Return of Capital is an investment term that refers to the portion of a company's profits returned to investors, which originates not from earnings, but from the invested capital itself. Simply put, it's the money returned to an investor from the initial investment rather than profits earned on that investment. ROC is commonly used in cases where a company or a fund has not generated enough profit to cover the expected return. It's a strategy that maintains cash flow to investors, even when earnings are low or non-existent. It's important to understand that while ROC increases immediate cash flow, it also reduces the value of the initial investment or cost basis. ROC is calculated by subtracting the ending value of an investment from its initial value, then subtracting any income and capital gains, and finally dividing the result by the initial value of the investment. This final value is often expressed as a percentage. Let's consider a case study of a REIT (Real Estate Investment Trust) that an investor bought for $100,000. If the REIT distributed $10,000 to the investor over a year, but only $6,000 was from income and capital gains, the remaining $4,000 is considered ROC. ROC distributions are often seen in dividend payments, especially in high-yield investments like REITs and MLPs (Master Limited Partnerships). These entities often distribute ROC to maintain a steady dividend, even in lean years. ROC reduces the shareholder's basis in the investment. In the previous example, the $4,000 ROC reduces the investor's basis in the REIT from $100,000 to $96,000. This reduction can have significant tax implications, which brings us to our next section. ROC distributions are not immediately taxed as income. Instead, they reduce the cost basis of the investment. This can lead to larger capital gains when the investment is sold, resulting in higher capital gains tax. If the ROC distributions exceed the investor's cost basis, the excess is considered a capital gain and is subject to capital gains tax. REITs often distribute ROC as part of their legally mandated dividend payments. This is because REITs are required to distribute 90% of their taxable income to shareholders. Like REITs, MLPs also distribute a significant amount of ROC to maintain cash flow to investors. However, the tax implications are slightly different due to the unique structure of MLPs. Mutual funds and exchange-traded funds (ETFs) may also distribute ROC, particularly those that focus on generating high levels of income. However, consistent ROC distributions can indicate that the fund is returning invested capital because it's not generating enough income or capital gains. ROC can make an investment seem more attractive because it boosts the investment's yield. However, a high ROC can also be a red flag, indicating that the company or fund isn't generating enough profit to meet its distribution commitments. ROC is a useful measure of how efficiently a company is using its capital to generate profits. A company that consistently returns a significant portion of capital might be struggling to generate sufficient profits. ROC can be beneficial for investors seeking to preserve their capital while generating income. By returning a portion of the invested capital, it helps maintain the initial investment amount, providing stability and security. ROC can have potential tax advantages, especially in certain jurisdictions. Unlike dividends or capital gains, which are subject to taxation, ROC is considered a return of the original investment and is generally treated as a non-taxable event. This can result in lower tax liabilities for shareholders. For income-focused investors, ROC can be advantageous in terms of managing cash flow. Instead of relying solely on dividend payments, ROC provides a regular income stream that can be used for personal expenses, reinvestment, or diversification into other investments. ROC can act as a risk mitigation strategy for investors, particularly during periods of market volatility or economic