Liquidity risk refers to the risk of not being able to buy or sell an asset quickly enough to prevent a loss or to meet financial obligations. This type of risk arises when there is a lack of marketability or when there is a sudden shift in market conditions, resulting in the inability to find a buyer or seller at a fair price. Liquidity risk can affect any type of asset, including stocks, bonds, currencies, and commodities. It is particularly important for financial institutions, which rely on short-term funding sources to meet their obligations, and for investors who need to quickly buy or sell assets to meet their investment goals. Sudden shocks or events that impair market functioning can result in heightened liquidity risk. These disruptions can be caused by natural disasters, geopolitical events, or financial crises. They can lead to a rapid reduction in market liquidity, making it difficult for financial institutions to buy or sell assets to meet their obligations. Asset-liability mismatch occurs when a financial institution's assets and liabilities have different maturities or interest rate sensitivities. This can lead to cash flow imbalances and increase liquidity risk, especially during periods of market stress when it becomes more challenging to liquidate assets or obtain funding. Funding concentration refers to an over-reliance on a single or few funding sources, increasing vulnerability to liquidity risk. If a financial institution loses access to a major funding source, it may struggle to meet its financial obligations, leading to a liquidity crisis. Over-reliance on short-term funding exposes financial institutions to liquidity risk by creating a maturity mismatch between their assets and liabilities. This can lead to cash flow imbalances and liquidity shortfalls, particularly if market conditions change and short-term funding becomes more expensive or difficult to access. Changes in interest rates can have a significant impact on a financial institution's liquidity risk profile. Rising interest rates can increase the cost of borrowing, reduce the market value of fixed-income assets, and lead to cash flow imbalances. Conversely, falling interest rates can lead to deposit outflows, as customers seek higher returns elsewhere. Macroeconomic downturns, such as recessions or periods of economic stagnation, can exacerbate liquidity risk for financial institutions. During these times, credit risk increases, market participants become more risk-averse, and funding sources may become more limited, making it harder for financial institutions to access liquidity when needed. Changes in financial regulations can also impact liquidity risk. For example, new regulations that impose higher capital or liquidity requirements on financial institutions may force them to adjust their balance sheets, potentially leading to liquidity imbalances and increased liquidity risk. Market liquidity risk arises when an organization is unable to execute transactions at the desired price due to market conditions. It can occur due to various factors, such as low trading volume, market impact, and transaction costs. A low trading volume in a market can make it difficult for an organization to buy or sell assets quickly without causing a significant price change. This lack of liquidity can lead to increased costs and potential losses. Market impact refers to the effect of a large trade on the market price, while transaction costs are the fees associated with trading activities. High market impact and transaction costs can exacerbate market liquidity risk. Funding liquidity risk occurs when an organization faces difficulties in obtaining funds to meet its financial obligations. It can be caused by limited access to funding sources, adverse market conditions, or a mismatch between assets and liabilities. An organization's ability to access funds and refinance its debts can be affected by external factors such as credit rating downgrades, market turmoil, and counterparty risk. This may result in higher borrowing costs and increased funding liquidity risk. When an organization's assets and liabilities have different maturities, it can lead to a mismatch that exposes the organization to liquidity risk. This can be particularly problematic during times of financial stress when it may be difficult to sell assets or raise new funds. Operational liquidity risk is the risk of not being able to meet day-to-day financial obligations due to ineffective cash flow management or inadequate contingency planning. Effective cash flow management is crucial for minimizing operational liquidity risk. Organizations must monitor and forecast their cash inflows and outflows to ensure they can meet their financial obligations. A robust contingency plan is essential to address potential liquidity stress events. This includes identifying potential sources of liquidity risk, establishing triggers for action, and having backup funding sources. Contagion risk is the risk that a financial institution's liquidity issues could spread to other institutions or markets. This can occur when market participants become more risk-averse and seek to reduce their exposure to institutions with perceived liquidity issues. Contagion risk can amplify the effects of liquidity risk and potentially lead to systemic crises. Liquidity ratios are financial metrics used to assess an organization's ability to meet its short-term obligations. The current ratio