Risk budgeting is a critical aspect of financial management and portfolio optimization. It involves the process of allocating an organization's or an individual's risk capital across various investments, assets, or strategies to achieve the desired risk-return profile. Unlike traditional asset allocation, which focuses on the allocation of capital to different asset classes, risk budgeting focuses on how much risk is allocated to each investment or asset class. The primary goal of risk budgeting is to balance risks within a portfolio and align them with an investor's risk tolerance, risk appetite, and risk capacity. This article provides a comprehensive overview of risk budgeting in finance, its components, the risk budgeting process, applications, and the challenges and limitations faced by investors and financial institutions. Risk appetite refers to the amount and type of risk an organization or individual is willing to accept in pursuit of their objectives. It is a critical component of risk budgeting, as it determines the overall direction of an investment strategy. Factors that affect risk appetite include an investor's financial goals, investment horizon, and personal circumstances. Risk tolerance is the level of variability in investment returns an investor is willing to withstand. It is an essential component of risk budgeting because it defines the boundaries within which an investor is comfortable operating. Factors that influence risk tolerance include an investor's financial knowledge, investment experience, and emotional temperament. Risk capacity is the ability of an investor or organization to absorb losses without significantly impacting their financial objectives or well-being. Risk capacity is crucial in risk budgeting, as it helps to ensure that an investor does not take on more risk than they can handle. Factors that affect risk capacity include an investor's income, net worth, and financial commitments. The first step in the risk budgeting process is to define the risk objectives, which include the desired risk-return profile, investment constraints, and financial goals. These objectives should be specific, measurable, achievable, relevant, and time-bound (SMART) to facilitate the monitoring and control of risk budgets. After setting risk objectives, investors must identify and categorize the various risks associated with their investment portfolio. These may include market risk, credit risk, liquidity risk, operational risk, and legal and regulatory risk. Categorizing risks allows for a more focused and effective risk management process. Quantitative risk assessment techniques involve the use of statistical models and historical data to estimate the probability and magnitude of potential losses. Some common quantitative methods include: Value at Risk (VaR): VaR is a widely-used risk metric that estimates the potential loss of an investment portfolio over a specific time horizon and at a given confidence level. Stress Testing: Stress testing involves the evaluation of an investment portfolio's performance under extreme market conditions to assess its resilience and identify potential vulnerabilities. Scenario Analysis: Scenario analysis is a technique that examines the potential impact of various hypothetical events on an investment portfolio to identify risks and opportunities. Qualitative risk assessment techniques involve the use of expert judgment, experience, and intuition to assess potential risks. Some common qualitative methods include: Expert Judgement: Experts with domain-specific knowledge provide insights and opinions on potential risks and their impacts on investment portfolios. Risk Rating Systems: Risk rating systems involve the assignment of scores or grades to risks based on their likelihood and impact to facilitate the prioritization and management of risks. Risk budgets are allocated using either a top-down or bottom-up approach: Top-Down Approach: In a top-down approach, the overall risk budget is determined at the portfolio level, and then individual risk budgets are allocated to various assets, strategies, or sectors based on their expected contribution to the portfolio's risk and return profile. Bottom-Up Approach: In a bottom-up approach, individual risk budgets are determined at the asset, strategy, or sector level, and then aggregated to form the overall risk budget. This approach allows for a more granular understanding of the risk drivers within the portfolio. To ensure that the risk budgets are adhered to, investors must establish risk limits and thresholds. These limits act as a control mechanism that prevents the portfolio from exceeding its predetermined risk boundaries, thereby reducing the likelihood of significant losses. Effective monitoring and control of risk budgets require transparent and timely reporting of risk metrics and performance. Regular risk reporting enables stakeholders to make informed decisions and take corrective actions if necessary. Additionally, clear communication of risk budgets and performance results fosters a culture of risk awareness within the organization. In portfolio management, risk budgeting is employed to optimize asset allocation and diversification. By allocating risk budgets across various asset classes, investors can achieve an optimal balance between risk and return, leading to improved portfolio performance. Risk budgeting is also applicable in corporate finance, where it can be used for capital structure optimization and mergers and acquisitions (M&A) decision-making. By allocating risk budgets to different sources of capital and potential M&A targets, companies can optimize their capital structures and minimize the risk associated with M&A transactions. Financial institutions such as banks and insurance companies use risk budgeting to manage their inherent risks, including credit risk, market risk, and operational risk. By allocating risk budgets across various business lines and risk categories, these institutions can maintain their solvency and comply with regulatory requirements. Sovereign wealth funds and pension funds also employ risk budgeting to manage the long-term risks associated with their investment portfolios. By allocating risk budgets across various asset classes and investment strategies, these funds can achieve their long-term financial objectives while minimizing the risk of significant losses. Risk budgeting relies on the availability and quality of historical data for risk assessment and measurement. However, data limitations, such as a lack of sufficient data points or unreliable data sources, can hinder the accuracy and effectiveness of risk budgeting models. Model risk arises from the potential inaccuracies and limitations of the statistical models used in risk budgeting. These models may not accurately capture the complexities and interdependencies of financial markets, leading to incorrect risk estimates and suboptimal risk budget allocations. Investor behavior can introduce biases in the risk budgeting process, leading to suboptimal decision-making. For example, overconfidence, loss aversion, and anchoring can cause investors to underestimate risks or allocate risk budgets inappropriately. Risk budgeting practices must comply with relevant laws and regulations, such as the Basel III framework for banks and the Solvency II directive for insurance companies. Compliance with these regulations can be complex and resource-intensive, potentially limiting the implementation of risk budgeting strategies. Risk budgeting is a vital component of financial management and portfolio optimization. By balancing risks within a portfolio and aligning them with an investor's risk appetite, tolerance, and capacity, risk budgeting helps to achieve desired risk-return profiles. Despite the challenges and limitations associated with data availability, model risk, behavioral biases, and regulatory compliance, risk budgeting remains a critical tool for investors and financial institutions in managing and mitigating risks in a complex and interconnected financial landscape.What Is Risk Budgeting?

