Market Volatility is a financial term that refers to the degree of fluctuation in the prices of securities, assets, or financial instruments within a specific market or across various markets over a given period of time. It is often measured by calculating the standard deviation or average true range of price changes and serves as an indicator of the inherent risk, uncertainty, and instability in market conditions. High market volatility is characterized by rapid and significant price swings, while low market volatility indicates a more stable and consistent price movement. Market participants, such as investors and traders, closely monitor market volatility to make informed decisions and manage their risk exposure in response to changing market dynamics. Understanding market volatility is critical for investors because it influences the risk and potential returns associated with an investment. High volatility can lead to larger price swings, while low volatility indicates more stable and predictable price movements. By grasping the concept of market volatility, investors can make more informed decisions and develop strategies to manage risk effectively. Various factors contribute to market volatility, including economic, political, and psychological factors. These factors can influence investor sentiment and cause price fluctuations in financial markets. Economic indicators, such as GDP growth, unemployment rates, and consumer spending, can influence market volatility. Significant changes in these indicators can lead to increased uncertainty and cause fluctuations in asset prices. Inflation can cause market volatility because it impacts interest rates, consumer spending, and business investment. High inflation may lead to higher interest rates, which can negatively impact stock prices, while low inflation may signal economic stagnation, creating uncertainty in the market. Interest rate changes can cause market volatility as they impact the cost of borrowing and the discount rate used to value future cash flows. When central banks raise or lower interest rates, the market often reacts with increased price fluctuations. Elections can cause market volatility due to the uncertainty surrounding potential policy changes and their impact on the economy. Markets often experience increased volatility in the run-up to and the aftermath of elections. Government policy changes, such as tax reforms, regulatory shifts, and trade policies, can influence market volatility. These changes can create uncertainty among investors, leading to increased price fluctuations in financial markets. Geopolitical events, such as wars, terrorist attacks, or diplomatic tensions, can significantly impact market volatility. These events can create uncertainty and fear among investors, leading to increased trading activity and price fluctuations. Investor sentiment plays a significant role in market volatility. When investors are optimistic, they tend to buy more assets, pushing prices higher. Conversely, when investors are pessimistic, they may sell their holdings, causing prices to fall. Herd mentality refers to the tendency of investors to follow the actions of the majority, either buying or selling assets. This behavior can exacerbate market volatility, as it often leads to overreactions and sharp price movements. Fear and greed are powerful emotions that can drive market volatility. When investors become fearful, they may sell their investments, causing prices to drop. On the other hand, when investors become greedy, they may drive prices higher by buying more assets. Market volatility affects the risk and potential returns associated with an investment. High volatility may result in larger price swings, providing opportunities for higher returns but also increasing the risk of losses. Low volatility may indicate more stable price movements but with potentially lower returns. Market volatility can impact investors' portfolio management strategies. In periods of high volatility, investors may adjust their portfolios to mitigate risk by rebalancing, diversifying, or employing hedging strategies. Market volatility can impact businesses' ability to raise capital through equity or debt financing. During periods of high volatility, investors may be more risk-averse, making it more challenging for businesses to secure funding. Market volatility can influence business planning and decision-making, as it can create uncertainty about future economic conditions. In response to increased market volatility, businesses may adjust their plans, such as delaying investments or cutting costs. Market volatility can affect consumer and business confidence, which in turn can impact economic growth. High volatility may cause consumers and businesses to become more cautious in their spending and investment decisions, potentially slowing economic growth. Market volatility can influence economic growth both positively and negatively. While periods of high volatility may lead to decreased consumer and business confidence, they can also provide The VIX, also known as the "fear index," is a widely-used measure of market volatility. It represents the market's expectation of 30-day volatility for the S&P 500 index and is calculated using option prices. In addition to the VIX, there are various other volatility indexes that measure market volatility for different asset classes and geographies, such as the Nasdaq Volatility Index (VXN) and the Cboe Europe 50 Volatility Index (EVIX). Implied volatility is derived from the prices of options and represents the market's expectation of future volatility for an underlying asset. It is