A Timber Investment Management Organization is a specialized investment management institution primarily serving institutional investors by providing portfolio exposure to timberland assets. TIMOs handle the acquisition, management, and selling of timberland on behalf of their investors, aiming to maximize financial returns while often also considering environmental sustainability and responsible forest management. Their services bridge the gap between investors and the complexities of timberland ownership and management, making timber a more accessible and manageable asset class for investment portfolios. A typical TIMO comprises a team of professionals specializing in different areas such as forestry, finance, and real estate. The team typically includes a portfolio manager, investment analyst, and forest operations manager, among others. TIMOs perform several core functions, including: Acquisition of Timberland: TIMOs identify and acquire timberland properties on behalf of their investors. This involves rigorous due diligence to assess the quality of the timber, the potential for growth, and any potential risks. Management and Maintenance of Timberland: Once a property is acquired, the TIMO is responsible for managing and maintaining the land. This includes ensuring sustainable forestry practices, managing pests and diseases, and optimizing the growth and health of the timber. Harvesting and Selling Timber: TIMOs oversee the harvesting and sale of timber. They work to maximize returns while minimizing the impact on the environment. Marketing and Selling Timberland Properties: When appropriate, TIMOs may sell timberland properties. They typically engage in extensive marketing efforts to attract potential buyers. Several stakeholders are involved in a TIMO, including the investors, the TIMO management team, the landowners, and the local communities where the timberland is located. TIMOs employ various investment strategies depending on their investment objectives and the needs of their investors. Some focus on acquiring high-quality timberland with strong growth potential, while others may focus on properties with development potential or conservation value. TIMOs generate revenue through the sale of timber and, in some cases, timberland properties. The profitability of a TIMO depends on factors such as the quality of the timberland, the efficiency of the forestry operations, and the market conditions for timber. Risk management is a critical aspect of a TIMO's operations. This involves identifying potential risks such as fire, pests, diseases, market fluctuations, and regulatory changes and implementing strategies to mitigate these risks. Performance evaluation is critical for TIMOs, both to assess their operations and to provide transparency to their investors. Measures of performance often include financial metrics such as the Internal Rate of Return (IRR) and Net Present Value (NPV), as well as non-financial metrics related to environmental sustainability and social impact. One of the key roles of TIMOs is to promote responsible forest management. This involves implementing practices that not only maximize timber production but also maintain the health of the forest ecosystem. TIMOs often follow established sustainability standards such as the Forest Stewardship Council (FSC) and the Sustainable Forestry Initiative (SFI). Through responsible forest management, TIMOs contribute significantly to environmental conservation. Well-managed forests serve as important carbon sinks, helping to mitigate climate change. They also provide habitat for wildlife and help to protect watersheds. Climate change presents both challenges and opportunities for TIMOs. Changing weather patterns can affect forest health and productivity and increase the risk of wildfires. However, the role of forests in sequestering carbon also presents opportunities for TIMOs to contribute to climate change mitigation efforts and generate additional revenue through carbon credits. TIMOs operate within a complex legal and regulatory framework that varies by country and region. This can include regulations related to forest management, environmental protection, labor practices, land use, and taxation. Compliance with these regulations is critical for TIMOs. Ethical considerations are also paramount, especially in relation to land rights, indigenous communities, and biodiversity conservation. Changes in regulatory frameworks can have significant impacts on TIMOs. For instance, changes in environmental regulations can affect forest management practices, while changes in tax laws can influence investment strategies. A Timber Investment Management Organization (TIMO) is a vital player in the financial and forestry sectors. By definition, a TIMO is a specialized institution that offers institutional investors the opportunity to diversify their portfolios through timberland assets. The operation and structure of a TIMO are tailored to bridge the gap between investors and the intricacies of timberland ownership and management. A TIMO typically comprises professionals in forestry, finance, and real estate who work in concert to acquire, manage, and sell timberland, aiming to maximize financial returns while often also promoting environmental sustainability. Their role in the financial landscape underlines the growing importance of alternative investments, particularly those with an environmental focus. Thus, TIMOs are a significant conduit between the financial world and sustainable forestry.What Is Timber Investment Management Organization (TIMO)?

