Market risk refers to the potential for an investor to experience losses due to factors that affect the overall performance of financial markets. These risks are inherent to investing and are largely unpredictable, as they stem from changes in economic conditions, political events, and market sentiment. Understanding and managing market risk is crucial for investors and businesses, as it allows them to protect their investments and make informed decisions. By identifying potential risks and implementing strategies to mitigate them, businesses and investors can optimize their returns and minimize the impact of market volatility. Market risk can be broadly categorized into four main types: equity risk, interest rate risk, currency risk, and commodity risk. Each type of risk arises from different factors and can impact a portfolio's performance in unique ways. Equity risk is the risk of loss due to fluctuations in stock prices. It arises from factors such as changes in a company's financial performance, industry trends, and broader economic conditions. For example, a downturn in the economy could lead to lower earnings for a company, causing its stock price to decline. Equity risk can be influenced by both systematic factors (those affecting the entire market) and unsystematic factors (those specific to a particular company or industry). Systematic factors include changes in interest rates, inflation, and political events, while unsystematic factors encompass changes in a company's management, financial performance, and industry-specific events. Interest rate risk is the potential for loss due to changes in interest rates, which can impact the value of fixed-income investments such as bonds. For example, when interest rates rise, the market value of existing bonds with lower coupon rates tends to decrease. Interest rate risk is influenced by factors such as monetary policy decisions by central banks, inflation expectations, and overall economic conditions. Additionally, the risk can vary depending on the maturity and credit quality of the fixed-income instrument. Currency risk, also known as exchange rate risk, refers to the potential for loss due to fluctuations in foreign currency exchange rates. This risk can impact investors and businesses that have exposure to foreign currencies through investments, trade, or operations. For example, a U.S. investor holding stocks in a European company may experience losses if the euro depreciates against the dollar. Factors that can affect currency risk include changes in economic conditions, political events, central bank policies, and market sentiment. Additionally, currency risk can be influenced by factors specific to a particular country or region, such as economic stability, fiscal policies, and geopolitical events. Commodity risk is the risk of loss due to fluctuations in the prices of commodities such as oil, gold, and agricultural products. This risk can impact investors and businesses that have exposure to commodities through investments or operations. For example, an oil producer may experience losses if oil prices decline. Commodity risk is influenced by factors such as changes in supply and demand, geopolitical events, and macroeconomic conditions. Additionally, factors specific to a particular commodity or market, such as weather events, technological advancements, and regulatory changes, can impact commodity risk. Value at Risk (VaR) is a widely used risk metric that estimates the maximum potential loss on an investment over a specified time period, given a certain level of confidence. VaR is commonly used by investment managers and financial institutions to quantify their exposure to market risk and to set risk limits for their portfolios. Despite its widespread use, VaR has several limitations. It does not provide information on the potential losses beyond the specified confidence level, and it assumes that asset returns follow a normal distribution, which may not always be the case. Additionally, VaR does not take into account the potential for extreme events, or "tail risks," which can lead to significant losses. Conditional Value at Risk (CVaR), also known as Expected Shortfall, is a risk measure that addresses some of the limitations of VaR. CVaR estimates the expected loss in the worst-case scenarios beyond the specified confidence level. It is particularly useful for capturing tail risks and providing a more comprehensive view of the potential losses in extreme market conditions. CVaR has several advantages over VaR, including a more accurate representation of tail risks and a better ability to capture the severity of potential losses in extreme scenarios. Additionally, CVaR is a coherent risk measure, meaning it satisfies certain desirable mathematical properties, such as subadditivity. Stress testing is a risk management technique used to evaluate the potential impact of extreme market events on a portfolio or financial institution. It involves simulating various adverse scenarios, such as economic recessions, market crashes, or geopolitical crises, to assess how a portfolio or institution would perform under these conditions. Stress testing helps investors and financial institutions identify vulnerabilities and implement measures to mitigate potential losses. Stress testing plays a crucial role in managing market risk, as it enables investors and financial