Zacks Investment Research is a renowned provider of independent investment research and financial data. It offers a wide range of services and tools to help investors make informed decisions in the stock market. It employs a unique approach that combines quantitative analysis, fundamental research, and qualitative insights to provide accurate and timely investment recommendations. The company utilizes its proprietary models and algorithms to evaluate stocks, assess their potential for growth, and identify investment opportunities. With a focus on delivering unbiased and objective information, Zacks Investment Research aims to empower investors with the knowledge and tools they need to navigate the complex world of investing and achieve their financial goals. Zacks Investment Research was founded by Len Zacks in 1978. Len Zacks, armed with a Ph.D. in Mathematics from MIT, discovered that earnings estimate revisions were the most powerful force impacting stock prices. This discovery led to the creation of the Zacks Rank, a proprietary quantitative model that rates stocks based on changes to analyst estimates. Today, Zacks continues to be a leader in the investment research industry. Zacks' mission is to provide investors with independent and reliable investment research and data to make informed decisions in the stock market. Zacks aims to be a trusted source of investment information and empower investors to achieve their financial goals by offering accurate and timely stock analysis, unbiased recommendations, and innovative tools. The company strives to deliver superior value to its clients and maintain a strong commitment to excellence, integrity, and transparency in its research and services. Zacks Investment Research plays a significant role in the financial industry. They provide independent, unbiased, quality research that empowers investors with critical information. Zacks' contributions to the financial industry are particularly notable in their development of the Zacks Rank system, an innovative tool that uses changes in earnings estimates to predict stock performance. The Zacks Rank system is a quantitative stock-rating system developed by Zacks Investment Research. It uses changes in earnings estimates to predict stock performance. The system ranks stocks on a scale of 1 to 5, with 1 being a "Strong Buy" and 5 being a "Strong Sell." The Zacks Rank system uses a five-point scale: 1. Strong Buy: The top 5% of stocks with the highest potential for outperformance. 2. Buy: The next 15% of stocks are expected to outperform. 3. Hold: The next 70% of stocks with average expected performance. 4. Sell: The next 15% of stocks are expected to underperform. 5. Strong Sell: The bottom 5% of stocks with the highest potential for underperformance. Zacks calculates stock ratings by evaluating changes in earnings estimates. Analysts frequently update their earnings estimates based on new information. When these estimates are revised upward, it can be a positive signal, suggesting the company may perform better than previously expected. The Zacks Rank system is a vital tool for investors. It offers a simple, transparent rating system that helps investors cut through the noise of the financial markets. It identifies stocks that are likely to outperform or underperform based on changes in earnings estimates, helping investors make informed decisions. Zacks provides a wide array of services to investors. These include stock and mutual fund research, Exchange Traded Funds (ETF) recommendations, portfolio management tools, and various subscription services. Zacks Premium offers investors enhanced features and tools. It provides access to the Zacks Rank, Equity Research reports the Earnings ESP filter, and Premium screens for stocks, ETFs, and mutual funds. Zacks also offers a variety of free services. These include daily articles and reports, portfolio trackers, and a stock screener tool. Zacks' ETF ranking system works similarly to its stock ranking system. It ranks ETFs on a scale of 1 (Strong Buy) to 5 (Strong Sell), depending on their expected performance based on the changes in the earnings estimates of their constituent stocks. Zacks provides research tools designed to help investors make informed decisions. These include the Zacks Rank, Equity Research reports, an Earnings Expected Surprise Prediction (ESP) Filter, and various stock and ETF screening tools. Zacks Equity Research provides a detailed analysis of a wide range of stocks. These reports often include a Zacks Rank, earnings estimates, valuation analysis, and an overview of the company's industry and competitors. Zacks' Screener tool is a powerful resource for investors. It allows users to filter stocks, ETFs, and mutual funds based on a wide range of criteria, including Zacks Rank, sector, industry, market cap, earnings estimates, and more. Zacks' Portfolio Tracker is a tool that allows investors to track the performance of their investments in real time. This tool provides a comprehensive view of an investor's portfolio, including total return, current value, and changes in value over time. Zacks offers a number of proprietary investment strategies, including the Value Investor, Momentum Trader, and Insider Trader strategies. Each strategy is designed to target specific investment objectives and risk tolerances. Zacks' Value Investor strategy seeks out companies