is calculated by dividing an organization's current assets by its current liabilities. A higher ratio indicates better short-term liquidity. The quick ratio, also known as the acid-test ratio, measures an organization's ability to meet its short-term liabilities using its most liquid assets. It is calculated by dividing the sum of cash, cash equivalents, and accounts receivable by current liabilities. The cash ratio measures an organization's ability to cover its short-term liabilities using only its cash and cash equivalents. It is calculated by dividing cash and cash equivalents by current liabilities. Liquidity gap analysis is a technique used to assess an organization's liquidity position by comparing its cash inflows and outflows over different time horizons. A maturity ladder is a tool used in liquidity gap analysis that categorizes an organization's assets and liabilities by their maturity dates. This helps to identify any potential mismatches that may cause liquidity risk. The cumulative liquidity gap is the difference between an organization's cumulative cash inflows and outflows over a specific time horizon. A positive gap indicates a surplus of cash, while a negative gap indicates a potential liquidity shortfall. Stress testing is a process used to evaluate an organization's ability to withstand adverse market conditions and extreme events that may affect its liquidity position. Scenario analysis involves simulating various hypothetical situations to assess an organization's liquidity risk exposure. This can include market disruptions, economic downturns, or changes in interest rates. Sensitivity analysis measures the impact of small changes in key variables, such as market prices, interest rates, or credit spreads, on an organization's liquidity position. This helps to identify vulnerabilities and areas of potential risk. A well-defined liquidity risk policy is essential for effective risk management. It should include a clear risk appetite statement and governance structure. A risk appetite statement outlines an organization's tolerance for liquidity risk and provides guidance on acceptable levels of risk exposure. A strong governance structure is crucial for managing liquidity risk. This includes the establishment of a dedicated risk management function, clear reporting lines, and regular communication between risk managers and senior management. Diversifying funding sources can help to reduce liquidity risk by minimizing the reliance on any single source of funding. This can include accessing both short-term and long-term funding markets and maintaining relationships with various counterparties. Effective asset-liability management involves matching the maturities of assets and liabilities to minimize liquidity risk. Organizations can minimize liquidity risk by ensuring that the maturities of their assets and liabilities are closely aligned. This helps to ensure that cash inflows are sufficient to cover cash outflows. Maintaining a portfolio of highly liquid assets can help to mitigate liquidity risk by providing a source of cash in times of financial stress. Contingency funding planning involves identifying potential liquidity stress events and developing action plans and triggers to address them. Organizations should regularly assess the likelihood and potential impact of liquidity stress events, such as market disruptions, credit rating downgrades, or counterparty failures. Organizations should establish clear action plans and trigger to respond to potential liquidity stress events. This may include activating backup funding sources, reducing non-essential expenses, or adjusting the asset-liability mix. The Basel III regulatory framework includes specific provisions aimed at improving the management of liquidity risk. The LCR requires banks to hold a sufficient level of high-quality liquid assets to cover their net cash outflows over a 30-day stress scenario. The NSFR is designed to promote stable, long-term funding by requiring banks to maintain a minimum level of stable funding relative to the liquidity of their assets. In addition to the Basel III framework, local regulatory authorities may impose additional requirements for liquidity risk management. Regulators may require organizations to report on their liquidity risk exposure and disclose specific metrics to promote transparency and market discipline. Regulatory authorities may conduct regular supervisory reviews and evaluations of an organization's liquidity risk management practices to ensure compliance with relevant regulations and standards. Liquidity risk management plays a crucial role in maintaining the financial stability of organizations. By understanding the various sources of liquidity risk, such as market liquidity risk, funding liquidity risk, and operational liquidity risk, organizations can better prepare for potential challenges. Effective measurement and assessment techniques, including liquidity ratios, liquidity gap analysis, and stress testing, enable organizations to identify and mitigate liquidity risk. Implementing robust risk management practices, such as establishing clear risk policies, diversifying funding sources, and employing asset-liability management strategies, is essential for minimizing the potential impact of liquidity risk. Regulatory frameworks, like Basel III, provide guidelines and requirements to further strengthen liquidity risk management. What Is Liquidity Risk?

