Reinvestment is the practice of using cash inflows generated from an investment to purchase additional assets or shares. In essence, rather than taking the profits out as cash, the investor puts them back into the investment, further increasing the potential for growth. Reinvestment can occur in various forms: reinvesting dividends received from a stock, interest from a bond, income from real estate, or profits from a business venture. It is a strategic approach that can significantly enhance an investor's return over time. A critical aspect of reinvestment is its role in compounding. Compounding, often referred to as "earning interest on interest," is the process where the returns generated from an investment are reinvested, creating the potential for even greater returns in the future. Reinvestment can significantly accelerate the compounding process, leading to exponential growth in wealth over time. Reinvestment is a powerful tool for financial growth. By continually reinvesting earnings, investors can exponentially increase their returns, creating a snowball effect. This strategy can lead to substantial wealth accumulation, especially over a long investment horizon. Dollar-cost averaging is a reinvestment strategy where a fixed dollar amount is invested regularly, regardless of market prices. This strategy reduces the impact of market volatility and eliminates the need to time the market, as more shares are purchased when prices are low, and fewer shares are bought when prices are high. Dividend Reinvestment Plans are programs offered by companies that allow shareholders to reinvest their dividends automatically in additional shares. DRIPs offer a convenient and cost-effective method for investors to accumulate more shares and enhance their investment returns over time. Many mutual funds and brokerage firms offer automatic investment plans. These plans allow investors to specify a fixed amount to be automatically reinvested at regular intervals. Like DRIPs, automatic investment plans provide a systematic approach to reinvestment, facilitating consistent growth of the investment portfolio. Reinvestment plays a crucial role in enhancing returns from stocks and bonds. Investors can reinvest dividends received from stocks or interest earned from bonds to buy additional shares or bonds, respectively. Many companies and bond issuers offer options for automatic reinvestment of dividends or interest. In the case of mutual funds and Exchange Traded Funds (ETFs), any income or capital gains distributions can be reinvested to purchase additional fund units. This reinvestment can be automated, providing a seamless way to compound returns. Real estate investors can also leverage reinvestment. Rental income can be reinvested into property improvements, additional real estate properties, or real estate investment trusts (REITs), amplifying the income potential and property value. The reinvestment rate is the rate of return earned on the reinvestment of cash flows. For fixed income investments, it's the interest rate at which the interest income from the investment can be reinvested. The reinvestment rate can be calculated using various methods, depending on the investment type. For example, for a bond, the reinvestment rate could be the prevailing market interest rate at the time the interest payments are received. Reinvestment risk is the possibility that cash flows received in the future will have to be reinvested at a lower interest rate than the rate of the original investment. For example, an investor holding a bond yielding 5% faces the risk that when the bond matures or the interest is paid, they may only be able to reinvest in a new bond yielding 3%. Reinvestment risk can be managed in several ways. Diversification across different types of investments and maturity dates can reduce the impact of interest rate changes. Laddering—a strategy involving investing in multiple securities with different maturity dates—can also help manage reinvestment risk. Market conditions significantly influence reinvestment decisions. During bull markets, reinvesting dividends or profits can be highly beneficial due to rising asset prices. Conversely, during bear markets, investors might prefer to hold cash or reinvest in safer, fixed-income securities. The investor's goals also dictate reinvestment decisions. Those with long-term growth objectives might choose to reinvest all earnings, while those seeking regular income might prefer to take some or all profits as cash. Risk tolerance—the investor's ability to withstand losses or volatility—also plays a key role in reinvestment decisions. Risk-averse investors may lean towards reinvesting in less volatile securities or diversifying their investments. Reinvestment can significantly boost a portfolio's total return—comprising both capital gains and income from dividends or interest. Over the long term, reinvested earnings can contribute a substantial portion of the portfolio's total return due to the power of compounding. Reinvestment can also impact portfolio diversification. By reinvesting earnings into different asset classes or sectors, investors can achieve a more balanced and diversified portfolio, potentially reducing risk and enhancing returns. Reinvestment plays a crucial role in building retirement savings. By consistently reinvesting dividends, interest, and capital gains during their working years, investors can grow their retirement nest egg more rapidly and ensure they have sufficient funds to maintain their lifestyle in retirement. Even in retirement, reinvestment remains important. While retirees may start withdrawing from their portfolios for living expenses, reinvesting a portion of their portfolio's earnings can help ensure their savings last through their retirement years. Reinvestment is the strategy of using the returns from an investment—whether from dividends, interest, or capital gains—to purchase additional assets, thereby potentially enhancing future returns. Reinvestment plays a vital role in compounding, contributing significantly to financial growth. Various reinvestment strategies, such as Dollar-Cost Averaging, DRIPs, and automatic investment plans, can be used across different financial instruments, including stocks, bonds, mutual funds, ETFs, and real estate. Investors should consider their financial goals, market conditions, and risk tolerance when making reinvestment decisions. Reinvestment can significantly impact portfolio performance and is a key consideration in retirement planning. It is important to consult a financial advisor or other investment professionals for further information and guidance on reinvestment. What Is Reinvestment?

