The dollar-weighted return is a measure of an investment's performance that takes into account the timing and size of cash flows, such as contributions and withdrawals. This metric provides a more accurate reflection of an investor's actual experience, as it accounts for the impact of their investment decisions on the overall return. Dollar-weighted return is used to assess the effectiveness of investment strategies, evaluate mutual fund performance, and compare investment returns across different portfolios. It provides valuable insights into the impact of cash flows on investment performance, enabling investors and financial professionals to make more informed decisions. The primary users of the dollar-weighted return metric include individual investors, portfolio managers, financial advisors, and analysts. To calculate the dollar-weighted return, the following data is required: The beginning and ending balances of the investment. The timing and amount of all cash flows, such as contributions and withdrawals. Determine the time periods between each cash flow and the end of the investment period. Calculate the rate of return for each period based on the cash flows and the beginning and ending balances. Determine the average rate of return, taking into account the time periods and cash flows. Calculate the dollar-weighted return by multiplying the average rate of return by the total investment period. A higher dollar-weighted return indicates that the investment has performed well, considering the timing and size of cash flows. Conversely, a lower dollar-weighted return suggests that the investment has underperformed, given the impact of cash flows on the overall return. The time-weighted return is another measure of investment performance that calculates the compound growth rate of an investment over a specified period, without considering the timing and size of cash flows. While the time-weighted return is useful for comparing the performance of different investments, it may not accurately reflect an investor's actual experience if cash flows are significant. The internal rate of return (IRR) is a metric that calculates the discount rate at which the net present value of an investment's cash flows equals zero. Like the dollar-weighted return, the IRR considers the timing and size of cash flows, making it useful for evaluating the performance of investments with varying cash flow patterns. The annualized return is a measure of investment performance that calculates the average compound growth rate of an investment over a specified period, expressed on an annual basis. This metric provides a standardized way to compare the performance of different investments over different time horizons, but does not take into account the impact of cash flows. Dollar-weighted return can be used to assess the effectiveness of investment strategies by providing a more accurate representation of an investor's actual experience. By considering the timing and size of cash flows, the dollar-weighted return enables investors to evaluate the impact of their investment decisions on overall performance. The dollar-weighted return measures the impact of cash flows on investment performance, helping investors understand how their decisions to contribute or withdraw funds have affected their returns. Dollar-weighted return can be used to compare the performance of different mutual funds, providing a more accurate representation of the investor's experience by accounting for the timing and size of cash flows. This enables investors to make more informed decisions when selecting funds for their portfolios. Dollar-weighted return can also be used to evaluate the skill of a fund manager by assessing the impact of their investment decisions on the fund's overall performance. A fund manager who consistently generates a high dollar-weighted return demonstrates an ability to manage cash flows effectively and make timely investment decisions. Dollar-weighted return can be used to identify the sources of outperformance or underperformance in a portfolio. By comparing the dollar-weighted return of a portfolio to that of a benchmark or peer group, investors can determine whether their investment strategy has added value. The dollar-weighted return can be used to compare the performance of a portfolio to that of peers or benchmarks, providing valuable insights into the effectiveness of the portfolio's investment strategy and the skill of the portfolio manager. The dollar-weighted return is sensitive to the timing and size of cash flows, which can lead to variations in the metric's value. This sensitivity may result in misleading performance evaluations, particularly for investments with irregular or large cash flows. Comparing dollar-weighted returns across different investments can be challenging, as the metric is influenced by the unique cash flow patterns of each investment. This may make it difficult to accurately compare the performance of various investments using dollar-weighted returns alone. The calculation of the dollar-weighted return can be complex, particularly for investments with multiple cash flows or varying cash flow patterns. This complexity may make it difficult for individual investors to calculate and interpret the metric without the assistance of financial professionals or specialized software. The dollar-weighted return is an essential metric for assessing the performance of investments, as it takes into account the impact of cash flows on overall returns. This provides a more accurate representation of an investor's actual experience, enabling them to make more informed decisions about their investment strategies and portfolio allocations. While the dollar-weighted return offers numerous benefits, it also has limitations, such as sensitivity to timing and size of cash flows, challenges in comparing across different investments, and the complexity of calculation. Investors and financial professionals should consider these limitations when using the metric and integrate it with other performance measures to develop a more comprehensive understanding of investment performance. The dollar-weighted return can be combined with other performance metrics, such as time-weighted return, internal rate of return, and annualized return, to provide a more comprehensive analysis of investment performance. By integrating these metrics, investors and financial professionals can better understand their investments' performance and make more informed decisions about their portfolios.What Is Dollar-Weighted Return?

