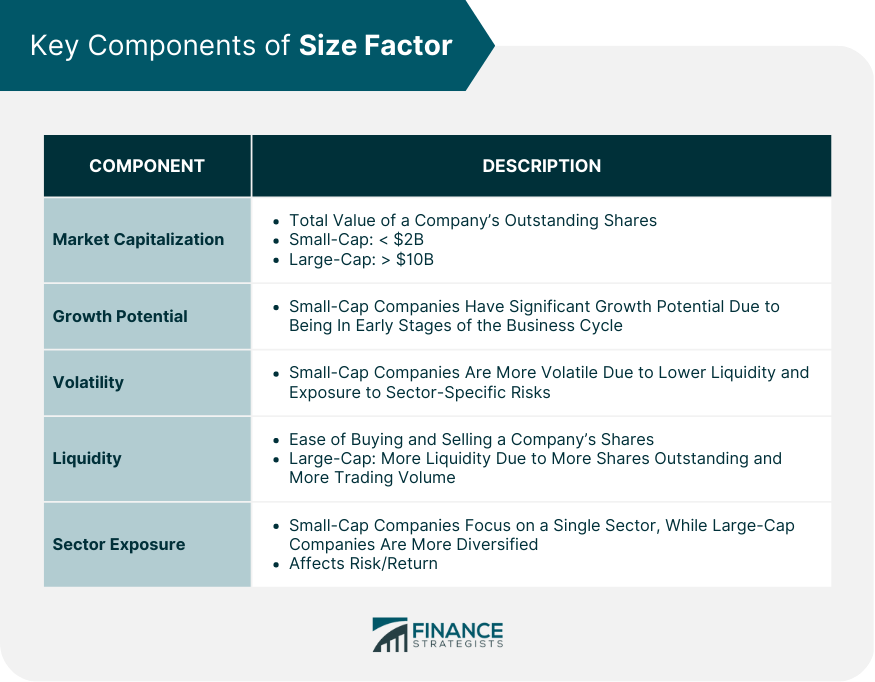

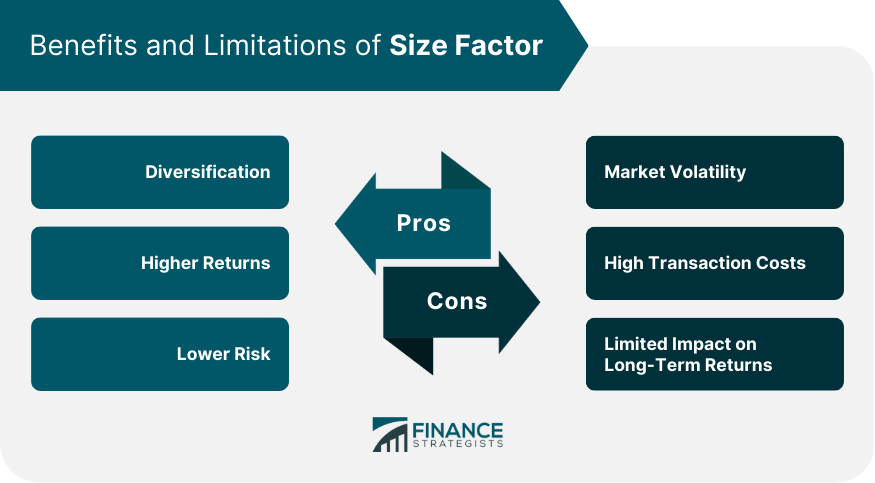

Size factor is a crucial concept in wealth management. It refers to the performance of small-cap companies relative to large-cap companies. In other words, the size factor is the difference in returns between small-cap and large-cap companies. Small-cap companies are those with a market capitalization of less than $2 billion, while large-cap companies are those with a market capitalization of more than $10 billion. Historically, small-cap companies have outperformed large-cap companies. This trend has been observed in the US equity markets for over 80 years. Research indicates that small-cap companies tend to offer higher returns than large-cap companies due to their potential for growth. Small-cap companies have more room to grow and expand, and as such, their stocks tend to appreciate more rapidly than large-cap companies. The size factor has several components that investors should be aware of to make informed investment decisions. The market capitalization of a company is the total value of its outstanding shares. The market capitalization of small-cap companies is typically less than $2 billion, while the market capitalization of large-cap companies is usually more than $10 billion. Market capitalization is a crucial component of the size factor because it determines whether a company is classified as small-cap or large-cap. Small-cap companies tend to have more significant growth potential than large-cap companies. They are often in the early stages of their business cycle, and as such, have more room to grow and expand. This growth potential is a crucial component of the size factor because it contributes to the higher returns that small-cap companies can offer. Small-cap companies tend to be more volatile than large-cap companies. They are often subject to more significant price fluctuations due to their lower liquidity and exposure to sector-specific risks. Volatility is a crucial component of the size factor because it contributes to the higher risk that small-cap companies can pose. Liquidity refers to the ease with which a company's shares can be bought and sold in the market. Large-cap companies tend to have higher liquidity than small-cap companies because they have more shares outstanding and more trading volume. Liquidity is a crucial component of the size factor because it can affect transaction costs and the ease of executing trades. Small-cap companies tend to be more focused on a single sector than large-cap companies, which can make them more vulnerable to sector-specific risks. In contrast, large-cap companies tend to be more diversified and operate in multiple sectors, which can make them less exposed to sector-specific risks. Sector exposure is a crucial component of the size factor because it can affect the risk and return characteristics of small-cap and large-cap companies. The size factor has numerous applications in wealth management, including portfolio construction, risk management, asset allocation, and market timing. The size factor is an essential element in portfolio construction. Investors can create a diversified portfolio by allocating their assets to different market segments, including small-cap and large-cap companies. A diversified portfolio can help investors manage risk and achieve superior returns. The size factor also plays a crucial role in risk management. Investors can manage risk by balancing their portfolios with small-cap and large-cap companies. Small-cap companies tend to offer higher returns but are more volatile and have higher risk. In contrast, large-cap companies are less volatile but offer lower returns. By balancing their portfolios with small-cap and large-cap companies, investors can manage risk and achieve superior returns. Asset allocation is another application of the size factor in wealth management. Investors can allocate their assets to different market segments based on their investment objectives and risk tolerance. For instance, investors with a high-risk tolerance can allocate more of their assets to small-cap companies, while investors with a low-risk tolerance can allocate more of their assets to large-cap companies. The size factor can also be used for market timing. Market timing refers to the strategy of buying and selling securities based on market trends and fluctuations. Investors can use the size factor to time the market by monitoring the performance of small-cap and large-cap companies. During times of economic expansion, small-cap companies tend to perform well, and investors can increase their exposure to small-cap companies. In contrast, during times of economic contraction, large-cap companies tend to perform better, and investors can increase their exposure to large-cap companies. The size factor is a popular investment strategy in wealth management due to its potential to offer investors diversification, higher returns, and lower risk. The size factor allows investors to create a diversified portfolio by allocating their assets to different market segments. By diversifying their portfolio, investors can reduce the risk of loss and achieve superior returns. Investing in both small-cap