What Are Balanced Funds?

Balanced funds are a type of investment fund that aims to provide investors with a balanced mix of both stocks and bonds, as well as sometimes other asset classes, in a single portfolio.

The goal of balanced funds is to provide both capital appreciation through equity investments and income through fixed-income investments, while also managing risk by diversifying across asset classes.

Balanced funds typically hold a predetermined allocation of stocks and bonds, and their asset mix may be adjusted over time by the fund manager to reflect changes in market conditions or the fund's investment objectives.

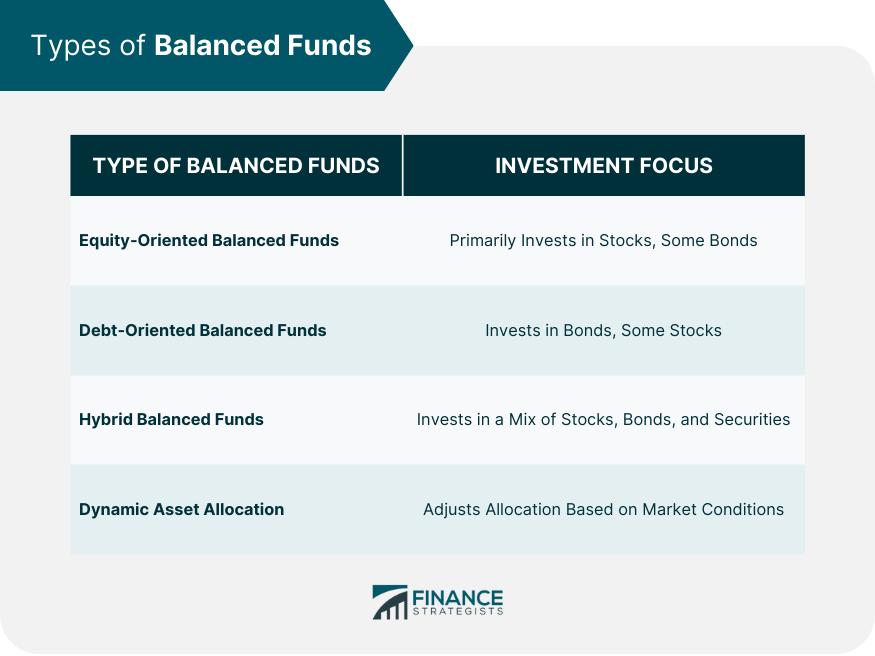

Types of Balanced Funds

Equity-Oriented Balanced Funds

Equity-oriented balanced funds primarily invest in stocks, with a smaller allocation to bonds and other fixed-income securities. These funds tend to be more aggressive, seeking capital appreciation while providing some degree of income through dividends and interest payments.

Debt-Oriented Balanced Funds

Debt-oriented balanced funds focus on fixed-income securities like bonds and debentures, with a smaller allocation to stocks. These funds are generally more conservative, aiming for income generation and capital preservation.

Hybrid Balanced Funds

Hybrid balanced funds invest in a mix of stocks, bonds, and other securities, often with no specific preference for either asset class. The fund manager adjusts the allocation between asset classes based on market conditions and investment objectives.

Dynamic Asset Allocation Funds

Dynamic asset allocation funds are a type of balanced fund that adjusts the allocation between stocks and bonds based on market conditions and the fund's investment strategy. These funds aim to optimize returns by adjusting the asset mix to take advantage of market opportunities.

Characteristics of Balanced Funds

Diversification

Balanced funds offer diversification by investing in various asset classes, reducing the overall risk of the portfolio. Diversification helps to minimize the impact of a poor-performing asset class on the overall portfolio.

Risk and Return Profile

Balanced funds have a moderate risk and return profile, offering a balance between the higher potential returns of stocks and the stability of bonds. This makes them suitable for investors with moderate risk tolerance.

Time Horizon

Balanced funds are generally recommended for investors with a medium to long-term investment horizon, as the mix of assets provides the potential for both growth and income over time.

