Annualized return is a measure of an investment's average rate of return per year, taking into account the effects of compounding. It allows investors to compare the performance of different investments over various time periods on a standardized basis. Annualized return is an essential tool in investment analysis, as it helps investors evaluate the performance of various investment options, assess the effectiveness of their investment strategies, and make informed decisions about asset allocation and portfolio construction. While absolute return represents the total gain or loss of an investment over a specific period, annualized return calculates the average rate of return per year, allowing for more meaningful comparisons between investments with different holding periods. Simple annualized return is calculated by dividing the total return of an investment by the number of years it was held and multiplying by 100 to express the result as a percentage. This method does not account for the effects of compounding and is generally appropriate for investments with simple interest, such as bonds. CAGR is a more accurate method for calculating annualized return, as it takes into account the effects of compounding. It is calculated by dividing the ending value of an investment by its initial value, raising the result to the power of 1/n (where n is the number of years), and subtracting 1. Geometric mean return is another method for calculating annualized return, particularly for investments with varying returns over time. It is calculated by multiplying the returns for each period, taking the nth root (where n is the number of periods), and subtracting 1. Annualized return allows investors to compare the performance of different investments over various time periods, making it easier to identify the best-performing assets and optimize their investment portfolios. Investors can use annualized return to compare the performance of their investments against relevant benchmarks, such as market indices, to evaluate the effectiveness of their investment strategies. By analyzing the annualized returns of different assets, investors can assess the risk-return tradeoff and make more informed decisions about asset allocation and portfolio construction. Annualized return can help investors determine the appropriate allocation of assets in their portfolios, based on their risk tolerance, investment objectives, and time horizon. Understanding the annualized returns of various investment options can help investors make informed decisions about their retirement savings strategies and ensure they are on track to meet their financial goals. Annualized return can help parents and guardians evaluate the performance of education savings plans and make adjustments to their investment strategies, as needed, to achieve their education funding goals. Investors can use annualized return to estimate the growth of their investments over time and determine whether they are on track to achieve their specific financial goals, such as buying a home or starting a business. Annualized return assumes that the investment's performance remains constant over the entire holding period, which may not be the case in reality. Additionally, it does not account for any changes in the investment, such as reinvestment of dividends or interest, or additional contributions or withdrawals. Annualized return does not capture the volatility of an investment, which can significantly impact an investor's experience and risk tolerance. Investments with high volatility may have a similar annualized return to those with low volatility but can expose investors to a higher degree of risk. The choice of the performance period can have a significant impact on the calculation of annualized return, leading to potential biases in investment analysis. Investors should be mindful of the specific time periods used when comparing different investments or evaluating their investment strategies. Total return is another performance metric that takes into account both capital gains and income generated by an investment, such as dividends or interest. Unlike annualized return, total return does not standardize the performance of investments over time, making it less suitable for comparing investments with different holding periods. The Sharpe ratio is a widely used measure of risk-adjusted performance that evaluates an investment's excess return per unit of risk, as measured by its standard deviation. A higher Sharpe ratio indicates better risk-adjusted performance. The Sortino ratio is a variation of the Sharpe ratio that focuses on downside risk, as measured by the downside deviation of an investment's returns. A higher Sortino ratio indicates better performance on a risk-adjusted basis, considering only downside volatility. The Treynor ratio is another measure of risk-adjusted performance that evaluates an investment's excess return per unit of systematic risk, as measured by its beta. A higher Treynor ratio indicates better risk-adjusted performance. Drawdowns are a measure of the decline in an investment's value from its peak to its trough, while recovery represents the time it takes for the investment to regain its peak value. Understanding drawdowns and recovery can help investors assess the riskiness of their investments and make more informed decisions about asset allocation and risk management. Tax-adjusted annualized return accounts for the impact of taxes on an investment's performance, providing a more accurate measure of an investor's after-tax return. This can be particularly important for investments subject to different tax rates, such as stocks and bonds. Inflation-adjusted annualized return, also known as the real rate of return, takes into account the impact of inflation on an investment's purchasing power over time. By adjusting for inflation, investors can better assess the true performance of their investments and make more informed decisions about asset allocation and portfolio construction. Annualized return is a critical tool in investment analysis, allowing investors to compare the performance of various investment options, evaluate the effectiveness of their investment strategies, and make informed decisions about asset allocation and portfolio construction. Despite its usefulness, annualized return has several limitations, such as assumptions about constant performance, the impact of volatility, and potential biases related to the choice of performance periods. Investors should consider these limitations when using annualized return in their investment analysis and decision-making processes. By understanding and incorporating annualized return into their investment strategies, investors can better navigate the complexities of financial markets, optimize their portfolios for risk-adjusted performance, and achieve their long-term financial goals.What Is Annualized Return?

