Zacks Lifecycle Indexes are a series of indexes developed by Zacks Investment Research. Their primary function is to serve as benchmarks for Target-Date Funds (TDFs). These indexes are designed with a specific retirement year in mind, and the asset allocation gradually shifts as the target date approaches, moving from riskier assets like stocks to more stable ones like bonds. This mechanism, often referred to as a "glide path," reflects the changing risk tolerance of investors as they age. Zacks Lifecycle Indexes were first introduced in the early 2000s as the popularity of TDFs began to rise. Over the years, they have evolved in response to market trends and changing investor needs. Today, they are recognized as an industry standard for benchmarking TDFs and are widely used by both individual investors and financial professionals. To fully appreciate the role of Zacks Lifecycle Indexes in investment management, it's essential to understand their composition. Zacks Lifecycle Indexes comprise a blend of different asset classes, including equities, bonds, and cash equivalents. The precise mix depends on the time horizon of the index. For instance, a 2060 index, aimed at younger investors, would have a higher equity allocation to maximize growth potential, while a 2020 index, designed for investors closer to retirement, would lean more towards bonds for stability. The asset allocation in Zacks Lifecycle Indexes is not static; it changes over time following a predetermined glide path. This glide path determines the pace at which the asset mix shifts from riskier to safer investments. It's a critical feature of these indexes, designed to balance growth potential and risk as investors move closer to their retirement date. Unlike most indexes that represent a specific market or sector, Zacks Lifecycle Indexes are designed to reflect the investment journey of an individual. Their unique composition and dynamic nature make them an essential tool for retirement planning and long-term investment management. Zacks Lifecycle Indexes play a significant role in investment management, serving as both a benchmark and a guide for portfolio diversification. In investment management, benchmarks are used to gauge the performance of a portfolio or fund. As the standard for TDFs, Zacks Lifecycle Indexes provide a reference point to assess the relative performance of these funds. Fund managers can use these indexes to compare their funds' performance and make necessary adjustments to their investment strategy. Diversification is a cornerstone of effective investment management. Zacks Lifecycle Indexes, with their blend of various asset classes, offer a model for achieving a diversified portfolio. Investors can use these indexes as a guide to distribute their investments across different assets, reducing risk and enhancing potential returns over the long term. The glide path of Zacks Lifecycle Indexes also provides valuable insights for investment decisions. By studying asset allocation adjustments over time, investors can better understand how to adapt their investment strategy as they age. This insight can be instrumental in making sound investment decisions that align with one's financial goals and risk tolerance. In the volatile world of investment, risk management is paramount. Zacks Lifecycle Indexes play a significant role in this regard, offering an effective mechanism to manage investment risk. Risk tolerance, the degree of uncertainty an investor is willing to take on, changes over time. As investors age and get closer to retirement, their capacity to absorb financial shocks typically decreases. Zacks Lifecycle Indexes mirror this shift in risk tolerance through their glide path, gradually moving from high-risk to low-risk assets as the target date nears. By aligning the asset allocation with the investor's changing risk profile, Zacks Lifecycle Indexes provide a built-in risk mitigation mechanism. This automatic adjustment helps investors maintain an appropriate risk level in their portfolio without needing to actively monitor and rebalance it, which can be a significant advantage, especially for less experienced investors. Despite their benefits, Zacks Lifecycle Indexes are not without criticism. Some critics argue that the one-size-fits-all approach of these indexes may not suit all investors, as it does not account for individual circumstances and preferences. Furthermore, the predetermined glide path may not always align with market conditions, potentially leading to suboptimal performance in certain scenarios. Retirement planning is another area where Zacks Lifecycle Indexes play a crucial role. Their design caters specifically to this need, making them an invaluable tool for individuals planning for their golden years. Target-date funds are mutual funds that automatically adjust their asset allocation based on the investor's intended retirement date. They follow a glide path similar to Zacks Lifecycle Indexes, moving from a growth-oriented strategy to a more conservative one as the target date approaches. By providing a benchmark for these funds, Zacks Lifecycle Indexes directly influence how millions of people invest for their retirement. Zacks Lifecycle Indexes' long-term, goal-oriented approach is ideal for wealth accumulation. By starting with a growth-focused strategy and gradually shifting to a preservation-focused one, these indexes aim to maximize wealth accumulation during the investor's working years and preserve it as they near retirement. Zacks Lifecycle Indexes, designed as benchmarks for target-date funds, serve as an invaluable roadmap for investors' retirement journey. These indexes play an essential role in investment management, providing insights for portfolio diversification and serving as a performance gauge. They are also significant in risk management, mirroring investors' shifting risk tolerance as they age through a predefined glide path. In retirement planning, Zacks Lifecycle Indexes facilitate long-term wealth accumulation by guiding the strategic shift from growth-oriented to preservation-focused investments. Looking ahead, these indexes are expected to evolve in response to changing investor needs and market trends, becoming more nuanced and personalized. Zacks Lifecycle Indexes are not only shaping current investment strategies but are also poised to influence the future landscape of wealth management.Zacks Lifecycle Indexes Overview

