Growth funds are a category of mutual funds or exchange-traded funds (ETFs) that focus on investing in stocks of companies with higher-than-average growth potential. These companies are expected to experience rapid revenue and earnings growth, leading to an increase in their stock prices. Growth funds typically invest in companies that are experiencing rapid growth in their earnings, revenue, or market share. These companies often reinvest their profits into further growth opportunities, rather than paying dividends to shareholders. The primary objective of growth funds is to provide investors with capital appreciation. By investing in companies with strong growth prospects, these funds aim to generate higher returns than the broader market over the long term. There are various types of growth funds, each focusing on a specific market capitalization, region, or sector. Understanding these types can help investors choose the right fund for their investment goals. Large-cap growth funds invest in large, established companies with strong growth potential. These companies usually have a market capitalization of over $10 billion and are considered less risky than smaller companies. Mid-cap growth funds focus on medium-sized companies with a market capitalization between $2 billion and $10 billion. These companies may offer higher growth potential than large-cap companies but also come with increased risk. Small-cap growth funds target small companies with a market capitalization of less than $2 billion. These companies have the potential for significant growth but are also associated with higher risk due to their smaller size and vulnerability to market fluctuations. International growth funds invest in companies based outside the United States, providing investors with exposure to global growth opportunities. These funds can offer diversification benefits but may also carry additional risks such as currency fluctuations and political instability. Sector-specific growth funds focus on companies within a particular industry or sector, such as technology or healthcare. These funds can offer concentrated exposure to high-growth industries but may also be more susceptible to industry-specific risks. Investing in growth funds can offer several benefits, including the potential for higher returns and diversification. Understanding these advantages can help investors determine if growth funds are a suitable addition to their portfolio. Growth funds aim to invest in companies with strong growth potential, which can result in higher returns compared to more conservative investment options. However, higher returns often come with increased risk and volatility. Growth funds can provide diversification benefits by investing in a variety of growth-oriented companies across different industries and market capitalizations. This can help reduce overall portfolio risk and improve long-term performance. Growth funds are managed by professional portfolio managers who have expertise in identifying and investing in high-growth companies. This can save investors time and effort while potentially improving their investment results. Like all investments, growth funds come with certain risks. Understanding these risks can help investors make informed decisions about whether to include growth funds in their portfolio. Growth funds tend to be more volatile than other types of funds due to their focus on high-growth companies. These companies are often more sensitive to market fluctuations and economic conditions, which can result in larger price swings and increased risk for investors. Since growth funds often invest in companies within specific industries or sectors, they may be more susceptible to industry-specific risks. For example, a technology-focused growth fund may be negatively impacted by regulatory changes or a decline in consumer demand for tech products. The performance of growth funds depends on the skill and expertise of their portfolio managers. Poor investment decisions or failure to identify high-growth opportunities can lead to underperformance compared to the fund's benchmark or other investment options. Evaluating the performance of growth funds is crucial for investors to make informed decisions. Several tools and metrics can be used to assess fund performance, including benchmarks, risk-adjusted measures, and ratings from fund-rating agencies. Benchmarks and indices are used to compare the performance of growth funds against a representative sample of the market. Common benchmarks for growth funds include the S&P 500 Growth Index and the Russell 2000 Growth Index. Risk-adjusted measures, such as the Sharpe ratio, help investors evaluate a fund's performance relative to its level of risk. Higher risk-adjusted performance indicates that a fund has generated better returns for a given level of risk compared to other funds. Fund rating agencies, such as Morningstar and Lipper, provide ratings and analysis on growth funds based on various factors, including past performance, risk-adjusted returns, and fees. These ratings can help investors identify top-performing growth funds for their portfolios. Implementing effective investment strategies can help investors optimize their growth fund investments. Some common strategies include dollar-cost averaging, asset allocation, diversification, and regular portfolio rebalancing. Dollar-cost averaging involves investing a fixed amount of money in growth funds at regular intervals, regardless of market conditions. This approach can reduce the impact of market volatility and help investors avoid making poor investment decisions based on short-term market fluctuations. Asset allocation is the process of dividing an investment portfolio among different asset classes, such as stocks, bonds, and cash. Allocating a portion of a portfolio to growth funds can help investors balance potential risks and rewards based on their investment goals and risk tolerance. Diversification involves investing in a variety of growth funds that focus on different market capitalizations, sectors, or regions. This can help reduce overall portfolio risk and improve long-term investment performance. Regularly rebalancing a portfolio involves adjusting the allocation of growth funds and other investments to maintain a desired level of risk and return. This can help investors stay on track with their investment goals and prevent their portfolios from becoming overly concentrated in a single asset class or investment type. Growth funds can play an important role in portfolio management, offering the potential for higher returns and diversification benefits. By understanding the different types of growth funds, their advantages and risks, and strategies for investing, investors can make informed decisions about including growth funds in their portfolios. It is essential to consider individual investment goals and risk tolerance before investing in growth funds, and to regularly evaluate and adjust investment strategies to optimize performance.What Are Growth Funds?

