Front-running is an unethical and illegal trading practice where a broker, trader, or another market participant takes advantage of non-public information or pending orders to make a trade for their own benefit. This practice undermines the integrity of financial markets and erodes investor trust. Front-running can occur in various ways, including trading on insider information, trading ahead of customer orders, and using high-frequency trading strategies to exploit market inefficiencies. Front-running has been a persistent issue in financial markets for decades. With the advent of electronic trading and the increasing speed of information flow, front-running has become more sophisticated and challenging to detect. In the past, front-running typically involved brokers who had access to customer orders and would trade ahead of them to profit from the price movement. As technology evolved, front-running techniques adapted, taking advantage of high-frequency trading and algorithmic strategies to exploit market inefficiencies and capitalize on non-public information. Trading on insider information is one of the most common forms of front-running. This occurs when a trader, typically a broker or an employee of a financial institution, gains access to non-public information about a company or a pending transaction and uses that information to make trades before the information becomes public. This practice not only violates securities laws but also undermines investor confidence in the market. It creates an uneven playing field and allows those with privileged access to information to profit at the expense of other investors who are left in the dark. Trading ahead of customer orders is another common form of front-running. Brokers with access to pending customer orders can use this information to make trades for their own accounts, knowing that the customer's order will likely impact the market price. This type of front-running is detrimental to the customer, as it can lead to inferior execution prices and reduced profits. It also erodes the fiduciary responsibility that brokers have to their clients and can negatively impact the overall trust in the financial markets. High-frequency trading (HFT) is a trading strategy that utilizes advanced technology and algorithms to rapidly execute trades in fractions of a second. While HFT has been credited with increasing market liquidity and efficiency, it has also been criticized for enabling certain forms of front-running. Some HFT firms have been accused of using their advanced technology to detect and exploit large institutional orders in the market, enabling them to trade ahead of these orders and profit from the subsequent price movements. This practice has raised concerns about market fairness and the potential for manipulation by well-resourced trading firms. Algorithmic trading involves using complex computer algorithms to execute trades based on predetermined criteria, such as price, volume, or time. Some unscrupulous traders have developed algorithmic trading strategies specifically designed to front-run other market participants. These strategies may involve detecting large institutional orders, identifying patterns in trading activity, or exploiting other market inefficiencies to gain an unfair advantage. As with other forms of front-running, algorithmic front-running erodes trust in the market and can lead to increased regulation and scrutiny of trading practices. Front-running is illegal under U.S. securities laws and is subject to enforcement by the Securities and Exchange Commission (SEC). The SEC has the authority to bring civil enforcement actions against individuals and entities that engage in front-running, which can result in fines, penalties, and other sanctions. In addition to enforcing existing regulations, the SEC also works to develop new rules and guidelines to address evolving front-running practices. By staying vigilant and adapting to changes in the market, the SEC aims to maintain a fair and transparent trading environment for all investors. The Financial Industry Regulatory Authority (FINRA) is a self-regulatory organization that oversees brokerage firms and their registered representatives in the United States. FINRA has specific rules in place to address front-running, including prohibiting the practice of trading ahead of customer orders. FINRA enforces these rules through regular audits, investigations, and disciplinary actions against firms and individuals found to have engaged in front-running. By holding market participants accountable for their actions, FINRA plays a crucial role in maintaining the integrity of the financial markets and protecting investors. Front-running is not only illegal but also raises significant ethical concerns. When market participants engage in front-running, they undermine the principles of fairness and equal access to information that underpin the financial markets. This unethical behavior can lead to a loss of investor trust, causing some investors to withdraw from the markets or refrain from participating altogether. The erosion of investor trust can have long-term consequences for the overall health and stability of the financial markets, making it essential to combat front-running and promote ethical trading practices. Front-running is not limited to the United States and is similarly prohibited in many countries around the world. Regulatory authorities in Europe, Asia, and other regions have enacted laws and regulations to combat front-running and protect the integrity of their financial markets. While the specific rules and enforcement mechanisms may vary across jurisdictions, the global nature of financial markets necessitates international cooperation and coordination to address front-running effectively. By working together, regulators worldwide can help ensure a fair and transparent trading environment for all investors. Both regulators and financial institutions invest in surveillance and compliance systems designed to detect and prevent front-running. These systems analyze trading data and monitor market activity for potential signs of front-running or other market abuses. By identifying suspicious trading patterns or irregularities, these systems can alert compliance officers and regulators to possible instances of front-running. Timely detection and intervention can help minimize the damage caused by front-running and serve as a deterrent for future misconduct. Brokerage firms are required to have best execution policies in place to ensure that customer orders are executed at the most favorable terms available. These policies are designed to protect customers from front-running and other trading practices that could compromise the quality of their order execution. By adhering to best execution policies and prioritizing the interests of their clients, brokers can help maintain the integrity of the financial markets and foster investor trust. Strong best execution policies also serve as a defense against potential regulatory scrutiny and enforcement actions. Whistleblower programs, such as those offered by the SEC and FINRA, provide incentives for individuals to report potential instances of front-running or other securities law violations. By offering financial rewards and protection from retaliation, these programs encourage insiders to come forward with information that may be difficult for regulators to uncover on their own. Whistleblower programs have proven to be an effective tool in detecting and combating front-running, as they leverage the knowledge and insights of those with direct access to the trading activities in question. By empowering individuals to report wrongdoing, regulators can more effectively identify and address front-running in the financial markets. Regulators and industry participants work together to combat front-running through a combination of rulemaking, enforcement actions, and technological advancements. This collaboration includes sharing information, developing best practices, and promoting a culture of compliance and ethical behavior within the financial industry. Educational initiatives and industry conferences also play a role in raising awareness of front-running and the importance of maintaining market integrity. By fostering a shared understanding of the challenges posed by front-running and the need for proactive measures to address it, regulators and industry participants can collaborate more effectively to protect investors and maintain market fairness. As technology continues to evolve and reshape the financial markets, the potential for new and sophisticated front-running techniques is likely to grow. Advances in artificial intelligence, machine learning, and data analysis could enable market participants to identify and exploit new opportunities for front-running, potentially outpacing the ability of regulators and compliance systems to detect and prevent such activities. However, technology can also be harnessed to combat front-running more effectively, with the development of more advanced surveillance and compliance tools. By staying abreast of technological developments and adapting their strategies accordingly, regulators and market participants can work together to maintain market integrity and protect investors. In response to the ongoing challenge of front-running, regulators worldwide are exploring new approaches to address this practice more effectively. These efforts may include enhanced coordination and information sharing among regulators, the development of new rules and guidelines to address emerging front-running techniques, and the implementation of innovative enforcement mechanisms. By staying proactive and adapting to the evolving landscape of financial markets, regulators can better protect investors and maintain market integrity. Additionally, the adoption of international standards and best practices can help ensure a more consistent and effective approach to combating front-running across jurisdictions.Definition of Front-Running

