Counterparty risk, also known as default risk, is a financial risk inherent in contracts wherein a party may not fulfill their contractual obligations. This risk can originate from various sources, including loans, derivatives contracts, or any financial transaction that relies on a promise of future performance by a counterparty. Understanding counterparty risk is essential in the financial landscape. It serves as a measure of financial stability and is an integral part of risk management practices in financial institutions. The 2008 financial crisis highlighted the potential impact of counterparty risk, showing how the failure of one entity can send shock waves through the financial system. Counterparty risk emanates from the possibility that a counterparty may default on a contractual obligation. This can happen due to various reasons, such as financial insolvency, operational failure, or even geopolitical events that may hinder the counterparty's ability to fulfill its contractual obligations. Counterparties play a pivotal role in financial transactions. They are the other party in a financial contract, such as loans, securities trading, and derivatives contracts. Each party in the contract assumes a certain level of risk that the other party might default on their obligations. Several key factors contribute to counterparty risk. These include the counterparty's financial stability, the nature and duration of the contract, the regulatory environment, the complexity of the transaction, and the level of collateral or guarantees provided. Credit risk is the most fundamental type of counterparty risk. It refers to the risk of loss if a counterparty fails to meet its financial obligations due to financial distress or insolvency. Pre-settlement risk refers to the risk that a counterparty will fail to meet its obligations before the settlement of a transaction. This risk is particularly significant in long-dated contracts where the market value of the contract can change significantly over time. Settlement risk arises when there is a time lag between the execution of a transaction and its settlement. During this period, one party might fulfill their part of the transaction while the other party defaults. Replacement cost risk is the risk that a counterparty will default and the non-defaulting party will have to replace the defaulted contract at current market prices, which may be unfavorable. Derivatives, including futures, options, and swaps, are financial contracts that derive their value from an underlying asset. Counterparty risk in derivatives arises when one party fails to fulfill their contractual obligations, impacting the value of the derivative. Securities lending involves the temporary transfer of securities from a lender to a borrower. The lender faces counterparty risk if the borrower fails to return the securities as agreed or if the collateral provided by the borrower is insufficient to cover the value of the borrowed securities. In a repurchase agreement (repo), one party sells securities to another party with an agreement to repurchase them at a later date. The buyer (lender) faces counterparty risk if the seller (borrower) fails to repurchase the securities as agreed. Over-the-counter (OTC) transactions are trades that occur directly between two parties without the oversight of an exchange. These transactions carry significant counterparty risk due to the lack of standardized contracts and regulatory oversight. In cryptocurrency transactions, counterparty risk arises due to the absence of a central authority or intermediary. For example, in Bitcoin transactions, once a transaction is confirmed, it cannot be reversed, leading to the risk of loss if the counterparty does not fulfill its part of the transaction. Potential Future Exposure (PFE): PFE is a measure of the maximum potential loss from a counterparty's default during the life of a contract, considering potential changes in market conditions. Credit Value Adjustment (CVA): CVA is a monetary measure of counterparty risk. It quantifies the adjustment to the risk-free portfolio value to account for the counterparty's potential default. Debt Value Adjustment (DVA): DVA is the adjustment to the valuation of a company's debt, considering the probability that the company itself might default on its obligations. Advanced Measurement Approaches (AMA): AMA is a set of techniques used by financial institutions to estimate their operational risk, including counterparty risk. These approaches often use internal data, external data, and scenario analysis. Stress testing plays a critical role in counterparty risk measurement by providing insights into potential future scenarios. This forward-looking analysis enables financial institutions to assess counterparty exposure under extreme but plausible conditions. By understanding the potential risks, they can establish more robust strategies to mitigate the impact of adverse events, thus ensuring financial stability. It also assists in capital allocation decisions by calculating the potential maximum loss a counterparty can create. Hence, stress testing is not just a regulatory requirement but a crucial risk management tool in the financial sector. Counterparty risk management is crucial for financial institutions due to its potential to cause significant financial losses and destabilize the financial system. Effective management of this risk can protect a company from losses and maintain investor confidence. Collateral management involves the use of assets to secure a loan or other obligation. By holding collateral, a lender can reduce the loss in case of a counterparty's default. Netting agreements allow parties to offset their obligations against each other, reducing the total counterparty risk. Credit limit management involves setting a maximum exposure limit to a single counterparty to control the potential loss in case of default. Diversifying counterparties across various industries and regions can also reduce counterparty risk by spreading the risk exposure. CCPs act as intermediaries in financial transactions, assuming the counterparty risk. They ensure the smooth functioning of financial markets by guaranteeing the obligations of both parties. The Basel III standards introduced by the Basel Committee on Banking Supervision include stringent requirements for managing counterparty risk, requiring banks to hold more capital against potential counterparty defaults. The Dodd-Frank Act in the United States implemented comprehensive regulations for financial institutions, including measures to reduce counterparty risk in derivatives trading. EMIR introduced mandatory clearing and reporting requirements for OTC derivatives in Europe, aiming to reduce counterparty risk and increase transparency. Counterparty risk, or default risk, is a significant concern in the financial landscape, as demonstrated during the 2008 financial crisis. Effective management of this risk is crucial for financial institutions to mitigate losses and maintain investor confidence. Understanding counterparty risk and employing appropriate measurement techniques, such as Potential Future Exposure (PFE) and Credit Value Adjustment (CVA), is essential. Risk mitigation techniques like collateral management, netting agreements, credit limit management, and diversification of counterparties help reduce counterparty risk. Central Counterparties (CCPs) play a vital role in assuming counterparty risk and ensuring transaction obligations. Regulatory frameworks like Basel III, the Dodd-Frank Act, and EMIR have introduced measures to manage counterparty risk, including capital requirements, clearing obligations, and increased transparency. By adhering to these regulations, financial institutions can minimize the negative impact of counterparty risk and maintain stability in the financial system.What Is Counterparty Risk?

