Asset-backed securities (ABS) are financial instruments that represent an ownership interest in a pool of underlying assets, such as mortgages, credit card receivables, auto loans, or student loans. These assets are packaged together and securitized, transforming them into marketable securities that investors can buy and sell. The primary purpose of asset-backed securities is to allow financial institutions to transfer the credit risk associated with the underlying assets to investors, freeing up their balance sheets and enabling them to extend new loans. Investors benefit from the diversified cash flows generated by the underlying assets, often with enhanced credit quality due to the securitization process. Key participants in the ABS market include originators (lenders), underwriters (investment banks), investors (institutional and individual), rating agencies, and regulators. Below are the different types of ABS. These include: Residential mortgage-backed securities (RMBS) are a type of ABS backed by residential mortgages, such as home loans. They are typically classified into prime, Alt-A, and subprime categories, based on the credit quality of the underlying mortgages. Commercial mortgage-backed securities (CMBS) are ABS backed by mortgages on commercial properties, such as office buildings, retail centers, and hotels. CMBS can be more complex than residential MBS, given the heterogeneous nature of the underlying properties and varying lease structures. Collateralized debt obligations (CDOs) are a type of ABS backed by a diversified pool of debt instruments, such as corporate bonds, residential mortgages, and commercial loans. CDOs are further structured into different tranches with varying levels of risk and return, depending on the seniority in the cash flow waterfall. Auto loan ABS are securities backed by a pool of automobile loans, including new and used car loans and leases. These securities can offer investors exposure to the auto loan market, with varying levels of credit risk based on the credit quality of the underlying borrowers. Credit card receivables-backed securities are ABS backed by a pool of credit card receivables generated by cardholders' purchases and cash advances. These securities can be sensitive to changes in consumer spending and credit behavior. Student loan ABS are securities backed by a pool of student loans, often guaranteed by the federal government or a private guarantor. These securities can offer investors exposure to the higher education financing market, with varying levels of credit risk based on the underlying borrowers' credit quality and the presence of a guarantor. Other types of ABS include those backed by equipment leases, trade receivables, and other asset classes that generate predictable cash flows. These securities can provide investors with diversified exposure to niche asset classes with varying levels of risk and return. The ABS origination process involves pooling assets by a financial institution, creating a special purpose vehicle (SPV) to hold the assets, and issuing securities by the SPV, which are then sold to investors. Pooling of assets involves aggregating loans, leases, or other receivables into a portfolio. This process helps diversify the underlying risk, as the performance of individual assets is less likely to impact the overall performance of the ABS significantly. Securitization refer to transforming pooled assets into tradable securities. This involves structuring the securities into different tranches with varying levels of risk and return based on their priority in the cash flow waterfall. Senior tranches generally offer lower risk and return, while junior tranches have higher risk and return. Credit enhancement mechanisms are used to improve the credit quality of issued securities. These can include over-collateralization, subordination, reserve accounts, and external guarantees. These mechanisms help mitigate the risk of default and enhance the attractiveness of the ABS to investors. Credit risk in ABS refers to the potential for losses due to the default or nonperformance of the underlying assets. Assessing credit risk involves analyzing the credit quality of the underlying borrowers, the performance history of the assets, and the credit enhancement mechanisms in place. Prepayment risk refers to the potential for borrowers to repay their loans ahead of schedule, which can impact the cash flows ABS investors receive. Prepayment risk is particularly relevant for mortgage-backed securities, as changes in interest rates can lead to refinancing activity. Interest rate risk refers to the potential for interest rate changes to impact ABS's value. For example, when interest rates rise, the value of fixed-rate ABS may decline. Investors must consider the impact of interest rate fluctuations on their ABS investments. Liquidity risk refers to the potential difficulty in selling an ABS at a fair price in a timely manner. Some ABS, particularly those backed by niche asset classes or with lower credit ratings, may have limited liquidity in the market. Legal and regulatory risks in ABS refer to the potential for changes in laws, regulations, or accounting rules to impact the value or marketability of the securities. Investors must stay informed of regulatory developments and consider the potential impact on their ABS investments. Cash flow modeling involves projecting the future cash flows generated by the underlying assets, considering factors such as prepayment rates, default rates, and recovery rates. These cash flow projections are used to estimate the value of the ABS. Discounting techniques are used to determine the present value of the projected cash flows, considering the time value of money and the riskiness of the cash flows. The discount rate used in the calculation is typically based on a benchmark interest rate adjusted for the credit risk of the ABS. Yield measures, such as yield to maturity or average life, express the potential return on an ABS