Overconfidence bias is a cognitive bias where individuals tend to overestimate their abilities, knowledge, and the precision of their beliefs. In the context of finance and investing, this bias can lead to suboptimal decisions and increased risk-taking. Understanding overconfidence bias is crucial for both individual investors and professionals in the finance industry to make informed and rational decisions. The illusion of control occurs when individuals believe they have more control over outcomes than they actually do. This can lead to overconfidence in their ability to influence the outcomes of their investments. Confirmation bias refers to the tendency to favor information that confirms preexisting beliefs and to ignore or discount contradictory evidence. This can result in overconfidence as investors may only seek out information that supports their investment decisions while dismissing conflicting data. Hindsight bias is the tendency to believe, after an event has occurred, that one would have predicted or expected the outcome. This can lead to overconfidence, as investors may believe they are better at predicting future events based on their perceived ability to understand past events. Self-attribution bias is the inclination to attribute positive outcomes to one's own skills and knowledge while attributing negative outcomes to external factors. This can cause overconfidence as investors may believe their successes are due to their abilities while dismissing their failures as out of their control. Limited attention refers to the tendency to focus on a small subset of information, while the availability heuristic is the tendency to rely on information that is easily accessible. Both of these can lead to overconfidence, as investors may make decisions based on limited information and fail to consider alternative viewpoints or data. Overconfidence can lead investors to trade more frequently than necessary, as they may believe they can consistently outperform the market. Excessive trading can result in higher transaction costs and taxes, ultimately reducing investment returns. Overconfident investors may concentrate their investments on a small number of assets, believing they can accurately predict the performance of those assets. This lack of diversification can increase portfolio risk and vulnerability to market fluctuations. Overconfidence can cause investors to underestimate the risks associated with their investments. This can lead to excessive risk-taking and potential financial losses. Overconfident investors may overvalue their skills, leading them to believe they can consistently outperform the market. This can result in poor investment decisions and reduced returns. Overconfidence can cause investors to disregard expert advice, as they may believe their own knowledge is superior. This can result in missed opportunities and poor investment decisions. Individuals affected by overconfidence bias may overestimate their financial knowledge, believing they are better equipped to make investment decisions than they truly are. Overconfident investors may place too much emphasis on past performance, believing it to be indicative of future results. This can lead to an overreliance on historical data and a disregard for current market conditions. Overconfidence can lead to the setting of unrealistic financial goals, as individuals may believe they can achieve higher returns than are reasonably attainable. Individuals affected by overconfidence bias may be more likely to dismiss professional advice, believing their own knowledge to be superior. Overconfidence bias can also affect finance professionals, such as portfolio managers and analysts, leading them to make overly optimistic forecasts and investment decisions. Overconfident finance professionals may be more likely to overestimate the accuracy of their financial forecasts. This can result in misguided investment decisions and a failure to appropriately manage risk. Overconfidence can contribute to market inefficiencies, as investors may follow the decisions of other overconfident market participants, resulting in herding behavior. This can lead to asset price bubbles and subsequent market crashes. Overconfidence bias can also affect corporate decision-makers, leading them to overestimate the returns on investment projects and undertake excessively risky ventures. This can result in suboptimal capital allocation and decreased shareholder value. Recognizing one's own limitations and biases is essential in combating overconfidence. Investors should practice humility and self-awareness, acknowledging that they are not infallible and that they may not always have the best information or make the best decisions. Diversification is a key strategy for mitigating the risks associated with overconfidence. By spreading investments across a variety of asset classes and sectors, investors can reduce their exposure to any single risk factor. Consulting with objective third parties, such as financial advisors, can help investors overcome overconfidence bias. These professionals can provide unbiased feedback and guidance based on their expertise and knowledge of the markets. Focusing on long-term investment goals and strategies can help investors avoid the pitfalls of overconfidence. By maintaining a long-term perspective, investors are less likely to make impulsive decisions based on short-term market fluctuations. Behavioral finance techniques, such as pre-commitment strategies and the use of decision-making checklists, can help investors minimize the impact of overconfidence on their financial decisions. Overconfidence bias is a pervasive cognitive bias that can lead to suboptimal financial decisions and increased risk-taking. By understanding the causes and effects of overconfidence bias, investors and finance professionals can take steps to mitigate its impact on their decision-making. Practicing humility and self-awareness, diversifying investments, seeking objective feedback and expert advice, developing a long-term investment strategy, and implementing behavioral finance techniques are all strategies that can help investors overcome the pitfalls of overconfidence bias. Overconfidence Bias Overview

