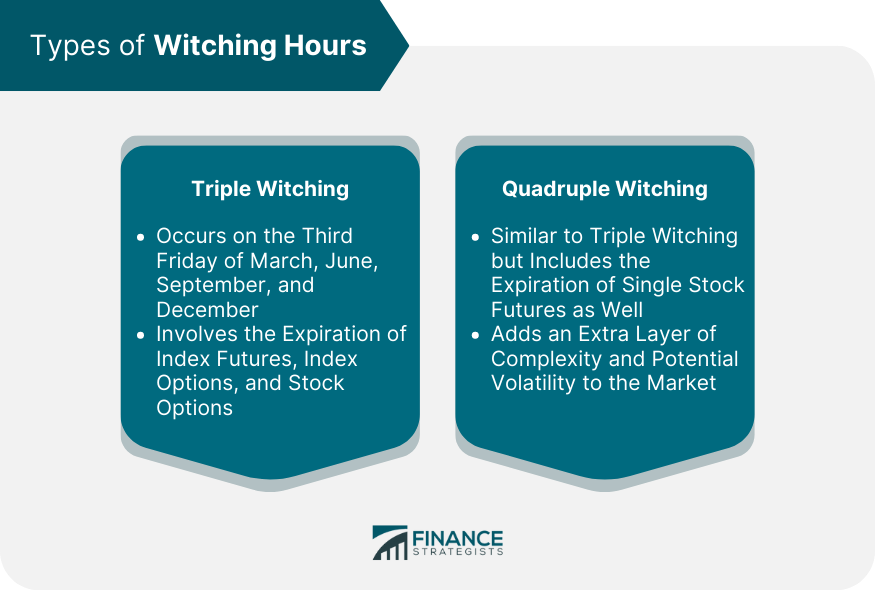

Witching Hour refers to the final hour of stock trading, specifically occurring on the third Friday of each month. During this time, a significant event takes place as index futures, index options, stock options, and single stock futures all expire simultaneously. This convergence of expirations can lead to increased volatility and higher trading volumes as market participants rush to close or roll over their positions. The Witching Hour is closely watched by traders, investors, and market analysts, as it can potentially impact stock prices and market sentiment. Understanding and anticipating the effects of the Witching Hour is important for market participants looking to navigate these periods of increased market activity. For wealth and investment managers, understanding and navigating the Witching Hour is crucial. It can present opportunities and challenges, from potentially advantageous price movements to increased risk due to heightened volatility. The key is to understand the dynamics of the Witching Hour, anticipate its potential impact on portfolios, and adjust strategies accordingly. During the Witching Hour, market participants—from institutional investors to individual traders—seek to close, roll over, or offset their positions. This increased activity can lead to significant price fluctuations and increased trading volumes. Types of Witching Hours Although all third Fridays of each month are notable, not all are created equal. There are two key types of witching hours: triple witching and quadruple witching. Triple witching is the third Friday of March, June, September, and December, when index futures, index options, and stock options expire. Quadruple witching, on the other hand, involves the expiration of the same three types of contracts and single stock futures. Quadruple witching occurs in the same months and adds an extra layer of complexity and potential volatility. Witching Hour can trigger significant price volatility and unusual trading volumes, particularly in the underlying stocks of index futures and options. Investors and traders scramble to offset, close, or roll over their positions, causing sharp price fluctuations. As a result, wealth and investment managers must pay close attention to the Witching Hour to manage their portfolios effectively. Witching Hour's impact on wealth management strategies can be profound. It can affect asset allocation, risk management, and overall portfolio performance. To deal with the Witching Hour, wealth managers can adopt various strategies. They can monitor the markets closely during these periods, adjust their asset allocation to minimize risk, and use derivatives to hedge against potential losses. Additionally, they can use increased liquidity to execute large trades that might otherwise impact the market. The Witching Hour also plays a significant role in investment management. It can influence investment decisions and portfolio management strategies. During Witching Hour, increased market activity can lead to opportunities for arbitrage, as discrepancies can arise between the futures and spot prices. Consequently, savvy investment managers can exploit these price differences for potential profits. The Witching Hour is synonymous with increased market volatility. This volatility can affect wealth and investment management decisions. The simultaneous expiration of futures and options contracts during the Witching Hour often increases trading activity. This activity can result in dramatic price swings and heightened market volatility. Historical market data shows significant spikes in trading volume and price volatility during the Witching Hour periods. During increased volatility, wealth and investment managers must be extra vigilant. They may need to adjust their portfolios to mitigate risk or seize opportunities. This could involve altering asset allocation, implementing hedging strategies, or making tactical trades. Preparation is key to navigating the Witching Hour effectively. Here are some proactive measures for wealth and investment managers. Market Monitoring: Keep an eye on market trends and indicators leading up to the Witching Hour. Risk Assessment: Evaluate the potential impact of the Witching Hour on your portfolio and adjust your strategies accordingly. Contingency Planning: Have a plan to deal with increased volatility and potential liquidity issues. Understanding of Witching Hour Dynamics: Familiarize yourself with the mechanics and implications of the Witching Hour. Risk Management Strategy: Develop a robust risk management strategy to deal with potential market volatility. Trading Plan: Create a detailed trading plan outlining your actions during the Witching Hour. Tools and Resources: Ensure you can access the necessary financial tools and software