investment. These measures consider the projected cash flows, purchase price, and the time horizon of the investment. Spread analysis involves comparing the yield on an ABS to the yield on a comparable benchmark security, such as a Treasury bond or a swap rate. This spread represents the additional compensation investors require for taking on the credit risk and other risks associated with the ABS. A wider spread indicates a higher perceived risk, while a narrower spread suggests a lower risk. Investing in ABS can offer several benefits to investors, including: Diversification: ABS provides exposure to various asset classes and credit qualities, helping diversify an investment portfolio. Attractive Risk-Return Profile: ABS generally offer higher yields than comparable government or corporate bonds while still providing a level of credit enhancement that mitigates risk. Predictable Cash Flows: The underlying assets in ABS often generate stable and predictable cash flows, providing investors with a reliable income stream. While ABS can offer attractive benefits, investors must also consider the potential risks and challenges, such as: Credit Risk: The performance of the underlying assets may be negatively impacted by economic downturns or borrower defaults, leading to losses for ABS investors. Interest Rate Risk: Changes in interest rates can impact the value of fixed-rate ABS, potentially leading to capital losses. Liquidity Risk: Some ABS, particularly those backed by niche asset classes or with lower credit ratings, may have limited liquidity in the market, making it difficult to sell the securities at a fair price. When investing in ABS, investors should consider factors such as the credit quality of the underlying assets, the structure of the securities, and the potential risks associated with interest rate fluctuations, prepayments, and liquidity. Investors can employ various strategies when investing in ABS, such as: Buy and Hold: Investors can purchase ABS with the intention of holding them until maturity, benefiting from the income generated by the underlying assets. Active Trading: Investors can trade ABS in the secondary market, seeking to capitalize on changes in credit spreads, interest rates, or other market factors. Portfolio Immunization: Investors can use ABS to immunize their portfolios against interest rate risk by matching the duration of their assets and liabilities. ABS issuers and underwriters are subject to various regulatory requirements, including capital adequacy standards, risk management practices, and disclosure obligations. These regulations aim to protect investors and ensure the financial system's stability. ABS issuers must provide detailed information about the underlying assets, the structure of the securities, and the credit enhancement mechanisms in place. This information is typically disclosed in offering documents, such as prospectuses and periodic reports. Rating agencies are crucial in the ABS market by providing credit ratings for the issued securities. These ratings are intended to help investors assess the credit risk associated with the ABS and make informed investment decisions. The global financial crisis of 2008 led to significant regulatory reforms in the ABS market aimed at improving transparency, risk management, and investor protection. These reforms include the Dodd-Frank Wall Street Reform and Consumer Protection Act in the United States and the European Market Infrastructure Regulation (EMIR) in the European Union. ABS regulation can vary across jurisdictions, with differences in disclosure requirements, risk retention rules, and credit rating methodologies. Investors must know these differences when investing in ABS issued in different countries. Technological innovations, such as blockchain and artificial intelligence, are expected to impact the ABS market significantly. Blockchain technology could potentially streamline the issuance and settlement process for ABS, while AI could be used to analyze and predict the performance of the underlying assets. Environmental, Social, and Governance (ESG) criteria are increasingly being incorporated into the ABS market, with investors seeking to align their investments with their values and promote sustainable business practices. ABS backed by assets with strong ESG characteristics may become more attractive to investors, leading to increased demand for these securities. As the ABS market evolves, new asset classes, such as renewable energy financing, digital asset-backed securities, and infrastructure financing, will likely emerge. These new asset classes may provide investors unique investment opportunities and diversification benefits. The ABS market is becoming increasingly global, with issuances and investments occurring across different regions and countries. This globalization presents opportunities and challenges for investors as they navigate different regulatory frameworks, credit risk profiles, and market dynamics. Asset-backed securities play a crucial role in the global financial system, allowing financial institutions to transfer credit risk to investors and freeing up their balance sheets to extend new loans. ABS provides investors with access to diversified pools of assets and predictable cash flows with varying levels of risk and return. While ABS can offer attractive benefits, investors must also consider the potential risks and challenges and the impact of regulatory developments and technological innovations. As the ABS market evolves, investors must stay informed and adapt to changing market conditions. In order to make informed investment decisions in the complex and ever-changing world of asset-backed securities, it is essential to seek the advice of a qualified financial advisor. Wealth management services can provide investors with the expertise and resources needed to navigate the ABS market and develop a diversified investment portfolio tailored to their needs and goals.What Are Asset-Backed Securities (ABS)?