often used as a gauge of market sentiment and can help investors assess potential price movements. Historical volatility is a measure of past fluctuations in an asset's price. It is calculated using historical price data, typically over a specified period, such as 30, 60, or 90 days. Historical volatility provides insight into how volatile an asset has been in the past and can help investors make informed decisions about future price movements. Realized volatility is the actual price volatility observed over a specific period. It is calculated by measuring the standard deviation of an asset's price changes during that period. Realized volatility provides a snapshot of how an asset's price has fluctuated over a given time frame, helping investors assess risk and potential returns. The Average True Range (ATR) is a technical analysis indicator that measures market volatility by calculating the average range between an asset's high and low prices over a specified period. ATR can help traders identify potential price movements and manage risk in their trading strategies. It provides opportunities for investors and businesses to capitalize on price fluctuations, potentially stimulating economic growth. Diversification is an essential strategy for managing market volatility. By spreading investments across different asset classes and sectors, investors can reduce the impact of market fluctuations on their portfolios. Options are financial instruments that give investors the right, but not the obligation, to buy or sell an asset at a predetermined price. Investors can use options to hedge their portfolios against market volatility and limit potential losses. Futures contracts are agreements to buy or sell an asset at a future date and a predetermined price. Investors can use futures to hedge their portfolios against market volatility and manage risk. Exchange-traded funds (ETFs) are investment funds that trade on stock exchanges and hold a diversified basket of assets. Investors can use ETFs to hedge their portfolios against market volatility by investing in inverse or volatility-focused ETFs. Adjusting asset allocation is another strategy for managing market volatility. By allocating investments across different asset classes, investors can create a more balanced portfolio that is less susceptible to market fluctuations. Dollar-cost averaging is a strategy that involves investing a fixed amount of money at regular intervals, regardless of market conditions. This approach can help investors manage market volatility by reducing the impact of short-term price fluctuations and smoothing out investment returns over time. Stop-loss orders are instructions to sell an asset when its price reaches a predetermined level. Investors can use stop-loss orders to manage market volatility by limiting potential losses and protecting their profits. Position sizing involves adjusting the size of an investment based on the level of risk associated with the asset. By allocating smaller portions of their portfolios to more volatile assets, investors can manage market volatility and reduce the impact of price fluctuations on their overall portfolio. The risk/reward ratio is a measure of the potential return of an investment compared to its risk. Investors can use the risk/reward ratio to assess and manage market volatility by focusing on investments that offer a favorable balance between potential returns and risks. Contrarian investing is a strategy that involves taking positions that are opposite to the prevailing market sentiment. Contrarian investors seek to profit from market volatility by buying assets when prices are low and selling when prices are high. Trend-following is a trading strategy that involves identifying and following the prevailing market trend, either upward or downward. Trend-following traders aim to profit from market volatility by capturing price movements in the direction of the trend. Swing trading is a short-term trading strategy that focuses on capturing price fluctuations within a larger market trend. Swing traders aim to profit from market volatility by buying low and selling high or selling short and covering their positions when prices are lower. Day trading is a trading strategy that involves buying and selling financial instruments within the same trading day. Day traders seek to profit from market volatility by capitalizing on intraday price movements. Scalping is a high-frequency trading strategy that involves making numerous small trades throughout the trading day. Scalpers aim to profit from market volatility by exploiting small price movements and quickly closing their positions to limit risk. Market volatility is an essential aspect of financial markets, influenced by various economic, political, and psychological factors. Measuring market volatility using tools such as volatility indexes, implied volatility, historical volatility, realized volatility and the Average True Range (ATR) is crucial for investors to make informed decisions. Market volatility affects investors, businesses, and the overall economy, impacting risk, potential returns, and economic growth. Effective strategies for managing market volatility include diversification, hedging, asset allocation, dollar-cost averaging, and risk management techniques. Trading strategies, such as contrarian investing, trend-following, swing trading, day trading, and scalping, can also help investors navigate market volatility. Understanding market volatility and employing appropriate strategies can significantly enhance investment outcomes and optimize portfolio performance.Definition of Market Volatility