institutions to better understand their exposure to extreme events and take proactive steps to minimize potential losses. Additionally, stress testing is often required by regulators to ensure that financial institutions maintain adequate capital and risk management practices. The Sharpe ratio is a measure of risk-adjusted return that compares an investment's excess return (return above the risk-free rate) to its volatility, as measured by standard deviation. A higher Sharpe ratio indicates a better risk-adjusted performance. The Sortino ratio is a variation of the Sharpe ratio that focuses on downside risk by only considering the standard deviation of negative returns. This ratio provides a more accurate assessment of an investment's risk-adjusted performance when returns are not normally distributed. The Treynor ratio measures an investment's risk-adjusted performance by comparing its excess return to its beta, which represents its sensitivity to market risk. A higher Treynor ratio indicates a better risk-adjusted performance relative to market risk. Diversification is a risk management strategy that involves investing in a variety of assets or sectors to reduce the impact of individual risks on a portfolio. By spreading investments across different asset classes, industries, and geographic regions, investors can mitigate the effects of market risk and reduce the potential for losses. Portfolio diversification can be achieved through various methods, such as investing in different asset classes (e.g., stocks, bonds, and commodities), sectors (e.g., technology, healthcare, and finance), and geographic regions (e.g., domestic and international markets). Hedging is a risk management strategy that involves using financial instruments, such as derivatives, to offset potential losses from an investment or exposure. For example, an investor who owns shares of a company that is sensitive to oil prices might use oil futures contracts to hedge against the risk of falling oil prices. Some common hedging instruments include swaps, futures, and options. These instruments can be used to hedge various types of risks, such as equity, interest rate, currency, and commodity risk, depending on the specific needs of the investor or business. Asset allocation is the process of distributing investments across different asset classes in a portfolio to balance risk and return. A well-designed asset allocation strategy helps investors achieve their financial goals while managing market risk and maintaining an appropriate level of portfolio risk. Strategic asset allocation involves setting long-term target allocations for different asset classes based on an investor's risk tolerance, investment horizon, and financial goals. Tactical asset allocation, on the other hand, involves making short-term adjustments to the strategic allocation in response to changing market conditions or investment opportunities. Regular risk monitoring is essential for effective market risk management, as it enables investors and businesses to identify emerging risks, assess their potential impact, and take timely action to mitigate them. By closely monitoring market risk, investors can make better-informed decisions and adapt their strategies to changing market conditions. Key risk indicators (KRIs) are metrics that provide insight into the level of risk exposure in a portfolio or organization. Examples of KRIs include Value at Risk, volatility, and credit ratings. Regular reporting of KRIs to management and other stakeholders helps ensure that market risk is effectively managed and communicated within the organization. Basel III is a global regulatory framework designed to strengthen the resilience of banks and financial institutions in the face of market risk and other risks. Developed by the Basel Committee on Banking Supervision, Basel III introduces more stringent capital requirements, liquidity standards, and leverage ratios for banks. Basel III includes specific requirements for the management of market risk, such as the use of standardized risk measurement models, enhanced disclosure requirements, and the incorporation of stress testing in risk management processes. The Dodd-Frank Wall Street Reform and Consumer Protection Act is a U.S. law enacted in response to the 2008 financial crisis. It aims to promote financial stability, enhance consumer protection, and improve the transparency and accountability of financial institutions. The Dodd-Frank Act includes provisions related to market risks, such as the establishment of the Volcker Rule, which restricts proprietary trading by banks, and the implementation of enhanced risk management standards and reporting requirements for systemically important financial institutions. Effective market risk management is essential for maintaining financial stability and promoting investor confidence. By identifying, measuring, and mitigating market risk, investors and businesses can better navigate the complexities of financial markets and achieve their long-term financial goals. Market risk is constantly evolving, driven by factors such as technological advancements, globalization, and changes in market structure. To effectively manage market risk in the future, investors and businesses must continuously adapt their risk management strategies and stay informed about emerging trends and potential risks.Definition of Market Risk