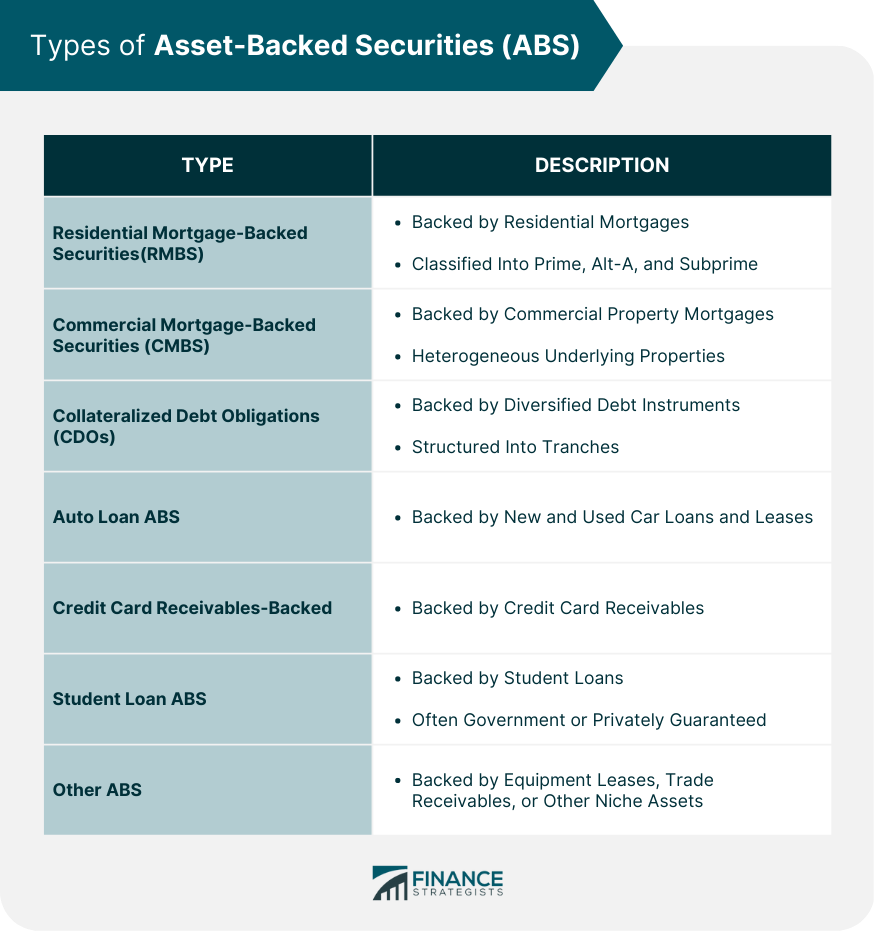

Types of Asset-Backed Securities (ABS)

Residential Mortgage-Backed Securities (RMBS)

Commercial Mortgage-Backed Securities (CMBS)