and large-cap companies can also provide a buffer against market volatility. Small-cap companies have the potential for growth, which makes them more likely to offer higher returns than large-cap companies. The size factor can, therefore, enable investors to achieve higher returns by allocating their assets to small-cap companies. Balancing portfolios with small-cap and large-cap companies can help investors manage risk and achieve superior returns. Large-cap companies tend to be less volatile and offer lower returns, while small-cap companies tend to be more volatile but offer higher returns. However, the size factor also has limitations, including market volatility, high transaction costs, and limited impact on long-term returns. Small-cap companies tend to be more volatile than large-cap companies, which makes them more susceptible to market fluctuations. In times of market volatility, small-cap companies may experience more significant price fluctuations, which can result in significant losses. Investing in small-cap companies can be more expensive than investing in large-cap companies due to higher transaction costs. Small-cap companies tend to have lower trading volume, which can make it more challenging to execute trades at desired prices. While the size factor can offer superior returns in the short term, its impact on long-term returns may be limited. Over the long term, factors such as economic trends, company-specific factors, and market conditions may have a more significant impact on investment returns than the size factor. The size factor is a crucial concept in the world of wealth management. It refers to the performance of small-cap companies relative to large-cap companies and is a significant determinant of the performance of investment portfolios. Investors must be knowledgeable about the concept of size factor to make informed investment decisions. The size factor has numerous applications in wealth management, including portfolio construction, risk management, asset allocation, and market timing. While the size factor has several advantages, including diversification, higher returns, and lower risk, it also has several limitations, including market volatility, high transaction costs, and limited impact on long-term returns. Despite these limitations, the size factor remains a valuable investment strategy for investors seeking superior returns while managing risk.What Is Size Factor?

Key Components of Size Factor

Market Capitalization

Growth Potential

Volatility

Liquidity

Sector Exposure

Application of Size Factor in Wealth Management

Portfolio Construction

Risk Management

Asset Allocation

Market Timing

Benefits of Size Factor

Diversification

Higher Returns

Lower Risk

Limitations of Size Factor

Market Volatility

High Transaction Costs

Limited Impact on Long-Term Returns

Conclusion

Size Factor FAQs

The size factor in wealth management refers to the difference in returns between small-cap and large-cap companies. Small-cap companies are those with a market capitalization of less than $2 billion, while large-cap companies have a market capitalization of more than $10 billion. The size factor is a crucial concept in wealth management because it is a significant determinant of the performance of investment portfolios.

The size factor has several advantages in wealth management, including diversification, higher returns, and lower risk. By balancing portfolios with small-cap and large-cap companies, investors can create a diversified portfolio that can help them manage risk and achieve superior returns. Small-cap companies also have the potential for growth, which makes them more likely to offer higher returns than large-cap companies.

The size factor also has limitations, including market volatility, high transaction costs, and limited impact on long-term returns. Small-cap companies tend to be more volatile than large-cap companies, which makes them more susceptible to market fluctuations. Investing in small-cap companies can also be more expensive than investing in large-cap companies due to higher transaction costs. Additionally, while the size factor can offer superior returns in the short term, its impact on long-term returns may be limited.

Investors can apply the size factor in wealth management through portfolio construction, risk management, asset allocation, and market timing. By balancing portfolios with small-cap and large-cap companies, investors can create a diversified portfolio that can help them manage risk and achieve superior returns. They can also allocate their assets to different market segments based on their investment objectives and risk tolerance.

The economic cycle can affect the performance of the size factor in wealth management. During times of economic expansion, small-cap companies tend to perform well as they have the potential for growth. In contrast, during times of economic contraction, large-cap companies tend to perform better as they are more stable and have established businesses. As such, investors should consider the economic cycle when constructing portfolios and making investment decisions based on the size factor.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.