A Zero-Investment Portfolio is a strategy that involves creating a portfolio of assets that are financed through borrowing at a lower rate than the expected returns. The objective is to achieve a return on investment that is greater than the cost of borrowing, resulting in a net profit. The borrowed funds are used to purchase a mix of securities such as stocks, bonds, and mutual funds. The idea is to balance the risk and return of each asset to achieve the desired outcome. The key to creating a Zero-Investment Portfolio is to find an asset that generates a return higher than the cost of borrowing. For example, if the interest rate on a loan is 3%, an investor could borrow funds at that rate and invest in a stock that has a dividend yield of 5%. This would result in a net profit of 2% on the investment. The investor would continue to hold the stock and pay off the loan until the investment has reached maturity. This is the money that an investor borrows to finance the investment. The borrowed funds are typically obtained at a lower interest rate than the expected returns from the investment. This is the asset or assets that an investor purchases using the borrowed funds. The asset is chosen based on its ability to generate a return higher than the cost of borrowing. This is an asset that an investor pledges to secure the loan. The collateral is used to mitigate the risk of default on the loan. One of the main advantages of Zero-Investment Portfolio is the minimal risk involved. Since the investment is financed by borrowing at a lower rate than the expected returns, the investor is not using their own funds to make the investment. If the investment does not perform as expected, the investor can sell the investment and pay off the loan without incurring any losses. Another advantage of Zero-Investment Portfolio is the potential to maximize returns. By financing the investment through borrowing, the investor can purchase a larger amount of assets than they could with their own funds. This increases the potential for higher returns on the investment. Zero-Investment Portfolio also allows investors to make more effective use of their financial resources. By borrowing funds at a lower rate, investors can use their own funds for other investments or expenses. This increases their overall financial flexibility. The investor is not exposed to the full risk of the investment since the investment is financed by borrowing. If the investment does not perform as expected, the investor can sell the investment and pay off the loan without incurring any losses. One of the main disadvantages of Zero-Investment Portfolio is the lower potential returns. While the strategy minimizes risk, it also limits the potential for higher returns. The investor has to pay back the loan with interest, which reduces the overall return on investment. Another disadvantage of Zero-Investment Portfolio is the limited investment options. Since the strategy requires finding an asset that generates a return higher than the cost of borrowing, the investment options are limited to those that meet this criteria. This can limit the diversification of the portfolio and increase the risk of losses. If interest rates increase, the cost of borrowing will increase, reducing the potential return on investment. If the market experiences a downturn, the value of the investment may decrease, making it difficult to pay off the loan. Since the strategy involves borrowing funds, it is important to ensure that the investor is comfortable with the level of risk involved. The investor should consider their financial situation and personal preferences before making any investment decisions. The investor should have a clear understanding of their investment objectives and what they hope to achieve through the investment. This will help them to determine the appropriate investment mix and risk level. The investor should be clear about how long they plan to hold the investment and what their expected return on investment is over that period. Asset allocation is also an important factor to consider when building a Zero-Investment Portfolio. The investor should balance the risk and return of each asset in the portfolio to achieve the desired outcome. By spreading the investment across a range of assets, the investor can reduce the risk of losses and increase the potential for higher returns. The investor should consider a mix of assets such as stocks, bonds, and mutual funds to achieve the desired outcome. Rebalancing is another important strategy for building a Zero-Investment Portfolio. The investor should periodically review the portfolio to ensure it is balanced and aligned with their investment objectives. This will help them to make any necessary adjustments to ensure that the portfolio is performing as expected. A Zero-Investment Portfolio is a popular investment strategy used by investors to minimize risks and maximize returns. It involves building a portfolio of assets that have a net cost of zero, meaning the investment is financed by borrowing money at a lower rate than the returns generated by the portfolio. The strategy has several advantages such as minimal risk, maximizing returns, effective use of financial resources, and protection against market fluctuations. However, it also has some disadvantages such as lower potential returns, limited investment options, and dependence on market conditions. When building a Zero-Investment Portfolio, consider factors such as risk tolerance, investment goals, time horizon, and asset allocation. By using strategies such as diversification and rebalancing, investors can build a Zero-Investment Portfolio that meets their investment objectives. As with any investment strategy, it is important to conduct thorough research, seek professional advice, and regularly monitor the portfolio to ensure that it is performing as expected.What Is a Zero-Investment Portfolio?