Nature of Counterparty Risk

Understanding the Risk

Role of Counterparties in Financial Transactions

Key Factors Contributing to Counterparty Risk

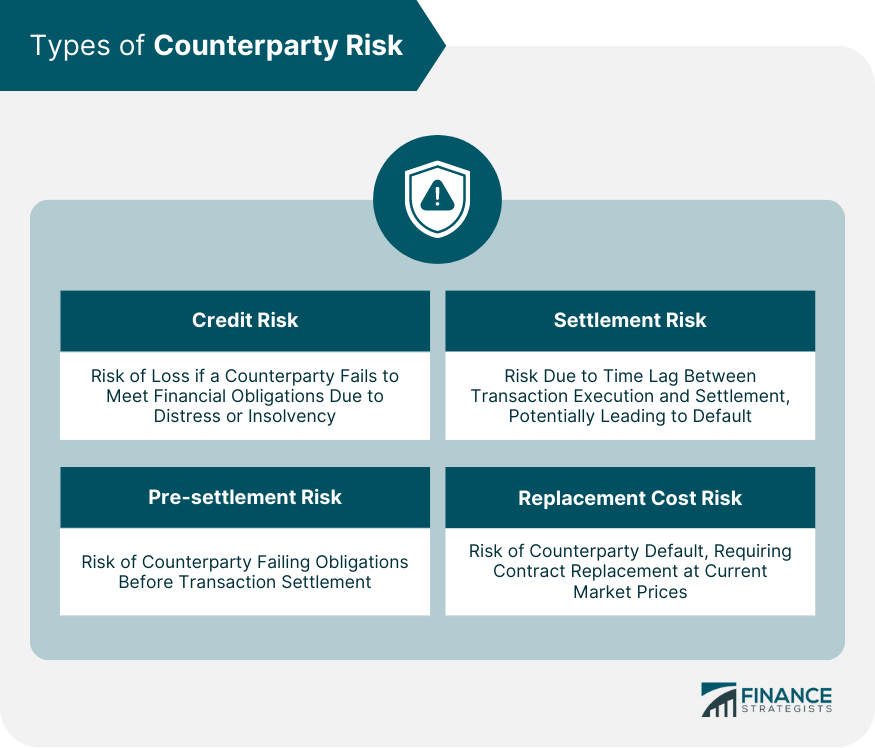

Types of Counterparty Risk

Credit Risk

Pre-Settlement Risk

Settlement Risk

Replacement Cost Risk

Counterparty Risk in Different Financial Instruments

Derivatives

Securities Lending

Repo Agreements

Over-The-counter Transactions

Counterparty Risk in Cryptocurrencies

Measurement of Counterparty Risk

Use of Stress Testing in Counterparty Risk Measurement

Management of Counterparty Risk

Counterparty Risk Management

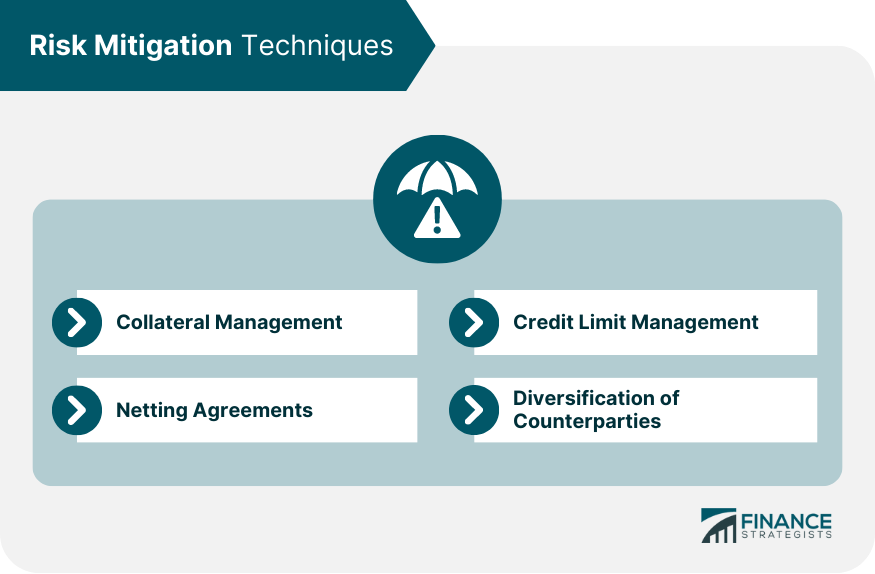

Risk Mitigation Techniques

Collateral Management

Netting Agreements

Credit Limit Management

Diversification of Counterparties

Role of Central Counterparties (CCPs)

Regulatory Framework for Counterparty Risk

Basel III Regulatory Standards

Dodd-Frank Wall Street Reform and Consumer Protection Act

European Market Infrastructure Regulation (EMIR)

Final Thoughts

Counterparty Risk FAQs

Counterparty risk is the likelihood that a party involved in a financial transaction will default on its contractual obligations.

The types of counterparty risk include credit risk, pre-settlement risk, settlement risk, and replacement cost risk.

Counterparty risk can be measured using techniques such as Potential Future Exposure (PFE), Credit Value Adjustment (CVA), Debt Value Adjustment (DVA), and stress testing.

Techniques to mitigate counterparty risk include collateral management, netting agreements, credit limit management, and diversification of counterparties.

Regulatory frameworks like Basel III, Dodd-Frank Act, and EMIR establish standards and requirements for managing counterparty risk, ensuring financial stability and transparency.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.