Active return, also known as alpha, refers to the difference between a portfolio's performance and its benchmark index's performance. It measures the value added or subtracted by the portfolio manager's investment decisions and reflects the effectiveness of the active management strategy. In portfolio management, active return is a critical metric as it helps investors assess the value an active manager brings to the investment process. A positive active return indicates that the manager's decisions have led to better performance than the benchmark, while a negative active return suggests underperformance. Active return is closely related to active risk, which represents the additional risk assumed by an investor due to the portfolio manager's active investment decisions. A higher active return often comes with higher active risk, as managers seek to outperform the benchmark by taking on more aggressive positions. Portfolio returns represent the total return generated by the investments in a portfolio over a specified period, including interest income, capital gains, and dividends. They are a crucial component of active return calculations. Benchmark returns are the returns of a representative index, such as the S&P 500 or the MSCI World Index, that serve as a comparison for the portfolio's performance. The difference between the portfolio and benchmark returns represents the active return. Absolute active return is calculated by subtracting the benchmark return from the portfolio return. This straightforward calculation directly measures the portfolio's performance relative to the benchmark. Relative active return, expressed as a percentage, represents the portfolio's performance as a proportion of the benchmark's performance. This method helps investors understand the magnitude of the active return in the context of the benchmark's overall performance. The portfolio manager's skill plays a crucial role in generating an active return. A skilled manager with in-depth market knowledge and strong investment instincts can identify opportunities to outperform the benchmark and achieve a positive active return. Effective security selection, or choosing the right investments, can significantly impact active return. Portfolio managers who can identify undervalued or high-potential investments can generate higher active returns by capitalizing on these opportunities. Market timing or investment decisions based on anticipated market movements can influence active return. Portfolio managers who can accurately predict market trends and adjust their portfolios accordingly can potentially achieve higher active returns. Active management offers the potential for higher returns compared to passive management, as portfolio managers can leverage their expertise to identify undervalued investments and capitalize on market inefficiencies. Additionally, active managers can adapt their strategies to changing market conditions, potentially reducing portfolio risk. Active management often comes with higher fees, as portfolio managers charge a premium for their expertise and active decision-making. Additionally, consistently generating positive active returns can be challenging, and there is no guarantee that an active manager will outperform a passive benchmark. Passive management typically involves lower fees and expenses compared to active management, as it requires less frequent trading and decision-making. Additionally, passive management can offer more consistent returns, as it seeks to match the performance of a benchmark index rather than outperform it. Passive management does not offer the potential for outperformance, as it simply aims to replicate the benchmark's performance. It may also be less adaptable to changing market conditions, as passive managers do not have the flexibility to make quick adjustments to their portfolio holdings. This lack of flexibility can be a disadvantage in highly volatile markets, where active managers may be better equipped to adjust their strategies in response to sudden market shifts. Comparing active and passive management involves assessing each approach's potential benefits and drawbacks. While active management offers the potential for outperformance, it often comes with higher fees and the risk of underperformance. In contrast, passive management typically has lower fees and more consistent returns but lacks the potential for outperformance. The allocation effect measures the impact of a portfolio manager's asset allocation decisions on the active return. This includes the manager's ability to overweight or underweight certain sectors or asset classes relative to the benchmark, which can contribute to the portfolio's outperformance or underperformance. The selection effect captures the influence of a portfolio manager's security selection decisions on the active return. It assesses the manager's ability to choose individual investments that outperform or underperform their respective benchmarks, reflecting the manager's stock-picking skills. The interaction effect represents the combined influence of both allocation and selection decisions on the active return. It accounts for situations where the manager's allocation and selection decisions work together, magnifying their individual effects on the portfolio's performance. The information ratio is a risk-adjusted performance measure that compares a portfolio's active return to its active risk, as measured by the tracking error. A higher information ratio indicates a better risk-adjusted performance, suggesting that the manager has successfully generated active returns without taking excessive risks. The Sharpe ratio measures a portfolio's risk-adjusted return by comparing its excess return (the return above the risk-free rate) to its total risk, as measured by standard deviation. A higher Sharpe ratio indicates better risk-adjusted performance, reflecting efficient portfolio management. The Sortino ratio is a variation of the Sharpe ratio that focuses on downside risk, as it only considers the standard deviation of negative returns. This measure provides a more accurate assessment of a portfolio's risk-adjusted performance when the portfolio's return distribution is asymmetric or has significant downside risk. Understanding active return is crucial for investors and portfolio managers alike, as it helps assess the value added by active management strategies and informs decisions about portfolio construction and risk management. Achieving positive active return often involves taking on additional risk. Portfolio managers must carefully balance the pursuit of active return with the need to manage risk and adhere to their clients' risk tolerance and investment objectives. To achieve a positive active return, portfolio managers should employ a disciplined investment process, consistently monitor market conditions, maintain a diversified portfolio, and utilize risk-adjusted performance measures to evaluate their strategies. To optimize your portfolio's performance and enhance your active return, consider partnering with experienced wealth management professionals. They can provide tailored investment strategies and valuable insights to help you achieve your financial goals.What Is Active Return?

