Regret Theory, in its most basic form, refers to a cognitive approach that incorporates emotions into decision-making processes. It specifically addresses the emotional feeling of regret experienced when a decision leads to an unfavorable outcome, especially when a different decision could have led to a better outcome. The concept, first formally introduced by Graham Loomes and Robert Sugden in 1982, is considered a significant milestone in behavioral economics, effectively challenging traditional utility theory’s assumption of perfectly rational economic agents. The Regret Theory rests on the concept of utility - a measure of satisfaction or happiness derived from a particular outcome. It modifies traditional utility theory to include the psychological aspects of decision-making. Traditional utility theory proposes that individuals aim to maximize their total utility, making choices based on their rational calculation of the greatest benefit or least cost. However, Regret Theory suggests that this is not always the case. Regret Theory argues that people's decisions are not solely determined by expected utility but are also influenced by their fear of regret. For instance, people often choose options that may not provide the highest possible utility because they fear the regret they might experience if their choice leads to an unfavorable outcome. Regret and disappointment are two fundamental concepts in this theory. Regret is the emotion experienced when one realizes that the outcome of the chosen option is less desirable than the outcome of an alternative, unchosen option. On the other hand, disappointment arises when the outcome is worse than what was expected. These emotions are considered to influence future decision-making processes significantly. A key concept in Regret Theory is counterfactual thinking, which is the process of imagining alternative outcomes that could have occurred in the past. This type of thinking tends to amplify feelings of regret when individuals consider what could have happened if they had made different decisions. Regret Theory also emphasizes the role of opportunity cost in decision-making. This concept refers to the potential benefits an individual misses out on when choosing one alternative over another. Regret often arises when people reflect on the opportunity costs of their decisions. Regret Theory has crucial implications in investment decision-making. It can explain why some investors are hesitant to sell their underperforming assets, holding on to them in the hope that their value might improve. This behavior, known as the disposition effect, can be attributed to the fear of regret if the asset's value increases after selling it. Regret aversion, or the tendency to avoid decision-making that could lead to regret in the future, impacts investor behavior. This phenomenon often leads to investment inertia, where investors maintain their current portfolio allocation despite market changes that suggest they should adjust their investments. Regret Theory's principles significantly influence wealth management strategies. Acknowledging that individuals may make decisions influenced by the potential for future regret, instead of purely rational considerations, allows wealth managers to better tailor their services and advice. An understanding of Regret Theory helps wealth managers better assess a client's risk tolerance. Individuals who exhibit high levels of regret aversion are typically more risk-averse and may prefer safer investment strategies. By identifying clients' potential for regret aversion, wealth managers can provide investment advice more aligned with their clients' psychological profile. Regret Theory can help explain the phenomenon of excessive portfolio diversification. The fear of regret often leads investors to over-diversify their portfolios to mitigate the risk of poor performance in a particular asset. Understanding this can allow wealth managers to better guide their clients towards effective diversification that optimizes returns while still accounting for potential regret. Wealth managers can use Regret Theory to guide their investment advice. This involves recommending investment strategies that not only have favorable expected outcomes but also minimize potential regret. For instance, instead of suggesting aggressive investment strategies that could potentially yield high returns (but also carry high risk), a wealth manager might propose a more balanced strategy to a regret-averse client. Regret Theory can also provide the basis for behavioral coaching, a method increasingly employed by wealth managers. By educating clients about regret and other cognitive biases, wealth managers can help them make more informed and rational decisions. For example, wealth managers can counsel clients about the common tendency to hold onto losing stocks due to the fear of regret if the stocks rebound after selling, a phenomenon known as the disposition effect. Regret aversion often affects asset liquidation strategies. Investors might be reluctant to sell an underperforming asset due to the fear of regret if the asset's price rebounds after the sale. Wealth managers, understanding this emotional bias, can provide advice that helps clients make more rational sell decisions. Regret Theory is grounded on the belief that individuals anticipate the regret that a decision might cause, and this regret shapes their decision-making. This perspective assumes that people are rational and have the foresight to predict their emotional reactions. However, this is not always the case. In many situations, people might act impulsively or fail to anticipate their emotional responses accurately, thus limiting the applicability of Regret Theory. While Regret Theory explicitly focuses on regret and disappointment, it tends to neglect other emotional states that may influence decision-making. Emotions such as fear, anxiety, joy, or even relief could also play crucial roles in guiding decisions. As a result, a decision-making model solely based on Regret Theory might not fully capture the complexity of human behavior. Certain empirical findings appear to contradict the predictions of Regret Theory. For example, some studies suggest that people tend to regret actions more than inactions, which contradicts the theory's central premise. This discrepancy can limit the explanatory and predictive power of the theory. Regret, like all emotions, is influenced by cultural norms and values. Therefore, the experience and expression of regret might vary across different cultures. However, Regret Theory, which was largely developed in Western contexts, may not necessarily account for these cultural variations, thereby limiting its cross-cultural validity. Regret Theory can play a vital role in enhancing investor education. By incorporating the principles of Regret Theory into educational materials, educators can better prepare investors for the emotional challenges of investment decision-making. Future development of investment products and services could benefit from the principles of Regret Theory. For instance, financial institutions could design products that minimize potential regret, such as low-risk funds for conservative investors or insurance products that offer protection against extreme market downturns. Regret Theory has emerged as a transformative perspective in behavioral economics and finance, particularly in wealth and investment management. By integrating emotional factors into decision-making processes, Regret Theory challenges traditional utility theory's assumption of purely rational economic agents. It underscores the significant influence of regret, counterfactual thinking, and opportunity cost in our choices, offering nuanced insights into investor behavior and wealth management strategies. Despite its limitations, such as assuming rational regret and neglecting other emotions, Regret Theory remains a powerful tool for understanding and predicting human decision-making, making it invaluable for investment advisors, wealth managers, and financial institutions. Looking forward, Regret Theory holds tremendous potential for enhancing investor education and refining financial products and services. By educating investors about regret and other cognitive biases, financial professionals can help them make more informed, rational decisions. Likewise, financial institutions can leverage Regret Theory's principles to design products that cater to clients' regret aversion, further personalizing their offerings. As the understanding of human decision-making evolves, Regret Theory will continue to shape the approach to economics and finance, highlighting the intricate interplay of cognition and emotion in decisions.What Is Regret Theory?

