A zero-beta portfolio, also known as a market-neutral portfolio, is a investment strategy designed to eliminate systematic risk by maintaining a beta of zero. Beta measures the sensitivity of an asset or portfolio to market movements. A zero-beta portfolio aims to achieve a neutral position, where it is not affected by overall market fluctuations. This is achieved by holding long and short positions in assets that are expected to have low or no correlation with the market. By creating a balance between long and short positions, a zero-beta portfolio seeks to generate returns independent of market movements, making it an attractive option for investors looking to reduce systematic risk. Beta is a measure of the systematic risk of an investment compared to the overall market. It is a key component of the Capital Asset Pricing Model (CAPM), which helps investors understand the relationship between risk and expected return. A beta of 1 indicates that an asset moves in tandem with the market, while a beta greater than 1 suggests that the asset is more volatile than the market. Conversely, a beta of less than 1 implies that the asset is less volatile than the market. Based on their beta values, portfolios can be classified into three categories: High-Beta Portfolios: These portfolios comprise assets with betas greater than 1, indicating a higher level of volatility and potential for higher returns. Low-Beta Portfolios: These portfolios consist of assets with betas less than 1, offering lower volatility and potential for lower returns. Zero-Beta Portfolios: These portfolios are designed to achieve a beta of zero, ensuring that the portfolio's performance is independent of market fluctuations. The CAPM is a widely used financial model that helps investors determine the expected return on an investment based on its level of risk. The model states that the expected return on an asset is equal to the risk-free rate plus a risk premium, which is calculated by multiplying the asset's beta by the difference between the market return and the risk-free rate. The CAPM emphasizes the importance of beta in managing a portfolio's risk and expected return. The first step in constructing a zero-beta portfolio is to identify assets with different betas. These can include stocks, bonds, commodities, and other investment instruments. Some assets, such as treasury bonds, typically have low or negative betas, while others, like high-growth technology stocks, tend to have high betas. Once assets with varying betas have been identified, they can be combined in a manner that achieves a beta of zero. This involves determining the appropriate weights for each asset in the portfolio, such that the sum of the weighted betas equals zero. This can be achieved through mathematical optimization techniques or specialized portfolio management software. Diversification is a crucial component of constructing a zero-beta portfolio, as it helps to minimize unsystematic risk. This is achieved by investing in a wide variety of assets that are not highly correlated with one another. In a zero-beta portfolio, diversification ensures that the individual asset risks cancel each other out, leaving the portfolio with a beta of zero. Risk-free assets, such as treasury bonds, play a significant role in the construction of a zero-beta portfolio. These assets typically have low or negative betas, which can help balance out the positive betas of other investments in the portfolio. Additionally, risk-free assets provide a stable source of income and help lower the portfolio's overall volatility, making them a valuable component in achieving a zero-beta portfolio. One of the primary benefits of a zero-beta portfolio is its ability to protect investors against market fluctuations. By achieving a beta of zero, the portfolio's performance becomes independent of the overall market, ensuring that investors can earn stable returns regardless of market conditions. A well-constructed zero-beta portfolio can provide consistent returns in various market conditions, including bull, bear, and sideways markets. This stability can be particularly valuable for conservative investors or those approaching retirement, who may be more focused on preserving capital rather than aggressively pursuing high returns. Zero-beta portfolios tend to have lower volatility compared to high-beta or even low-beta portfolios. This reduced volatility can be beneficial for risk-averse investors, as it helps to minimize the impact of market fluctuations on the portfolio's value. A zero-beta portfolio can potentially offer improved risk-adjusted performance compared to other investment strategies. By minimizing systematic risk, a zero-beta portfolio allows investors to achieve stable returns with a lower level of volatility, which can lead to better risk-adjusted returns over the long term. Constructing a perfect zero-beta portfolio can be challenging, as it requires precise asset allocation and