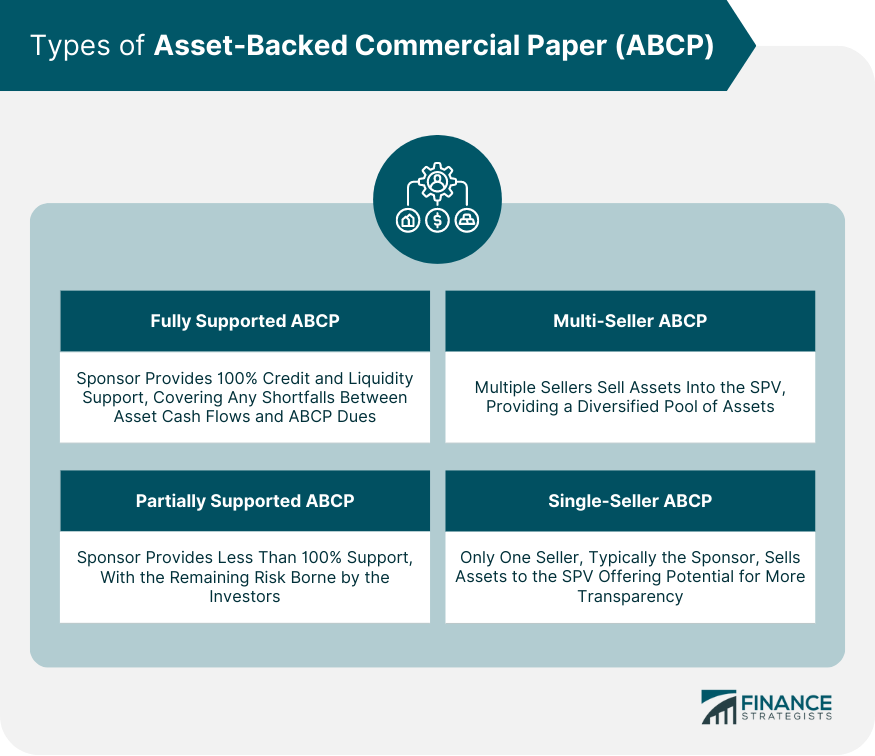

Asset-Backed Commercial Paper is a form of short-term investment, typically maturing within 270 days, issued by a special purpose vehicle (SPV). It's not backed by the creditworthiness of the issuing institution but by an array of underlying assets like auto loans, mortgages, and credit card receivables. The market is diverse, featuring types of ABCP such as fully supported, partially supported, multi-seller, and single-seller ABCP, each catering to different risk tolerances and investment objectives. The risk and return profile of ABCP is distinctive. While yields are generally higher than those of unsecured commercial paper or Treasury bills, ABCP carries inherent credit, liquidity, and market risks. Therefore, an informed understanding of these characteristics is essential when considering investment in the ABCP market. ABCP emerged in the mid-1980s as a response to corporate America's growing demand for innovative and flexible short-term financing alternatives. The first ABCP program was initiated by the American auto industry, which sought to separate their high-quality auto loan receivables from the more volatile aspects of their businesses. Over the years, the ABCP market has grown exponentially, driven by the increasing participation of financial institutions and the broadening range of assets backing the papers. This growth was further spurred by the low interest rate environment and financial innovation, which widened the scope of assets that could be securitized. Financial crises often expose the vulnerabilities of various financial instruments, and ABCP was no exception. The 2007-2008 global financial crisis highlighted structural weaknesses in the ABCP market, including over-reliance on short-term funding, lack of transparency, and insufficient risk assessment. As a result, ABCP experienced significant contraction in the aftermath of the crisis. An Asset-Backed Commercial Paper program typically involves a sponsoring financial institution setting up a special purpose vehicle or conduit. The SPV purchases assets from the sponsor or other sellers and finances these purchases by issuing ABCP to investors. The SPV is bankruptcy-remote, meaning its assets and liabilities are separate from those of the sponsoring institution. Three key parties are involved in ABCP transactions: the issuers, the investors, and the sponsors. The sponsor, usually a commercial bank or other financial institution, sets up the SPV, arranges for the purchase of assets, and provides liquidity and credit enhancement support. Investors are typically institutional investors seeking short-term, asset-backed investment opportunities. Creating ABCP involves several steps. First, the sponsor identifies a pool of assets for securitization. The assets are then transferred to the SPV, which finances the purchase by issuing ABCP. The cash flow generated by the underlying assets is used to pay the principal and interest to the ABCP holders upon maturity. Fully supported ABCP programs are those where the sponsor provides 100% credit and liquidity support. This means that the sponsor commits to covering any shortfalls between the cash flows from the underlying assets and the amount due to the ABCP holders. In partially supported ABCP programs, the sponsor provides less than 100% credit and liquidity support. The rest of the risk is borne by the investors, who must rely on the performance of the underlying assets to recover their investment. This structure allows for greater potential returns but comes with higher risk. Multi-seller ABCP programs involve multiple sellers selling assets into the SPV, providing a diversified asset pool. Single-seller programs, on the other hand, involve only one seller, often the sponsor, selling assets to the SPV. While multi-seller programs offer more diversification, single-seller programs may provide more transparency to investors about the underlying assets. Like all investments, ABCP carries risks. Credit risk arises if the underlying assets default or the sponsor fails to fulfil its support obligations. Liquidity risk arises from the mismatch between the short-term maturity of the ABCP and the longer-term cash flows of the underlying assets. Finally, market risk arises from changes in interest rates, exchange rates, or other market variables that affect the value of the ABCP or the underlying assets. Despite these risks, ABCP offers several potential returns and benefits. The yields are typically higher than those of unsecured commercial paper or Treasury bills, compensating for the additional risk. Furthermore, ABCP provides diversification benefits due to the wide range of assets that can back the paper. ABCP, like other securitized products, falls under the regulatory oversight of various agencies, including the Securities and Exchange Commission (SEC) and the Federal Reserve. These agencies enforce regulations concerning the issuance, rating, and disclosure of ABCP, aimed at promoting transparency and protecting investors. Regulations have significant impacts on ABCP market dynamics. For example, post-financial crisis regulations have increased transparency requirements and tightened the rules on risk retention and capital requirements for sponsors. These regulations have led to a contraction in the ABCP market but have also contributed to a more resilient and transparent market. Regulatory considerations for ABCP in the future may include further enhancements to transparency and risk assessment requirements. There may also be increased scrutiny on the types of assets that can be securitized and the role of credit rating agencies in the ABCP market. The ABCP market played a significant role in the 2007-2008 financial crisis. The excessive issuance of ABCP backed by low-quality assets, particularly subprime mortgages, and the subsequent defaults on these assets, contributed to the liquidity crunch and the broader financial turmoil. The financial crisis provided several lessons about the ABCP market. It highlighted the importance of sound risk management practices, including thorough due diligence on the underlying assets and adequate support from sponsors. It also underscored the need for transparency and regulatory oversight to promote market stability. Current trends influencing the ABCP market include the low interest rate environment, which continues to drive demand for higher-yielding assets such as ABCP. Technological advancements, particularly in the area of fintech, are also reshaping the ABCP market by providing new platforms for issuing and trading ABCP and novel types of assets for securitization. Looking ahead, the ABCP market is expected to continue evolving in response to changes in the financial environment and regulatory landscape. The trend towards greater transparency and risk management is likely to continue, potentially leading to a more resilient and efficient ABCP market. At the same time, the increasing integration of technology in finance may open up new opportunities and challenges for the ABCP market. In conclusion, Asset-Backed Commercial Paper is a short-term investment instrument, backed by a diversified pool of assets, providing an effective tool for corporations to manage their short-term funding requirements. The ABCP market is versatile, with fully supported, partially supported, multi-seller, and single-seller ABCP types catering to a variety of risk appetites and investment preferences. However, it's vital to understand the risk and return profile of ABCP. While the yields are typically higher than those of unsecured commercial paper or Treasury bills, they come with credit, liquidity, and market risks. Therefore, potential investors should undertake a comprehensive risk assessment before investing. The ABCP market, with its complexities and potential for high returns, underscores the importance of understanding the mechanics and risks of financial instruments.Definition of Asset-Backed Commercial Paper (ABCP)

