An asset allocation fund is a type of mutual fund or exchange-traded fund (ETF) that invests in a diverse mix of assets, such as stocks, bonds, and cash equivalents. The fund's objective is to achieve a balanced risk-return profile by allocating assets across different asset classes and investment styles. Asset allocation funds aim to provide investors with several key benefits: Diversification: By spreading investments across various asset classes, investors can reduce their exposure to risks associated with individual asset classes or sectors. Professional Management: Asset allocation funds are managed by experienced investment professionals who have expertise in multiple asset classes and allocation strategies. Simplicity: Investors can achieve a diversified portfolio with a single investment, making it easier to manage their overall holdings. Asset allocation funds are suitable for a wide range of investors, including: Novice investors who may not have the knowledge or experience to build a diversified portfolio themselves Busy investors who prefer a hands-off approach to investing and want a professionally managed solution Investors looking for a long-term investment vehicle that can help them meet their financial goals while managing risk An asset allocation fund typically invests in various asset classes to create a diversified portfolio. These asset classes include: Stocks represent ownership in a company and offer investors potential capital gains and dividend income. Stocks can be further categorized by market capitalization and geographic location. Large-cap: These are stocks of well-established companies with a large market capitalization, typically over $10 billion. Mid-cap: These are stocks of medium-sized companies with a market capitalization between $2 billion and $10 billion. Small-cap: These are stocks of smaller companies with a market capitalization of less than $2 billion. International: International stocks provide exposure to companies based outside the investor's home country, offering potential diversification benefits. Bonds are debt securities issued by governments, corporations, and municipalities to raise capital. They provide investors with interest income and the potential for capital appreciation. Government Bonds: Issued by national governments, these bonds are generally considered low-risk investments, as they are backed by the issuing government. Corporate Bonds: Issued by corporations, these bonds tend to offer higher yields than government bonds, but they carry a higher risk due to the potential for default. Municipal Bonds: Issued by state and local governments, these bonds are often exempt from federal income tax and sometimes from state and local taxes as well. International Bonds: International bonds provide exposure to debt securities issued by foreign governments and corporations, offering potential diversification benefits. Cash and cash equivalents are short-term, highly liquid investments that can be easily converted into cash with minimal risk. Money Market Funds: These are mutual funds that invest in short-term debt instruments, such as commercial paper and Treasury bills. Certificates of Deposit (CDs): CDs are time deposits issued by banks that offer a fixed interest rate for a specified period. Treasury Bills: Issued by the U.S. government, these are short-term debt securities with maturities ranging from a few days to 52 weeks, and they are considered to be virtually risk-free investments. Alternative investments include assets that are not part of the traditional investment universe of stocks, bonds, and cash equivalents. These investments can offer diversification benefits and may help enhance portfolio returns. Real Estate: Real estate investments can be made directly by purchasing physical property or indirectly through real estate investment trusts (REITs) and other securities. Commodities: Investors can gain exposure to commodities such as gold, oil, and agricultural products through various investment vehicles, including futures contracts, ETFs, and stocks of companies involved in the production or distribution of commodities. Private Equity: Private equity investments involve taking ownership stakes in privately held companies or participating in leveraged buyouts. These investments generally require a long-term commitment and can offer potentially higher returns compared to traditional investments. Hedge Funds: Hedge funds are actively managed investment funds that employ advanced strategies to generate returns, such as short selling, leveraging, and derivatives trading. They often require a high minimum investment and may carry higher fees compared to traditional investment funds. Asset allocation strategies determine how a fund's assets are distributed across various asset classes to balance risk and return. There are several approaches to asset allocation: Strategic asset allocation involves establishing a long-term asset mix based on an investor's risk tolerance, investment horizon, and financial goals. This approach typically involves: Determining Long-Term Asset Mix: Investors determine their desired allocation to various asset classes based on historical returns, risk levels, and correlation between assets. Rebalancing: Periodically, the portfolio is reviewed and adjusted to maintain the desired allocation, which may involve selling assets that have increased in value and buying assets that have decreased in value. Tactical asset allocation involves adjusting the portfolio's asset mix based on short-term market conditions and opportunities. This approach includes: Market Timing: Investors attempt to capitalize on short-term market trends by increasing exposure to asset classes expected to outperform and decreasing exposure to underperforming assets. Adjusting Allocations Based on Short-Term Market Conditions: The portfolio's asset mix is adjusted to take advantage of changing economic conditions, such as shifts in interest rates, inflation, or market sentiment. Dynamic asset allocation is a more flexible approach that involves constantly adjusting the asset mix in response to market trends and economic indicators. This approach includes: Constantly Adjusting Asset Mix: The portfolio's allocation is continuously reviewed and adjusted based on market conditions, economic indicators, and the investor's objectives. Responding to Market Trends and Economic Indicators: The portfolio's asset mix is altered in response to changes in market trends, such as bull or bear markets, and economic indicators, such as GDP growth or inflation rates. Managing risk is an essential aspect of investing in asset allocation funds. Risk management techniques include diversification, assessing risk tolerance, and evaluating risk-adjusted returns. Diversification is the process of spreading investments across various asset classes, sectors, and geographic regions to reduce risk. Benefits of diversification include: Reducing Portfolio Volatility: By investing in a diverse range of assets, investors can lower the overall volatility of their portfolio, as the performance of individual assets is unlikely to be perfectly correlated. Mitigating