continuous monitoring of the individual assets' betas. Betas can change over time due to various factors, including changes in market conditions or the financial health of the underlying companies. While zero-beta portfolios offer stability and protection against market fluctuations, they may also have lower return potential compared to high-beta portfolios. Investors with higher risk tolerance and a longer investment horizon may prefer high-beta portfolios, which can provide the opportunity for higher returns, albeit with increased volatility. The betas of individual assets can change over time, requiring investors to continuously monitor and adjust their portfolio to maintain a zero-beta position. This can be time-consuming and may necessitate the use of sophisticated portfolio management tools or the assistance of a professional financial advisor. There may be a limited number of assets with negative or low betas available for investment, making it challenging to construct a zero-beta portfolio. In some cases, investors may need to use derivatives or other financial instruments to achieve a zero-beta position, which can introduce additional complexity and risk. Institutional investors, such as pension funds and endowments, often seek stable returns and capital preservation, making zero-beta portfolios an attractive investment strategy for these organizations. Conservative investors who prioritize capital preservation and stability over high returns can benefit from zero-beta portfolios. This investment strategy can help protect their capital from market fluctuations while still providing consistent returns. Investors with high-risk portfolios may use zero-beta portfolios as a hedging strategy to protect their investments from market fluctuations. By allocating a portion of their investment capital to a zero-beta portfolio, these investors can help offset potential losses in their high-risk holdings. Zero-beta portfolios can also be used for market-neutral investing, a strategy that aims to profit from individual asset performance rather than the overall market direction. Market-neutral investing can be beneficial during periods of market uncertainty or volatility, as it allows investors to earn returns independent of the broader market movements. Passive portfolio management involves investing in a broad market index, such as the S&P 500, with the goal of achieving returns that closely match the market's performance. In contrast, active portfolio management seeks to outperform the market by selecting individual investments based on research, analysis, and forecasting. Zero-beta portfolios can be considered an active investment strategy, as they require the selection and allocation of assets to achieve a specific beta value. Low-volatility investing focuses on constructing portfolios with assets that exhibit lower volatility than the overall market. While zero-beta portfolios also seek to minimize volatility, they specifically target a beta of zero, whereas low-volatility investing may still allow for some exposure to market risk. Smart-beta strategies involve constructing portfolios that seek to outperform traditional market-cap-weighted indices by using alternative weighting schemes based on factors such as value, size, or momentum. While zero-beta portfolios also deviate from traditional market-cap weighting, their primary goal is to achieve market neutrality rather than outperformance. Traditional asset allocation methods typically involve diversifying a portfolio across various asset classes, such as stocks, bonds, and cash, to achieve an optimal balance between risk and return. Zero-beta portfolios also rely on diversification, but their primary objective is to achieve a beta of zero to minimize exposure to market risk. A Zero-Beta Portfolio is an investment strategy that focuses on achieving a beta value of zero, ensuring that the portfolio's performance remains independent of market fluctuations. This unique approach to portfolio construction involves combining assets with varying betas in a manner that achieves market neutrality, providing investors with protection against market volatility and delivering stable returns across different market conditions. The key advantages of Zero-Beta Portfolios include their ability to offer protection against market fluctuations, lower volatility compared to other portfolios, and the potential for improved risk-adjusted performance. However, investors must also consider the limitations and drawbacks of this strategy, such as the difficulty in achieving a perfect zero-beta, lower return potential compared to high-beta portfolios, and the need for continuous monitoring of the dynamic nature of betas. Overall, understanding the concept, construction, advantages, and limitations of Zero-Beta Portfolios can help investors make informed decisions about whether this investment approach aligns with their risk tolerance and financial goals.What Is Zero-Beta Portfolio?

