Proprietary trading, often termed "prop trading," involves a financial institution or firm trading in financial instruments such as stocks, bonds, currencies, commodities, and their derivatives using their own funds, aiming for direct profits instead of earning commissions from client transactions. Types of proprietary trading include equities trading, fixed-income securities trading, commodities and futures trading, forex trading, derivatives trading, and algorithmic or high-frequency trading. The benefits of proprietary trading include the potential for substantial profits and income diversification for financial institutions. However, it also carries significant risks, such as the potential for substantial losses in case of poorly managed trades, conflicts of interest between firms and their clients, and potential contribution to market volatility. Therefore, it requires a careful balance of strategy, risk management, and regulatory compliance. Proprietary trading plays a crucial role in financial institutions as a potential source of significant profits. This type of trading allows financial institutions to leverage their market expertise and trading strategies to earn profits beyond the steady income derived from client fees. By engaging in proprietary trading, these institutions can exploit market opportunities and generate income regardless of market conditions, thereby adding to their revenue diversification. However, due to its inherent risk, effective risk management systems and strict compliance with regulations are critical. In equities trading, firms purchase shares of public companies to sell them at a higher price in the future. For instance, Goldman Sachs, a leading investment bank, has a robust equities trading operation. This involves trading in debt instruments such as government bonds, corporate bonds, and other fixed-income securities. JPMorgan Chase, for example, has a substantial fixed-income trading operation, dealing in bonds and other debt instruments. Firms engage in the trading of physical commodities like oil, gold, and agricultural products, as well as financial contracts, known as futures. Cargill, one of the largest private companies in the U.S., trades extensively in the commodities market. Forex trading involves buying and selling currencies. Barclays, for example, is known for its strong presence in the forex trading market. Involves trading contracts whose value is derived from underlying assets. Firms like Citadel LLC are known for their active participation in derivatives trading. Some firms specialize in algorithmic or high-frequency trading (HFT), a type of prop trading where complex algorithms are used to make trades at extremely high speeds. Two Sigma and Renaissance Technologies are notable examples of firms excelling in this domain. This initial stage involves identifying potential trading opportunities based on market analysis, financial modeling, and forecasting. Firms must assess and manage the risks associated with each trade. This can involve setting stop losses, diversifying trades, and continually monitoring market conditions. This stage involves placing the trade in the market using various strategies and techniques. The goal is to optimize the execution to minimize costs and slippage. After completing a trade, firms analyze the result to learn from their successes and failures. This information can help refine future trading strategies. In the European Union, the Markets in Financial Instruments Directive II (MiFID II) has strict rules on proprietary trading, requiring greater transparency and improved investor protection. Other jurisdictions have their regulatory frameworks, often aligning with international norms while addressing specific local conditions. For example, in Asia, the Monetary Authority of Singapore and the Hong Kong Securities and Futures Commission have regulations governing proprietary trading. Regulations has a profound effect on how proprietary trading is conducted. Following the implementation of the Volcker Rule, many U.S. banks spun off their prop trading desks. Similarly, MiFID II led to greater reporting requirements, affecting how trades are conducted in Europe. Proprietary trading can generate significant profits, often outperforming client-based trading. It also allows financial institutions to diversify their income streams and reduce dependency on client commissions. Despite the potential for high returns, proprietary trading can be risky. Poorly managed trades can lead to substantial losses, as demonstrated in the 2008 financial crisis. Furthermore, it can also lead to conflicts of interest between a firm and its clients. Proprietary trading can influence market liquidity. Large proprietary trades can create supply or demand imbalances, influencing asset prices. Additionally, high-frequency trading, a subset of prop trading, can contribute to market volatility. While proprietary trading involves the firm trading its capital, client-based trading involves trading on behalf of clients. Prop trading carries more risk but also the potential for higher profit, while client-based trading provides steadier, albeit smaller, income through fees. Technological advancements, particularly in artificial intelligence (AI) and machine learning, are transforming proprietary trading. Algorithmic trading strategies are becoming increasingly sophisticated, enabling firms to trade more efficiently and profitably. Regulations are expected to continue evolving in response to changes in the trading landscape. There's a growing focus on improving transparency and minimizing systemic risk in the financial markets. The advent of big data and AI is reshaping trading strategies. Traders now use these tools to analyze vast amounts of data to identify trading opportunities that would be impossible to detect manually. Proprietary trading, in essence, refers to a financial institution's engagement in trades using its own funds, as opposed to clients' funds, to reap direct profits. This form of trading manifests in various types, each presenting unique opportunities and risks. These include equities trading, where firms buy and sell shares of public companies; fixed-income securities trading involving debt instruments like bonds; commodities and futures trading, which covers physical commodities and financial contracts. Forex trading concerning the exchange of currencies; derivatives trading, which revolves around contracts derived from underlying assets; and finally, algorithmic and high-frequency trading that leverages advanced algorithms to execute trades at high speeds. Thus, understanding proprietary trading and its diverse forms is vital for financial institutions, given the significant potential for profit, coupled with the inherent risks.Definition of Proprietary Trading