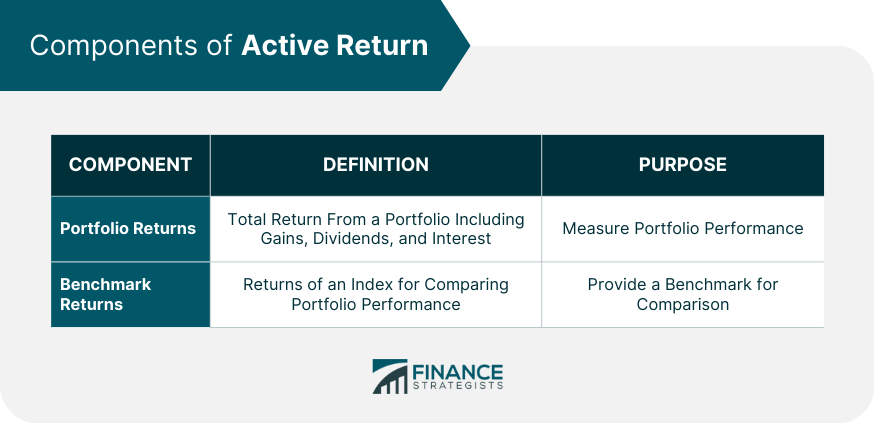

Components of Active Return

Portfolio Returns

Benchmark Returns

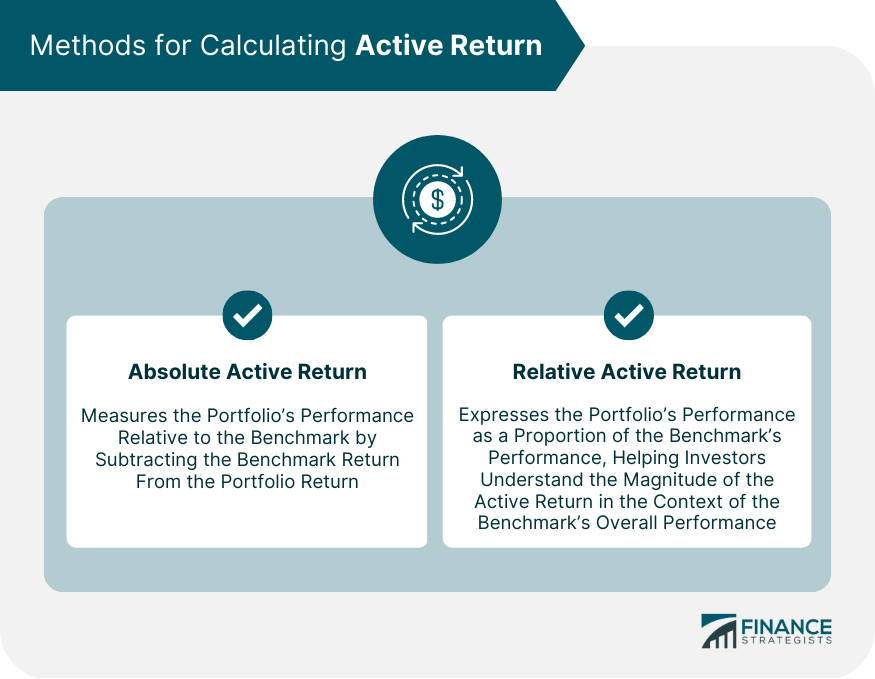

Methods for Calculating Active Return

Absolute Active Return

Relative Active Return

Factors Influencing Active Return

Portfolio Manager's Skill

Security Selection

Market Timing

Active Return and Investment Strategies

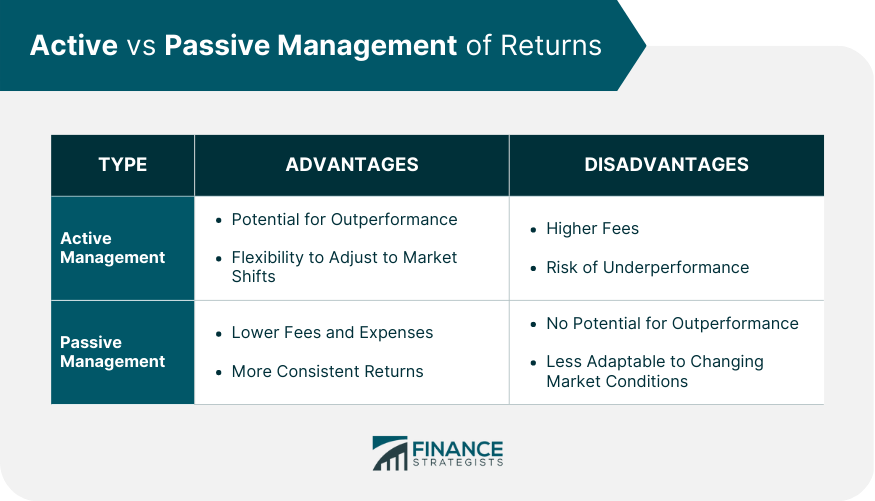

Active Management

Advantages of Active Management

Disadvantages of Active Management

Passive Management

Advantages of Passive Management

Disadvantages of Passive Management

Comparing Active and Passive Management

Tracking Active Return

Performance Attribution Analysis

Allocation Effect

Selection Effect

Interaction Effect

Risk-Adjusted Performance Measures

Information Ratio

Sharpe Ratio

Sortino Ratio

Final Thoughts

Active Return FAQs

Active return refers to the difference between a portfolio's performance and its benchmark. It is important because it measures the value added by a portfolio manager's investment decisions and helps investors evaluate the effectiveness of an active management strategy.

Active return is calculated by comparing the portfolio's returns to those of its benchmark. Absolute active return is the difference between the portfolio and benchmark returns, while relative active return is the portfolio return divided by the benchmark return.

Factors that influence active return include the portfolio manager's skill, security selection, and market timing abilities. These factors can contribute to the portfolio's outperformance or underperformance relative to its benchmark.

Active return can be tracked using performance attribution analysis, which breaks down the return into allocation and selection effects. Additionally, risk-adjusted performance measures, such as the information ratio, can help assess the efficiency of active return generation.

Pursuing active return involves challenges such as market inefficiencies, competition, and rapidly changing market conditions. However, these challenges also present opportunities for skilled portfolio managers to add value and generate positive active returns for their clients.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.