Key Concepts in Regret Theory

Utility

Regret and Disappointment

Counterfactual Thinking

Opportunity Cost

Regret Theory in Investment Management

Application in Investment Decision-Making

The Impact of Regret Aversion on Investor Behavior

Regret Theory and Its Influence on Wealth Management Strategies

Client Profiling and Risk Tolerance

Portfolio Diversification

Regret Minimization in Investment Advice

Behavioral Coaching

Asset Liquidation Strategy

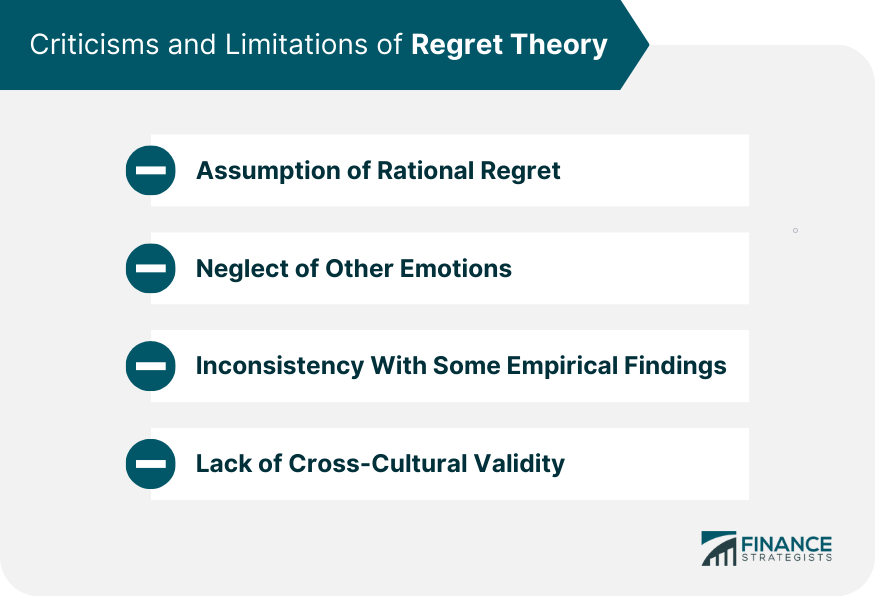

Criticisms and Limitations of Regret Theory

Assumption of Rational Regret

Neglect of Other Emotions

Inconsistency With Some Empirical Findings

Lack of Cross-Cultural Validity

Future Implications of Regret Theory

Improving Investor Education

Designing Investment Products and Services

Final Thoughts

Regret Theory FAQs

Regret Theory is a cognitive approach that incorporates emotions, specifically regret, into the decision-making process. It suggests that individuals not only consider the potential benefits and costs when making a decision, but they also take into account the potential for regret if a different decision could have resulted in a better outcome.

Regret Theory can explain certain behaviors observed in investors, such as the disposition effect, where investors hold onto underperforming assets in hopes of their value improving, due to the fear of regret if the asset's value increases after selling it. It also points to regret aversion, where investors avoid making decisions that could potentially lead to future regret, leading to investment inertia.

Regret Theory can help wealth managers better understand their clients' risk tolerance by considering their potential for regret aversion. It also guides investment advice, where managers can recommend strategies that minimize potential regret. Understanding Regret Theory can help wealth managers advise clients on diversification and asset liquidation strategies, and offer behavioral coaching to improve decision-making.

Regret Theory assumes that individuals can rationally anticipate regret, which isn't always the case. It also neglects other emotions that may influence decision-making and might not fully reflect cultural variations in the experience and expression of regret.

Regret Theory can play a crucial role in enhancing investor education, helping investors better prepare for the emotional challenges of investment decision-making. It can also guide the design of investment products and services, allowing financial institutions to create offerings that minimize potential regret, such as low-risk funds or insurance products that offer protection against market downturns.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.