uncertainty. By returning a portion of the invested capital, it reduces the exposure to market fluctuations and provides a cushion against potential losses. Return of Capital offers investors flexibility in managing their investments. Shareholders can choose to reinvest the returned capital in the same company or allocate it to other investment opportunities based on their financial goals and risk tolerance. In some cases, ROC may be an indication of a company's strong financial position and profitability. A company that consistently generates excess cash flow and returns capital to shareholders may attract investors seeking higher returns on their investment. By returning capital to shareholders, a company may be limiting its ability to reinvest in growth opportunities or fund future projects. This reduction in retained earnings can hinder the company's capacity to generate future profits and may impact its long-term growth prospects. ROC can sometimes be misinterpreted by investors as a positive sign of profitability. However, ROC does not necessarily indicate that a company is generating strong earnings or sustainable cash flow. It can give a false impression of financial health, leading investors to overlook underlying issues such as declining revenue or profitability. Companies that opt for ROC over regular dividends may disrupt the stability of dividend payments. While dividends are typically associated with predictable cash flow and income for shareholders, ROC can introduce variability and uncertainty in the timing and amount of distributions. Depending on the circumstances, ROC can erode the capital base of an investment over time. If a company consistently returns capital without generating sufficient profits, the value of the investment may gradually decline. This can be a concern for long-term investors seeking capital appreciation. ROC distributions can sometimes be viewed negatively by the market. Investors may interpret it as a sign that the company lacks attractive investment opportunities or is unable to generate sustainable profits. This perception can lead to a decline in the company's stock price, potentially impacting shareholder value. ROC can be confusing for investors, particularly those who are less familiar with financial terminology. Differentiating between ROC and other forms of investment income, such as dividends or capital gains, requires a clear understanding of the underlying mechanics and implications. Return on Capital (RoC) is a different metric that measures how efficiently a company generates profits from its capital. Unlike ROC, a high RoC is generally a positive sign, indicating profitable use of capital. For example, a company with a high RoC and low ROC is efficiently using its capital to generate profits and not returning much of the invested capital. Conversely, a company with a high ROC and low RoC is returning a significant portion of the invested capital because it's not generating sufficient profits. Return of Capital refers to the part of an investment return that is derived from the original capital invested, rather than earnings on that investment. ROC plays a pivotal role in the investment landscape, particularly for investors seeking consistent income streams. It's essential to understand how ROC distributions work, their impact on the cost basis of the investment, and their potential tax implications. ROC offers several benefits, including capital preservation, cash flow management, tax efficiency, risk mitigation, and a potential for higher returns. However, these must be weighed against potential drawbacks, such as reduced future earnings, misleading signals, decreased dividend stability, capital erosion, and confusion. It may also negatively impact market perception. Investing in entities that distribute ROC can be complex, and it's often beneficial to seek professional guidance. Financial advisors or tax professionals can provide personalized advice based on an individual's specific circumstances.What Is Return of Capital (ROC)?

