Time-weighted return (TWR) is a method of measuring investment performance that accounts for the impact of cash flows and the timing of those flows. This method is particularly useful for evaluating the performance of investment managers, as it eliminates the influence of cash inflows and outflows, focusing solely on the manager's investment decisions. TWR is a crucial metric in investment performance measurement as it provides a standardized and unbiased means of evaluating investment management skills. By isolating the impact of investment decisions from external factors, such as client contributions or withdrawals, TWR enables a fair comparison between different investment managers and portfolios. Time-weighted return is one of several methods used to calculate investment returns, with others including money-weighted return (MWR) and arithmetic mean return. The TWR calculation relies on two key components: returns and cash flows. Returns represent the change in investment value over time, while cash flows refer to the external contributions or withdrawals that affect the investment balance. The TWR calculation adjusts returns to account for the impact of cash flows, ensuring an accurate representation of investment performance. In TWR calculations, the investment period is divided into smaller sub-periods, with each sub-period associated with a cash flow event. This time-weighting approach allows for a more precise analysis of the effect of cash flows on investment returns, as it considers the timing of each cash flow and its influence on the overall performance. The calculation of TWR involves a series of steps that combine the returns and cash flows over the investment period. The process involves determining sub-period returns, calculating the geometric mean of these returns, and converting the result to an annualized return. By applying this method, investors can assess the impact of cash flows and investment decisions on overall performance. The first step in calculating TWR is to determine the sub-period returns. This involves dividing the investment period into smaller intervals, typically based on cash flow events, and calculating the return for each interval. This step helps isolate the performance of the investment manager from the effects of external cash flows. The second step in the TWR calculation is to compute the geometric mean of the sub-period returns. The geometric mean considers the compounding effect of returns and provides a more accurate measure of investment performance than the arithmetic mean. This step takes into account the timing and magnitude of cash flows and their impact on returns. The final step in calculating TWR is to convert the geometric mean of sub-period returns to an annualized return. This step allows for comparison across different investment periods and portfolios, as it standardizes the TWR to a common timeframe – typically one year. The annualized return provides a clear, comparable metric for evaluating investment manager performance. TWR relies on certain assumptions and faces limitations in its application. For example, it assumes consistent investment management throughout the investment period, which may not always be the case. Additionally, TWR does not capture the investor's personal experience, as it focuses on investment management performance rather than individual outcomes. TWR is a valuable tool for evaluating investment managers, as it isolates the manager's performance from external factors like cash inflows and outflows. This ensures a fair comparison between managers by focusing solely on their investment decisions, making it easier for investors to select the best manager for their needs. TWR allows for effective benchmarking and comparisons among different investment portfolios, managers, or strategies. By using TWR, investors can standardize the performance measurement across various investment options, ensuring an unbiased comparison that considers the impact of cash flows and investment management decisions. TWR is also useful for assessing risk-adjusted performance, which considers the risk level associated with a particular investment or strategy. By incorporating risk measures, such as standard deviation or beta, investors can better understand the trade-offs between return and risk when evaluating investment options or managers. TWR and MWR are both methods used to measure investment returns, but they differ in their approach and focus. TWR isolates investment management decisions from external factors like cash flows, whereas MWR considers the investor's personal experience, accounting for the timing and amount of contributions and withdrawals. Both methods have their merits, depending on the investor's objectives and context. TWR provides an unbiased measure of investment management performance, but it does not capture individual investor experiences. MWR, on the other hand, reflects the personal performance of individual investors, considering the timing and magnitude of their cash flows. However, MWR can be influenced by external factors, making it less suitable for comparing investment managers. The choice between TWR and MWR depends on the investor's objectives and the context of the evaluation. When assessing investment manager performance or comparing portfolios, TWR is the preferred method. However, for personal performance evaluation or financial planning purposes, MWR may be more relevant and insightful. TWR plays a key role in performance attribution. This process helps investors and managers understand the sources of portfolio returns. By using TWR in performance attribution analysis, investors can identify the specific factors, such as security selection or asset allocation, that contributed to a portfolio's performance. In modern portfolio theory, the efficient frontier represents the optimal balance between risk and return for a given portfolio. TWR can be used to assess the effectiveness of a portfolio's asset allocation and its position on the efficient frontier, providing valuable insights for investors when making investment decisions. The Sharpe ratio is a widely used risk-adjusted performance measure that evaluates the excess return of a portfolio relative to its risk level. By incorporating TWR in the Sharpe ratio calculation, investors can obtain a more accurate assessment of a portfolio's risk-adjusted performance, which is essential for comparing investment options and strategies. TWR is a vital metric in investment performance measurement, as it provides an unbiased means of assessing investment manager skill and enables fair comparisons between different portfolios and strategies. By accounting for the impact of cash flows and investment decisions, TWR offers valuable insights for investors and managers alike. When using TWR, investors and managers should consider its limitations and assumptions and the specific context in which it is applied. It is essential to understand the differences between TWR and other return measures, such as MWR, and choose the appropriate method based on the evaluation's objectives and context. As the investment landscape continues to evolve, TWR may see further advancements and refinements to enhance its accuracy and applicability. Expert advice can help investors navigate the complexities of investment performance measurement and make informed decisions that align with their financial goals and risk tolerance.What Is Time-Weighted Return?