Structure and Operation of a Timber Investment Management Organization

Organizational Structure of a TIMO

Core Functions and Operations of TIMO

Stakeholders Involved in a TIMO

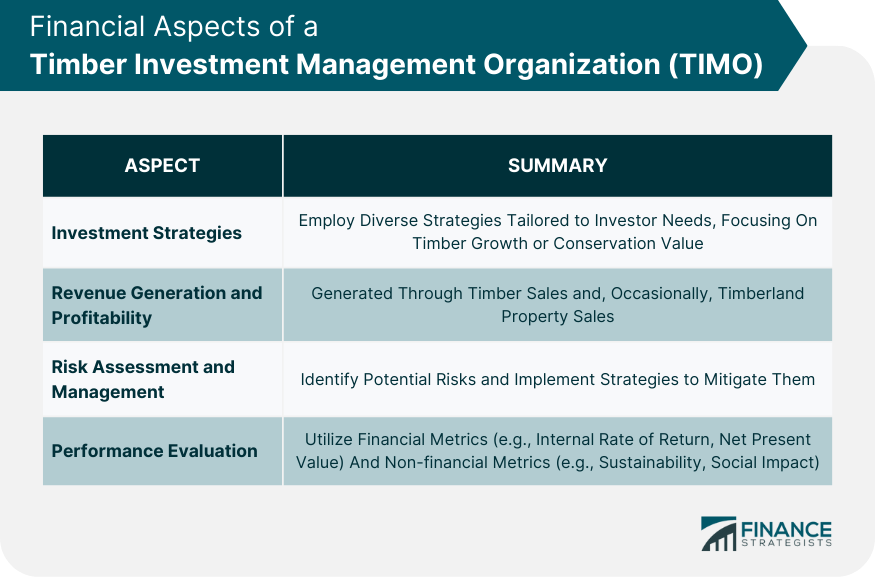

Financial Aspects of a Timber Investment Management Organization

Investment Strategies Employed

Revenue Generation and Profitability

Risk Assessment and Management

Evaluation of Performance

Role of Timber Investment Management Organizations in Sustainable Forestry

TIMOs and Responsible Forest Management

Contribution of TIMOs to Environmental Conservation

Challenges and Opportunities for TIMOs in the Context of Climate Change

Regulatory Landscape for Timber Investment Management Organizations

Legal and Regulatory Framework for TIMOs

Compliance and Ethics in TIMOs

Impact of Regulatory Changes on TIMOs

Bottom Line

Timber Investment Management Organization (TIMO) FAQs

A Timber Investment Management Organization (TIMO) is a specialized investment manager that focuses on the acquisition, management, and sale of timberland properties on behalf of investors. They act as intermediaries between investors and the operations of managing timberland, offering an avenue for diverse and sustainable investment opportunities.

TIMOs primarily generate revenue through the sale of timber from the lands they manage. In some cases, they may also generate revenue through the sale of timberland properties. The profitability of a TIMO depends on several factors, including the quality of the timberland, the efficiency of forestry operations, and the prevailing market conditions for timber.

TIMOs play a crucial role in sustainable forestry by implementing responsible forest management practices. These practices not only maximize timber production but also preserve the health of the forest ecosystem. Well-managed forests serve as significant carbon sinks, provide habitat for wildlife, and protect watersheds, contributing to environmental conservation.

Climate change presents several challenges for TIMOs, including altering weather patterns that can affect forest health and productivity and increasing the risk of wildfires. However, it also presents opportunities as forests play a vital role in sequestering carbon, allowing TIMOs to contribute to climate change mitigation efforts and potentially generate additional revenue through carbon credits.

Regulatory changes can significantly impact TIMOs. For instance, changes in environmental regulations can affect forest management practices, while changes in tax laws can influence investment strategies. As such, TIMOs must stay abreast of legal and regulatory developments in all regions where they operate.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.