Calculation of Dollar-Weighted Return

Data Requirements

Step-By-Step Calculation Process

Interpretation of Results

Comparison to Other Metrics

Time-Weighted Return

Internal Rate of Return

Annualized Return

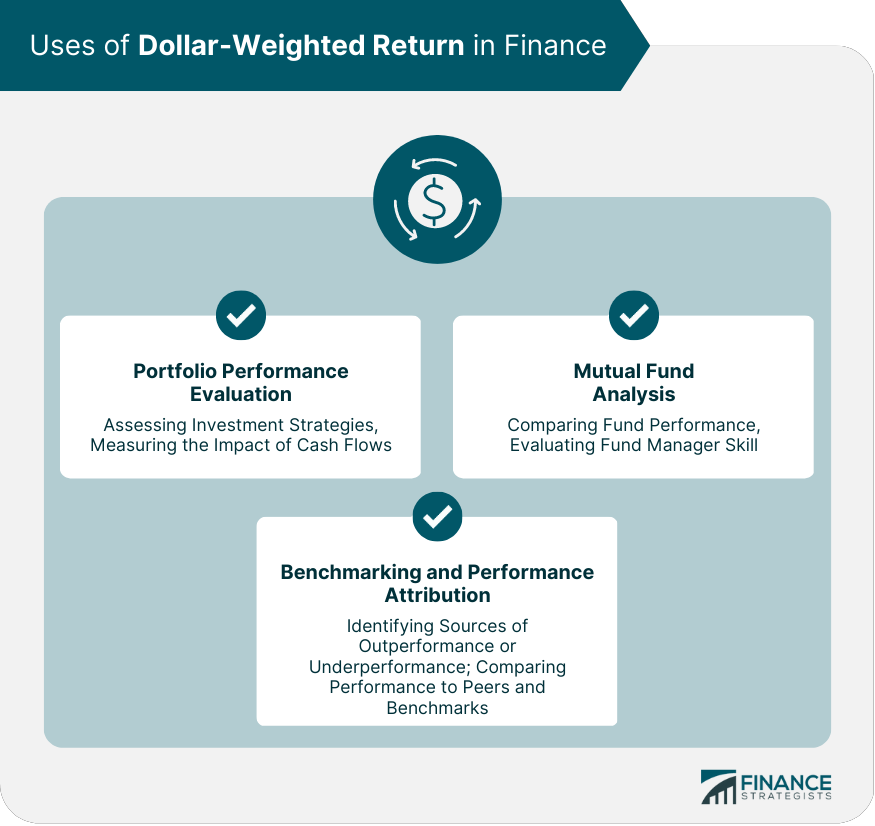

Uses of Dollar-Weighted Return in Finance

Portfolio Performance Evaluation

Assessing Investment Strategies

Measuring the Impact of Cash Flows

Mutual Fund Analysis

Comparing Fund Performance

Evaluating Fund Manager Skill

Benchmarking and Performance Attribution

Identifying Sources of Outperformance or Underperformance

Comparing Performance to Peers and Benchmarks

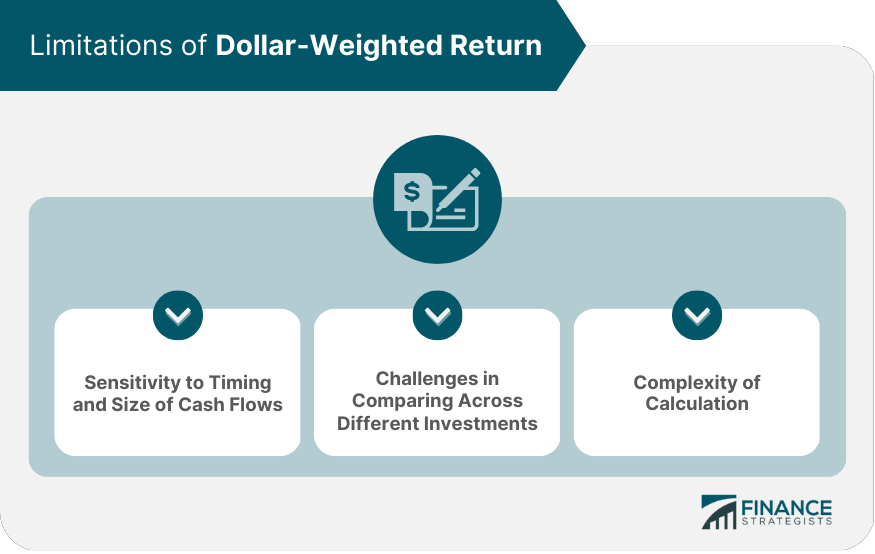

Limitations of Dollar-Weighted Return

Sensitivity to Timing and Size of Cash Flows

Challenges in Comparing Across Different Investments

Complexity of Calculation

Conclusion

Importance of Dollar-Weighted Return in Financial Analysis

Balancing Benefits and Limitations

Integration With Other Metrics and Tools

Dollar-Weighted Return FAQs

Dollar-weighted return is a measure of investment performance that takes into account the timing and amount of cash flows into and out of an investment. It is also known as the internal rate of return (IRR).

To calculate dollar-weighted return, the net present value (NPV) of all cash flows into and out of an investment is set equal to zero, and the discount rate that makes this equation true is the dollar-weighted return.

Dollar-weighted return takes into account the timing and amount of cash flows, whereas time-weighted return does not. Time-weighted return is a measure of investment performance that ignores the impact of cash flows and is used to compare the performance of investment managers.

Dollar-weighted return provides a more accurate measure of investment performance than other measures, such as simple returns or time-weighted returns, because it takes into account the impact of cash flows. It also helps investors make better decisions about when to buy or sell investments.

Dollar-weighted return can be used in portfolio management to evaluate the performance of individual investments and the portfolio as a whole. It can also be used to make decisions about when to buy or sell investments to improve portfolio performance. For example, if an investment has a low dollar-weighted return, an investor may consider selling it and investing in a different asset with a higher expected return.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.