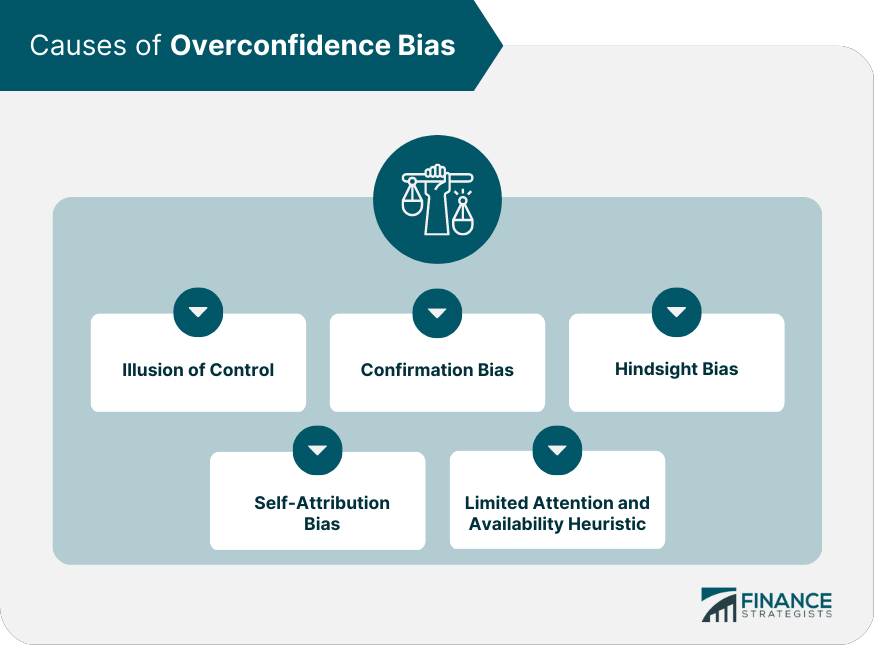

Causes of Overconfidence Bias

Illusion of Control

Confirmation Bias

Hindsight Bias

Self-Attribution Bias

Limited Attention and Availability Heuristic

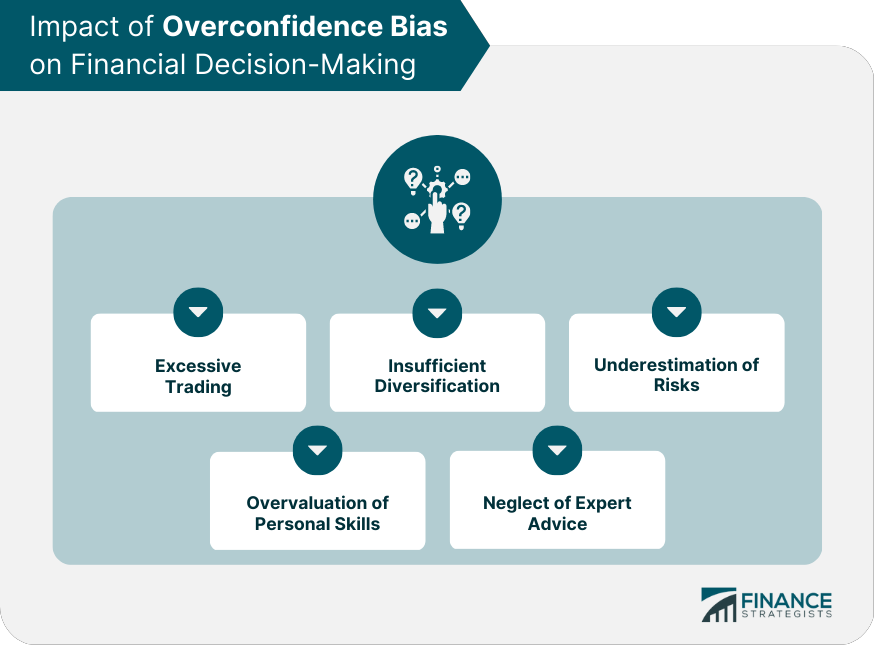

Impact of Overconfidence Bias on Financial Decision-Making

Excessive Trading

Insufficient Diversification

Underestimation of Risks

Overvaluation of Personal Skills

Neglect of Expert Advice

Identifying Overconfidence Bias in Personal Finance

Overestimation of Financial Knowledge

Overemphasis on Past Performance

Unrealistic Financial Goals

Disregard for Professional Advice

Overconfidence Bias in Professional Finance

Effects on Portfolio Managers and Analysts

Overconfidence in Financial Forecasts

Market Inefficiencies and Herding Behavior

Corporate Overconfidence and Investment Decisions

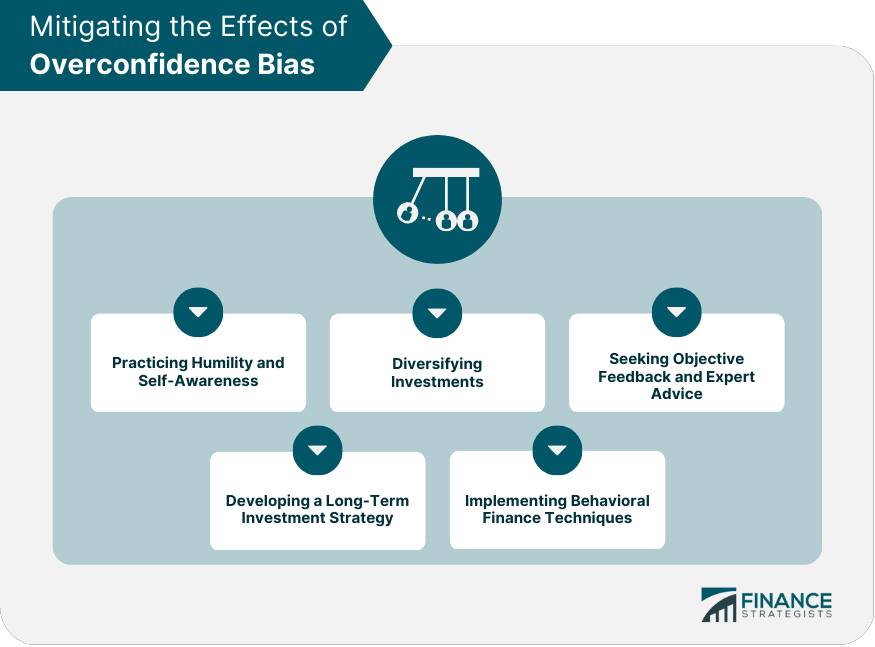

Mitigating the Effects of Overconfidence Bias

Practicing Humility and Self-Awareness

Diversifying Investments

Seeking Objective Feedback and Expert Advice

Developing a Long-Term Investment Strategy

Implementing Behavioral Finance Techniques

The Bottom Line

Overconfidence Bias FAQs

Overconfidence bias in finance refers to the tendency of investors to overestimate their abilities, knowledge, and the precision of their beliefs, leading to suboptimal financial decisions and increased risk-taking.

Overconfidence bias can lead to excessive trading, insufficient diversification, underestimation of risks, overvaluation of personal skills, and neglect of expert advice, among other impacts.

Overconfidence bias can be identified in personal finance through overestimation of financial knowledge, overemphasis on past performance, setting unrealistic financial goals, and disregarding professional advice.

Strategies for mitigating the effects of overconfidence bias include practicing humility and self-awareness, diversifying investments, seeking objective feedback and expert advice, developing a long-term investment strategy, and implementing behavioral finance techniques.

Practicing humility and self-awareness, diversifying investments, seeking objective feedback and expert advice, developing a long-term investment strategy, and implementing behavioral finance techniques are all strategies that can help investors overcome the pitfalls of overconfidence bias.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.