Understanding Beta and Its Role in Portfolio Management

Beta as a Measure of Systematic Risk

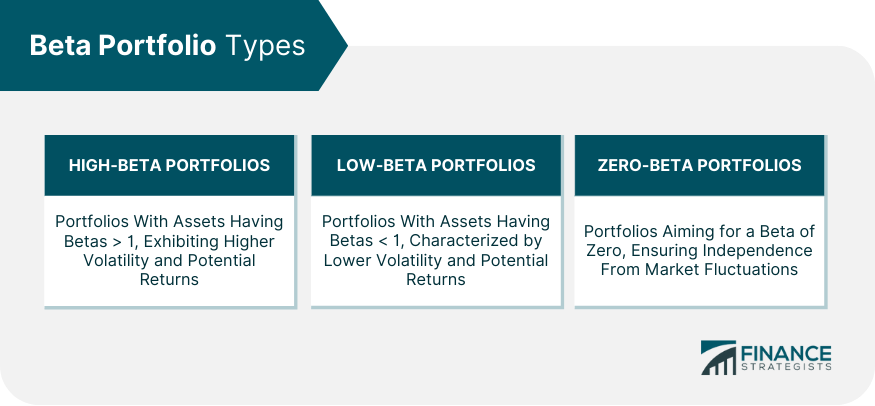

Differentiating Between High-Beta, Low-Beta, and Zero-Beta Portfolios

Capital Asset Pricing Model (CAPM) and Role of Beta

Constructing a Zero-Beta Portfolio

Identifying Assets With Varying Betas

Combining Assets to Achieve a Zero-Beta Portfolio

Diversification and Its Importance in Zero-Beta Portfolio Construction

Role of Risk-Free Assets in a Zero-Beta Portfolio

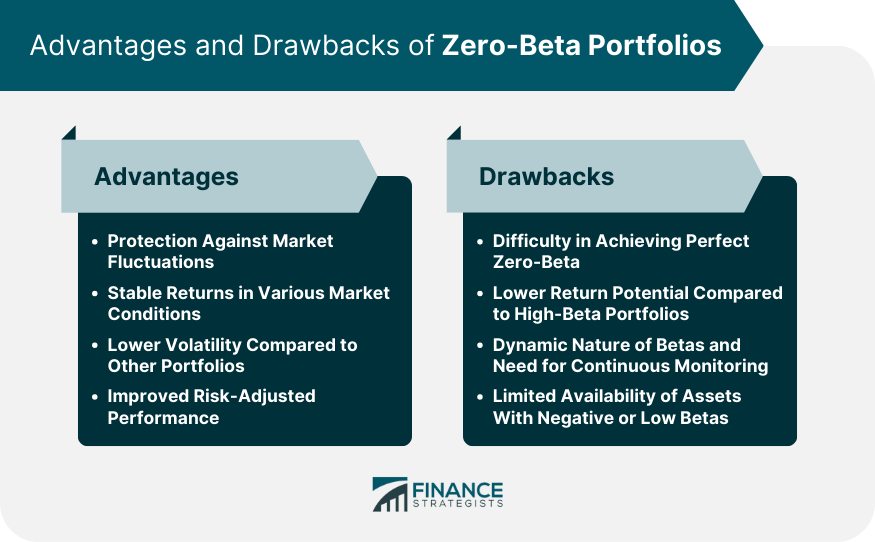

Advantages of Zero-Beta Portfolios

Protection Against Market Fluctuations

Stable Returns in Various Market Conditions

Lower Volatility Compared to Other Portfolios

Potential for Improved Risk-Adjusted Performance

Drawbacks of Zero-Beta Portfolios

Difficulty in Achieving Perfect Zero-Beta

Lower Return Potential Compared to High-Beta Portfolios

Dynamic Nature of Betas and the Need for Continuous Monitoring

Limited Availability of Assets With Negative or Low Betas

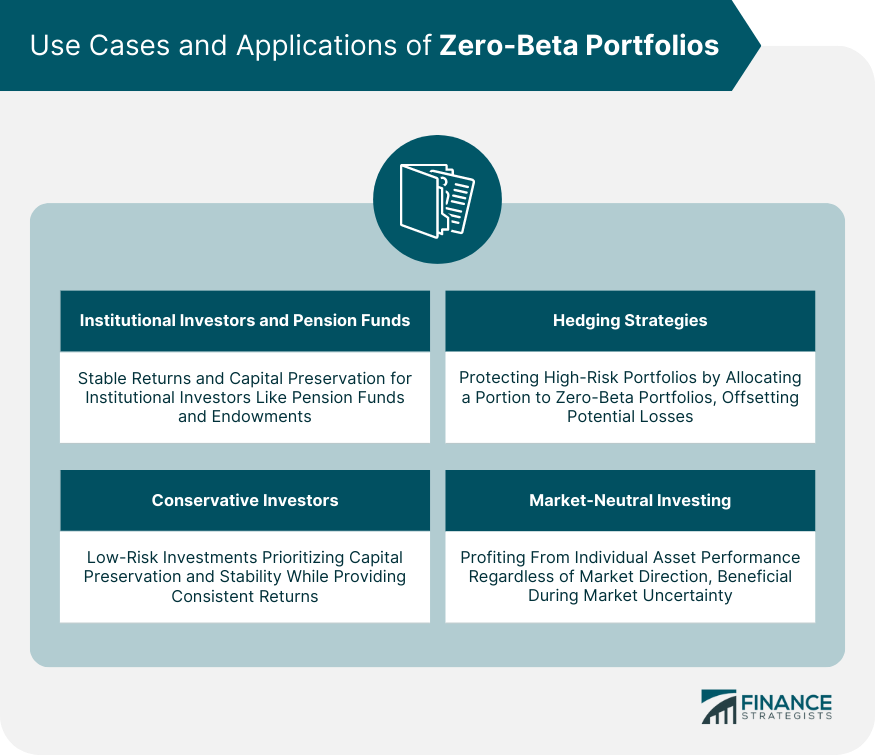

Use Cases and Applications of Zero-Beta Portfolios

Institutional Investors and Pension Funds

Conservative Investors Seeking Low-Risk Investments

Hedging Strategies for High-Risk Portfolios

Market-Neutral Investing

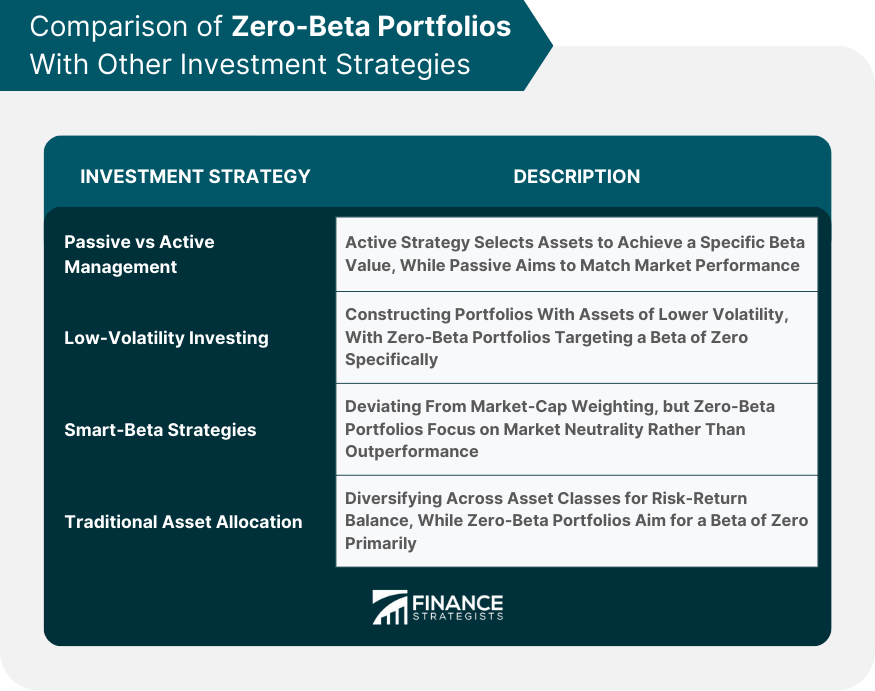

Comparison of Zero-Beta Portfolios With Other Investment Strategies

Passive vs Active Portfolio Management

Low-Volatility Investing

Smart-Beta Strategies

Traditional Asset Allocation Methods

Conclusion

Zero-Beta Portfolio FAQs

A Zero-Beta Portfolio is a collection of investments designed to achieve a beta of zero, making its performance independent of market fluctuations. This portfolio type is important because it offers protection against market volatility and provides stable returns in various market conditions.

To construct a Zero-Beta Portfolio, you need to identify assets with varying betas and combine them in a manner that achieves a beta of zero. This involves determining the appropriate weights for each asset in the portfolio so that the sum of the weighted betas equals zero. Diversification and the inclusion of risk-free assets play a significant role in achieving a zero-beta portfolio.

The advantages of investing in a Zero-Beta Portfolio include protection against market fluctuations, stable returns in various market conditions, lower volatility compared to other portfolios, and the potential for improved risk-adjusted performance.

Limitations of investing in a Zero-Beta Portfolio include the difficulty in achieving a perfect zero-beta, lower return potential compared to high-beta portfolios, the dynamic nature of betas requiring continuous monitoring, and limited availability of assets with negative or low betas.

While a Zero-Beta Portfolio aims to achieve market neutrality by targeting a beta of zero, low-volatility investing focuses on constructing portfolios with assets that exhibit lower volatility than the overall market, and smart-beta strategies seek to outperform traditional market-cap-weighted indices using alternative weighting schemes based on factors such as value, size, or momentum.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.