The real estate risk premium is the excess return that investors demand for investing in real estate compared to investing in a risk-free asset. The real estate risk premium reflects the additional risk that investors must take on to invest in real estate. Understanding the real estate risk premium is important for investors because it provides insight into the additional return that investors can expect to earn from investing in real estate compared to other asset classes. The real estate risk premium can also help investors to evaluate the risk of investing in a particular real estate asset. Economic factors such as interest rates, inflation, and economic growth can impact the real estate risk premium. Higher interest rates and inflation can increase the cost of borrowing and reduce demand for real estate, while economic growth can increase demand for real estate. Political factors such as government policies and regulations can impact the real estate risk premium. Changes in tax laws or zoning regulations can impact the value and demand for real estate assets. Market cycles can impact the real estate risk premium. During a real estate boom, investors may be willing to pay a higher price for real estate assets, while during a downturn, investors may demand a higher return for the additional risk. Property-specific risk factors such as age, condition, and location can impact the real estate risk premium. Older or poorly maintained properties may have a higher risk of maintenance issues or obsolescence, while properties in high-risk locations such as flood zones or earthquake zones may have a higher risk of damage. Location is a key determinant of the real estate risk premium. Properties in desirable locations such as urban centers or high-growth areas may command a higher price and lower risk premium, while properties in less desirable locations may have a higher risk premium. Physical characteristics such as building quality, size, and layout can impact the real estate risk premium. High-quality buildings with modern amenities and efficient layouts may have a lower risk premium compared to older or poorly maintained buildings. Management quality can impact the real estate risk premium. Properties with professional and experienced management teams may have a lower risk premium compared to properties with inexperienced or ineffective management. The real estate risk premium can be calculated by subtracting the risk-free rate from the expected return of a real estate investment. The risk-free rate is the rate of return on a risk-free asset such as a U.S. Treasury bond. Understanding the real estate risk premium is important for comparing the return and risk of real estate investments with other asset classes such as stocks, bonds, and commodities. The real estate risk premium can impact investment decisions by influencing the expected return and risk of a real estate investment. Investors may demand a higher return or require additional risk mitigation strategies for real estate investments with a higher risk premium. Risk management strategies such as insurance, maintenance, and property management can help to mitigate property-specific and physical risk factors. One of the most common risk management strategies for real assets is to purchase insurance. This can include property insurance to protect against damage from natural disasters, liability insurance to protect against lawsuits, and even crop insurance for agricultural investments. By purchasing insurance, you can help protect your investment from unexpected events that could cause financial losses. Another important risk management strategy for real assets is to invest in regular maintenance and upkeep. This can include routine repairs and upgrades to keep your property in good condition, as well as preventative measures to avoid potential problems. By investing in maintenance, you can help ensure that your real assets continue to generate income and appreciate in value over time. If you own rental properties or other real assets that require ongoing management, hiring a professional property manager can be an effective risk management strategy. A property manager can handle tenant screening and leasing, rent collection, property maintenance, and other tasks, allowing you to focus on other aspects of your investment strategy. With a skilled property manager in place, you can minimize the risks associated with managing real assets and maximize your potential returns. The real estate risk premium is an important factor in evaluating the expected return and risk of real estate investments. Understanding the real estate risk premium and its determinants can help investors to make informed investment decisions and develop effective risk mitigation strategies. The real estate risk premium is the excess return that investors demand for investing in real estate compared to investing in a risk-free asset. It reflects the additional risk that investors must take on to invest in real estate. Determinants of the real estate risk premium include economic and political factors, market cycles, property-specific risk, location, physical characteristics, and management quality. Investors can mitigate the real estate risk premium through diversification and risk management strategies such as insurance, maintenance, and property management. Overall, understanding the real estate risk premium is essential for investors who seek to invest in real estate and evaluate its potential return and risk. By considering the factors that influence the real estate risk premium and implementing effective risk mitigation strategies, investors can improve their chances of success in real estate investing.Definition of Real Estate Risk Premium