How a Zero-Investment Portfolio Works

Components of Zero-Investment Portfolios

Borrowed Funds

Invested Asset

Collateral

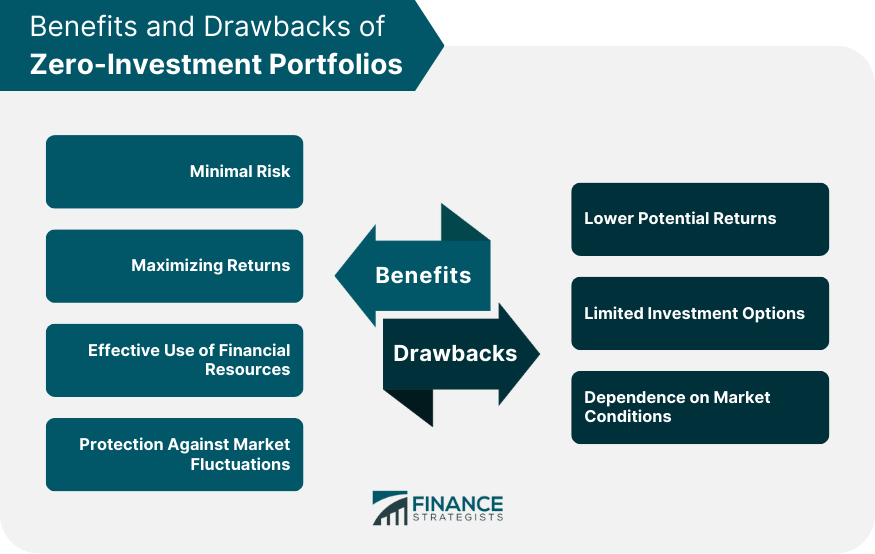

Benefits of Zero-Investment Portfolios

Minimal Risk

Maximizing Returns

Effective Use of Financial Resources

Protection Against Market Fluctuations

Drawbacks of Zero-Investment Portfolios

Lower Potential Returns

Limited Investment Options

Dependence on Market Conditions

Factors to Consider When Building a Zero-Investment Portfolio

Risk Tolerance

Investment Goals

Time Horizon

Asset Allocation

Strategies for Building a Zero-Investment Portfolio

Diversification

Rebalancing

Final Thoughts

Zero-Investment Portfolio FAQs

A Zero-Investment Portfolio is an investment strategy where the assets are financed through borrowing at a lower rate than the expected returns. The objective is to achieve a net profit by balancing the risk and return of the assets.

In a Zero-Investment Portfolio, borrowed funds are used to purchase investments that generate a return higher than the cost of borrowing. By leveraging borrowed money, investors aim to maximize returns while minimizing the use of their own funds.

Some advantages of a Zero-Investment Portfolio include minimal risk, the potential for higher returns, effective use of financial resources, and protection against market fluctuations. This strategy allows investors to diversify their portfolio and achieve a net profit without using their own capital.

Yes, there are some drawbacks. One drawback is the lower potential returns compared to investing solely with one's own funds. Additionally, the strategy may limit investment options and requires careful consideration of market conditions and interest rates.

Building a Zero-Investment Portfolio requires careful consideration of factors such as risk tolerance, investment goals, time horizon, and asset allocation. Strategies such as diversification and periodic rebalancing can be employed to create a portfolio that aligns with your investment objectives and minimizes risks.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.