The Provision for Credit Losses (PCL) is an expense set aside by financial institutions to cover potential losses on loans, credit exposures, and other financial instruments. This reserve is established based on the institution's expectations of future credit losses and serves as a buffer against potential financial setbacks due to borrower defaults or deteriorating credit quality. The process of estimating and setting aside provisions for credit losses is critical for maintaining a healthy financial institution and ensuring that it can withstand adverse economic conditions. In wealth management, the PCL plays a crucial role in preserving the financial stability of institutions that manage clients' assets. Adequately estimating and managing provisions for credit losses is essential to safeguarding clients' wealth and minimizing the risk of unexpected losses due to credit events. By maintaining an appropriate level of PCL, wealth management firms can ensure that they have sufficient resources to absorb potential credit losses, protecting their clients' investments and maintaining their reputation in the market. The primary purpose of the Provision for Credit Losses (PCL) is to protect financial institutions from potential credit losses, which can arise from borrower defaults, deteriorating credit quality, or other adverse events. By setting aside funds to cover these losses, institutions can ensure that they have sufficient resources to weather unexpected financial challenges and maintain their financial stability. In addition to serving as a financial buffer, the PCL also helps institutions comply with regulatory requirements and accounting standards. Regulators and accounting bodies require financial institutions to maintain an appropriate level of provisions for credit losses to promote transparency and ensure the safety and soundness of the financial system. Expected Credit Losses (ECL) represent an estimate of the potential credit losses that a financial institution can expect to incur over a specific period, typically one year. This component of PCL considers both the likelihood of default and the loss given default, which is the amount that the institution would lose if a borrower were to default on their obligations. By estimating ECL, financial institutions can proactively manage their credit risk exposure, making informed decisions about their lending activities and setting aside an appropriate level of PCL to cover potential losses. Specific credit losses are provisions set aside for individual loans or credit exposures that exhibit signs of significant deterioration in credit quality. These provisions are tailored to the unique circumstances of each borrower, taking into account factors such as payment history, financial performance, and credit rating. By setting aside specific provisions for credit losses, financial institutions can address the unique risks associated with individual borrowers and ensure that they have adequate resources to cover potential losses in their loan portfolio. Collective credit losses are provisions set aside for groups of loans or credit exposures with similar risk characteristics. These provisions are based on historical loss experience, current economic conditions, and other relevant factors that may influence the credit quality of the group as a whole. By establishing collective provisions for credit losses, financial institutions can address the aggregate risk associated with their loan portfolio and ensure that they have sufficient resources to cover potential losses across all borrowers. The Incurred Loss Model is a traditional method for estimating PCL, in which provisions are set aside only when a loss event has occurred or is considered probable. This model focuses on past events and historical loss experience, resulting in a more reactive approach to credit risk management. However, the Incurred Loss Model has been criticized for its reliance on historical data and its potential to underestimate future credit losses, especially during periods of economic stress. The Expected Loss Model is an alternative approach to estimating PCL that considers both the probability of default and the loss given default for each credit exposure. This model incorporates forward-looking information and economic factors, resulting in a more proactive approach to credit risk management. By considering potential future losses rather than focusing solely on past events, the Expected Loss Model can provide a more accurate estimate of PCL and help financial institutions better manage their credit risk exposure. The Current Expected Credit Loss (CECL) Model is a recent development in PCL estimation that aims to address the shortcomings of both the Incurred Loss Model and the Expected Loss Model. The CECL Model requires financial institutions to estimate credit losses over the entire life of a loan or credit exposure, considering both historical loss experience and forward-looking information. By incorporating a broader range of data and focusing on the entire life of a loan, the CECL Model provides a more comprehensive and accurate estimate of PCL, helping financial institutions better manage their credit risk exposure. Implementing a robust credit risk assessment process is essential for effective PCL management. Financial institutions should develop and maintain a comprehensive credit risk framework that considers both qualitative and quantitative factors, such as borrower creditworthiness, collateral value, and macroeconomic conditions. A thorough credit risk assessment can help institutions identify potential credit losses early, allowing them to proactively manage their PCL and minimize the impact of credit events on their financial stability. Regular portfolio monitoring is another critical aspect of PCL management. Financial institutions should regularly review their loan portfolio to identify potential risks and signs of credit deterioration, adjusting their PCL estimates and risk mitigation strategies accordingly. By staying informed about the performance of their loan portfolio and the credit quality of their borrowers, institutions can make timely and informed decisions about PCL management, protecting their financial stability and their clients' wealth. An adequate risk governance framework is essential for effective PCL management. Financial institutions should establish clear policies and procedures for credit risk management, including the estimation and allocation of provisions for credit losses. A well-defined risk governance framework can help ensure that PCL management activities are conducted consistently and transparently, promoting the safety and soundness of the financial institution. Implementing effective risk mitigation strategies is another important aspect of PCL management. Financial institutions should consider a range of risk mitigation techniques, such as collateralization, loan restructuring, and credit insurance, to protect themselves from potential credit losses. By proactively managing their credit risk exposure and implementing appropriate risk mitigation strategies, institutions can reduce the need for PCL and protect their financial stability. Accurate data collection and analysis are critical for effective PCL management. Financial institutions should invest in robust data management systems and analytics tools to ensure that they have access to accurate, timely, and relevant information about their loan portfolio and credit risk exposure. With accurate data and analysis, institutions can make informed decisions about PCL management, adjusting their estimates and risk mitigation strategies as needed to protect their financial stability and their clients' wealth. A Provision for Credit Losses (PCL) is an expense set aside by financial institutions to cover potential losses on loans and credit exposures, protecting their financial stability and ensuring compliance with regulatory requirements. The purpose of PCL is to serve as a financial buffer against potential credit losses, helping institutions maintain their financial stability and comply with regulatory requirements and accounting standards. Best practices for PCL management include robust credit risk assessment, regular portfolio monitoring, adequate risk governance framework, effective risk mitigation strategies, and accurate data collection and analysis. Proper PCL management is essential for the financial stability of institutions, particularly those involved in wealth management. By implementing best practices and staying informed about potential credit risks, financial institutions can protect their clients' wealth and maintain their reputation in the market.What Is the Provision for Credit Losses (PCL)?