to navigate the Witching Hour effectively. Stress testing involves simulating various Witching Hour scenarios to evaluate the potential impact on your portfolio. This can help identify vulnerabilities and inform risk management strategies. Diversify Your Portfolio: Having a well-diversified portfolio can help mitigate risks associated with witching hour scenarios. Spread your investments across different asset classes, sectors, and geographic regions to reduce exposure to specific market movements. Monitor Expiration Dates: Stay informed about the expiration dates of index futures, index options, stock options, and single-stock futures. These dates can impact market volatility, so being aware of them allows you to prepare accordingly. Evaluate Liquidity: Assess the liquidity of your portfolio holdings, particularly during witching hour periods. Liquid assets can be more vulnerable to price fluctuations, so ensure you have a sufficient level of liquidity to navigate potential volatility. Consider Hedging Strategies: Explore hedging strategies to manage risk during witching hour scenarios. Options strategies such as protective puts or collars can help limit potential losses and provide downside protection. Review Your Risk Tolerance: Assess your risk tolerance and ensure it aligns with the potential volatility associated with witching hour periods. Adjust your portfolio positioning if needed to maintain a risk level that you are comfortable with. Stay Updated With Market News: Keep up-to-date with market news, particularly leading up to witching hour dates. Stay informed about any developments or events that could impact market sentiment, and adjust your portfolio strategy accordingly. Consult With a Financial Advisor: Consider consulting with a financial advisor who can provide professional guidance and help you navigate witching hour scenarios. They can assist in stress-testing your portfolio, analyzing risk factors, and making informed investment decisions. The Witching Hour presents both risks and opportunities for wealth and investment managers. The increased volatility during the Witching Hour can lead to substantial market risks. For instance, abrupt price movements can erode the value of investment portfolios, and liquidity might become constrained for certain securities. Conversely, the Witching Hour can also present opportunities. The heightened volatility can result in mispriced securities, providing opportunities for profit. Additionally, the increased liquidity can facilitate larger trades without significantly impacting market prices. Wealth and investment managers must balance these risks and opportunities. This involves careful risk management, diligent market monitoring, and tactical trading. By doing so, they can navigate the Witching Hour effectively and protect their clients' portfolios. As wealth and investment managers gain experience with the Witching Hour, they can employ advanced strategies. Experienced wealth managers might use complex derivatives strategies, like straddles or strangles, during the Witching Hour. These involve holding a position in both a call and a put with the same strike price (straddle) or different strike prices (strangle), allowing managers to profit from large price movements in either direction. Investment managers can use advanced strategies like statistical arbitrage during the Witching Hour. This involves using complex algorithms and high-speed trading systems to exploit pricing inefficiencies between related securities. Various financial tools and software can help wealth and investment managers navigate the Witching Hour more effectively. These include risk management tools, algorithmic trading systems, and market monitoring software. These tools can provide real-time market data, automate trading activities, and help manage risk. Understanding and preparing for the Witching Hour is crucial for wealth and investment managers. It involves monitoring market trends, assessing risk, and having contingency plans in place. Diversifying portfolios, monitoring expiration dates, evaluating liquidity, and considering hedging strategies are important steps to stress-test portfolios against Witching Hour scenarios. Risk management, staying updated with market news, and consulting with financial advisors are also recommended. The Witching Hour presents both risks and opportunities, including increased volatility and mispriced securities. Wealth and investment managers must balance these factors and employ advanced strategies like derivatives and statistical arbitrage. Utilizing financial tools and software can aid in navigating the Witching Hour effectively. By following these guidelines, wealth and investment managers can better prepare for and manage the impacts of the Witching Hour on their portfolios.What Is a Witching Hour?

