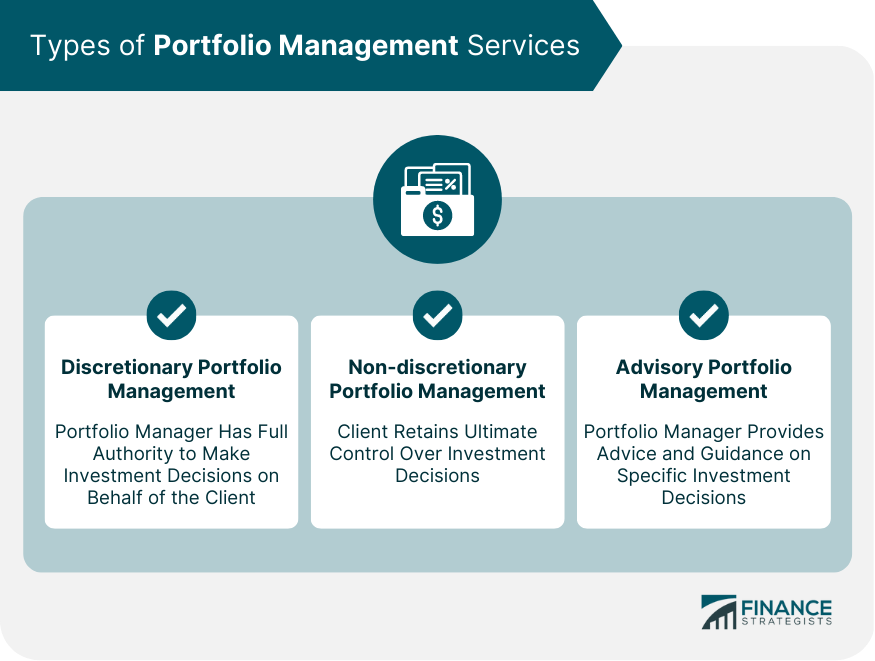

Types of Portfolio Management Services

Discretionary Portfolio Management

Non-discretionary Portfolio Management

Advisory Portfolio Management

Essential Skills for Portfolio Managers

Financial Analysis and Modeling

Interpersonal and Communication Skills

Critical Thinking and Problem-Solving

Market Knowledge and Adaptability

Key Industry Trends and Challenges

Technological Innovations in Portfolio Management

Environmental, Social, and Governance (ESG) Investing

Global Economic and Regulatory Developments

Career Path and Qualifications for Portfolio Managers

Educational Background and Credentials

Relevant Work Experience

Professional Certifications and Licenses

Conclusion

Portfolio Manager FAQs

A portfolio manager is a financial professional who is responsible for developing and implementing investment strategies for clients. They are responsible for constructing portfolios, selecting appropriate investments, monitoring portfolio performance, and providing regular reports to clients.

The core competencies of a portfolio manager include investment strategy formulation, asset allocation and diversification, risk management and mitigation, and performance evaluation and benchmarking.

The three types of portfolio management services are discretionary portfolio management, non-discretionary portfolio management, and advisory portfolio management. In discretionary portfolio management, the portfolio manager has full authority to make investment decisions on behalf of the client, while in non-discretionary portfolio management, the client retains ultimate control over investment decisions. Advisory portfolio management involves the portfolio manager providing advice and guidance on specific investment decisions.

The essential skills for success as a portfolio manager include financial analysis and modeling, interpersonal and communication skills, critical thinking and problem-solving, and market knowledge and adaptability.

Some of the key trends and challenges facing portfolio managers include technological innovations in portfolio management, the growing demand for environmental, social, and governance (ESG) investing, and global economic and regulatory developments that impact investment opportunities and risks.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.