trading at a discount to their intrinsic value. This strategy focuses on fundamental analysis and uses indicators such as the Price-To-Earnings (P/E) ratio, Price-To-Sales (P/S) ratio, and Price-To-Book (P/B) ratio. The Momentum Trader strategy by Zacks aims to capitalize on stocks with strong price momentum. The strategy uses technical analysis to identify stocks that are trending upward and are expected to continue their upward trajectory. Zacks' Insider Trader strategy focuses on stocks that have seen recent insider buying. The premise of this strategy is that insiders have the most intimate knowledge of their company's prospects, and their buying activity can signal a stock's potential to outperform. Zacks' market commentary offers valuable insights into the latest market trends and economic developments. It provides investors with a well-rounded perspective on the current state of the market and potential investment opportunities. Zacks' Earnings Trends report provides a comprehensive analysis of earnings trends across various sectors and industries. It offers insights into the earnings growth of different sectors, helping investors identify potential investment opportunities. Zacks' Industry Rank and Sector Rank reports provide a ranking of different sectors and industries based on the average Zacks Rank of the individual stocks within each sector or industry. These reports can help investors identify sectors and industries with strong earnings estimate revisions, which could signal outperformance. Zacks' Equity Research reports offer a comprehensive analysis of individual stocks. These reports can be used by investors to understand a company's financial health, industry position, and potential for future performance. Zacks offers a wealth of educational resources to help novice and seasoned investors. These resources range from in-depth articles and guides on investing fundamentals to advanced trading strategies and techniques. Zacks University is an educational platform offering a range of courses designed to educate investors about the financial markets. From introductory courses on investing basics to more advanced courses on technical analysis and portfolio management, Zacks University covers a broad spectrum of financial education. Zacks provides a vast library of educational articles covering various topics related to investing. Additionally, Zacks also hosts several podcasts that provide timely market insights and investment strategies. These resources offer investors valuable knowledge and insights to make informed investment decisions. Zacks regularly conduct webinars and seminars on a range of investment-related topics. These live events provide a platform for investors to learn from and interact with Zacks' experienced analysts and industry experts. Despite its many strengths, Zacks Investment Research has its share of criticisms. Some users find the interface of the website to be dated and less user-friendly. Others note that the company's focus on earnings estimates, while powerful, may not capture all aspects of a company's financial health and future prospects. The Zacks Rank system, while innovative, is not without its limitations. The ranking heavily depends on changes in earnings estimates, which may not always be reliable predictors of future performance. Furthermore, the Zacks Rank is a short-term rating system, making it less suitable for long-term investors. While Zacks' investment strategies have shown strong historical performance, past performance does not indicate future results. As with all investment strategies, Zacks' strategies involve risk and may not always achieve their intended results. Zacks Investment Research has made significant contributions to the investing field, particularly with the development of the Zacks Rank system. By focusing on earnings estimate revisions, Zacks has provided investors with a powerful tool to predict stock performance. Zacks has played a crucial role in promoting transparency in the financial industry. By providing independent and unbiased research, Zacks has helped to level the playing field for individual investors. Looking ahead, Zacks' research and strategies are likely to continue influencing the investment landscape. As more investors recognize the value of earnings estimate revisions, the Zacks Rank could become even more central to investment decision-making. Zacks Investment Research has had a significant impact on the financial industry by developing the influential Zacks Rank system, which uses earnings estimate revisions to predict stock performance. The company promotes transparency by providing independent and unbiased research, empowering individual investors. Zacks' research and strategies are expected to have future implications as more investors recognize the value of earnings estimate revisions. Despite its strengths, Zacks faces criticism for its website interface and the limitation of focusing solely on earnings estimates. The Zacks Rank system is a short-term rating system, making it less suitable for long-term investors. While Zacks' investment strategies have shown strong historical performance, past performance does not guarantee future results, and risks are involved. Overall, Zacks Investment Research has shaped investing and continues to be a trusted source of investment information.What Is Zacks Investment Research?