the Impact of Negative Events: Diversification helps to protect a portfolio from the adverse effects of events that may impact specific asset classes or sectors, such as economic downturns, interest rate changes, or geopolitical risks. Risk tolerance refers to an investor's willingness and ability to accept the possibility of losses in exchange for the potential for higher returns. Allocating assets based on risk tolerance involves: Assessing Risk Tolerance: Investors should consider factors such as their investment horizon, financial goals, and personal comfort with volatility when determining their risk tolerance. Allocating Assets Based on Risk Tolerance: Asset allocation funds should be tailored to an investor's risk tolerance, with more conservative investors opting for a higher allocation to bonds and cash equivalents, while more aggressive investors may choose a higher allocation to stocks and alternative investments. Risk-adjusted returns take into account both the potential returns of an investment and the associated risks. Evaluating risk-adjusted performance of asset allocation funds involves: Definition and Importance: Risk-adjusted returns provide a more accurate measure of an investment's performance by factoring in the level of risk taken to achieve those returns. This helps investors compare investments with different risk profiles on an equal footing. Evaluating Risk-Adjusted Performance: Common risk-adjusted performance measures include the Sharpe ratio and the Sortino ratio, which allow investors to compare the performance of different asset allocation funds while considering the level of risk associated with each fund. Measuring the performance of asset allocation funds involves comparing their returns to appropriate benchmarks and evaluating various performance metrics. Benchmarks are standard measures against which the performance of an asset allocation fund can be compared. Choosing Appropriate Benchmarks: Investors should select benchmarks that are representative of the asset classes and investment styles in their portfolio, such as a broad market index for stocks or a bond index for fixed income investments. Comparing Fund Performance to Benchmarks: By comparing the fund's performance to its benchmark, investors can determine whether the fund is meeting its objectives and providing adequate returns relative to the risks taken. Performance metrics help investors evaluate the performance of asset allocation funds based on different aspects, such as absolute returns, relative returns, and risk-adjusted returns. Absolute Return: Absolute return measures the total gain or loss of an investment over a specified period, expressed as a percentage of the initial investment. Relative Return: Relative return compares the performance of an investment to a benchmark or another investment, indicating whether the investment has outperformed or underperformed the comparison. Sharpe Ratio: The Sharpe ratio is a measure of risk-adjusted performance that calculates the excess return of an investment relative to its level of risk, as measured by standard deviation. Sortino Ratio: The Sortino ratio is similar to the Sharpe ratio but focuses on downside risk, evaluating the performance of an investment relative to the level of negative volatility. When selecting an asset allocation fund, investors should consider factors such as management style, fees, and the fund manager's track record. Passive and active management styles offer different advantages and disadvantages: Advantages and Disadvantages of Passive Management: Passive management typically involves lower fees, as it aims to replicate the performance of a benchmark index. However, passive funds are unlikely to outperform their benchmarks due to their nature. Advantages and Disadvantages of Active Management: Active management involves a fund manager actively making investment decisions, which may lead to the potential for outperformance. However, active management generally comes with higher fees and the risk that the fund manager may underperform the benchmark. Fees and expenses associated with asset allocation funds can impact investment returns: Management Fees: These fees cover the cost of professional portfolio management and are typically charged as a percentage of the fund's assets. Load Fees: Load fees are sales charges that may be applied when purchasing or selling shares of a mutual fund. These fees can be front-end (charged when shares are purchased) or back-end (charged when shares are sold). Expense Ratios: The expense ratio represents the annual operating expenses of a fund, including management fees, administrative expenses, and other costs, expressed as a percentage of the fund's assets. Evaluating a fund manager's performance and stability can provide insight into the potential success of an asset allocation fund. Evaluating Manager Performance: Investors should review the historical performance of the fund manager, taking into account factors such as consistency, risk-adjusted returns, and performance relative to benchmarks. Manager Tenure and Stability: A fund manager with a long tenure and a stable track record may be better equipped to navigate various market conditions and deliver consistent performance. Regular rebalancing and ongoing performance monitoring are essential to maintaining an effective asset allocation strategy. Rebalancing is the process of adjusting a portfolio's asset allocation to maintain the desired risk-return profile. Importance of Rebalancing: Regular rebalancing helps to maintain the intended risk level and asset allocation in the portfolio, ensuring that the investor's objectives remain on track. Rebalancing Frequency: The frequency of rebalancing can vary depending on the investor's preferences, market conditions, and the specific asset allocation fund. Some investors may choose to rebalance annually, while others may opt for quarterly or semi-annual rebalancing. Investors should regularly review the performance of their asset allocation funds and make adjustments as needed. Reviewing Fund Performance: By monitoring the fund's performance, investors can ensure that their investment objectives are being met and identify any areas of concern or opportunities for improvement. Adjusting Allocations as Needed: If a fund's performance is consistently underperforming or its risk profile has changed, investors may need to adjust their asset allocation to better align with their investment goals and risk tolerance. Asset allocation funds can play a significant role in wealth management, helping investors achieve long-term financial goals by maintaining a well-diversified, risk-adjusted portfolio tailored to their unique needs and objectives. Asset allocation is a critical component of successful investing, and asset allocation funds offer a convenient solution for investors seeking a diversified portfolio. By understanding the various asset classes, strategies, and risk management techniques involved, investors can make informed decisions about selecting and managing asset allocation funds that align with their objectives and risk tolerance.What Are Asset Allocation Funds?