History and Evolution of Asset-Backed Commercial Paper

The Origin of ABCP

The Evolution and Growth of ABCP Over the Years

Impact of Financial Crises on ABCP

Mechanics of Asset-Backed Commercial Paper

The Structure of an ABCP Program

Parties Involved in ABCP Transactions: Issuers, Investors, and Sponsors

The Process of Creating ABCP

Types of Asset-Backed Commercial Paper

Fully Supported ABCP

Partially Supported ABCP

Multi-Seller and Single-Seller ABCP

Risk and Return Profile of Asset-Backed Commercial Paper

Risk Characteristics of ABCP

Potential Returns and Benefits of Investing in ABCP

Asset-Backed Commercial Paper and the Regulatory Environment

Regulatory Oversight of ABCP

Impact of Regulation on ABCP Market Dynamics

Future Regulatory Considerations for ABCP

The Role of Asset-Backed Commercial Paper in Financial Crises

The ABCP Market During the 2007-2008 Financial Crisis

Lessons Learned From ABCP Market Behavior in Financial Crises

Future of Asset-Backed Commercial Paper

Current Trends Influencing the ABCP Market

Future Outlook and Predictions for the ABCP Market

Conclusion

Asset-Backed Commercial Paper (ABCP) FAQs

Asset-Backed Commercial Paper (ABCP) is a form of short-term investment issued by a special purpose vehicle (SPV) or conduit. It's backed by an underlying pool of assets like auto loans, mortgages, and credit card receivables rather than the creditworthiness of the issuing institution.

An ABCP program is structured by a financial institution, known as the sponsor, setting up an SPV. This SPV purchases assets from the sponsor or other sellers, which it then finances by issuing ABCP. The SPV is bankruptcy-remote, ensuring its assets and liabilities are separate from those of the sponsoring institution.

There are mainly three types of ABCP: fully supported, partially supported, and multi-seller or single-seller ABCP. Fully supported ABCP has 100% credit and liquidity support from the sponsor, while partially supported ABCP has less than 100% support. Multi-seller ABCP programs involve multiple sellers selling assets into the SPV, while single-seller programs involve only one seller.

Investing in ABCP carries credit risk, liquidity risk, and market risk. Credit risk arises if the underlying assets default or the sponsor fails to fulfill its support obligations. Liquidity risk is due to the mismatch between the short-term maturity of the ABCP and the longer-term cash flows of the underlying assets. Market risk comes from changes in interest rates, exchange rates, or other market variables that affect the value of the ABCP or the underlying assets.

The ABCP market was significantly affected during the 2007-2008 financial crisis. The crisis exposed structural weaknesses in the ABCP market, such as over-reliance on short-term funding, lack of transparency, and insufficient risk assessment. The deterioration in the quality of underlying assets, particularly subprime mortgages, led to substantial ABCP defaults, causing significant losses for ABCP investors.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.