Value Averaging, also known as dollar value averaging, is an investment strategy that involves adjusting the amount invested in a particular asset based on its market value and a predetermined growth path. This method helps investors maintain a consistent growth rate in their portfolios. In contrast to dollar-cost averaging, Value Averaging requires investors to buy more shares when prices are low and fewer when prices are high. This strategy can result in better long-term performance compared to other systematic investment methods. Dollar-Cost Averaging (DCA) is another popular investment strategy where investors invest a fixed amount of money at regular intervals, regardless of the asset's market price. This approach reduces the average cost per share over time, as investors acquire more shares when prices are low and fewer when prices are high. Value Averaging takes DCA a step further by adjusting the investment amount based on the asset's market value and the investor's target growth rate. This allows for more efficient capital allocation and can lead to better long-term performance. Investing using the Value Averaging method has several potential benefits. Value averaging is a systematic investment approach that allows investors to achieve their financial goals in a disciplined manner. This approach ensures that investors regularly invest a fixed amount of money to achieve their desired portfolio value. This systematic investment approach helps investors avoid impulsive investment decisions that may result in losses. Value averaging can help reduce portfolio volatility. As investors buy more shares when prices are low and fewer shares when prices are high, the overall cost per share is lower than the average cost per share. This can help minimize the impact of market fluctuations on an investor's portfolio. Value averaging is a long-term investment strategy that aims to maximize returns over time. As the strategy encourages investors to buy more shares when prices are low, the portfolio is well-positioned to benefit from any potential market upswing. Over time, this can lead to enhanced long-term performance and higher returns. Despite its potential benefits, Value Averaging also has some drawbacks. Value averaging requires investors to monitor the market and adjust their investments regularly. This can be time-consuming and may require a good understanding of investment principles. Additionally, investors may need to use specialized software or hire a financial advisor to implement this strategy effectively. Another drawback of Value Averaging is the potential for larger cash outlays during periods of declining asset prices. In order to maintain the target growth rate, investors may need to invest more money when prices are low. This increased investment during market downturns can be challenging for some investors, particularly those with limited cash reserves or those who are uncomfortable with the added risk. Value averaging requires investors to invest a fixed amount of money regularly, which can be inflexible. This may not suit investors who have fluctuating income or may not be able to commit to a regular investment schedule. Additionally, this strategy may not be suitable for investors who need liquidity or may need to access their investments at short notice. Implementing a Value Averaging strategy involves several key steps. Before implementing a Value Averaging strategy, investors must first determine their investment goals, including their target return and investment horizon. These goals will guide the development of the investment plan and the calculation of the value path. Having clear objectives will help investors stay focused on their long-term goals and avoid getting distracted by short-term market fluctuations. The value path is a series of target portfolio values based on the investor's predetermined growth rate. To create the value path, investors must decide on a starting value, a target growth rate, and an investment frequency. Once these parameters are set, the investor can calculate the value path for the investment period. This path will serve as a roadmap for implementing the Value Averaging strategy and adjusting investment amounts accordingly. To implement Value Averaging, investors need to apply the Value Averaging formula to determine the appropriate investment amount for each period. This formula takes into account the current portfolio value, the target value from the value path, and the investment frequency. By following this formula, investors can ensure that they are allocating their capital efficiently and maintaining their target growth rate. Once the Value Averaging strategy is in place, investors must regularly monitor and adjust their portfolio to ensure they stay on track with their value path. This may involve buying or selling assets to maintain the target growth rate, depending on market conditions. Regular monitoring and adjustments can help investors stay aligned with their long-term goals and maximize the potential benefits of the Value Averaging strategy. Value Averaging can be applied in various investment scenarios, both by individual and institutional investors. Individual investors can use Value Averaging as a way to build and maintain their investment portfolios, particularly when saving for long-term goals such as retirement or college expenses. This systematic approach can help investors achieve their financial objectives while reducing the impact of market volatility. By following a disciplined investment plan, individual investors can focus on their long-term goals and avoid emotional decision-making. Institutional investors, such as mutual funds and pension funds, can also apply Value Averaging as part of their portfolio management strategies. By maintaining a consistent growth rate, these investors can potentially improve their long-term performance and reduce the risks associated with market fluctuations. Implementing Value Averaging at an institutional level may require more sophisticated tools and resources, but the potential benefits can be significant. Value Averaging can be particularly beneficial when used as part of a retirement planning strategy. By maintaining a consistent growth rate, investors can build a more stable retirement nest egg and potentially achieve better long-term performance. Additionally, the lower portfolio volatility associated with Value Averaging can help retirees maintain a more stable income stream during retirement, reducing the risks associated with market fluctuations. Value Averaging is a disciplined investment strategy that can offer several advantages, including a systematic approach, lower portfolio volatility, and potentially better long-term performance. However, this method also has some drawbacks, such as its complexity and the potential for larger cash outlays during market downturns. Investors should carefully consider the pros and cons of Value Averaging and evaluate whether this strategy is suitable for their individual goals and risk tolerance. Further research and developments in the field may lead to a better understanding of the potential benefits and limitations of this investment approach.Definition of Value Averaging