Importance of Reinvestment

Role in Compounding

Impact on Financial Growth

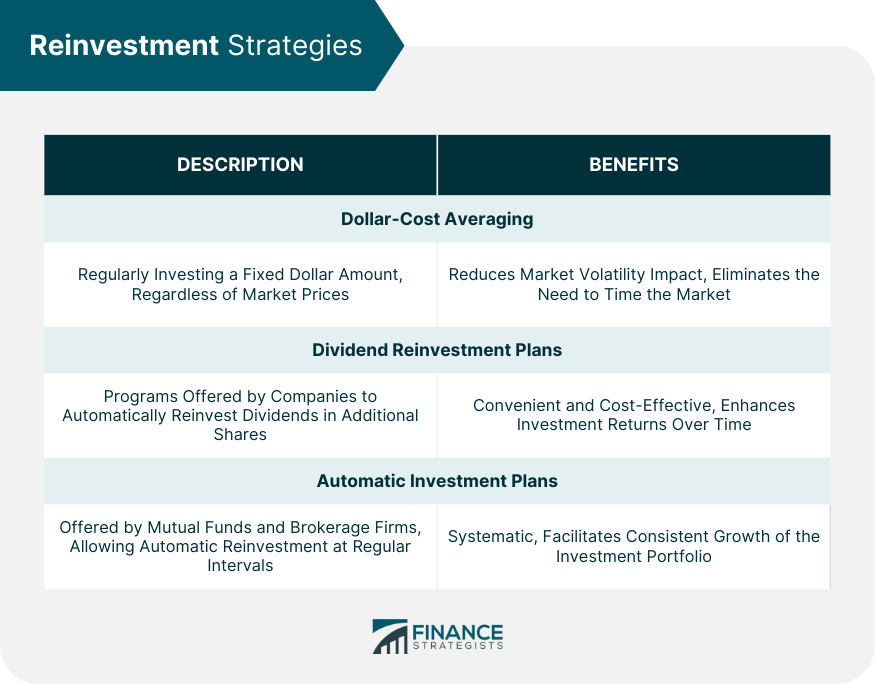

Reinvestment Strategies

Dollar-Cost Averaging

Dividend Reinvestment Plans (DRIPs)

Automatic Investment Plans

Reinvestment in Different Financial Instruments

Stocks and Bonds

Mutual Funds and ETFs

Real Estate

The Reinvestment Rate

Understanding the Concept

Calculating the Reinvestment Rate

Reinvestment Risk

Definition

Management of Reinvestment Risk

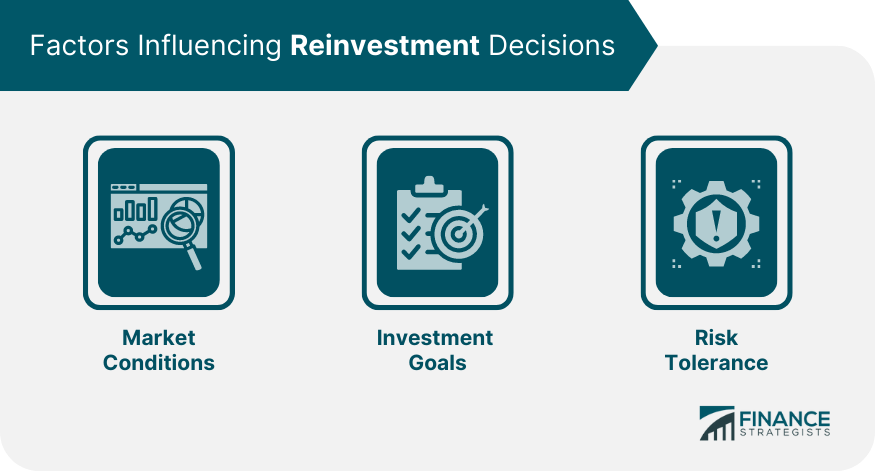

Factors Influencing Reinvestment Decisions

Market Conditions

Investment Goals

Risk Tolerance

Impact of Reinvestment on Portfolio Performance

Contribution to Total Returns

Effect on Portfolio Diversification

Reinvestment in the Context of Retirement Planning

Role in Building Retirement Savings

Reinvestment Strategies for Retirees

Final Thoughts

Reinvestment FAQs

Reinvestment involves using the returns from an investment to buy additional assets, thereby compounding future returns.

Reinvestment accelerates the process of compounding, leading to exponential growth in wealth over time.

Common reinvestment strategies include dollar-cost averaging, Dividend Reinvestment Plans (DRIPs), and automatic investment plans.

Reinvestment risk is the risk that future cash flows will need to be rein vested at a lower interest rate than the original investment, potentially reducing future returns.

Reinvestment can significantly enhance the growth of retirement savings. Even in retirement, strategic reinvestment can help ensure the longevity of one's nest egg.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.