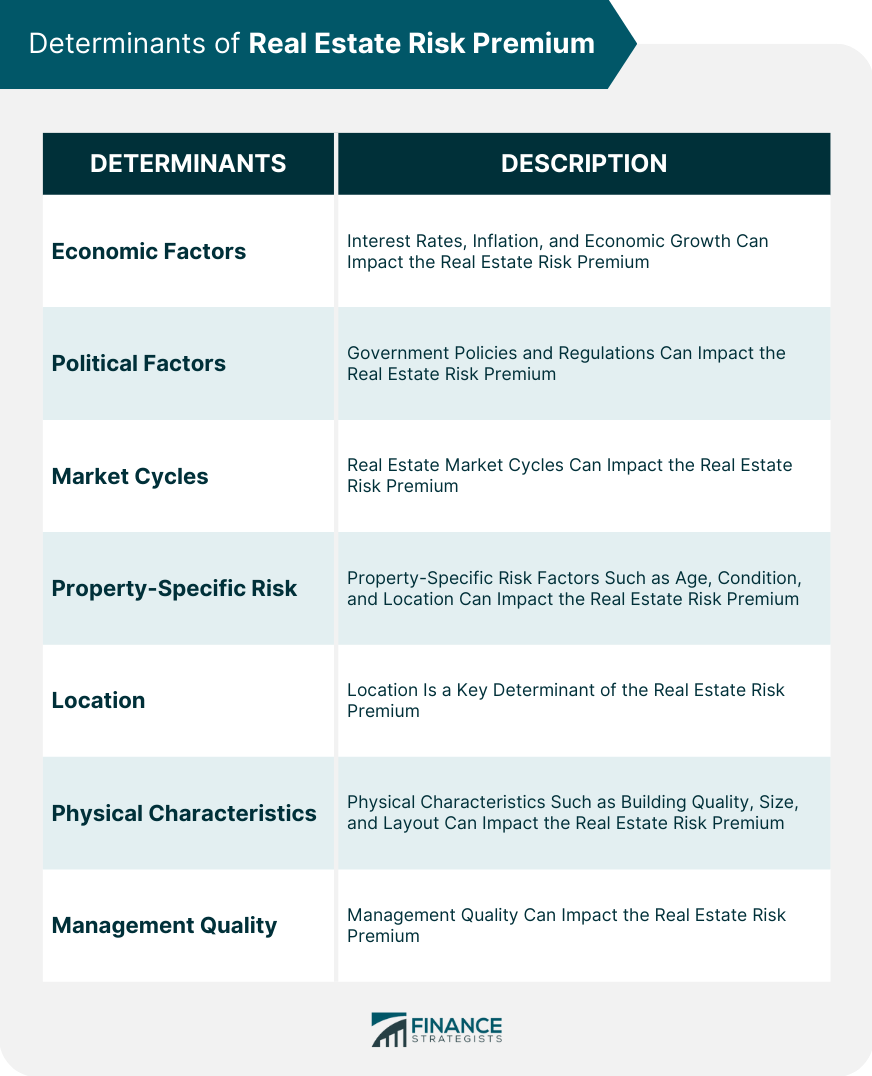

Determinants of Real Estate Risk Premium

Economic Factors

Political Factors

Market Cycles

Property-Specific Risk

Location

Physical Characteristics

Management Quality

Real Estate Risk Premium and Investment Analysis

Calculation of Real Estate Risk Premium

Comparison With Other Asset Classes

Impact on Investment Decisions

Risk Management Strategies

Insurance

Maintenance

Property Management

Final Thoughts

Real Estate Risk Premium FAQs

The real estate risk premium is the additional return on investment that investors expect to receive to compensate for the risks associated with investing in real estate.

The determinants of real estate risk premium include market risk factors such as economic and political factors, market cycles, and property-specific factors such as location, physical characteristics, and management quality.

The real estate risk premium is important because it helps investors make informed decisions about investing in real estate and manage risks associated with real estate investments.

Investors can mitigate real estate risk premium through diversification and risk management strategies such as hedging, insurance, and portfolio optimization.

The real estate risk premium is calculated as the difference between the expected return on a real estate investment and the risk-free rate of return adjusted for inflation. It represents the additional return that an investor expects to receive for bearing the risk of investing in real estate.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.