Importance of Understanding Market Risk for Investors and Businesses

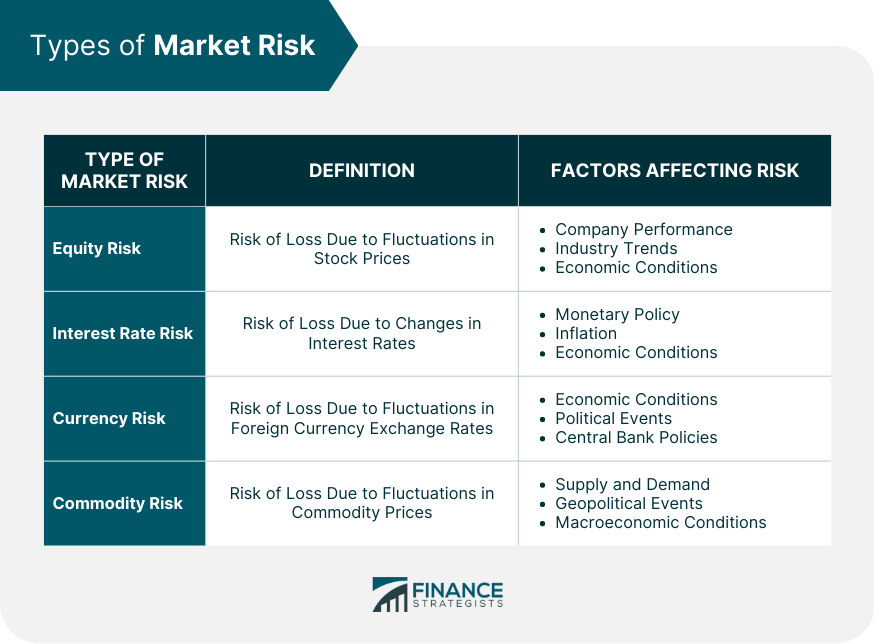

Types of Market Risk

Equity Risk

Definition and Examples

Factors Affecting Equity Risk

Interest Rate Risk

Definition and Examples

Factors Affecting Interest Rate Risk

Currency Risk

Definition and Examples

Factors Affecting Currency Risk

Commodity Risk

Definition and Examples

Factors Affecting Commodity Risk

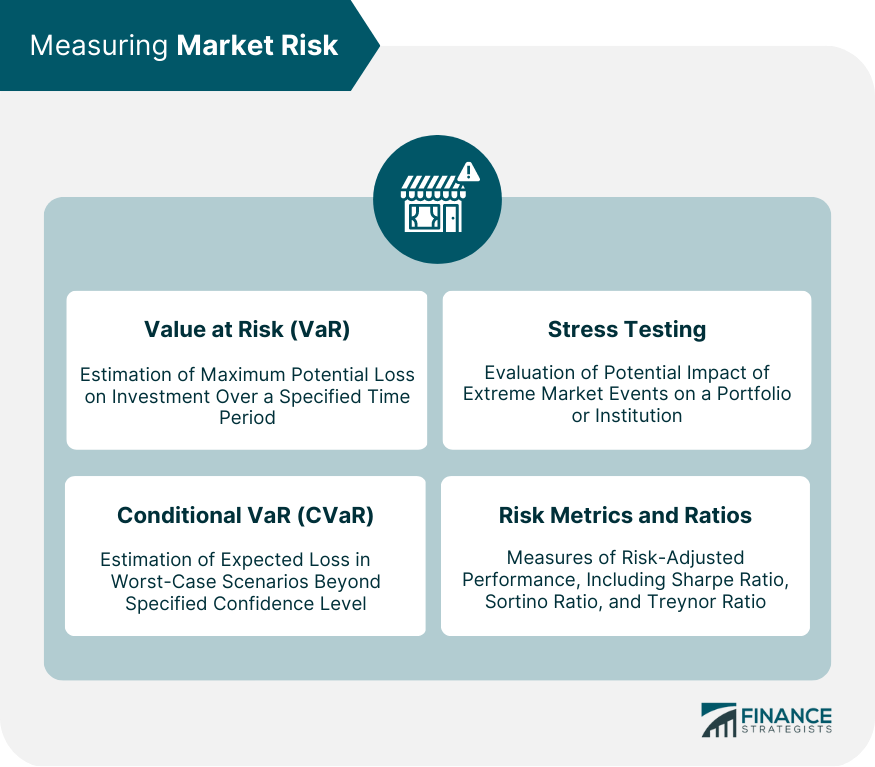

Measuring Market Risk

Value at Risk (VaR)

Conditional Value at Risk (CVaR)

Stress Testing

Risk Metrics and Ratios

Sharpe Ratio

Sortino Ratio

Treynor Ratio

Market Risk Management Strategies

Diversification

Definition and Benefits

Portfolio Diversification Methods

Hedging

Definition and Examples

Common Hedging Instruments

Asset Allocation

Definition and Importance

Strategic and Tactical Asset Allocation

Risk Monitoring and Reporting

Importance of Regular Risk Monitoring

Key Risk Indicators and Reporting

Regulatory Framework for Market Risk

Basel III Framework

Dodd-Frank Act

The Bottom Line

Market Risk FAQs

Market risk refers to the potential for losses due to factors that affect the overall performance of financial markets, such as economic conditions, political events, and market sentiment. It is important for investors and businesses to understand and manage market risk to protect their investments, make informed decisions, and optimize their returns.

The four main types of market risk are equity risk, interest rate risk, currency risk, and commodity risk. Each type arises from different factors and can impact a portfolio's performance in unique ways, making it essential for investors and businesses to manage these risks effectively.

Investors can measure market risk using various metrics, such as Value at Risk (VaR), Conditional Value at Risk (CVaR), and risk-adjusted performance ratios like the Sharpe, Sortino, and Treynor ratios. Additionally, stress testing can help assess the potential impact of extreme market events on a portfolio.

Some common strategies for managing market risk include diversification, hedging, asset allocation, and regular risk monitoring and reporting. These strategies help investors mitigate the impact of market risk, reduce potential losses, and achieve their financial goals.

Regulatory frameworks like Basel III and the Dodd-Frank Act aim to enhance financial stability and promote investor confidence by imposing more stringent capital requirements, liquidity standards, and leverage ratios on banks and financial institutions. They also include specific requirements for managing market risks, such as the use of standardized risk measurement models, enhanced disclosure requirements, and stress testing.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.