Taxation

The tax treatment of balanced funds depends on the proportion of equity and debt holdings in the portfolio. Equity-oriented balanced funds may qualify for favorable tax treatment, while debt-oriented funds are subject to taxation based on the investor's income tax bracket.

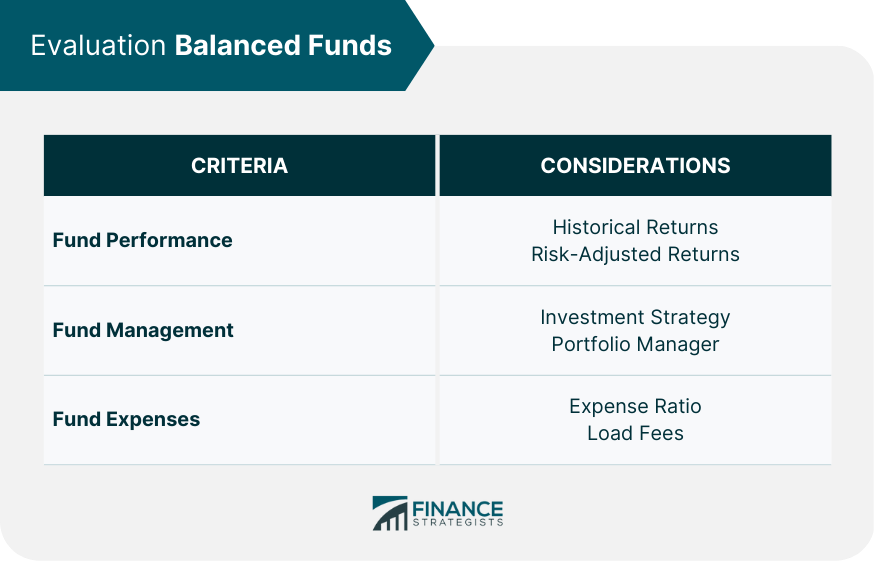

Evaluating Balanced Funds

Fund Performance

Historical Returns

When selecting a balanced fund, consider the fund's historical performance to understand its track record. While past performance is not a guarantee of future results, it can provide insight into the fund's ability to achieve its investment objectives.

Risk-Adjusted Returns

Risk-adjusted returns measure a fund's performance relative to the amount of risk it takes on. This metric is useful for comparing balanced funds with different risk profiles, as it helps identify funds that deliver higher returns for a given level of risk.

Fund Management

Investment Strategy

Evaluate the investment strategy of the balanced fund, including the asset allocation and the process for selecting individual securities. This will help you understand how the fund aims to achieve its objectives and whether it aligns with your investment goals.

Portfolio Manager

Consider the experience and track record of the portfolio manager, as their expertise can influence the fund's performance. Look for managers with a history of strong performance and a clear investment philosophy.

Fund Expenses

Expense Ratio

The expense ratio is the annual fee charged by the fund to cover management and operational costs. Lower expense ratios are generally preferable, as they leave more of the fund's returns for the investor.

Load Fees

Some balanced funds charge load fees, which are sales charges paid when buying or selling shares. These fees can reduce the investor's overall returns, so consider no-load funds as a more cost-effective option.

How to Invest in Balanced Funds

Direct Investments

Investors can purchase shares of balanced funds directly from the fund company or through a financial advisor. This method allows investors to bypass additional fees that may be associated with intermediaries.

Investing Through Intermediaries

Investment platforms, brokerages, and financial advisors offer access to a wide range of balanced funds. They can provide advice and guidance on selecting the right fund for your investment goals and risk tolerance.

Systematic Investment Plans (SIPs)

Systematic investment plans (SIPs) enable investors to contribute a fixed amount to a balanced fund at regular intervals, such as monthly or quarterly. This approach allows investors to benefit from dollar-cost averaging and can help reduce the impact of market volatility.

Online Investment Platforms

Online investment platforms offer a convenient way to research, compare, and invest in balanced funds. These platforms often provide tools and resources to help investors make informed decisions and track their investments.

