Definition of Foreign Currency Risk

Foreign currency risk, also known as exchange rate risk, refers to the potential for financial loss arising from fluctuations in the value of one currency relative to another. This risk is particularly important for businesses and investors involved in international transactions.

Foreign currency risk is the potential for financial loss resulting from changes in exchange rates.

These fluctuations can significantly impact the value of assets, liabilities, and cash flows denominated in foreign currencies, creating uncertainty for businesses and investors involved in international transactions.

In the globalized economy, foreign currency risk is an essential consideration for businesses and investors. As international trade and investment grow, understanding and managing this risk become increasingly important to ensure financial stability and success.

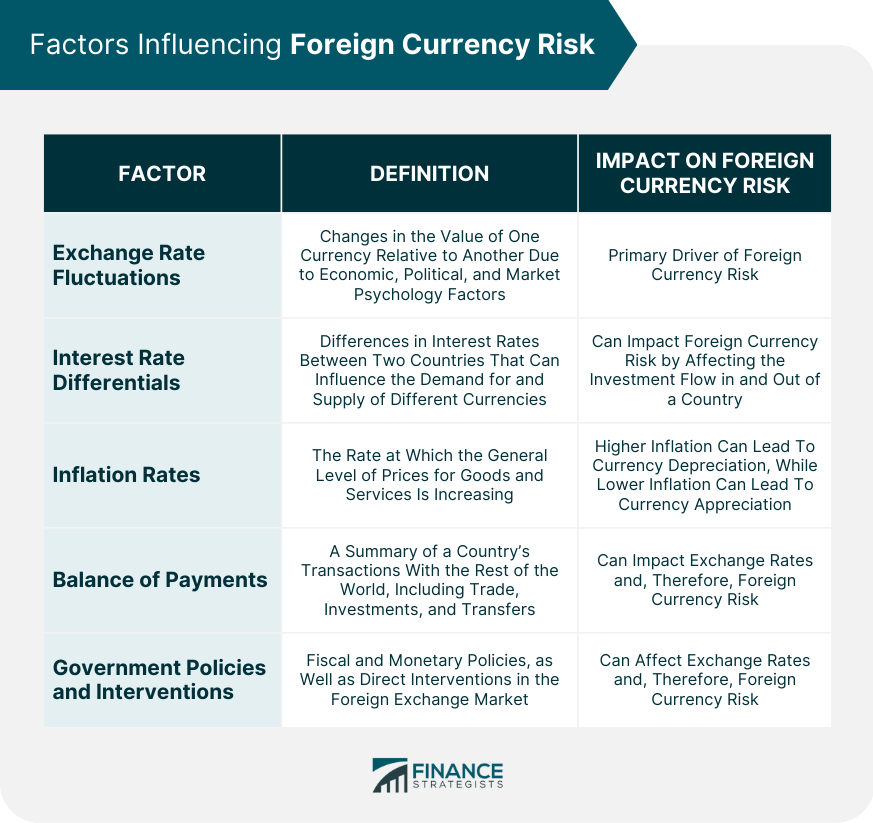

Factors Influencing Foreign Currency Risk

Several factors can influence foreign currency risk, including exchange rate fluctuations, interest rate differentials, inflation rates, balance of payments, and government policies and interventions.

Understanding these factors can help businesses and investors better assess and manage their exposure to foreign currency risk.

Exchange Rate Fluctuations

Exchange rate fluctuations are the primary driver of foreign currency risk. These fluctuations can be influenced by various factors, including economic, political, and market psychology factors.

Economic factors, such as differences in interest rates, inflation, and economic growth, can impact exchange rates. For example, higher interest rates in one country may attract foreign capital, leading to an appreciation of its currency.

Political factors, such as changes in government policies, political stability, and international relations, can also affect exchange rates. Lastly, market psychology, including investor sentiment and market expectations, can drive exchange rate fluctuations.

Interest Rate Differentials

Interest rate differentials refer to the differences in interest rates between two countries. These differentials can impact foreign currency risk by influencing the demand for and supply of different currencies.

For example, if interest rates are higher in one country compared to another, investors may be more likely to invest in the country with higher interest rates, leading to an appreciation of its currency.

Conversely, if interest rates are lower in one country, investors may be more likely to invest in other countries, leading to a depreciation of its currency.