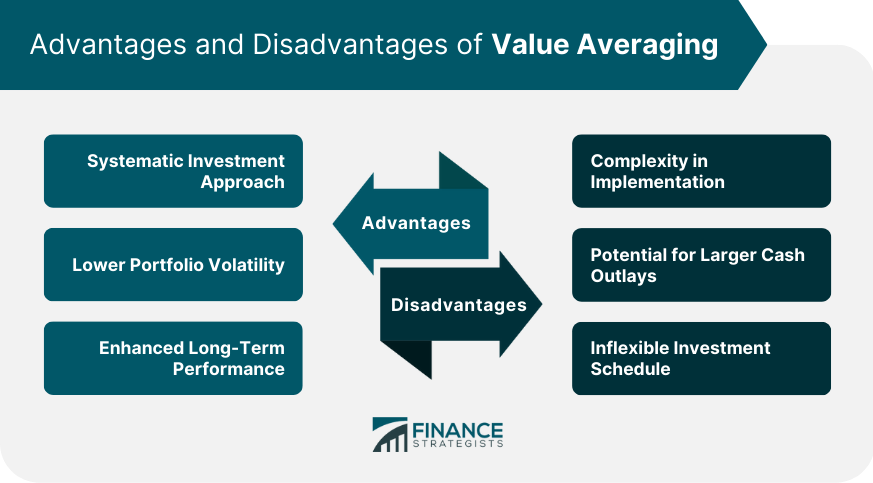

Advantages of Value Averaging

Systematic Investment Approach

Lower Portfolio Volatility

Enhanced Long-Term Performance

Disadvantages of Value Averaging

Complexity in Implementation

Potential for Larger Cash Outlays

Inflexible Investment Schedule

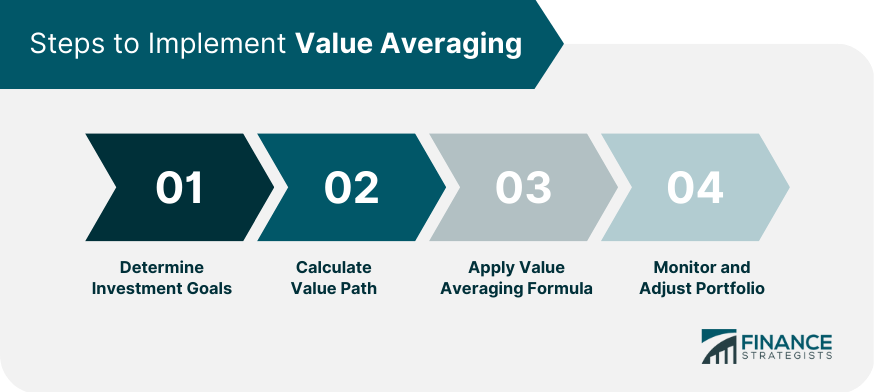

Steps to Implement Value Averaging

Determine Investment Goals

Calculate Value Path

Apply Value Averaging Formula

Monitor and Adjust Portfolio

Real-World Applications of Value Averaging

Individual Investors

Institutional Investors

Retirement Planning

Final Thoughts

Value Averaging FAQs

Value averaging is an investment strategy that aims to achieve a specific target value for a portfolio over time by adjusting the investment amount periodically.

While both strategies involve investing a fixed amount of money regularly, value averaging adjusts the amount invested based on market performance and aims to achieve a specific target value.

Value averaging can help investors buy more shares when prices are low and fewer shares when prices are high, potentially leading to higher returns in the long run.

Value averaging requires regular monitoring and adjustment, which can be time-consuming and may result in increased transaction fees.

Value averaging is a strategy suitable for long-term investors who have a specific target value in mind and are willing to monitor and adjust their investments regularly.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.