Overview of the Relevance of Witching Hour to Wealth and Investment Management

Understanding the Dynamics of Witching Hour

Impact of Witching Hour on Stock and Derivative Markets

Witching Hour and Wealth Management

Strategies for Wealth Managers to Deal With Witching Hour

Witching Hour and Investment Management

Witching Hour and Market Volatility

Preparation for Witching Hour

Proactive Measures for Wealth and Investment Managers to Prepare for Witching Hour

Checklist for Witching Hour Readiness in Wealth and Investment Management

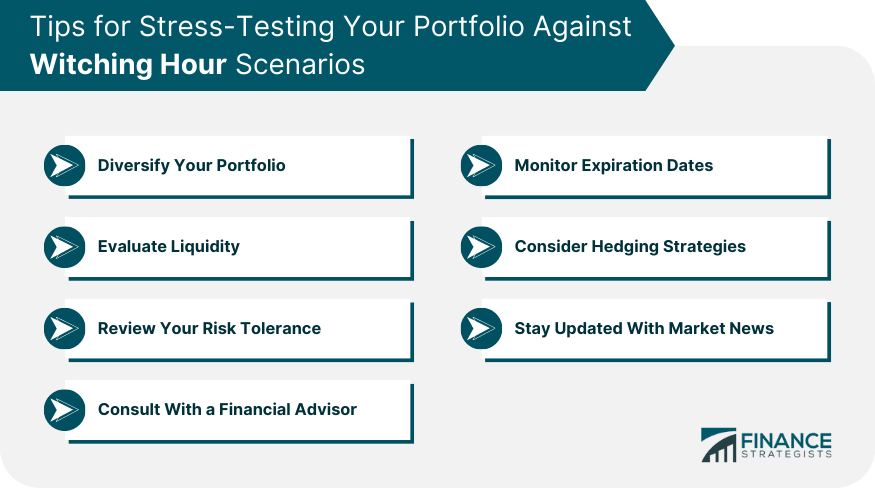

Tips for Stress-Testing Your Portfolio Against Witching Hour Scenarios

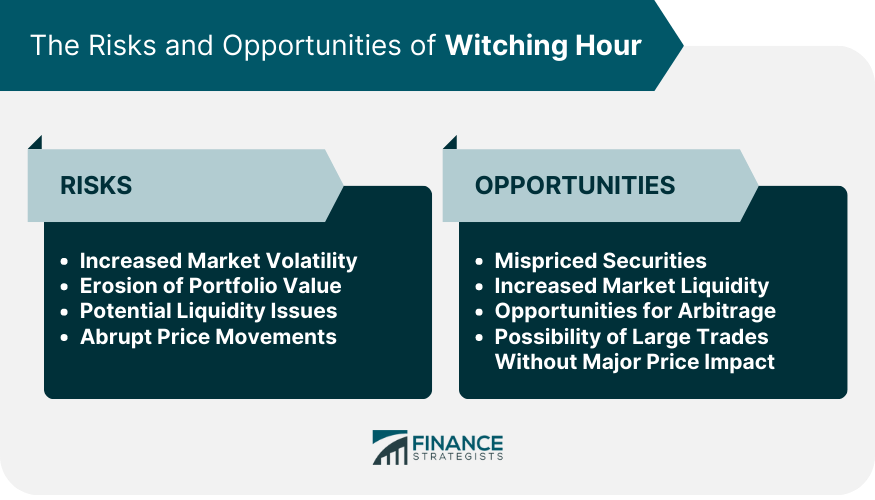

Risks and Opportunities of Witching Hour

Potential Risks Associated With Witching Hour

Potential Opportunities Presented by Witching Hour

Balancing Risks and Opportunities During Witching Hour

Advanced Strategies for Witching Hour

Conclusion

Witching Hour FAQs

The Witching Hour in finance refers to the final hour on the third Friday of each month when index futures, index options, stock options, and single stock futures expire simultaneously. This period often experiences increased market volatility and trading volume.

The Witching Hour can significantly impact wealth and investment management strategies due to the heightened market volatility and unusual trading volumes. It can affect asset allocation, risk management, and overall portfolio performance. Wealth and investment managers need to monitor these periods closely, adjust their strategies accordingly, and be prepared to capitalize on potential opportunities.

Investment managers can navigate the Witching Hour by monitoring market trends, employing risk management strategies such as hedging, and capitalizing on increased market liquidity to execute trades that might otherwise impact market prices. Advanced strategies might include statistical arbitrage, which exploits pricing inefficiencies between related securities.

Preparation for the Witching Hour involves market monitoring, risk assessment, and contingency planning. Wealth and investment managers should have a good understanding of Witching Hour dynamics, a robust risk management strategy, a detailed trading plan, and access to necessary financial tools and software.

Yes, while the Witching Hour can present an increased risk due to market volatility, it also offers opportunities. The heightened volatility can lead to mispriced securities, providing potential profit opportunities. Additionally, increased liquidity can facilitate larger trades without significantly impacting market prices.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.