Inflation Rates

Inflation rates can also impact foreign currency risk. Higher inflation in one country compared to another can lead to a depreciation of its currency, as the purchasing power of the currency decreases.

On the other hand, lower inflation in one country can lead to an appreciation of its currency, as the purchasing power of the currency increases.

Therefore, understanding inflation rates and their impact on exchange rates can be critical in assessing and managing foreign currency risk.

Balance of Payments

The balance of payments is a summary of a country's transactions with the rest of the world, including trade, investments, and transfers. A country's balance of payments can impact its exchange rate and, therefore, foreign currency risk.

For example, a country with a trade surplus (exports exceeding imports) may experience an appreciation of its currency, as demand for its goods and services increases.

Conversely, a country with a trade deficit (imports exceeding exports) may experience a depreciation of its currency, as demand for its goods and services decreases.

Government Policies and Interventions

Government policies and interventions can also impact foreign currency risk. These may include fiscal and monetary policies, as well as direct interventions in the foreign exchange market.

For example, a government may implement policies to stimulate economic growth or control inflation, which can affect exchange rates.

Additionally, central banks may intervene in the foreign exchange market to influence exchange rates, either by buying or selling their own currency or through coordinated interventions with other central banks.

Understanding the potential impact of government policies and interventions on exchange rates is essential in assessing and managing foreign currency risk.

Types of Foreign Currency Risk

Foreign currency risk can be classified into three main types: transaction risk, translation risk, and economic risk. Each type presents unique challenges and requires different management strategies.

Transaction Risk

Transaction risk refers to the potential for financial loss arising from changes in exchange rates during the time between entering into a contract and settling it. This risk is particularly relevant for businesses involved in international trade or investments.

For example, a company that agrees to buy goods from a foreign supplier at a specified price may experience transaction risk if the exchange rate changes between the time the contract is signed and the payment is made.

Similarly, an investor who purchases a foreign currency-denominated bond may face transaction risk if the exchange rate fluctuates between the time of purchase and the bond's maturity date.

Translation Risk

Translation risk, also known as accounting risk, arises when a company consolidates its financial statements, including the financial statements of its foreign subsidiaries.

Changes in exchange rates can impact the value of assets, liabilities, and income when they are converted from the subsidiary's local currency to the parent company's reporting currency.

For example, if a US-based company has a subsidiary in Japan, the assets and liabilities of the Japanese subsidiary may be denominated in Japanese yen.

When consolidating the financial statements, the US parent company must convert these values to US dollars, and any fluctuations in the USD/JPY exchange rate can create translation risk.

Economic Risk

Economic risk, also known as operating risk, refers to the potential for financial loss due to changes in exchange rates that can affect a company's future cash flows and competitiveness.

This risk is particularly relevant for businesses with significant operations or investments in foreign markets.

For example, a US-based company that exports goods to Europe may face economic risk if the US dollar appreciates against the euro, making its products more expensive for European customers.

Similarly, a company with production facilities in a foreign country may face economic risk if changes in exchange rates impact the cost of inputs or labor.

Measurement and Assessment of Foreign Currency Risk

Measuring and assessing foreign currency risk is crucial for businesses and investors to make informed decisions about managing their exposure.

Various methods can be used to quantify and analyze foreign currency risk, including Value at Risk (VaR), standard deviation, sensitivity analysis, and scenario analysis.

Value at Risk

Value at Risk is a widely used method for measuring the potential loss in the value of a portfolio due to changes in exchange rates. VaR calculates the maximum expected loss over a specific time horizon at a given confidence level.

For example, a VaR of $1 million at a 95% confidence level over a one-day time horizon implies that there is a 5% chance that the portfolio will lose more than $1 million due to exchange rate fluctuations in a single day.

VaR is useful for assessing foreign currency risk and making risk management decisions, such as setting risk limits or allocating capital to different investments.

Standard Deviation

Standard deviation is a measure of the dispersion or volatility of exchange rates. A higher standard deviation indicates greater volatility and, therefore, higher foreign currency risk.

By calculating the standard deviation of historical exchange rate changes, businesses and investors can gain insights into the potential volatility of exchange rates and their potential impact on their portfolios.

Standard deviation can also be used to estimate the potential range of future exchange rate movements, helping businesses and investors make informed decisions about managing their foreign currency risk.

