The quality factor is a fundamental characteristic of a company's financial health and performance that is used by investment managers to identify stocks and bonds that are expected to provide long-term returns with low risk. The quality factor is typically defined by a set of financial metrics that reflect a company's strong financial health, steady earnings growth, high profitability, low debt-to-equity ratio, and consistent dividend payout. The quality factor is an important consideration for investment managers because it is a key driver of long-term performance and risk management. Investing in companies with strong financial health and performance is expected to provide stable returns and low risk over the long term, while investing in companies with weak financial health and performance is expected to provide volatile returns and high risk. Companies with strong financial health typically have a solid balance sheet, high credit ratings, and a strong track record of generating cash flow and earnings. These companies are often able to weather economic downturns and market volatility and are less likely to experience financial distress. Companies with steady earnings growth typically have a strong competitive position, innovative products and services, and an experienced management team. These companies are often able to generate consistent revenue and earnings growth over time, which can lead to higher stock prices and dividends. Companies with high profitability typically have a strong competitive position, low costs, and high margins. These companies are often able to generate consistent returns on invested capital and are less likely to experience earnings volatility. Companies with low debt-to-equity ratios typically have a strong balance sheet and a conservative financial structure. These companies are often able to manage their debt obligations and are less likely to experience financial distress or default. Companies with consistent dividend payouts typically have a strong track record of generating cash flow and earnings and a commitment to returning value to shareholders. These companies are often able to provide stable income to investors and are less likely to experience dividend cuts or suspensions. Investing in companies with strong financial health and performance is expected to provide stable returns and low risk over the long term. Companies with strong financial health and performance typically have a competitive advantage, a solid balance sheet, and a track record of generating consistent earnings and dividends. These companies are often able to provide stable income to investors and are less likely to experience volatility or financial distress. Investing in companies with strong financial health and performance is also an effective way to manage risk. Companies with strong financial health and performance are less likely to experience financial distress or default, which can lead to significant losses for investors. Investing in companies with strong financial health and performance can also provide diversification benefits by reducing exposure to companies with weak financial health and performance. Fundamental analysis is a strategy for identifying companies with strong financial health and performance by analyzing a company's financial statements, management team, competitive position, and market trends. Fundamental analysis is typically used by value investors and long-term investors who are focused on identifying undervalued companies with strong financial health and performance. Quantitative analysis is a strategy for identifying companies with strong financial health and performance by using mathematical models and algorithms to analyze financial metrics and market trends. Active management is a strategy for investing in companies with strong financial health and performance by selecting individual stocks and bonds based on fundamental or quantitative analysis. Active management is typically associated with higher fees and greater risk, but also has the potential to generate higher returns than passive management. Passive management is a strategy for investing in companies with strong financial health and performance by investing in index funds or exchange-traded funds (ETFs) that track indexes composed of companies with strong financial health and performance. Passive management is typically associated with lower fees and lower risk than active management, but also has the potential to generate lower returns. Blue-chip stocks are large, well-established companies with a strong track record of generating consistent earnings and dividends. Blue-chip stocks are typically considered to be high-quality investments because they have a strong competitive position, a solid balance sheet, and a track record of providing stable returns to investors. Dividend-paying stocks are stocks that pay regular dividends to shareholders. Dividend-paying stocks are typically considered to be high-quality investments because they have a strong track record of generating consistent cash flow and earnings and a commitment to returning value to shareholders. High-quality bonds are bonds issued by companies or governments with a strong credit rating and a solid track record of managing their debt obligations. High-quality bonds are typically considered to be low-risk investments because they are less likely to experience default or financial distress. The quality factor is an important characteristic of a company's financial health and performance that is used by investment managers to identify stocks and bonds that are expected to provide long-term returns with low risk. The quality factor is typically defined by a set of financial metrics that reflect a company's strong financial health, steady earnings growth, high profitability, low debt-to-equity ratio, and consistent dividend payout. Investing in companies with strong financial health and performance can provide stable returns and low risk over the long term and is an effective way to manage risk and diversify an investment portfolio. Strategies for investing in quality factor include fundamental analysis, quantitative analysis, active management, and passive management, and examples of quality factor investments include blue-chip stocks, dividend-paying stocks, and high-quality bonds.Definition of Quality Factor