Importance of Understanding Market Volatility

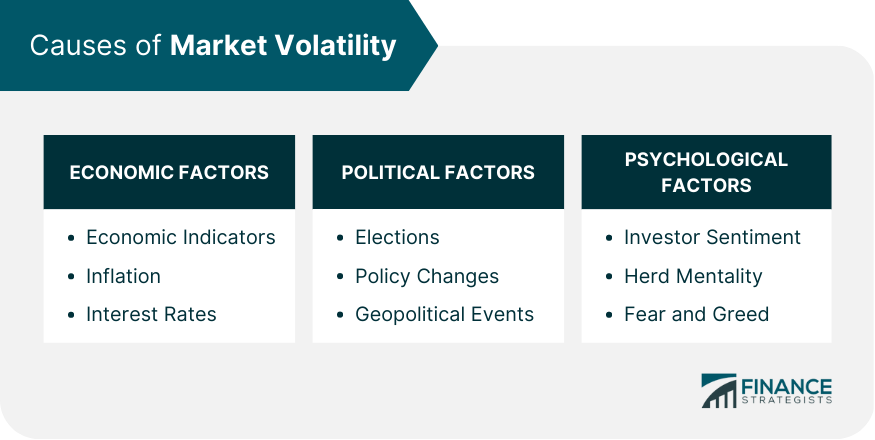

Factors Affecting Market Volatility

Causes of Market Volatility

Economic Factors

Economic Indicators

Inflation

Interest Rates

Political Factors

Elections

Policy Changes

Geopolitical Events

Psychological Factors

Investor Sentiment

Herd Mentality

Fear and Greed

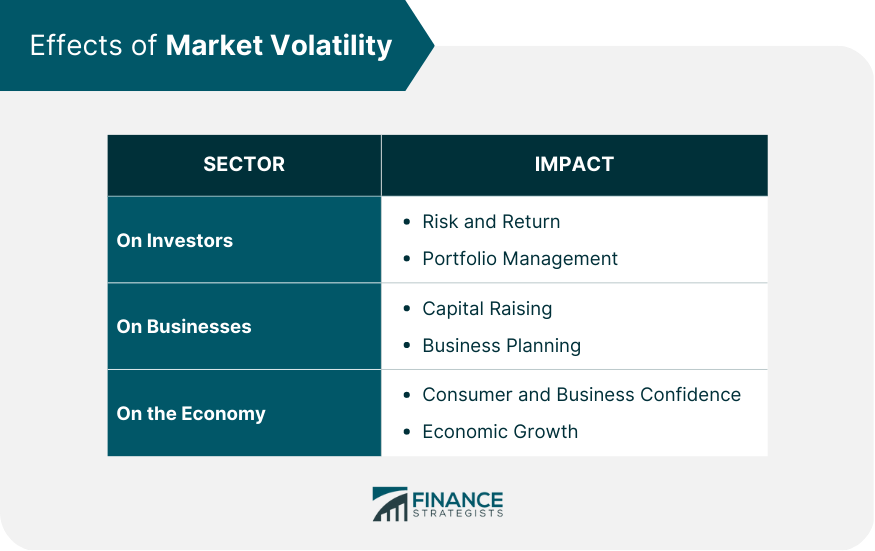

Effects of Market Volatility

Impact on Investors

Risk and Return

Portfolio Management

Impact on Businesses

Capital Raising

Business Planning

Impact on the Economy

Consumer and Business Confidence

Economic Growth

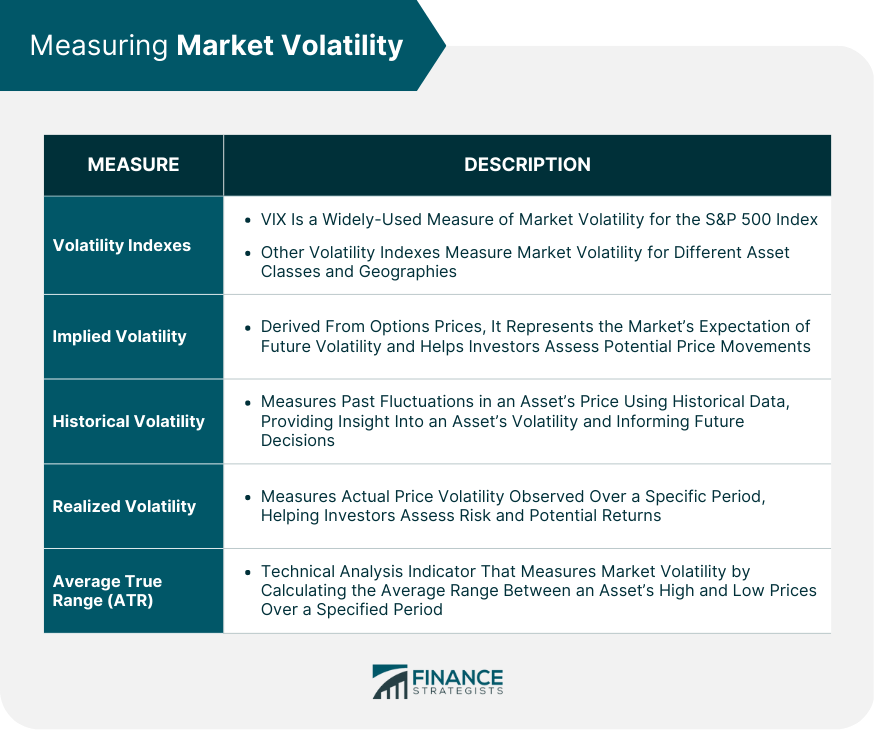

Measuring Market Volatility

Volatility Indexes

VIX (CBOE Volatility Index)

Other Volatility Indexes

Implied Volatility

Historical Volatility

Realized Volatility

Average True Range (ATR)

Managing Market Volatility

Diversification

Hedging Strategies

Options

Futures

ETFs

Asset Allocation

Dollar-Cost Averaging

Risk Management Techniques

Stop-Loss Orders

Position Sizing

Risk/Reward Ratio

Market Volatility and Trading Strategies

Contrarian Investing

Trend-Following

Swing Trading

Day Trading

Scalping

Conclusion

Market Volatility FAQs

Market volatility refers to the degree of fluctuation in the prices of financial instruments within a specific period. Understanding market volatility is important for investors because it influences the risk and potential returns associated with an investment, helping them make informed decisions and develop effective strategies to manage risk.

Various factors contribute to market volatility, including economic factors (such as economic indicators, inflation, and interest rates), political factors (like elections, policy changes, and geopolitical events), and psychological factors (including investor sentiment, herd mentality, and fear and greed).

Investors can measure market volatility using various tools, such as volatility indexes (like the VIX), implied volatility, historical volatility, realized volatility, and the Average True Range (ATR). These measurements help investors assess potential price movements and gauge market sentiment.

Strategies for managing market volatility include diversification, hedging (using options, futures, or ETFs), asset allocation, dollar-cost averaging, and risk management techniques (such as stop-loss orders, position sizing, and risk/reward ratio analysis). These strategies help investors mitigate risk and optimize their investment outcomes.

Trading strategies, such as contrarian investing, trend-following, swing trading, day trading, and scalping, can help investors navigate market volatility by capitalizing on price fluctuations and providing opportunities for profit. These strategies enable investors to take advantage of market volatility and improve their overall portfolio performance.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.