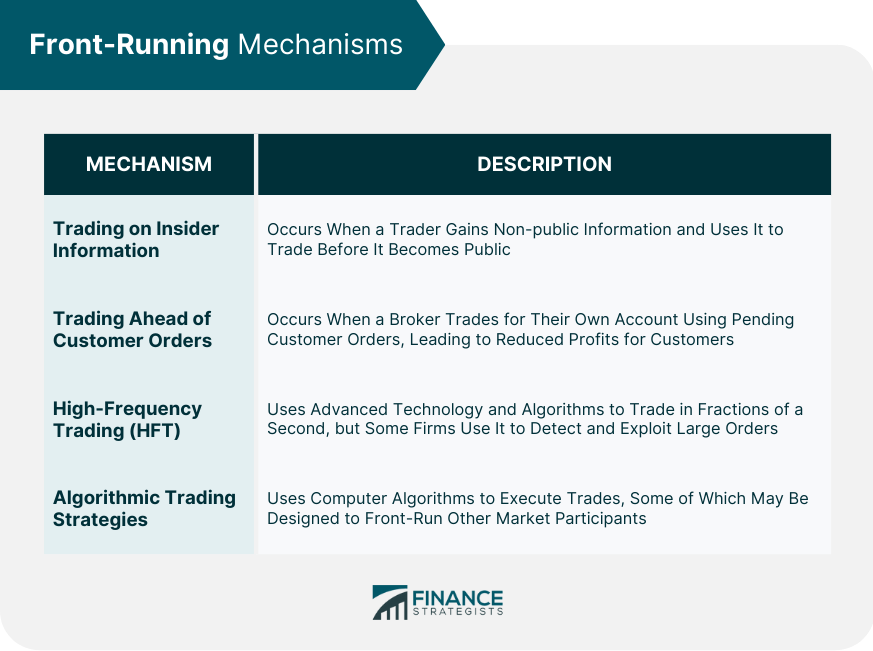

Mechanisms and Techniques of Front-Running

Trading on Insider Information

Trading Ahead of Customer Orders

High-Frequency Trading and Front-Running

Algorithmic Trading Strategies for Front-Running

Legal and Ethical Implications of Front-Running

Securities and Exchange Commission Regulations

Financial Industry Regulatory Authority Rules

Ethical Considerations and Investor Trust

International Laws and Regulations on Front-Running

Detecting and Preventing Front-Running

Surveillance and Compliance Systems

Best Execution Policies

Whistleblower Programs

Regulatory and Industry Efforts to Combat Front-Running

Final Thoughts

Front-Running FAQs

Front-running is an illegal practice where a broker or trader uses insider information to buy or sell securities before executing a client's trade.

Front-running occurs when a broker or trader uses non-public information to predict a client's trade and then executes a trade in their own account before the client's trade is executed.

Front-running can be detected through trade surveillance, transaction monitoring, and analysis of order book data. Suspicious activities can be investigated by regulators and compliance departments.

An example of front-running is when a broker purchases a large number of shares in a company just before a client places an order to buy the same shares, hoping to sell at a higher price to the client.

To prevent front-running, regulators have imposed strict rules on brokers and traders, including restrictions on trading with insider information, and implementing measures to monitor and detect suspicious activities. Clients can also work with reputable brokers and traders with a history of compliance.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.