Brief History and Background of Zacks Investment Research

Zacks' Mission and Vision

Mission

Vision

Explanation of the Significance of Zacks in the Financial Industry

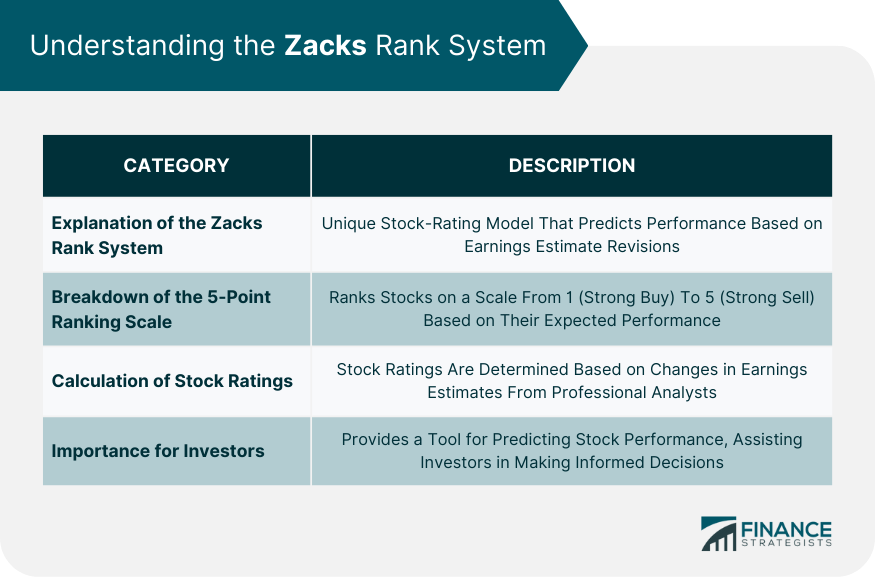

Understanding the Zacks Rank System

Explanation of the Zacks Rank System

Breakdown of the 5-Point Ranking Scale Used by Zacks

How Zacks Calculates Stock Ratings

Importance of the Zacks Rank for Investors

Zacks Investment Research Services

Evaluating Zacks' Research Tools

Zacks' Investment Strategies

Overview of Zacks' Proprietary Investment Strategies

Explanation of Zacks' Value Investor Strategy

Understanding Zacks' Momentum Trader Strategy

Insights Into Zacks’ Insider Trader Strategy

Analyzing Zacks' Market Commentary and Reports

Importance of Zacks' Market Commentary for Investors

Understanding Zacks' Earnings Trends Report

Analysis of Zacks' Industry Rank and Sector Rank Reports

How to Make Use of Zacks' Equity Research Reports

Zacks' Educational Resources

Overview of Zacks' Educational Offerings

Understanding the Role of Zacks University

Exploring Zacks' Educational Articles and Podcasts

Evaluating the Benefits of Zacks' Webinars and Seminars

Critiques and Limitations of Zacks Investment Research

Common Criticisms of Zacks Investment Research

Understanding the Limitations of the Zacks Rank System

Discussion of the Performance of Zacks' Investment Strategies

Impact of Zacks Investment Research on the Financial Industry

How Zacks Investment Research Has Influenced Investing

Zacks' Role in Promoting Transparency in the Financial Industry

Future Implications of Zacks' Research and Strategies

Bottom Line

Zacks Investment Research FAQs

Zacks Investment Research offers financial data and tools to professional investors and traders. Their proprietary Zacks Rank system predicts stock performance using earnings estimate revisions. They contribute to the financial industry through independent research, transparency promotion, and innovative investment offerings.

The Zacks Rank system is a unique stock-rating model developed by Zacks Investment Research. It rates stocks on a 5-point scale from 1 (Strong Buy) to 5 (Strong Sell) based on changes in earnings estimates. The premise is that stocks with positive earnings estimate revisions are more likely to outperform, while those with negative revisions are more likely to underperform.

Zacks Investment Research offers a wide array of services, including stock and mutual fund research, ETF recommendations, portfolio management tools, and various subscription services like Zacks Premium. They also provide free resources such as daily articles and reports, portfolio trackers, and a stock screener tool.

Zacks Investment Research provides a wealth of educational resources. They offer Zacks University, which provides a range of courses on investing basics to advanced trading strategies. Zacks also provides educational articles, podcasts, webinars, and seminars, all designed to educate investors and help them make informed investment decisions.

Some common critiques of Zacks Investment Research include a less user-friendly website interface and a heavy reliance on earnings estimates, which may not capture all aspects of a company's financial health. The Zacks Rank system, while innovative, is a short-term rating system and may not be suitable for long-term investors. Despite these limitations, Zacks remains a trusted source for independent and unbiased financial research.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.