What Is Momentum Risk Premium?

The momentum risk premium is a phenomenon observed in financial markets where assets that have performed well in the recent past tend to continue to perform well in the near future, and assets that have performed poorly tend to continue to perform poorly.

This creates a positive correlation between the past and future returns of the same assets, known as "momentum."

The momentum risk premium is the excess return that investors can earn by systematically buying assets that have exhibited positive momentum and selling assets that have exhibited negative momentum.

This premium is considered a type of "anomaly" or market inefficiency, as it contradicts the traditional finance theory that assets' past performance should not predict future returns.

Momentum Effect

Momentum in the Stock Market

Momentum is a phenomenon observed in financial markets, where the past performance of an asset tends to influence its future performance.

In the context of the stock market, momentum implies that stocks with strong recent returns tend to continue outperforming, while those with weak recent returns tend to continue underperforming.

Historical Evidence of the Momentum Effect

Numerous studies have documented the presence of the momentum effect across different time periods and markets.

The seminal work by Jegadeesh and Titman (1993) demonstrated that a momentum strategy, which involves buying past winners and selling past losers, generates significant positive returns in the U.S. stock market.

Subsequent research has provided further evidence supporting the existence of the momentum effect in international equity markets, as well as other asset classes such as fixed income, commodities, and real estate.

Factors Contributing to the Momentum Effect

Various factors have been proposed to explain the momentum effect in financial markets, including:

Investor Behavior

Behavioral biases such as overconfidence, anchoring, and availability bias can lead to the persistence of trends in asset prices, thereby contributing to the momentum effect.

Market Structure

Institutional investors, such as mutual funds and pension funds, may contribute to the momentum by following certain investment styles or trading strategies that favor stocks with strong recent performance.

Information Dissemination

The gradual dissemination of information across market participants can lead to the persistence of price trends, as investors react to new information over time.

Calculating Momentum Risk Premium

Identification of Momentum Stocks

To calculate the momentum risk premium, it is essential to identify stocks that exhibit momentum characteristics. This typically involves ranking stocks based on their past returns over a specific look-back period (e.g., 6 or 12 months).

Formation of Momentum Portfolios

Once momentum stocks have been identified, investors can form portfolios by taking long positions in high-momentum stocks and short positions in low-momentum stocks. Portfolios can be constructed using equal-weighted or value-weighted approaches.

Performance Measurement

The performance of the momentum strategy is typically assessed by comparing its risk-adjusted returns to those of a benchmark, such as the market portfolio or a passive index.

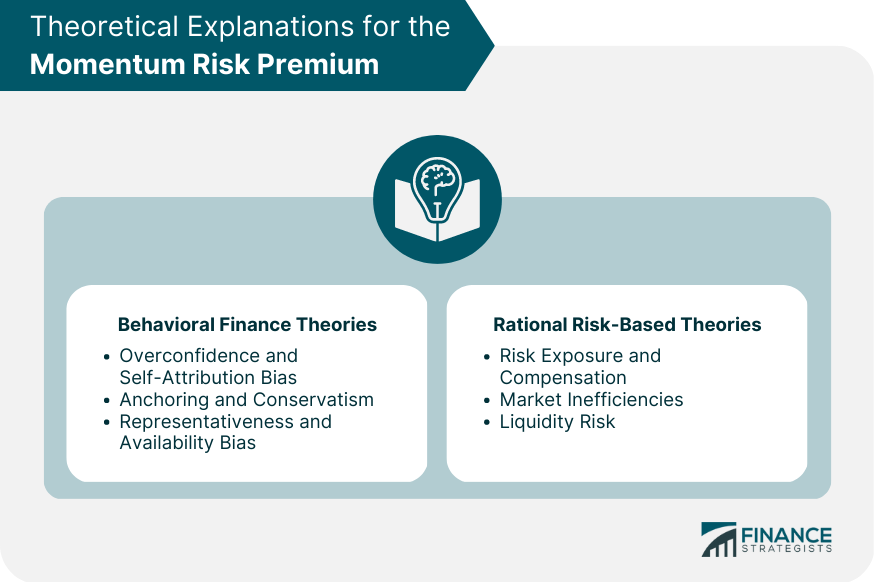

Theoretical Explanations for the Momentum Risk Premium

Behavioral Finance Theories

Behavioral finance theories suggest that cognitive biases among investors can lead to the momentum effect. Some key behavioral explanations include:

Overconfidence and Self-Attribution Bias

Investors may overestimate their ability to interpret information correctly, leading them to place undue weight on recent performance when making investment decisions.

Anchoring and Conservatism

Investors may anchor their expectations to past information and adjust them too slowly in response to new information, resulting in the persistence of price trends.

Representativeness and Availability Bias

Investors may rely on readily available information or focus on recent events, leading them to extrapolate recent performance into the future.

Rational Risk-Based Theories

Rational risk-based theories propose that the momentum risk premium arises due to differences in risk exposure among stocks or inefficiencies in the market. Some key risk-based explanations include:

Risk Exposure and Compensation

High-momentum stocks may be riskier than low-momentum stocks, and the momentum risk premium may represent compensation for bearing this additional risk.

Market Inefficiencies

The momentum effect could be a consequence of market inefficiencies, where mispricings persist due to slow information diffusion or other frictions in the market.

Liquidity Risk

High-momentum stocks may be subject to greater liquidity risk, and the momentum risk premium could represent compensation for bearing this risk.