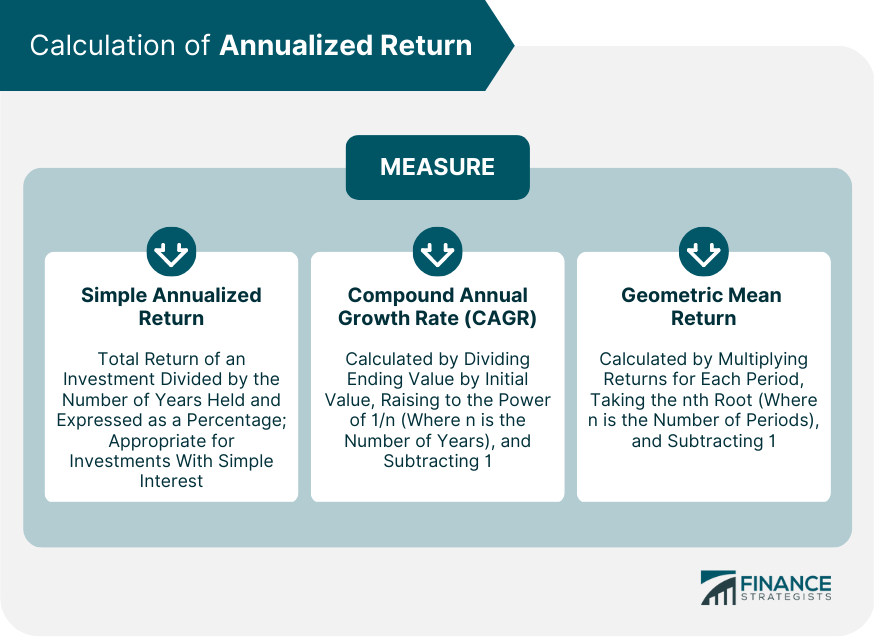

Calculation of Annualized Return

Simple Annualized Return

Compound Annual Growth Rate (CAGR)

Geometric Mean Return

Applications of Annualized Return

Performance Evaluation

Comparing Investments

Benchmarking

Portfolio Construction

Risk-Return Analysis

Asset Allocation

Financial Planning

Retirement Planning

Education Savings

Goal-Based Investing

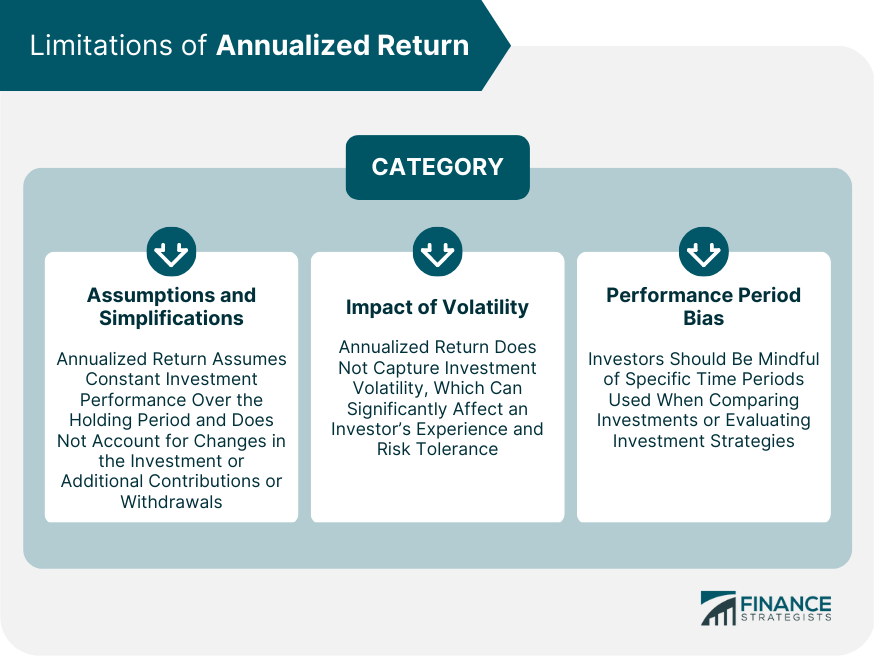

Limitations of Annualized Return

Assumptions and Simplifications

Impact of Volatility

Performance Period Bias

Other Performance Metrics

Total Return

Risk-Adjusted Return

Sharpe Ratio

Sortino Ratio

Treynor Ratio

Drawdowns and Recovery

Annualized Return in the Context of Taxes and Inflation

Tax-Adjusted Annualized Return

Inflation-Adjusted Annualized Return

Conclusion

Annualized Return FAQs

Annualized return is the rate of return on an investment over a period of one year. It is calculated by taking the total return earned on an investment over a given period and dividing it by the number of years in that period, then expressing the result as a percentage.

Annualized return is important because it allows investors to compare the performance of different investments over a standard time frame. It also helps investors understand the rate at which their investments are growing or declining, which is important when making investment decisions.

Yes, annualized return can be negative if an investment has lost value over the period for which the return is being calculated. In this case, the negative annualized return indicates that the investment has lost value on average each year during the period.

Annualized return can be used to measure the performance of a portfolio by calculating the average annual return earned on the portfolio over a given period. This allows investors to compare the portfolio's performance to that of a benchmark or other investment options.

Yes, annualized return is the same as compound annual growth rate (CAGR). Both measure the average annual return earned on an investment over a given period, and both take into account the effects of compounding. The difference is that CAGR assumes that the investment has been reinvested at the end of each year, while annualized return does not necessarily assume reinvestment.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.