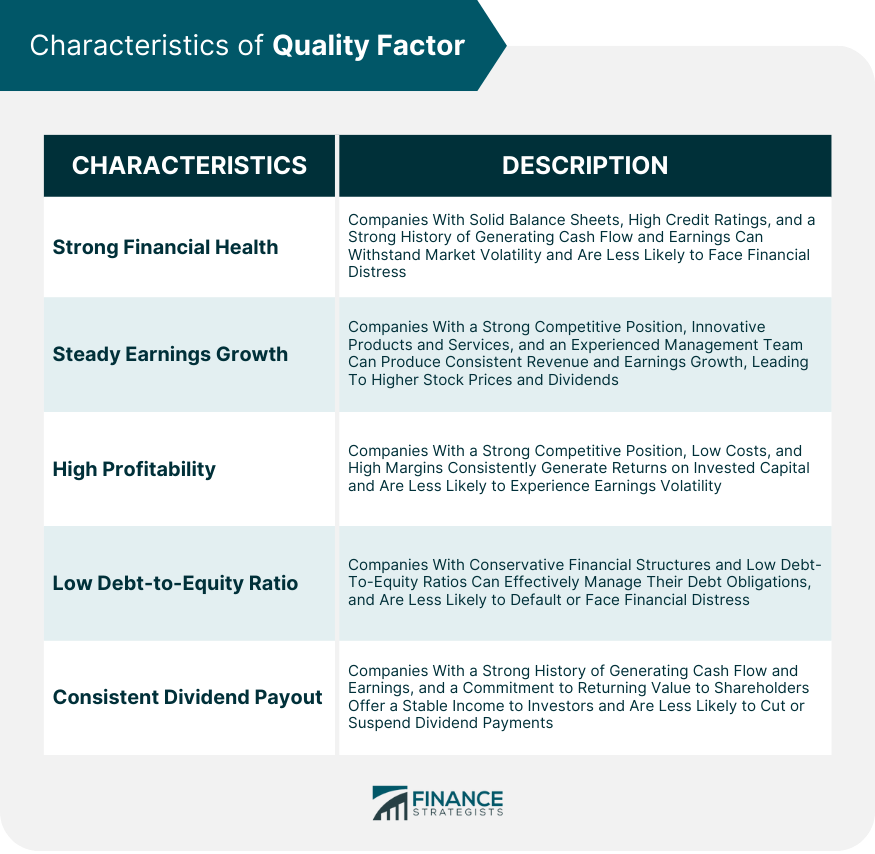

Characteristics of Quality Factor

Strong Financial Health

Steady Earnings Growth

High Profitability

Low Debt-to-Equity Ratio

Consistent Dividend Payout

Importance of Quality Factor in Investment Management

Long-Term Performance

Risk Management

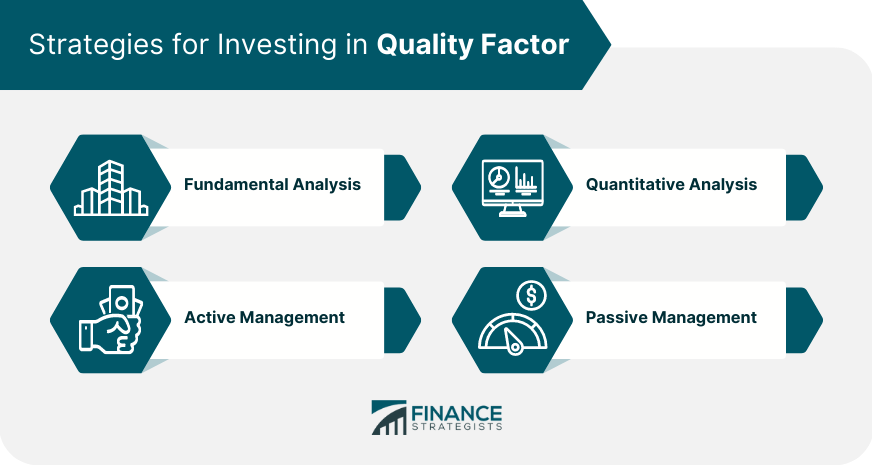

Strategies for Investing in Quality Factor

Fundamental Analysis

Quantitative Analysis

Quantitative analysis is typically used by quantitative investors and algorithmic traders who are focused on identifying patterns in market data and exploiting market inefficiencies.Active Management

Passive Management

Examples of Quality Factor Investments

Blue-Chip Stocks

Dividend-Paying Stocks

High-Quality Bonds

Final Thoughts

Quality Factor FAQs

Quality Factor refers to the set of characteristics that indicate a company's financial strength, stability, and profitability.

Quality Factor helps investors identify companies with strong fundamentals and long-term growth potential, reducing the risk of losses.

The key characteristics of Quality Factor include strong financial health, steady earnings growth, high profitability, low debt-to-equity ratio, and consistent dividend payouts.

Investors can use fundamental analysis, quantitative analysis, active management, and passive management strategies to invest in Quality Factor.

Blue-chip stocks, dividend-paying stocks, and high-quality bonds are some of the examples of Quality Factor investments.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.