Calculation of Return of Capital

Methodology for Calculating ROC

Example Scenario and Calculation Outcomes

ROC and Shareholder Distribution

Role in Dividend Payments

Impact on Shareholder's Basis

Tax Implications of Return of Capital

Impact on Capital Gains Tax

Tax Treatment of Excess ROC

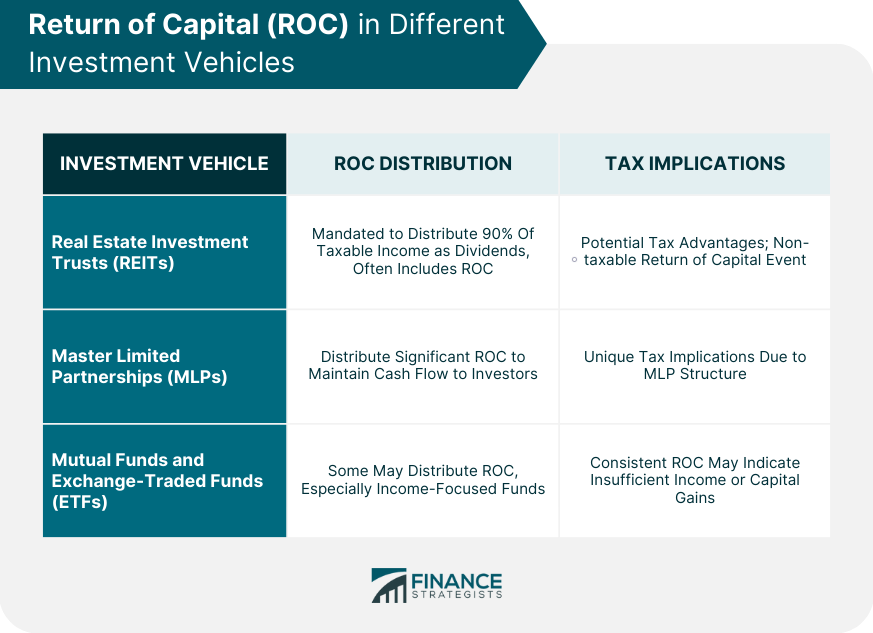

ROC in Different Investment Vehicles

Real Estate Investment Trusts

Master Limited Partnerships

Mutual Funds and ETFs

The Role of ROC in Investment Analysis

How ROC Influences Investment Decisions

ROC as a Measure of Investment Efficiency

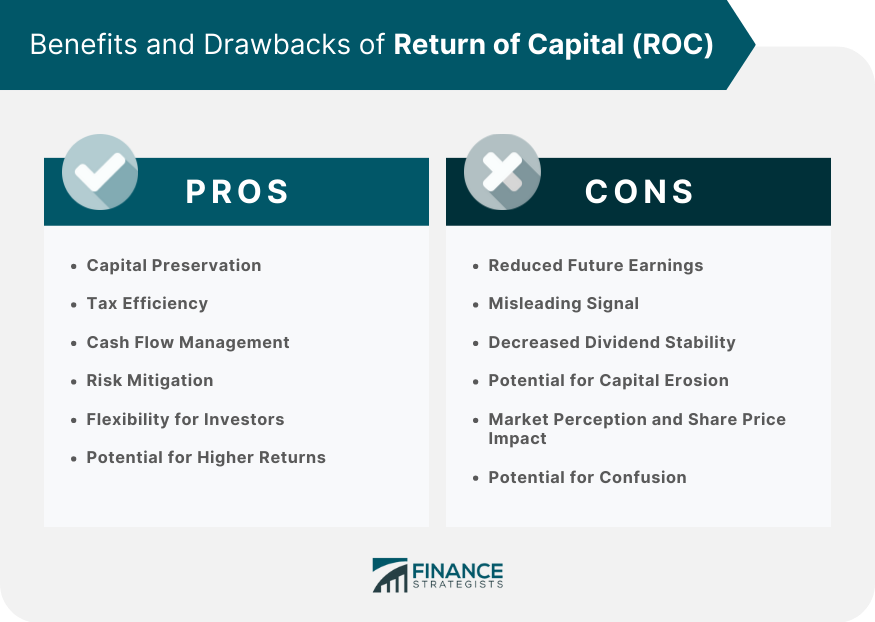

Benefits and Drawbacks of ROC

Pros

Capital Preservation

Tax Efficiency

Cash Flow Management

Risk Mitigation

Flexibility for Investors

Potential for Higher Returns

Cons

Reduced Future Earnings

Misleading Signal

Decreased Dividend Stability

Potential for Capital Erosion

Market Perception and Share Price Impact

Potential for Confusion

Return of Capital vs Return on Capital

Distinct Definitions and Use Cases

Practical Examples and Differences

Conclusion

Return of Capital (ROC) FAQs

ROC is the portion of an investment return that arises from the return of the initial capital invested, rather than profits earned on the investment.

ROC is calculated by subtracting the ending value of an investment from its initial value, then subtracting any income and capital gains, and finally dividing the result by the initial value of the investment.

ROC distributions are not immediately taxable. They instead reduce the cost basis of the investment, which may lead to a higher capital gains tax when the investment is sold. If ROC distributions exceed the investor's cost basis, the excess is considered a capital gain and is taxed accordingly.

RoC is a measure of how efficiently a company uses its capital to generate profits, while ROC refers to the return of the initial capital investment back to the investor.

The main risk of ROC is the potential erosion of the initial investment. Consistent ROC distributions can eventually return the entire initial investment, leaving the investor with no investment value. It might also indicate a company's struggle to generate sufficient profits, which can be a warning sign for its long-term stability.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.