Collateralized Debt Obligations (CDOs)

Auto Loan Asset-Backed Securities

Credit Card Receivables-Backed Securities

Student Loan Asset-Backed Securities

Other Asset-Backed Securities

Creation Process of Asset-Backed Securities (ABS)

Overview of the ABS Origination Process

Pooling of Assets in ABS

Securitization and Tranching of Asset-Backed Securities

Credit Enhancement Mechanisms in ABS

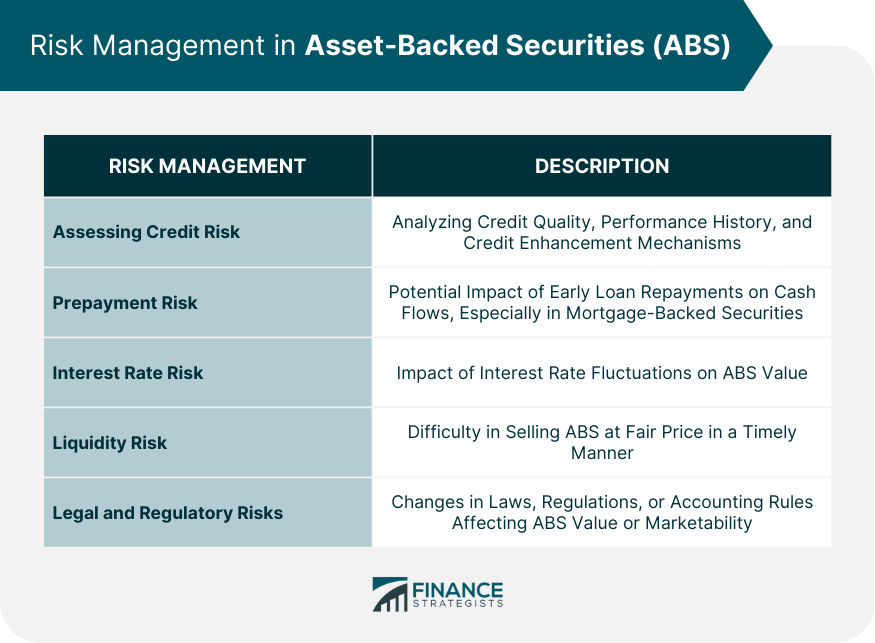

Risk Management in Asset-Backed Securities (ABS)

Assessing Credit Risk in ABS

Prepayment Risk in Asset-Backed Securities

Interest Rate Risk in Asset-Backed Securities

Liquidity Risk in Asset-Backed Securities

Legal and Regulatory Risks in Asset-Backed Securities

Valuation and Pricing of Asset-Backed Securities (ABS)

Cash Flow Modeling for ABS Valuation

Discounting Techniques in ABS Pricing

Yield Measures for Asset-Backed Securities

Spread Analysis in ABS Valuation

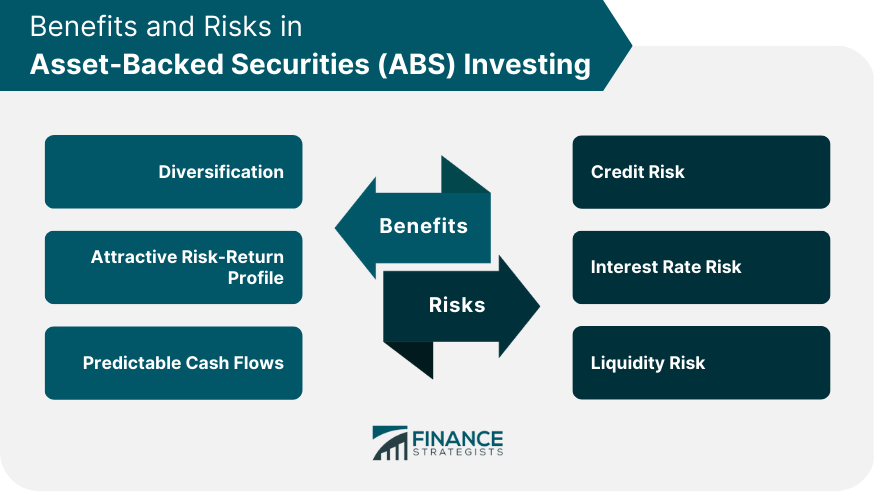

Investing in Asset-Backed Securities (ABS)