Purpose and Benefits of Asset Allocation Funds

Target Audience for Asset Allocation Funds

Asset Classes of Asset Allocation Funds

Stocks

Bonds

Cash and Cash Equivalents

Alternative Investments

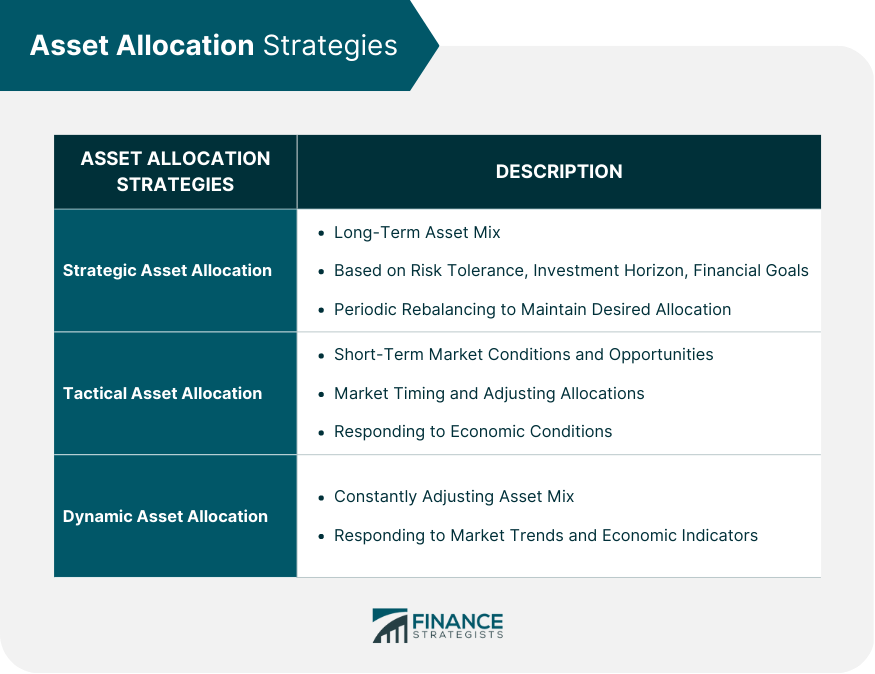

Asset Allocation Strategies

Strategic Asset Allocation

Tactical Asset Allocation

Dynamic Asset Allocation

Risk Management

Diversification

Risk Tolerance

Risk-Adjusted Returns

Performance Measurement

Benchmarks

Performance Metrics

Fund Selection

Passive vs Active Management

Fees and Expenses

Fund Manager Track Record

Rebalancing and Monitoring

Regular Rebalancing

Ongoing Performance Monitoring

Conclusion

Asset Allocation Funds FAQs

Asset allocation funds are investment vehicles, such as mutual funds or ETFs, that provide a diversified portfolio across various asset classes. They offer benefits like risk reduction, professional management, and simplicity, making them suitable for a range of investors.

Asset allocation funds typically invest in a mix of stocks, bonds, cash and cash equivalents, and alternative investments, such as real estate, commodities, private equity, and hedge funds, to achieve a balanced risk-return profile.

Asset allocation funds use strategies like diversification, strategic and tactical asset allocation, and dynamic asset allocation to balance risk and return. By selecting an appropriate asset mix based on the investor's risk tolerance, these funds can provide a customized investment solution.

To measure the performance of asset allocation funds, you can compare their returns to appropriate benchmarks and evaluate performance metrics like absolute return, relative return, and risk-adjusted returns (e.g., Sharpe ratio, Sortino ratio).

When selecting an asset allocation fund, consider factors such as management style (passive vs. active), fees and expenses, the fund manager's track record, and the fund's performance relative to benchmarks and risk-adjusted performance measures.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.