Components of Time-Weighted Return

Returns and Cash Flows

Time-Weighting Periods

Calculation Method

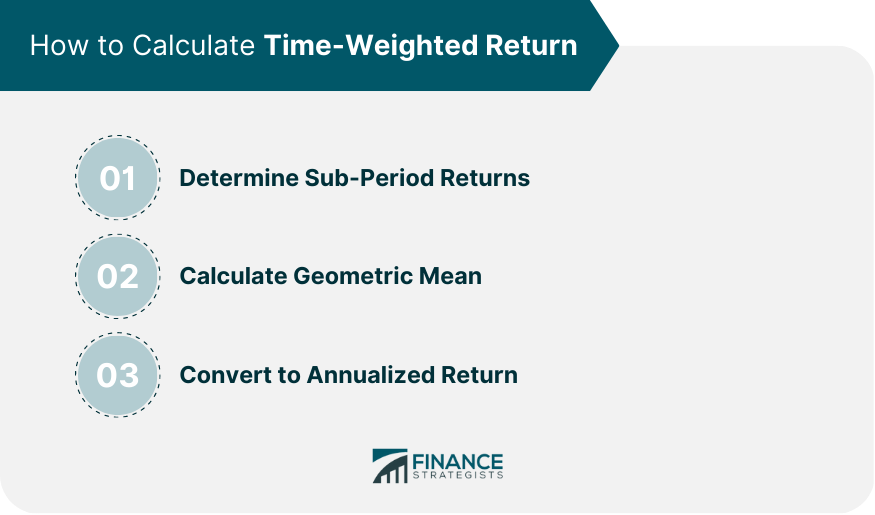

Calculation of Time-Weighted Return

Step-By-Step Process

Step 1 Determine Sub-Period Returns

Step 2 Calculate Geometric Mean

Step 3 Convert to Annualized Return

Limitations and Assumptions

Time-Weighted Return in Portfolio Management

Evaluating Investment Managers

Benchmarking and Comparisons

Risk-Adjusted Performance

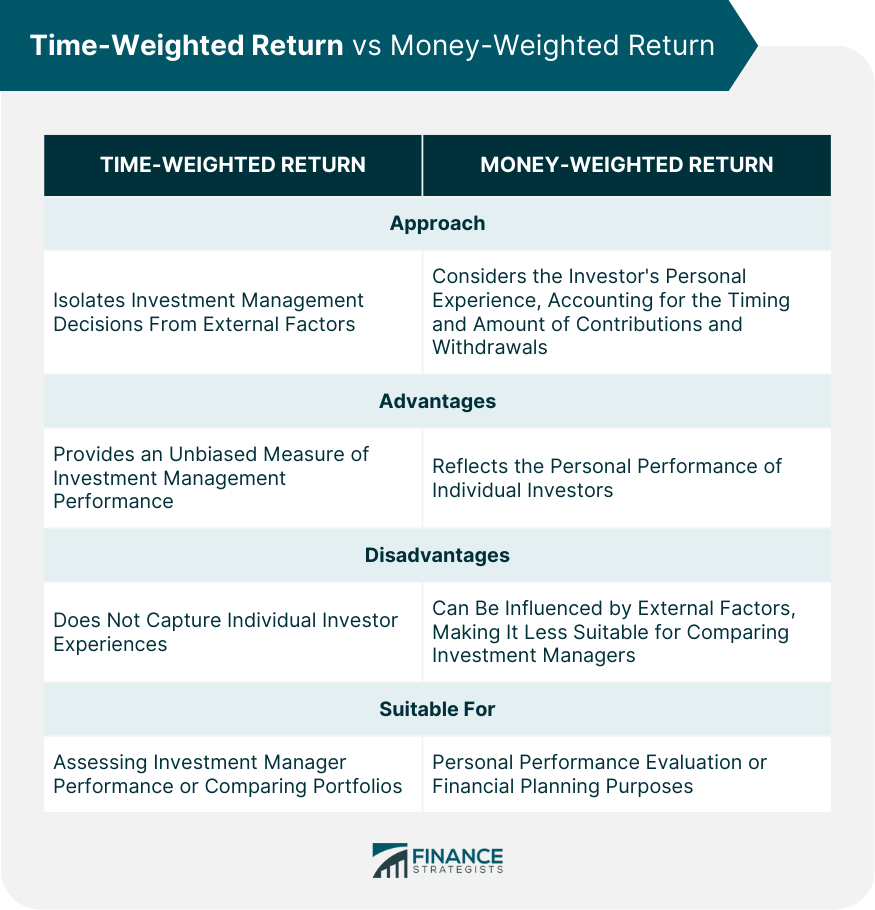

Time-Weighted Return vs Money-Weighted Return

Key Differences and Similarities

Advantages and Disadvantages of Each Method

Choosing the Appropriate Method for Specific Situations

Time-Weighted Return in Modern Portfolio Theory

Application in Performance Attribution

Efficient Frontier and Asset Allocation

Sharpe Ratio and Risk-Adjusted Returns

Final Thoughts

Time-Weighted Return FAQs

Time-weighted return is a method of measuring investment performance that accounts for the impact of cash flows and their timing. It is important because it allows for a standardized and unbiased evaluation of investment manager performance by isolating their decisions from external factors like cash inflows and outflows.

Time-weighted return isolates investment management decisions from external factors like cash flows, focusing on the manager's investment choices. In contrast, money-weighted return considers the investor's personal experience, accounting for the timing and amount of contributions and withdrawals.

Time-weighted return is particularly useful when assessing investment manager performance or comparing different investment portfolios and strategies. It offers an unbiased means of evaluating investment management skills, ensuring a fair comparison between managers and portfolios.

Time-weighted return can be incorporated into risk-adjusted performance measures, such as the Sharpe ratio, to provide a more accurate assessment of a portfolio's performance relative to its risk level. This is crucial for comparing investment options and strategies and making informed investment decisions.

Time-weighted return relies on certain assumptions and faces limitations in its application. For example, it assumes consistent investment management throughout the investment period, which may not always be the case. Additionally, TWR does not capture the investor's personal experience, focusing on investment management performance rather than individual outcomes.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.