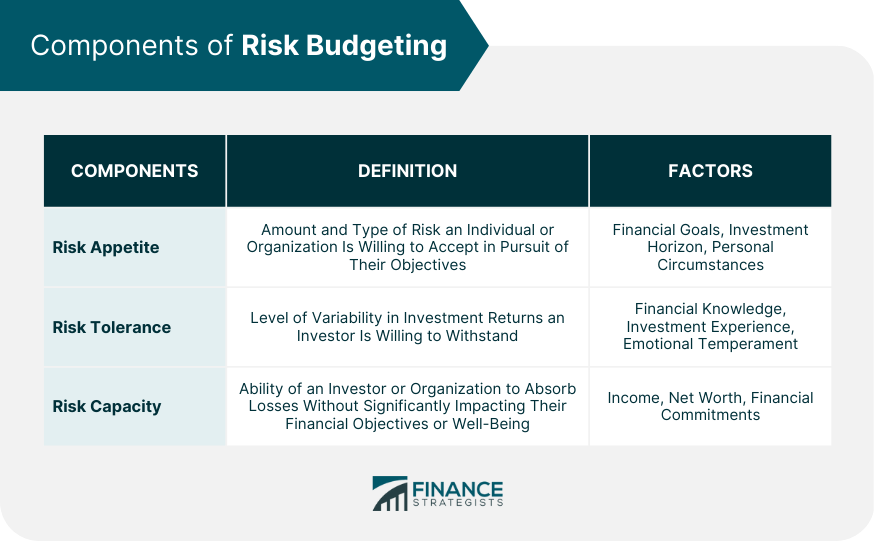

Components of Risk Budgeting

Risk Appetite

Risk Tolerance

Risk Capacity

Risk Budgeting Process

Establishing a Risk Management Framework

Setting Risk Objectives

Identifying and Categorizing Risks

Assessing and Measuring Risks

Quantitative Risk Assessment Techniques

Qualitative Risk Assessment Techniques

Allocating Risk Budgets

Monitoring and Controlling Risk Budgets

Risk Limits and Thresholds

Risk Reporting and Communication

Applications of Risk Budgeting in Finance

Portfolio Management

Corporate Finance

Financial Institutions

Sovereign Wealth Funds and Pension Funds

Challenges and Limitations of Risk Budgeting

Data Availability and Quality

Model Risk

Behavioral Biases in Risk Budgeting

Regulatory and Compliance Issues

Conclusion

Risk Budgeting FAQs

Risk budgeting is a process used to allocate risk among different investment portfolios based on a predetermined risk tolerance level.

Risk budgeting is important because it helps investors manage risk and optimize returns by allocating resources in a way that matches their risk appetite and investment goals.

Risk budgeting involves creating a portfolio that is diversified across different asset classes, with each asset class assigned a risk budget. The risk budget is determined by the investor's risk tolerance, investment objectives, and the risk characteristics of the asset class.

The benefits of risk budgeting include reducing the risk of loss, optimizing returns, and providing a disciplined approach to portfolio management. It also allows investors to make informed decisions about the allocation of their investment resources.

Risk budgeting is used by institutional investors such as pension funds, endowments, and insurance companies, as well as individual investors who seek to manage risk and optimize returns in their investment portfolios.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.