The Role of Proprietary Trading in Financial Institutions

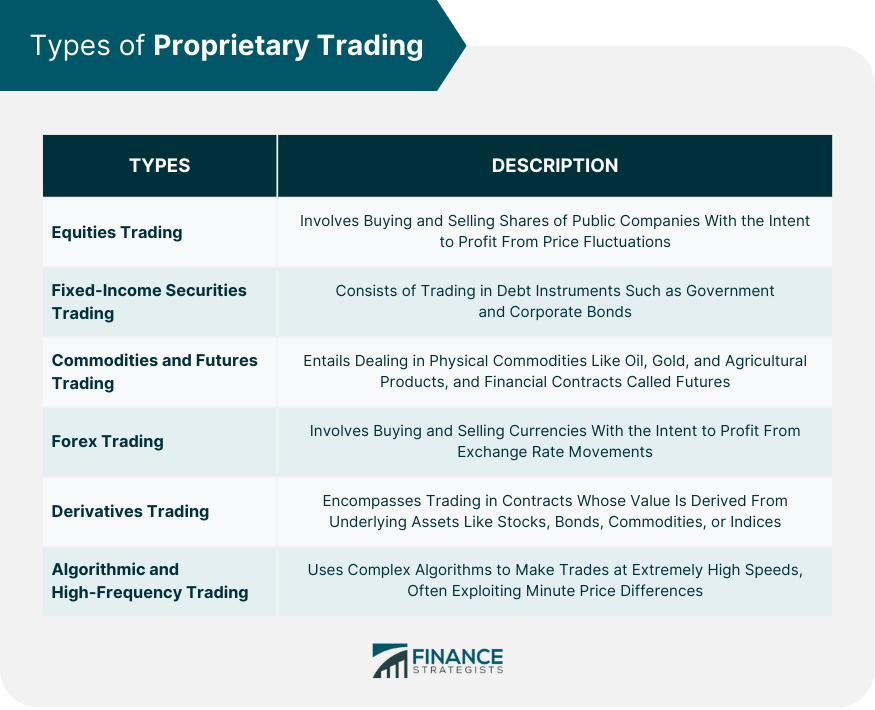

Types of Proprietary Trading

Equities Trading

Fixed-Income Securities Trading

Commodities and Futures Trading

Forex Trading

Derivatives Trading

Algorithmic and High-Frequency Trading

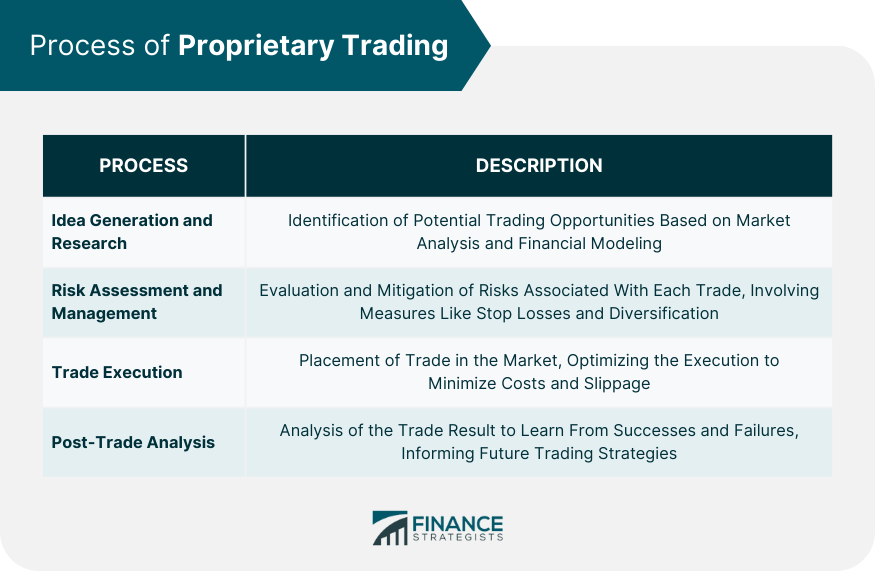

The Process of Proprietary Trading

Idea Generation and Research

Risk Assessment and Management

Trade Execution

Post-Trade Analysis

Regulations in the European Union: MiFID II

Other Global Regulatory Frameworks

Impact of Regulations on Proprietary Trading

Benefits and Risks of Proprietary Trading

Benefits to Financial Institutions

Risks and Drawbacks for Financial Institutions

The Effect of Proprietary Trading on Markets

Proprietary Trading vs Client-Based Trading

The Future of Proprietary Trading

Technological Advances and Their Impact

Emerging Regulatory Trends

Evolution of Trading Strategies in the Era of Big Data and AI

Conclusion

Proprietary Trading FAQs

Proprietary trading, also known as "prop trading," is when a financial institution or firm trades financial instruments with their funds, aiming to make direct profits instead of earning commissions from client transactions.

The types of proprietary trading include equities trading, fixed-income securities trading, commodities and futures trading, forex trading, derivatives trading, and algorithmic or high-frequency trading.

Proprietary trading allows financial institutions to leverage their market expertise and trading strategies to earn profits beyond steady income from client fees. It helps in diversifying revenue streams and making profits in all market conditions.

The benefits of proprietary trading include potential for substantial profits and income diversification. However, it carries significant risks, such as potential for substantial losses if trades are poorly managed, conflicts of interest with clients, and potential contributions to market volatility.

Regulations like the Dodd-Frank Act and the Volcker Rule in the U.S., and MiFID II in Europe, have greatly influenced proprietary trading. Many institutions have had to adjust their trading strategies to comply with these laws, often leading to increased transparency and reduced risk in financial markets.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.