Momentum Risk Premium and Portfolio Management

Diversification Benefits

Incorporating momentum strategies into a portfolio can potentially enhance diversification, as momentum returns tend to exhibit low correlations with traditional risk factors such as market, size, and value.

Tactical Asset Allocation Strategies

Investors can exploit the momentum risk premium by implementing tactical asset allocation strategies that involve periodically rebalancing their portfolios based on the recent performance of different asset classes or investment styles.

Risk Management Considerations

While momentum strategies have been shown to generate positive returns, they can also entail higher levels of risk.

Investors should consider the potential risks associated with momentum strategies, such as increased turnover, transaction costs, and the potential for momentum crashes during periods of market stress.

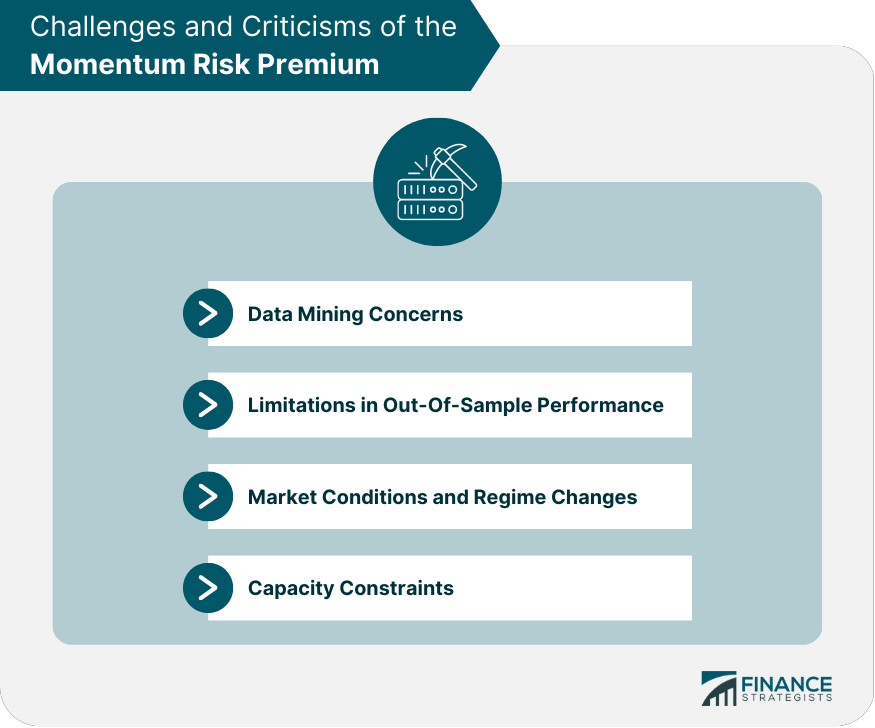

Challenges and Criticisms of the Momentum Risk Premium

Data Mining Concerns

Some critics argue that the momentum risk premium may be a result of data mining, where researchers discover spurious patterns in the data due to multiple testing or selection biases.

Limitations in Out-of-Sample Performance

Although momentum strategies have demonstrated strong historical performance, there is no guarantee that they will continue to generate positive returns in the future. Investors should be cautious when extrapolating past performance into future expectations.

Market Conditions and Regime Changes

The performance of momentum strategies may be sensitive to changes in market conditions or regime shifts, such as changes in market sentiment, interest rates, or economic cycles.

Capacity Constraints

As more investors become aware of the momentum risk premium and seek to exploit it, capacity constraints may arise, leading to a reduction in the profitability of momentum strategies.

Conclusion

The momentum risk premium is an intriguing market anomaly that has attracted significant attention from both practitioners and researchers.

While there is considerable empirical evidence supporting the existence of the momentum risk premium across various markets and asset classes, investors should be mindful of the potential risks and challenges associated with momentum strategies.

Future research may focus on better understanding the underlying drivers of the momentum effect, as well as identifying ways to enhance the risk-adjusted performance of momentum strategies in the context of portfolio management.

Momentum Risk Premium FAQs

The momentum risk premium is a market anomaly referring to the tendency of stocks with strong recent performance to continue outperforming, and those with weak recent performance to continue underperforming. It is important because understanding and exploiting this phenomenon can potentially enhance portfolio returns, diversification, and risk management.

The momentum risk premium is calculated by first identifying stocks with momentum characteristics based on their past returns. Then, portfolios are formed by taking long positions in high-momentum stocks and short positions in low-momentum stocks. The performance of the momentum strategy is assessed by comparing its risk-adjusted returns to a benchmark, such as the market portfolio or a passive index.

The main theoretical explanations for the momentum risk premium can be grouped into two categories: behavioral finance theories and rational risk-based theories. Behavioral finance theories attribute the momentum effect to cognitive biases among investors, while rational risk-based theories suggest that the momentum risk premium arises due to differences in risk exposure among stocks or market inefficiencies.

Incorporating momentum strategies into a portfolio can enhance diversification and provide investors with a way to exploit the momentum risk premium through tactical asset allocation strategies. However, investors should also be aware of the potential risks associated with these strategies, such as increased turnover and transaction costs, as well as the potential for momentum crashes during market stress.

Some challenges and criticisms related to the momentum risk premium include data mining concerns, limitations in out-of-sample performance, sensitivity to market conditions and regime changes, and capacity constraints. Investors should be mindful of these issues when considering the implementation of momentum strategies in their portfolios.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.