History and Evolution of Zacks Lifecycle Indexes

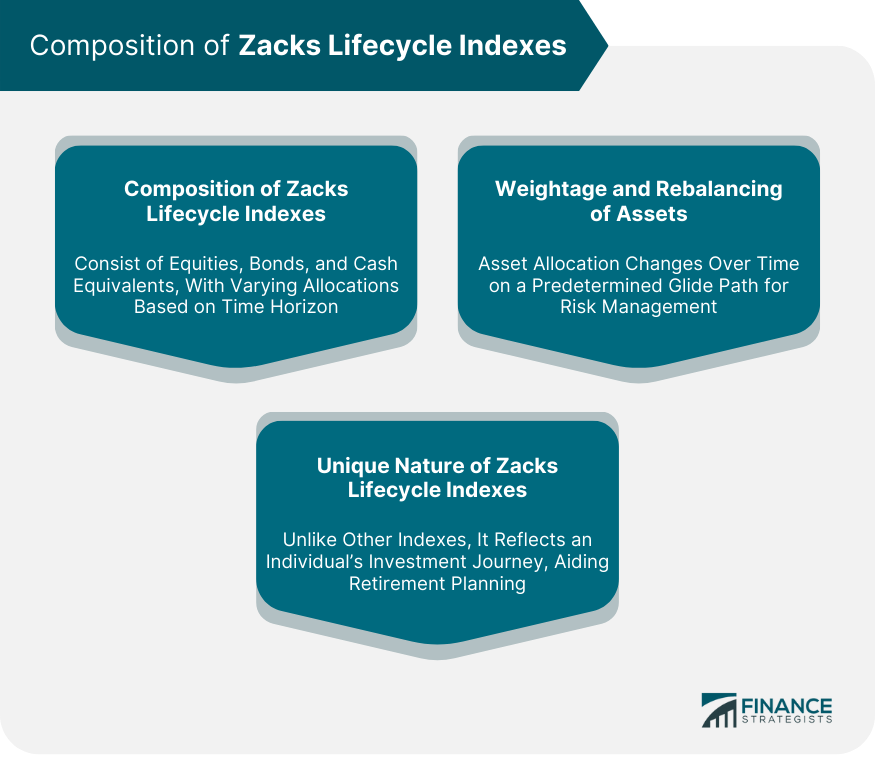

Understanding the Composition of Zacks Lifecycle Indexes

Different Components of Zacks Lifecycle Indexes

Weightage and Rebalancing of Assets

How Zacks Lifecycle Indexes Differ From Other Indexes

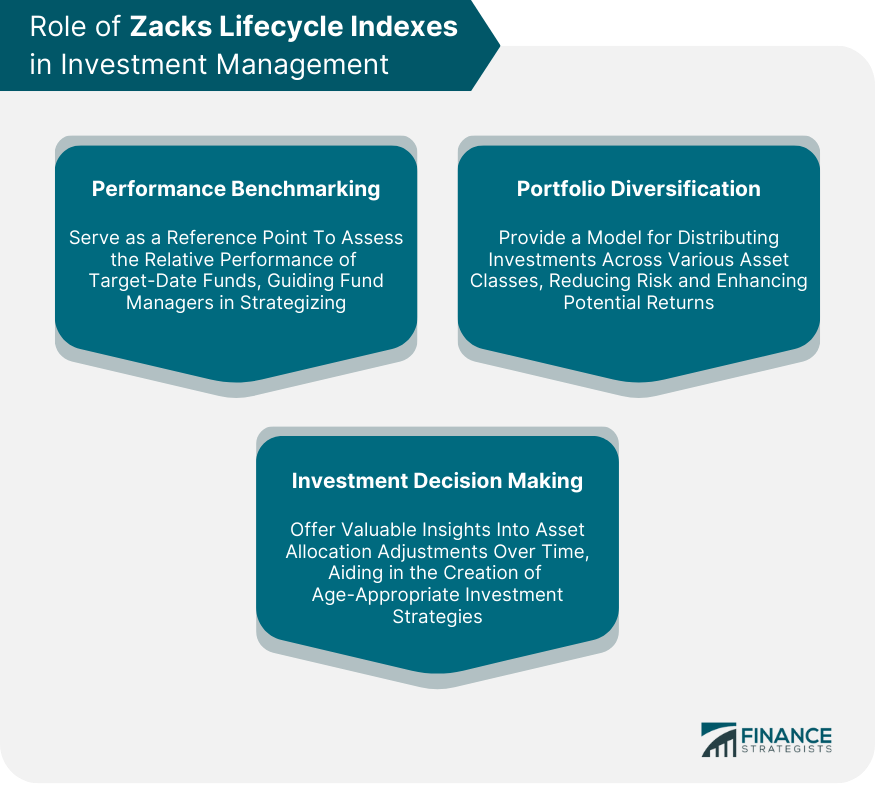

Role of Zacks Lifecycle Indexes in Investment Management

Zacks Lifecycle Indexes as a Benchmark

Use of Zacks Lifecycle Indexes in Portfolio Diversification

How Zacks Lifecycle Indexes Inform Investment Decisions

Zacks Lifecycle Indexes and Risk Management

Risk Tolerance and Zacks Lifecycle Indexes

How Zacks Lifecycle Indexes Help in Risk Mitigation

Limitations and Criticisms of Zacks Lifecycle Indexes in Risk Management

Zacks Lifecycle Indexes in Retirement Planning

Concept of Target-Date Funds

How Zacks Lifecycle Indexes Aid in Long-Term Wealth Accumulation

Bottom Line

Zacks Lifecycle Indexes FAQs

Zacks Lifecycle Indexes guide target-date funds, adjusting asset allocation towards retirement. They align portfolios with goals and risk tolerance, shifting from stocks to bonds as the target date nears.

Zacks Lifecycle Indexes play a significant role in risk management. They reflect the changing risk tolerance of investors as they age, gradually shifting the asset mix from riskier to safer investments as the target date nears. This built-in risk mitigation mechanism helps investors maintain an appropriate risk level in their portfolio without needing to actively monitor and rebalance it.

Zacks Lifecycle Indexes cater to retirement planning as benchmarks for target-date funds. They optimize wealth accumulation by starting with growth and gradually shifting to preservation, aligning with the investor's retirement goals.

Zacks Lifecycle Indexes adapt to investor needs and market trends. They may include factors like environmental, social, and governance (ESG), adjust for longer horizons, and become more personalized beyond target dates.

Despite their benefits, Zacks Lifecycle Indexes have been criticized for their one-size-fits-all approach, which may not suit all investors as it does not account for individual circumstances and preferences. Additionally, the predetermined glide path may not always align with market conditions, potentially leading to suboptimal performance in certain scenarios.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.