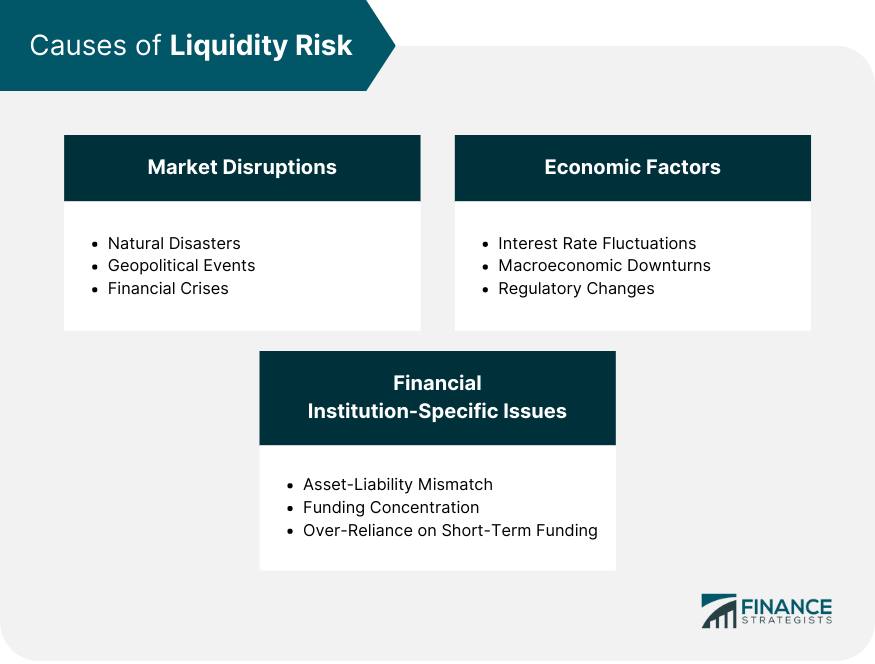

Causes of Liquidity Risk

Market Disruptions

Financial Institution-Specific Issues

Asset-Liability Mismatch

Funding Concentration

Over-Reliance on Short-Term Funding

Economic Factors

Interest Rate Fluctuations

Macroeconomic Downturns

Regulatory Changes

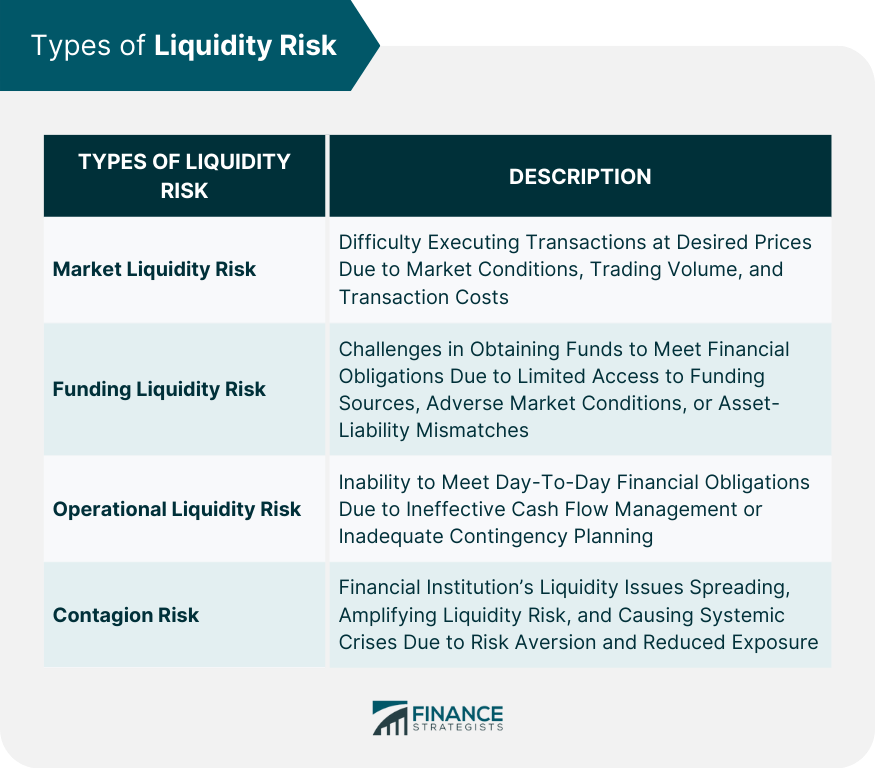

Types of Liquidity Risk

Market Liquidity Risk

Trading Volume and Liquidity

Market Impact and Transaction Costs

Funding Liquidity Risk

Access to Funds and Refinancing

Asset-Liability Mismatch

Operational Liquidity Risk

Cash Flow Management

Contingency Planning

Contagion Risk

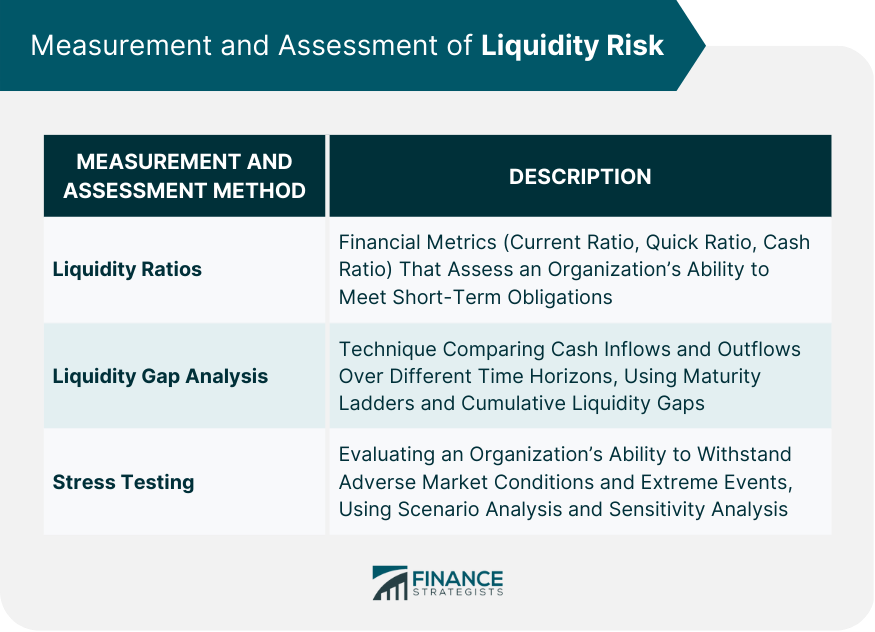

Measurement and Assessment of Liquidity Risk

Liquidity Ratios

Current Ratio

Quick Ratio

Cash Ratio

Liquidity Gap Analysis

Maturity Ladder

Cumulative Liquidity Gap

Stress Testing

Scenario Analysis

Sensitivity Analysis

Liquidity Risk Management

Establishing a Liquidity Risk Policy

Risk Appetite Statement

Governance Structure

Diversification of Funding Sources

Asset-Liability Management

Matching Maturities

Holding Liquid Assets

Contingency Funding Planning

Identifying Potential Liquidity Stress Events

Developing Action Plans and Triggers

Regulatory Framework and Requirements

Basel III and Liquidity Risk

Liquidity Coverage Ratio (LCR)

Net Stable Funding Ratio (NSFR)

Local Regulatory Requirements

Reporting and Disclosure

Supervisory Review and Evaluation

Conclusion

Liquidity Risk FAQs

Liquidity risk refers to the possibility that an organization may be unable to meet its financial obligations due to insufficient cash flow. It is important for financial organizations because it can lead to financial instability, reputational damage, and regulatory penalties if not effectively managed.

The main sources of liquidity risk include market liquidity risk, funding liquidity risk, and operational liquidity risk. Market liquidity risk arises from an inability to execute transactions at desired prices due to market conditions, while funding liquidity risk occurs when organizations face difficulties in obtaining funds to meet obligations. Operational liquidity risk is related to ineffective cash flow management or inadequate contingency planning.

Organizations can measure and assess their liquidity risk using liquidity ratios (such as the current ratio, quick ratio, and cash ratio), liquidity gap analysis (including maturity ladders and cumulative liquidity gaps), and stress testing (through scenario analysis and sensitivity analysis).

Effective liquidity risk management involves establishing a clear liquidity risk policy with a risk appetite statement and governance structure, diversifying funding sources, implementing asset-liability management strategies, and developing contingency funding plans to address potential liquidity stress events.

The Basel III regulatory framework addresses liquidity risk by introducing two key requirements: the Liquidity Coverage Ratio (LCR), which requires banks to hold sufficient high-quality liquid assets to cover their net cash outflows over a 30-day stress scenario, and the Net Stable Funding Ratio (NSFR), which aims to promote stable, long-term funding by requiring banks to maintain a minimum level of stable funding relative to the liquidity of their assets.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.