Benefits of Investing in ABS

Risks and Challenges in ABS Investing

Key Considerations for ABS Investors

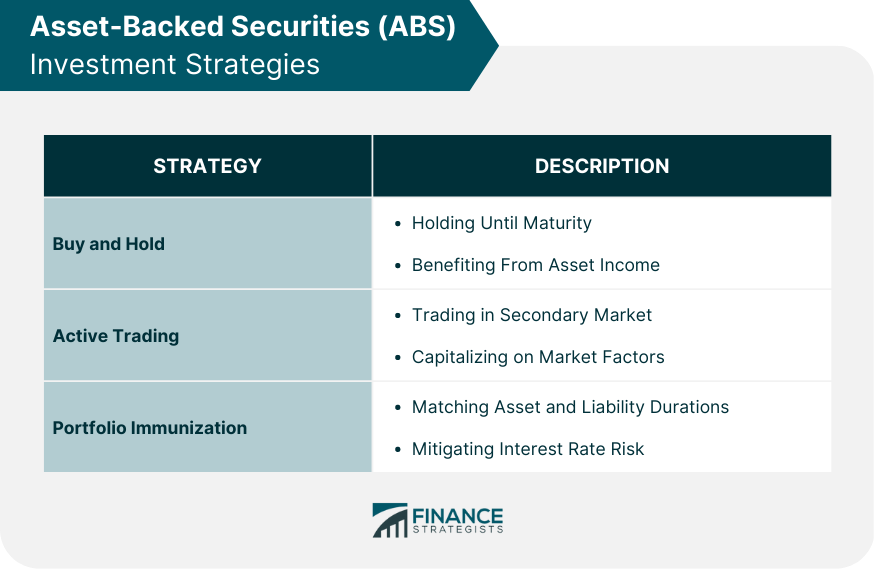

ABS Investment Strategies

Regulatory Environment for Asset-Backed Securities (ABS)

Regulation of ABS Issuers and Underwriters

ABS Disclosure Requirements

Rating Agencies and ABS

Impact of Financial Crises on ABS Regulation

International Regulatory Differences in ABS

Future Trends in Asset-Backed Securities (ABS)

Technological Innovations in ABS

Environmental, Social, and Governance (ESG) Criteria in ABS

Emergence of New Asset Classes in ABS

Globalization of the Asset-Backed Securities Market

Final Thoughts

Asset-Backed Securities (ABS) FAQs

Asset-backed securities are financial instruments that represent an ownership interest in a pool of underlying assets, such as mortgages, credit card receivables, auto loans, or student loans. These assets are packaged together and securitized, transforming them into marketable securities that investors can buy and sell.

The primary purpose of asset-backed securities is to allow financial institutions to transfer the credit risk associated with the underlying assets to investors, freeing up their balance sheets and enabling them to extend new loans. In turn, investors benefit from the diversified cash flows generated by the underlying assets, often with enhanced credit quality due to the securitization process.

Investing in ABS can be associated with various risks, including credit, interest rate, liquidity, and regulatory risks.

ABS is priced based on the projected cash flows generated by the underlying assets, taking into account factors such as prepayment rates, default rates, and recovery rates. These cash flow projections are used to estimate the value of the ABS. Discounting techniques are used to determine the present value of the projected cash flows, taking into account the time value of money and the riskiness of the cash flows.

Rating agencies play a crucial role in the ABS market by providing credit ratings for issued securities. These ratings are intended to help investors assess the credit risk associated with the ABS and make informed investment decisions. However, rating agencies have been criticized for their role in the 2008 financial crisis, leading to increased regulatory scrutiny and reforms in the ABS market.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.