Importance of PCL in Wealth Management

Purpose of the Provision for Credit Losses (PCL)

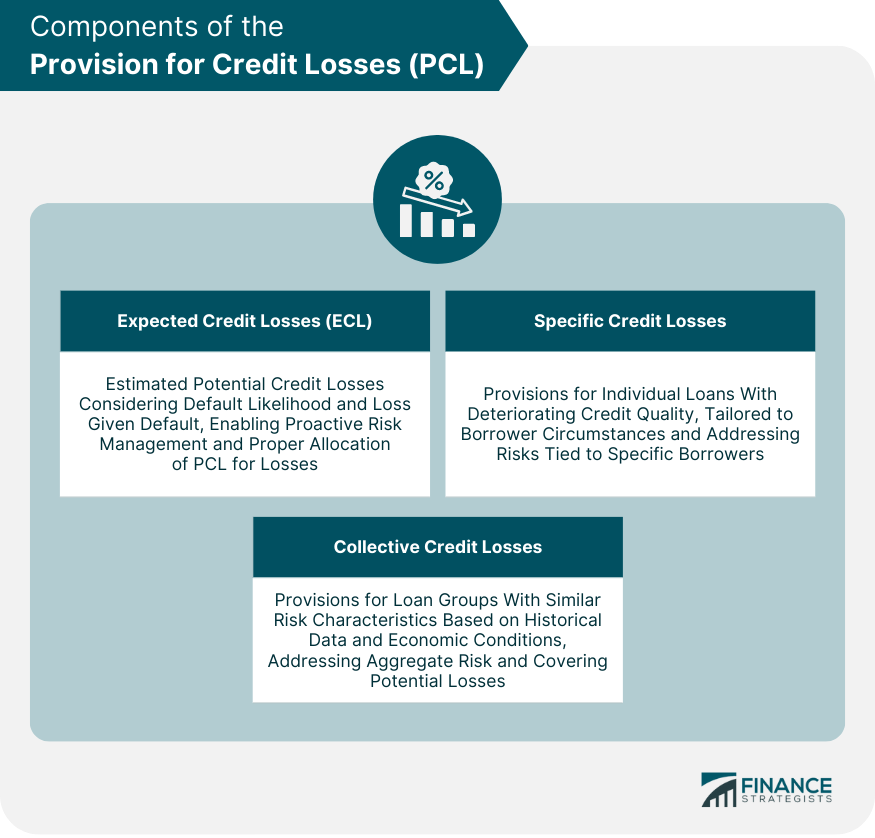

Components of PCL

Expected Credit Losses (ECL)

Specific Credit Losses

Collective Credit Losses

Methods for Estimating PCL

Incurred Loss Model

Expected Loss Model

Current Expected Credit Loss (CECL) Model

Best Practices for PCL Management

Robust Credit Risk Assessment

Regular Portfolio Monitoring

Adequate Risk Governance Framework

Effective Risk Mitigation Strategies

Accurate Data Collection and Analysis

Conclusion

Provision For Credit Losses (PCL) FAQs

A Provision for Credit Losses (PCL) is an expense set aside by financial institutions to cover potential losses on loans and credit exposures, protecting their financial stability and ensuring compliance with regulatory requirements.

PCL is important in wealth management because it helps preserve the financial stability of institutions that manage clients' assets, safeguarding clients' wealth and minimizing the risk of unexpected losses due to credit events.

The components of PCL include Expected Credit Losses (ECL), Specific Credit Losses, and Collective Credit Losses.

Methods for estimating PCL include the Incurred Loss Model, the Expected Loss Model, and the Current Expected Credit Loss (CECL) Model.

Best practices for PCL management include robust credit risk assessment, regular portfolio monitoring, adequate risk governance framework, effective risk mitigation strategies, and accurate data collection and analysis.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.