Risks Associated With Balanced Funds

Market Risk

Market risk refers to the possibility that the value of the fund's investments will decline due to fluctuations in the financial markets. While diversification can help mitigate this risk, balanced funds are still exposed to market movements.

Interest Rate Risk

Interest rate risk is the potential for the value of fixed-income securities in the fund's portfolio to decline when interest rates rise. This can negatively impact the overall performance of the balanced fund.

Credit Risk

Credit risk is the risk that issuers of bonds and other fixed-income securities in the fund's portfolio will default on their obligations. This can result in losses for the balanced fund.

Liquidity Risk

Liquidity risk is the possibility that the fund may have difficulty selling its investments at a fair price in a timely manner. This can affect the fund's ability to meet redemptions and may result in losses for investors.

Currency Risk (For Global Balanced Funds)

Global-balanced funds that invest in securities denominated in foreign currencies are exposed to currency risk. This risk arises from fluctuations in exchange rates, which can impact the value of the fund's investments.

Strategies for Investing in Balanced Funds

Assessing Personal Risk Tolerance

Before investing in a balanced fund, determine your risk tolerance to ensure that the fund's risk and return profile aligns with your investment goals and preferences.

Setting Investment Goals

Define your investment goals, such as retirement planning or wealth accumulation, to guide your selection of balanced funds that can help you achieve those objectives.

Rebalancing the Portfolio

This process involves selling assets that have performed well and buying assets that have underperformed, helping to keep your portfolio aligned with your risk tolerance and investment goals.

Diversifying Across Multiple Balanced Funds

Investing in multiple balanced funds with different investment strategies can further diversify your portfolio, reducing risk and potentially enhancing returns.

Role of Balanced Funds in a Portfolio

Achieving Asset Allocation

Balanced funds can help investors achieve their desired asset allocation by providing exposure to a mix of stocks, bonds, and other securities in a single investment.

Providing Stability

The combination of growth and income-producing assets in a balanced fund can provide stability to an investor's portfolio, reducing the impact of market volatility on overall performance.

Serving as a Core Investment

Balanced funds can serve as a core investment in a portfolio, providing a foundation for additional investments in more specialized or niche funds that target specific sectors or investment themes.

Conclusion

Balanced funds offer investors a diversified investment option that combines the growth potential of stocks with the income and stability of bonds.

By understanding the different types of balanced funds, their characteristics, and the factors to consider when evaluating them, investors can make informed decisions to incorporate balanced funds into their portfolios.

By assessing personal risk tolerance, setting investment goals, and employing strategies such as rebalancing and diversification, investors can optimize their balanced fund investments to achieve their financial objectives.

In conclusion, balanced funds play an essential role in modern investing by providing a versatile and accessible solution for investors seeking a balance between risk and return.

Balanced Funds FAQs

A balanced fund is a type of mutual fund that invests in a mix of stocks, bonds, and other securities to achieve a balance between risk and return. Unlike pure equity or debt funds, balanced funds offer diversification across multiple asset classes, providing a moderate risk and return profile suitable for investors with a medium to long-term investment horizon.

There are four main types of balanced funds: equity-oriented balanced funds, debt-oriented balanced funds, hybrid balanced funds, and dynamic asset allocation funds. Each type offers a different balance between stocks and bonds, catering to investors with varying risk tolerances and investment objectives.

To evaluate the performance of a balanced fund, consider the fund's historical returns and risk-adjusted returns. Historical returns provide insight into the fund's track record, while risk-adjusted returns allow for comparison with other funds by considering the level of risk taken to achieve those returns. Additionally, assess the fund's investment strategy, portfolio manager, and expense ratio to make an informed decision.

Investing in a balanced fund involves several risks, including market risk, interest rate risk, credit risk, liquidity risk, and currency risk (for global balanced funds). While diversification can help mitigate some of these risks, it's essential to understand and assess these risks before investing.

Balanced funds can help achieve asset allocation, provide stability, and serve as a core investment in your portfolio. By offering exposure to a mix of stocks, bonds, and other securities, balanced funds can contribute to diversification, reduce the impact of market volatility, and help achieve your long-term investment goals.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.