Sensitivity Analysis

Sensitivity analysis is a method used to assess the impact of changes in exchange rates on a company's financial performance or an investment portfolio's value.

This analysis involves changing the values of key variables, such as exchange rates, and observing the resulting effects on the company's financial metrics or the portfolio's value.

For example, a company may conduct sensitivity analysis by simulating how changes in exchange rates could impact its revenues, costs, and profitability.

Similarly, an investor may assess the sensitivity of their portfolio's value to changes in exchange rates. Sensitivity analysis can help businesses and investors identify areas of vulnerability and develop appropriate strategies to manage their foreign currency risk.

Scenario Analysis

Scenario analysis is a method used to assess the potential impact of various exchange rate scenarios on a company's financial performance or an investment portfolio's value.

This analysis involves creating hypothetical scenarios that reflect different exchange rate conditions, such as a significant appreciation or depreciation of a currency, and estimating their potential effects.

For example, a company may develop different exchange rate scenarios to evaluate their potential impact on its revenues, costs, and profitability.

Similarly, an investor may use scenario analysis to estimate the potential effects of different exchange rate scenarios on their portfolio's value.

Scenario analysis can help businesses and investors better understand the potential risks and opportunities associated with different exchange rate conditions and develop appropriate strategies to manage their foreign currency risk.

Foreign Currency Risk Management Strategies

Various strategies can be employed to manage foreign currency risk, including financial hedging, operational hedging, and natural hedging.

Each strategy offers unique benefits and challenges, and businesses and investors should carefully consider their specific needs and objectives when selecting the appropriate approach.

Financial Hedging

Financial hedging involves using financial instruments, such as forward contracts, futures contracts, options contracts, and currency swaps, to offset potential losses due to changes in exchange rates.

These instruments allow businesses and investors to lock in specific exchange rates or limit their exposure to unfavorable exchange rate movements.

For example, a company that expects to receive payments in a foreign currency at a future date may enter into a forward contract to sell the foreign currency at a predetermined exchange rate, thereby reducing the risk of losses due to unfavorable exchange rate fluctuations.

Similarly, an investor may use options contracts to limit their exposure to potential losses due to changes in exchange rates.

Operational Hedging

Operational hedging involves adjusting a company's business operations to manage foreign currency risk. This may include strategies such as diversification, matching currency cash flows, and invoicing in the home currency.

For example, a company may diversify its operations across multiple countries and currencies to reduce its exposure to any single currency.

Additionally, a company may match its currency cash flows by using revenues generated in a foreign currency to cover expenses denominated in the same currency, thereby reducing its net exposure to exchange rate fluctuations.

Invoicing in the home currency can also help a company reduce its foreign currency risk by ensuring that its revenues are received in its preferred currency.

Natural Hedging

Natural hedging involves using existing business activities to offset foreign currency risk without the use of financial instruments or operational adjustments. Common natural hedging strategies include netting, leading and lagging, and currency clauses.

For example, a company may use netting to offset its foreign currency receivables and payables by settling them simultaneously, thereby reducing its net exposure to exchange rate fluctuations.

Leading and lagging involve adjusting the timing of payments or receipts to take advantage of favorable exchange rate movements.

Currency clauses in contracts can help businesses manage foreign currency risk by specifying the exchange rate to be used for future transactions or allowing for adjustments based on changes in exchange rates.

Conclusion

Managing foreign currency risk is essential for businesses and investors involved in international transactions.

By understanding the factors influencing foreign currency risk, the different types of risk, and the various strategies for managing it, businesses and investors can make informed decisions to protect their financial interests and capitalize on opportunities in the global market.

Continuous monitoring and assessment of foreign currency risk are crucial to adapting to the ever-changing global economic environment.

By implementing appropriate risk management strategies, businesses and investors can mitigate potential losses due to exchange rate fluctuations and ensure their long-term financial stability and success.

Foreign Currency Risk FAQs

Foreign currency risk refers to the potential financial loss resulting from changes in the exchange rate between two currencies.

Several factors influence foreign currency risk, including inflation rates, interest rates, political stability, and economic growth.

There are three types of foreign currency risk: transaction risk, translation risk, and economic risk.

Foreign currency risk can be measured using several methods, including Value at Risk (VaR), scenario analysis, and stress testing.

Companies can mitigate foreign currency risk by using various strategies, such as hedging with derivatives, using natural hedges, and diversifying their operations globally.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.