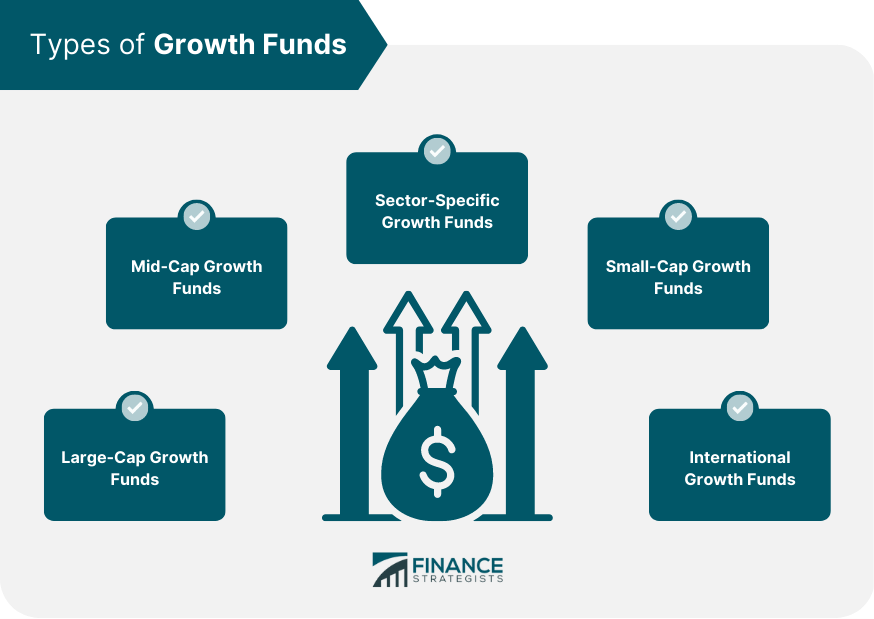

Types of Growth Funds

Large-Cap Growth Funds

Mid-Cap Growth Funds

Small-Cap Growth Funds

International Growth Funds

Sector-Specific Growth Funds

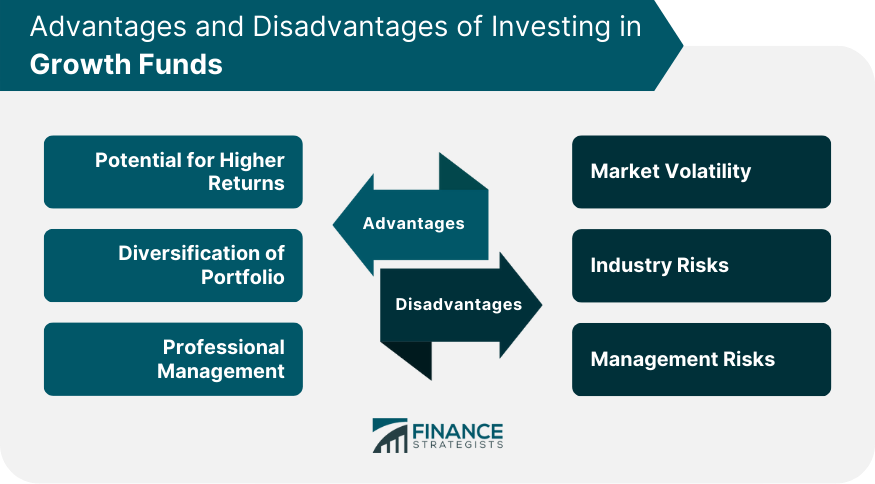

Advantages of Investing in Growth Funds

Potential for Higher Returns

Diversification of Portfolio

Professional Management

Disadvantages of Investing in Growth Funds

Market Volatility

Industry Risks

Management Risks

Performance Evaluation of Growth Funds

Benchmarks and Indices

Risk-Adjusted Measures

Fund Rating Agencies

Strategies for Investing in Growth Funds

Dollar-Cost Averaging

Asset Allocation

Diversification

Regular Portfolio Rebalancing

Conclusion

Growth Funds FAQs

Growth Funds are mutual funds or exchange-traded funds that invest in companies with high growth potential, typically in emerging markets or industries.

There are various types of Growth Funds, including small-cap Growth Funds, large-cap Growth Funds, mid-cap Growth Funds, and international Growth Funds.

The advantages of investing in Growth Funds include the potential for high returns, diversification, and exposure to growth-oriented companies and industries.

The risks associated with investing in Growth Funds include market volatility, higher expense ratios, and a higher level of risk compared to other types of funds.

When choosing a Growth Fund, consider factors such as the fund's investment strategy, the fund manager's track record, expense ratios, and past performance. It's also important to consult with a financial advisor to determine if the fund is suitable for your investment goals and risk tolerance.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.